Authors: Ding HAN, Alice Kohn

Translation: glassnode

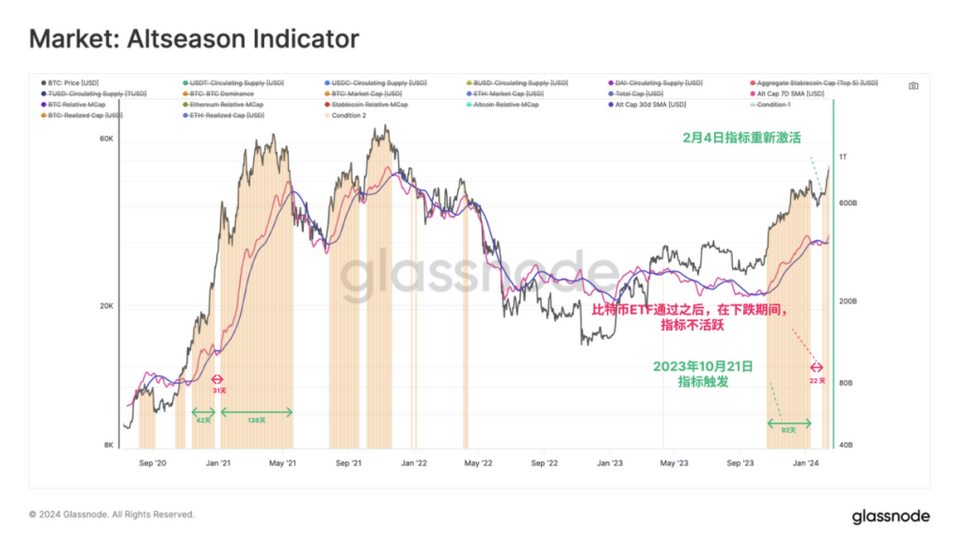

Since last October, our altcoin momentum indicator has shown a growing willingness among investors to further shift capital onto the risk curve.

While Bitcoin's dominance remains significant, we have seen early signs of more capital moving towards the Ethereum, Solana, Polkadot, and Cosmos ecosystems.

By investigating Uniswap liquidity pools, we can see that most of the capital still remains in the most mature assets. Although the total locked value (TVL) is moving towards the risk curve, the trading volume follows at a slower pace.

I. Expectation of "Altcoin Season"

With the momentum of new spot Bitcoin exchange-traded funds (ETFs) gaining strength, the bull market in the digital asset space may have already begun. In this context, we will continue to explore whether the capital covered in the 4th weekly on-chain report will flow into altcoins. This issue will focus on the performance of assets further along the risk curve.

The goal is to evaluate how capital rotates and flows in the altcoin market. We will once again use our altcoin indicator as a macro indicator (see the 41st weekly report in 2023). This indicator assesses whether positive momentum is forming within the total market value of exchange coins, accompanied by continuous inflows of funds into Bitcoin, Ethereum, and stablecoins.

Our altcoin indicator has been showing positive momentum since last October, despite a brief pause during the "sell-the-news" event after the approval of the Bitcoin ETF. It retriggered on February 4th.

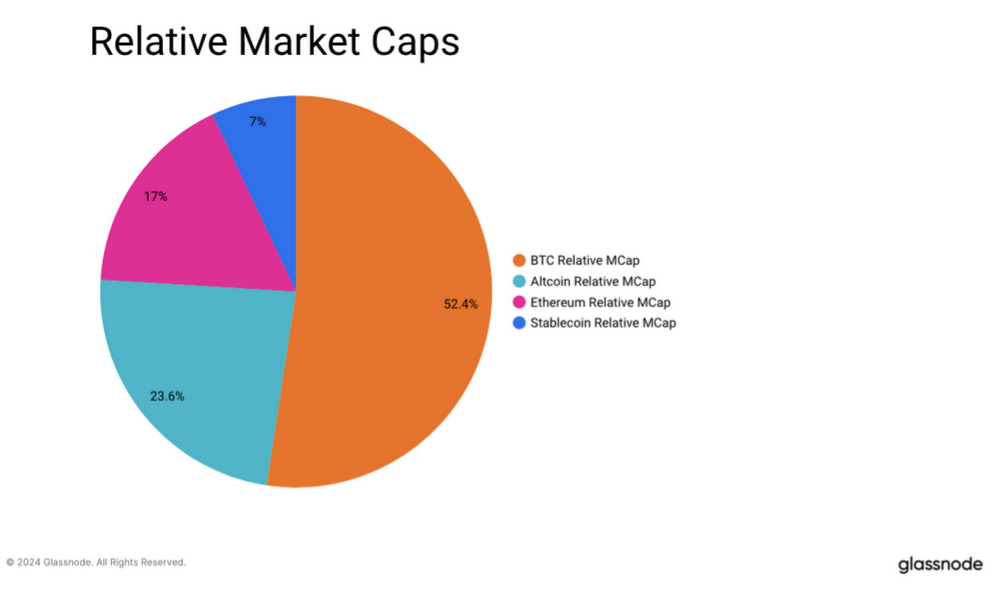

In terms of market share, Bitcoin continues to lead the entire digital asset market with over 52% market share. In comparison, Ethereum accounts for 17%, stablecoins for 7%, and the rest of the altcoins for 24%.

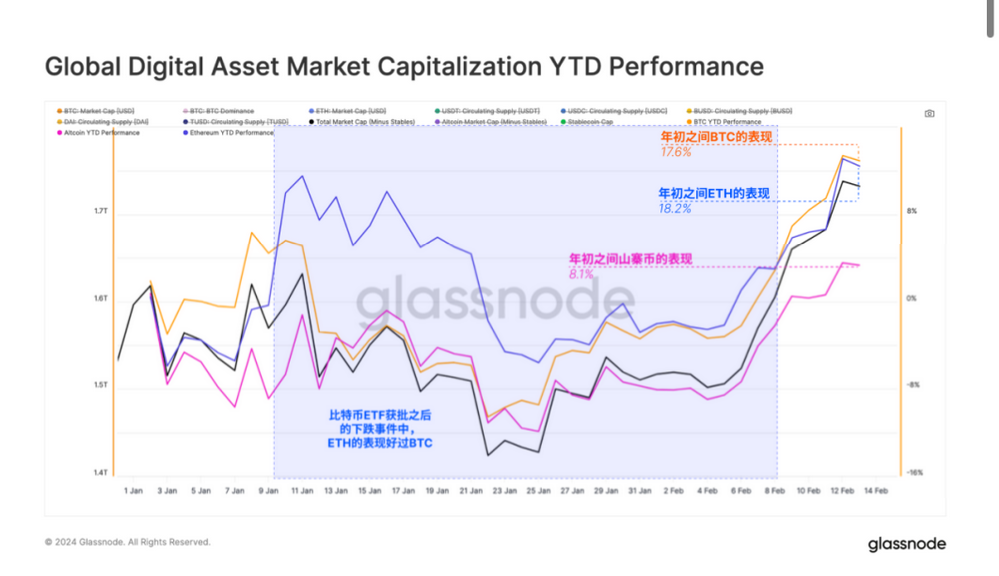

In terms of asset performance, BTC and ETH are leading, with year-to-date (YTD) gains of +17.6% and +18.2% respectively. We note that after the approval of the Bitcoin ETF, ETH began to surpass BTC, marking a change in relative performance that has been poor since 2023.

However, overall, the market value of altcoins has performed poorly, with growth since the beginning of the year being less than half of the two major currencies.

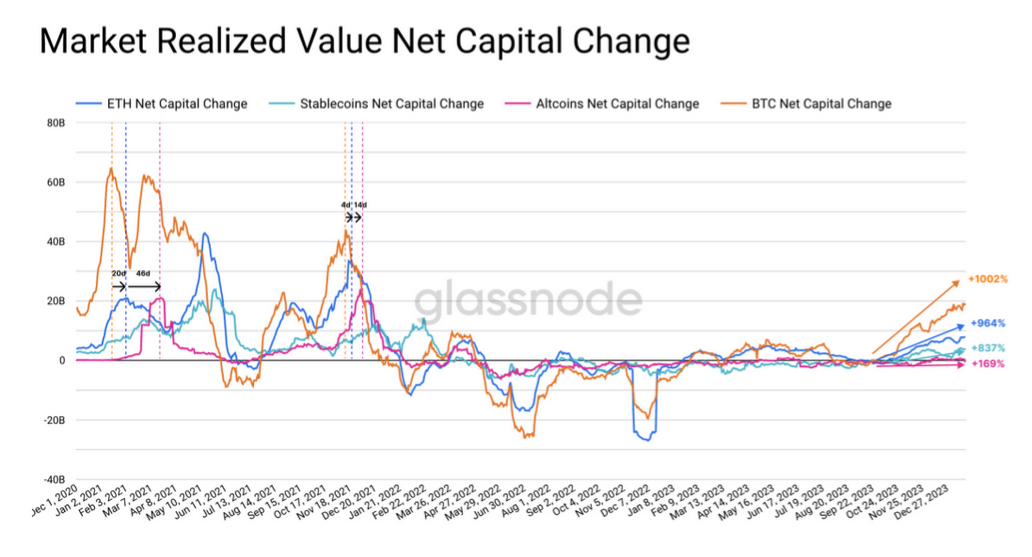

Another method to track performance is to use the realized market value of each industry, which aggregates the cost basis value of all coins transferred on-chain. From this, we can better assess the flow of capital within the digital asset market.

Bitcoin is once again significantly ahead, with nearly $20 billion in funds flowing in monthly.

Capital inflows into Ethereum often lag behind Bitcoin, indicating that investors are seeking confidence and confirmation that the digital asset market is growing. In the 2021 cycle, the peak of new capital inflows into BTC occurred 20 days before the peak inflow into ETH.

Altcoins tend to see similar lagged capital flows after ETH shows strength, with 46 days in the mid-2021 and 14 days at the end of 2021.

Clearly, the speed of capital flowing into altcoins is slower than the rotation between the two major cryptocurrencies, and this trend seems to be repeating once again.

II. Industry Rotation

With signs of capital flowing into the two major currencies, the next question is to observe how it further flows along the risk curve over time. In the previous cycle, several new Layer-1 ecosystems emerged. Many of these ecosystems not only compete with Ethereum in terms of innovation and user attraction but also in terms of attracting investment capital.

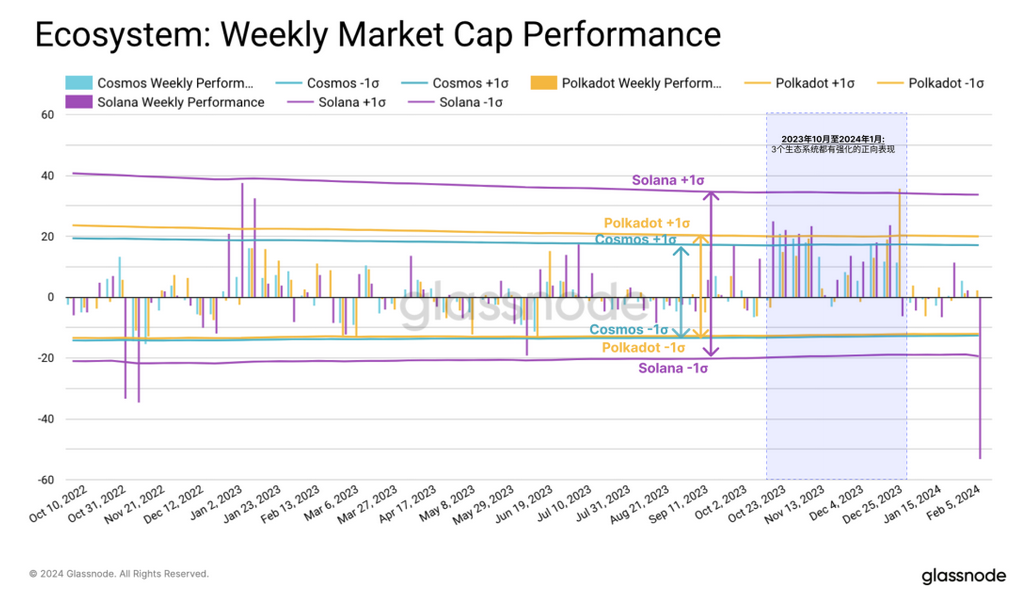

Therefore, we examined the weekly changes in the total market value of the top five tokens in selected ecosystems. Over the past 18 months, Solana has shown relatively high volatility, with particularly strong upward performance. The volatility of Polkadot and Cosmos is similar, but the Polkadot ecosystem outperforms the latter.

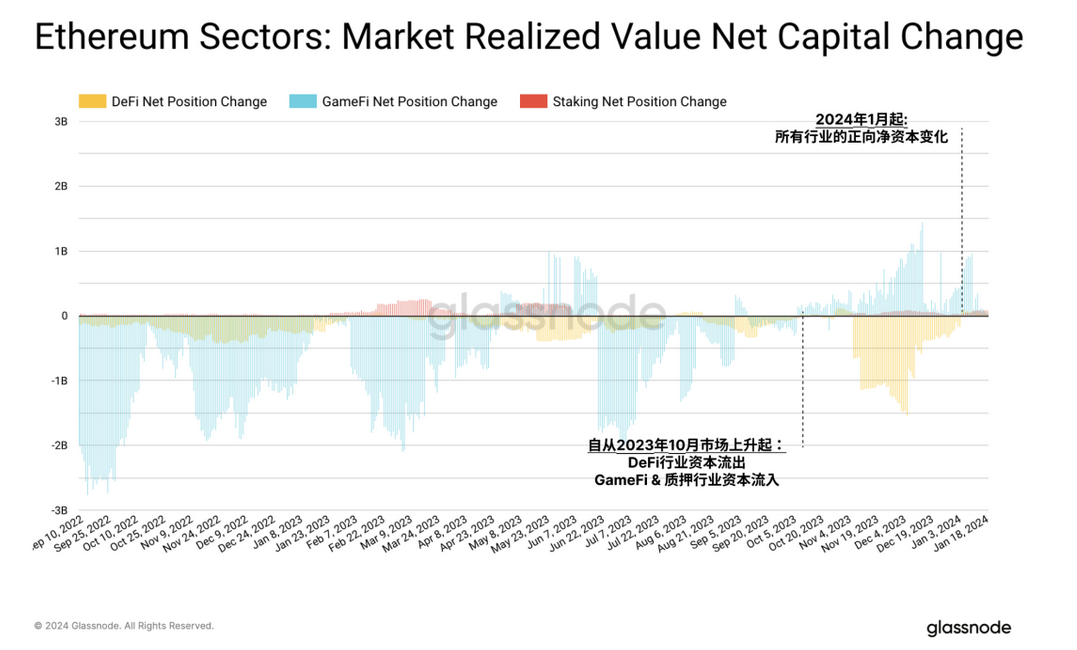

Within the Ethereum ecosystem, we can specify three main areas: DeFi, GameFi, and staking. Since the beginning of this year, all three industries have seen capital inflows, although the DeFi and GameFi industries have experienced relatively large capital outflows in 2022 and 2023.

There has been a reversal in the GameFi sector, with significant inflows since October, consistent with the timing of our altcoin indicator triggering. In contrast, staking tokens have consistently experienced positive capital inflows, albeit in smaller absolute amounts.

III. Moving Along the Risk Curve

To determine whether investor interest is shifting towards the risk curve and to what extent, we can refer to data from Uniswap liquidity pools. Since altcoins are typically traded by more native crypto traders on decentralized exchanges, the activity on the earliest established DEX can serve as a proxy for altcoin trading trends (note: this data reflects Uniswap trading on the Ethereum mainnet).

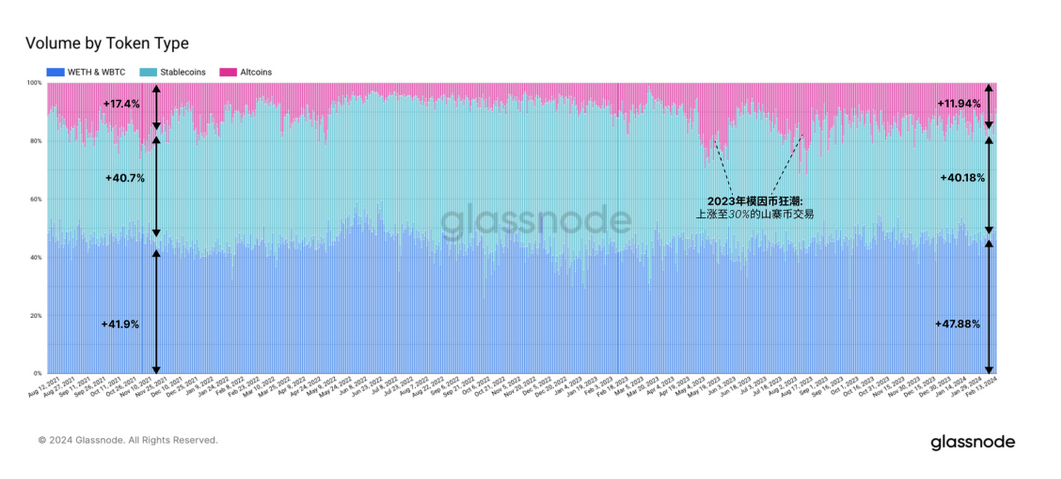

During the bear market in 2022, interest in altcoin trading was very low, but it began to increase in mid-2023, mainly driven by the "meme coin frenzy." Currently, altcoin trading accounts for nearly 12% of Uniswap trading volume, close to the peak of 17.4% during the last bull market. In comparison, WBTC and WETH trading accounts for 47% of the volume, and stablecoins for 40%.

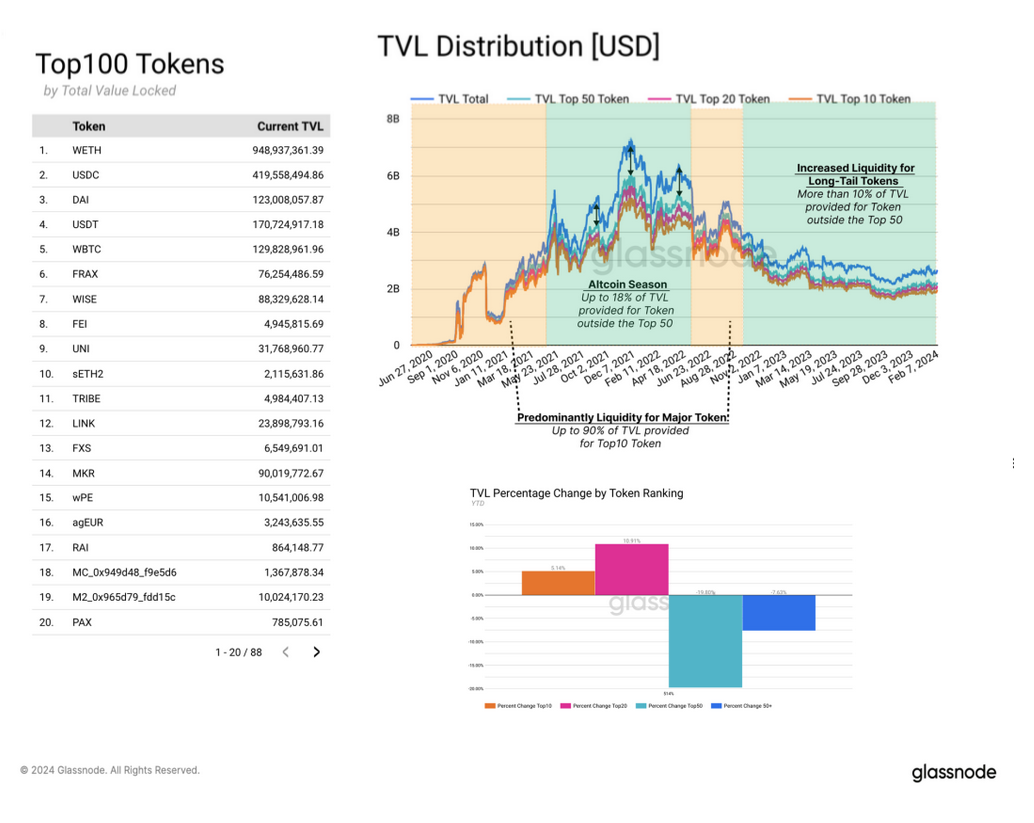

Liquidity providers on Uniswap tend to closely monitor the market, and changes in the distribution of liquidity across pools can provide indications of market trends. By examining the composition of the total locked value (TVL) on Uniswap, we observe an increase in liquidity allocation to tokens outside the top 50 during the altcoin season. This trend indicates growing interest from investors in long-tail assets.

During the bear market, liquidity was mainly provided for the top 50 tokens, as this is where most of the trading volume occurs. The top 10 tokens are primarily composed of WETH, WBTC, and stablecoins.

By examining the percentage change in TVL for each token category, we can detect an increase in liquidity provided for the top 10 (5.14%) and top 20 (10.9%) tokens, while liquidity for tokens ranked 20 to 50 has been removed. This indicates that the demand for long-tail assets has not significantly increased.

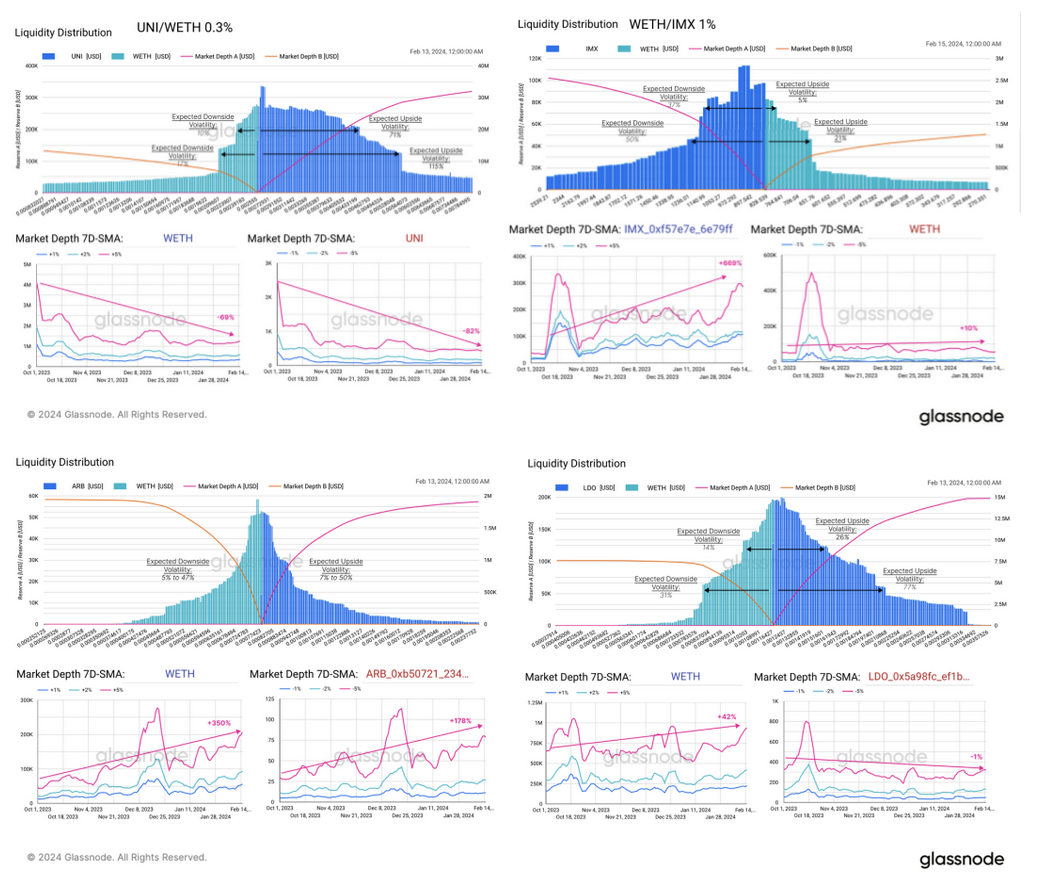

We will now examine the liquidity pools of top tokens in various sectors within Ethereum. This includes evaluating the distribution of liquidity across different price ranges and observing the evolution of market depth (similar to the hypothesis we established in the 36th weekly on-chain report).

The distribution between altcoins and WETH reserves is relatively balanced, with overall slightly higher expected upward volatility. This indicates that liquidity providers generally hold a bullish view on these tokens. GameFi token IMX is an exception.

When observing the rate of change in liquidity distribution, we see an increase in market depth in the -5% and +5% ranges, indicating that liquidity providers are preparing for a period of greater price volatility.

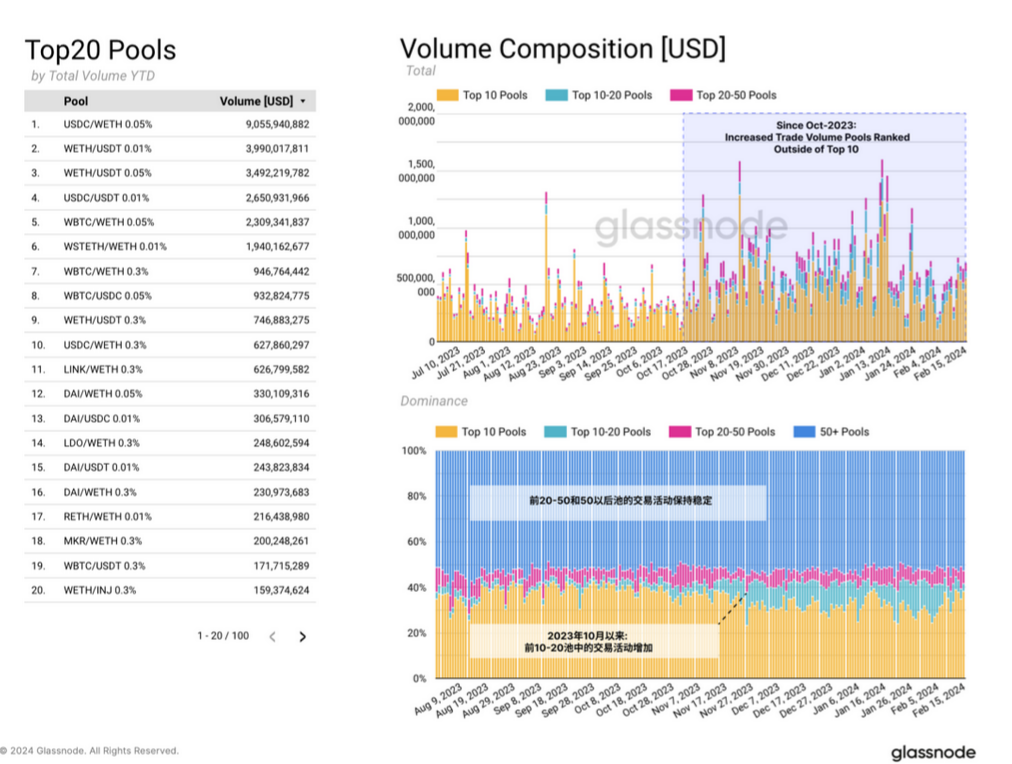

UNI is an exception, as market makers are increasingly concentrating liquidity around the current price range. This indicates an expectation of smaller price fluctuations for the UNI token, which is not surprising given that it is one of the most mature and stable tokens. Now, in contrast to the behavior of traders, we can observe an increase in trading volume on Uniswap since October 2023, including tokens outside the top 10.

In contrast to the behavior of traders, we can observe an increase in trading volume on Uniswap since October 2023, including tokens outside the Top 10. The trading activity of token pairs from the top 10 to the top 20 is also on the rise.

However, the trading activity of token pairs ranked 20-50 and 50+ remains unchanged, once again confirming our previous assumptions. While liquidity providers are moving towards the higher risk curve, trading volume has not kept pace.

IV. Summary and Conclusion

The market momentum of the new Bitcoin ETF, as well as the anticipation of a bull market in digital assets, has begun to shift capital towards altcoins. Our altcoin indicator suggests that the alternative coin market may experience a more mature and potentially sustained uptrend, but it is currently still relatively concentrated in higher market value assets.

Over the past cycle, there have been significant changes in the digital asset landscape, with new ecosystems challenging the dominance of Ethereum. Solana has been the strongest performer over the past year, but there has also been activity within the Polkadot and Cosmos ecosystems. Within the Ethereum ecosystem, the top tokens in the staking sector show the most consistent inflows of capital.

The resurgence of altcoin trading on Uniswap, along with patterns in liquidity and trading volume, highlights a growing and increasingly cautious interest in long-tail assets. This is initially reflected in the changing liquidity provision and the expectation of high volatility. However, this is particularly evident in the TVL within the pools, as trading volume from investors has not followed suit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。