Narrative and technical double blessing, is Starknet worthy of its name?

Author: MIIX Capital

Introduction

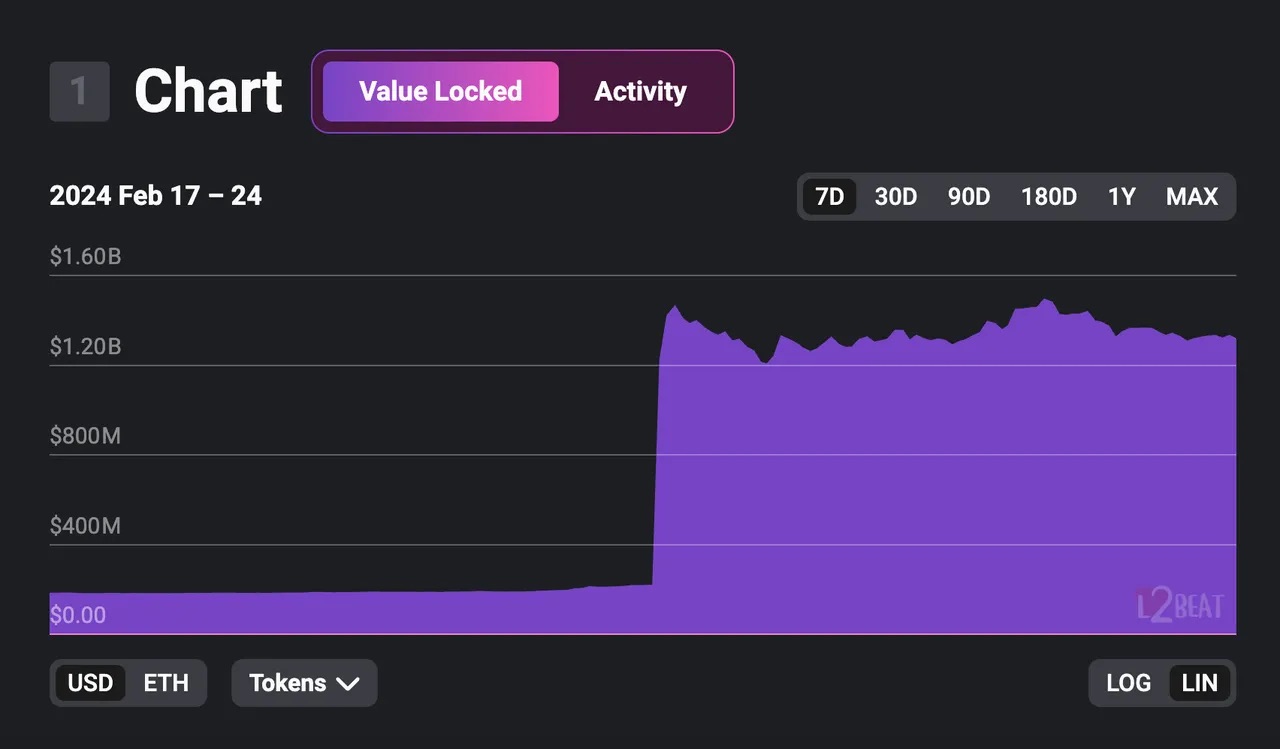

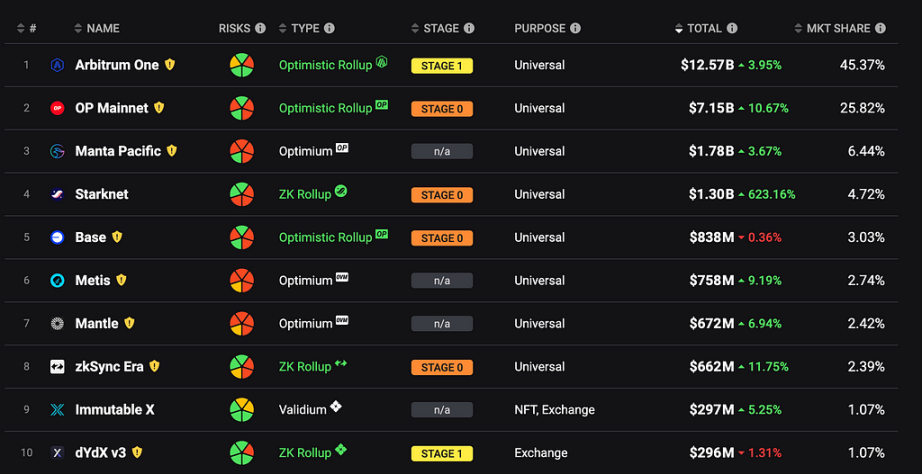

Recently, Starknet has continued to dominate the market spotlight and has received support and pursuit from numerous institutions and users. As of February 23, L2BEAT data shows that Starknet's TVL has exceeded $1.4 billion, reaching a historic high of $1.48 billion, with a 7-day increase of 705.42%.

TVL surged 6 times from the start of the airdrop

On February 14 (UTC+8), Starknet opened the qualification query entrance for claiming and officially opened the airdrop application on February 20, officially kicking off the hot trend of Starknet. Despite occasional address duplication records and incorrect markings during this period, it did not dampen the market's enthusiasm.

According to Token Flow data, on the day the application was opened, approximately 380,000 users claimed a total of 340 million STRK tokens, accounting for 57.99% of the total airdrop amount.

Furthermore, on the second day of the application opening (February 21), Starknet's TVL data surged 6 times, reaching a peak of over $14.8 billion, and has been maintained at over $12 billion. At the same time, STRK has been successively listed on multiple leading trading platforms, with the current price of approximately $1.91. Calculated accordingly, the total airdrop amount is close to the TVL growth, indicating that almost all tokens have been locked in, which seems to indirectly reflect the market's affirmation of Starknet's value consensus at this stage.

Intense focus eruption, Starknet receives strong support from leading platforms

Looking back at the relevant information, Starknet's popularity has almost erupted within the past two weeks, especially before and after the application opening on the 20th, major leading trading platforms such as Bitget, Binance, OKX, Bithumb, and Coinbase successively announced and launched STRK spot trading. Binance launched U-based STRK perpetual contracts on the 21st, with a maximum leverage of 50 times.

In addition, Binance and OKX almost simultaneously announced the distribution plan of STRK to ETH staking users, and OKX Web3 wallet announced on the 21st that it has fully supported the Starknet ecosystem. For a moment, Starknet has become the darling of the market and institutions. Based on our perception of it, it seems that the prosperity of Starknet and the market it brings are within reach.

Recent related developments

February 10: Starknet blockchain browser Voyager released the STRK airdrop data dashboard page;

February 14: Starknet opened the qualification query entrance and announced the application opening time;

February 17: Starknet's ecosystem AMM protocol JediSwap launched Jediswap v2, which is similar to the design of Uniswap v3;

February 19: News that the smart contract wallet Argent launched a multi-asset management solution Portfolio for managing Starknet assets;

February 20: Pyth Network announced the launch of STRK/USD price feed data;

February 22: Starknet Foundation announced the official launch of the DeFi Spring event, a month-long task series on Starknet;

February 22: Polygon Labs collaborated with the StarkWare team to launch the fast proof system Circle STARK, planned to be merged into Plonky3;

February 23: Starknet announced the launch of StarkGate 2.0 mainnet;

February 23: EthSign announced the integration of Starknet wallet, allowing users to seamlessly log in, send, and sign contracts through the Starknet wallet;

Narrative and technical double blessing, is Starknet worthy of its name?

StarkNet is recognized for its advantages in terms of technology: resistance to quantum attacks, STARKs technology, and a strong engineering team. In addition, it has the endorsement and recognition of well-known institutions and leading KOLs, including Vitalik, which makes StarkNet's narrative very strong, giving us great room for imagination in terms of market value.

However, the current popularity seems to overshadow certain factors that may make it appear to be out of line with its market value and popularity:

Firstly, StarkNet's ecosystem is still in its early stages and is relatively underdeveloped. Due to issues such as development and user experience, the ecosystem still lags behind other Layer2 solutions like zkSync, let alone compared to OP and ARB, not to mention replacing or surpassing them, at least in the short term.

Secondly, based on the current price, StarkNet's market value is close to $20 billion, which already exceeds the market value of OP and ARB. If calculated based on institutional investment amounts and valuations, the current market value of StarkNet alone is still overvalued.

From these two perspectives, with the surge in TVL and the concentrated eruption of market heat, Starknet's market value is clearly overvalued. Even with the double blessing of narrative and technology, it seems to be not living up to its name. This raises concerns about whether the current token price and market value are just a phase influenced by the environment.

Is Starknet's performance a burst of popularity or market inflation?

Starknet's hot performance is both the result of its own explosive energy accumulation in the past and related to the current market trend, all stemming from people's FOMO sentiment towards Starknet and the market.

From an objective perspective, on the one hand, Starknet's market value performance is clearly overvalued. Although accompanied by market heat and support from institutions and VCs, Starknet's current ecosystem and applications do not support its current performance, and it is highly likely to return to rationality in the end. On the other hand, the entire market is currently in an upward trend, and the overall market heat is constantly increasing. When users' expectations of the market and Starknet are superimposed, this overvaluation may only be superficial. With the continuation of market heat and trends, Starknet's value will transition from virtual to real.

It may not be that Starknet's performance is overvalued, but rather that the market is continuously inflating with capital inflows and accumulating emotions, and Starknet happens to be the most eye-catching in the market inflation. This seems to be another test before the arrival of a bull market, and perhaps the next moment will bring us the long-awaited surprise. All of this still needs time to verify.

About Starknet

StarkNet is an Ethereum Rollup Layer2 based on ZK-STARKs technology. Its parent company is StarkWare, which has StarkEX for enterprise services and StarkNet Layer2 for consumers. StarkNet simultaneously considers privacy and scalability, allowing DApps to achieve unlimited scalability and technical extension without compromising the composability and security of ETH, making it an effective solution for high throughput and security requirements.

Advantages of Starknet

Can complete transaction packaging without knowing the verifier, and there is no need for a seven-day waiting period when transferring assets across chains;

Balances privacy and scalability, effectively protecting the privacy of user transaction data and data security;

Highlights in ensuring network stability, promoting V3 transactions, reducing L1 fees to reduce transaction costs, and other aspects;

Each part of the native account abstraction has a unique role, contributing to the overall user experience improvement;

The hardware signature function utilizes the secure subsystem built into the device, ensuring the security of user keys even if the application processor core is compromised.

Issues with Starknet

The official cross-chain bridge StarkGate has just launched and may face smart contract risks;

The use of the independent Cairo language may affect developer entry, leading to slower-than-expected ecosystem development;

The current ecosystem lags behind in many aspects, which may result in being overtaken by other projects in terms of technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。