Prediction: With the disappearance of adverse factors such as regulation, the next Bitcoin halving event in April 2024 will boost the price of Bitcoin.

Author: panteracapital / Source

Translation: Plain Blockchain

1. Disappearance of Adverse Factors

At the Bloomberg Investment Conference last June, I discussed banking crises, global macro markets, and blockchain with former SEC Chairman Jay Clayton. At the end of the discussion, the host asked me what black swan events we should expect. My response was:

"Everyone ignores black swan events until one happens. Then everyone wants to talk about 'what's next.' I would say the biggest surprise is that we've already experienced all these huge events last year—and nothing crazy happened.

"But if you want me to say something, I would say, something that no one anticipated is regulatory clarity. There are several ways to achieve this."

Now a very important theme is the absence of adverse factors. Rare and crazy adverse factors have been occurring for most of 2022 and 2023.

The volatility of global macro markets has often exceeded historical ranges. According to Edward McQuarrie, a distinguished professor at Santa Clara University who researches historical investment returns, 2022 was the worst year for U.S. bond investors on record: "Even if you go back 250 years, you won't find a worse year than 2022."

Since the Great Depression, 2022 was the worst year for the classic 60/40 stock and bond investment portfolio.

Even more impactful was the private market, which affected our venture capital field. The amount raised in initial public offerings decreased by 95%, and the number of trades decreased by 85% compared to the previous year.

The blockchain market suffered all of this, along with Sam Bankman-Fried's $50 million criminal activity and the absurd leverage of half a dozen lending institutions, resulting in a 70% decrease in the total market value of the cryptocurrency market.

In my view, these are rare and strange events for a generation. In the next 10 to 15 years, no one will provide uncollateralized and transparent loans to leveraged cryptocurrency hedge funds again. (After experiencing a 25-year cycle, I know that someone in the next generation will do it again!)

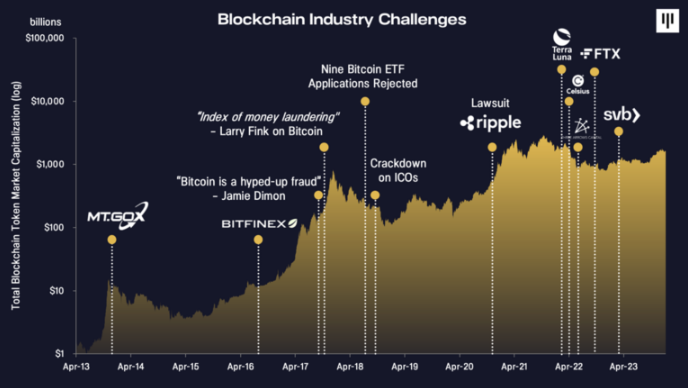

Below is a visualization of what many people consider to be a wave of catastrophic events in blockchain history.

Since these factors cannot destroy blockchain, the disappearance of these super bad events is extremely positive from a marginal perspective. Another major positive factor is the elimination of some regulatory barriers that used to hinder the development of our industry, as well as those institutions that hope to invest in this new asset class.

Since these factors cannot destroy blockchain, the disappearance of these super bad events is extremely positive from a marginal perspective. Another major positive factor is the elimination of some regulatory barriers that used to hinder the development of our industry, as well as those institutions that hope to invest in this new asset class.

In the past year, positive rulings have been made on some high-profile cases, such as the ruling that Ripple's native token XRP is not a security, and Grayscale's victory in the lawsuit against its Bitcoin ETF application. In our view, these may indicate that regulatory clarity for blockchain is being achieved, enabling the United States to further drive innovation.

Since the launch of the spot Bitcoin ETF in January, institutional adoption seems to be accelerating.

As the anticipated halving event in late April 2024 approaches, we believe the convergence of these positive factors will provide strong tailwinds for the next bull market.

Furthermore, blockchain may be transitioning from "dial-up" to "broadband." We can see this through the growth of Ethereum's layer 2 and large-scale blockchain.

We have experienced three complete cycles of frenzy—massive rallies, and then, unfortunately, facing about an 85% decline. I believe we are now in the early stages of the fourth major cycle.

The stock market crash in 2022 had a huge "denominator effect" on institutions, causing them to significantly withdraw from the private market. With the stock market hitting new highs again, they can reinvest in the private market, so I believe the next 18 to 24 months could be a strong bull market for cryptocurrencies.

This is a critical moment, as the traumatic and terrifying events in the capital markets and blockchain field over the past few years have disappeared, along with positive factors such as halving and regulatory clarity—all happening simultaneously.

2. The Most Overlooked Asset: Reassessing the Programmability of Bitcoin

Bitcoin is the most overlooked asset in the world. If I told you there was an asset:

With a market value of $900 billion (60% larger than Visa)

With a daily trading volume of $260 billion (250% more than Apple)

With a 50% annualized volatility (20% lower than Tesla)

Held by over 220 million people globally (more than the number of countries with a population of over 220 million)

…that has been ignored and excluded by the "major" financial institutions in the world for the past 10 years? Would ETFs satisfy you?

No. Especially when, relative to its size and scale, Bitcoin remains one of the most underestimated and under-financialized assets in the world.

Bitcoin is one of the most unique assets in the crypto ecosystem. Its market value and trading volume are about 2.5 times that of Ethereum. The Bitcoin network is a digital gold vault. It is a fortress supported by computing power about 500 times faster than the world's fastest supercomputer. There are over 200 million Bitcoin holders globally, while there are only 14 million Ethereum holders. Bitcoin stands alone in the regulatory gray area, recognized, classified, and treated as a digital commodity.

If Wall Street's financial system is unwilling to build for Bitcoin, then Bitcoin will have to build its own financial system.

If blockchain technology can help banks serve the unbanked, the most obvious path is through Bitcoin's global distribution in Latin America, Africa, and Asia. This already covers millions of people. If we expect trillions of dollars to eventually flow onto the chain, there is no network more secure and resilient than the Bitcoin network. As the number of Bitcoin users exceeds one billion, they will want to do more than just store and transfer assets. Capital and technology rarely stand still. This time is no exception.1) Bitcoin is a Technology

Although Bitcoin is overlooked as an asset, as a technology, it may be even more overlooked. Bitcoin has always lagged behind in scalability, programmability, and developer interest. I first attempted to build on Bitcoin in 2015, in the early stages of JPMorgan's cryptocurrency development. Apart from colored coins and sidechains, there was almost nothing else to explore at the time. These are the early pioneers of today's non-fungible tokens (NFTs) and second-layer protocols.

The conclusion at the time was: Building on Bitcoin was too hard. Ask David Marcus, former PayPal president and co-creator of Meta's Diem stablecoin. He is now building a Bitcoin payment company, Lightspark. Recently, David wrote on Twitter, "Building on Bitcoin is at least 5 times harder than using other protocols."

As a currency and technology, Bitcoin's blessing is also its curse:Resistant to change: This gives Bitcoin strong stability, but also leads to slow development. Upgrades are difficult to approve and may take 3-5 years to complete installation.

Simple design: This makes Bitcoin difficult to exploit, but also reduces its flexibility. The unspent transaction output (UTXO) model of the Bitcoin blockchain is very suitable as a simple payment transaction ledger. However, it is fundamentally incompatible with the complex logic or loops required for more advanced financial applications.

10-minute block time: This has helped the Bitcoin network achieve 100% uptime since 2013 (a rare achievement), but also makes it unable to accommodate a large number of consumer experiences.

Today, I see the stagnation of Bitcoin's development as a temporary non-structural condition. A decentralized financial system may finally be emerging, and Bitcoin is its foundation. Although its development path is different, its potential is similar to or even greater than today's decentralized finance (DeFi) on Ethereum.

2) Why Now?

In the past few years, Bitcoin has embarked on a new development trajectory:

Taproot Upgrade (November 2021): This upgrade expanded the amount of data and logic that Bitcoin transactions can store.

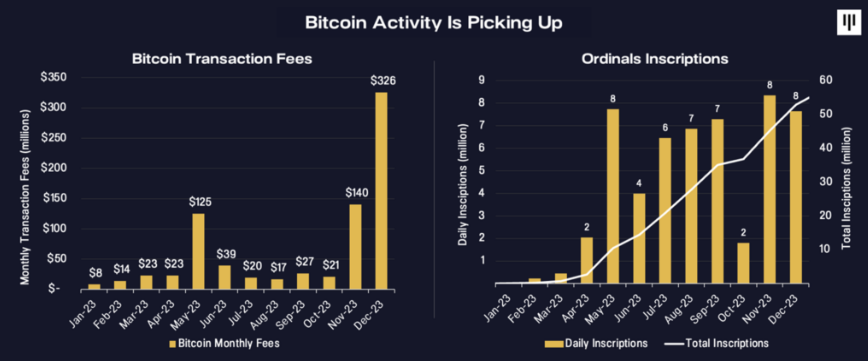

Ordinal Engraving (January 2023): A protocol implemented through Taproot that can engrave rich data into each satoshi (totaling 2.1 quadrillion). This provides a metadata layer for non-fungible tokens.

BRC-20 Token (March 2023): A type of ordinal engraving that enables deployment, minting, and transfer functions.

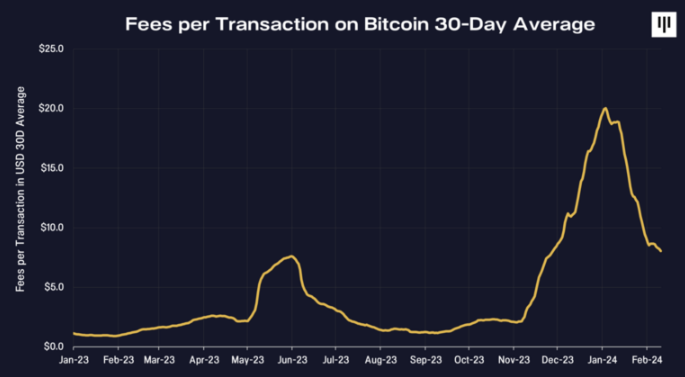

The release of fungible and non-fungible assets in 2016-2017 sparked the first wave of decentralized finance and non-fungible token activities on Ethereum. Early signs of this growth are now emerging. Due to the push for ordinal engraving, the average fee for Bitcoin transactions increased by 20 times in 2023. Bitcoin is destined to chart its own course, but it is clear that ordinal engraving has opened up a new design space for Bitcoin builders.

Larger macro trends within the Bitcoin community have sparked a psychological shift and reignited Bitcoin investors' interest in decentralized finance on Bitcoin:

Larger macro trends within the Bitcoin community have sparked a psychological shift and reignited Bitcoin investors' interest in decentralized finance on Bitcoin:

Layer 2 Adoption: Second-layer protocols like Arbitrum dominated new decentralized finance activities in 2023. This indicates the ability to scale blockchain capacity and programmability without altering the base layer.

Acceptance by Traditional Institutions: Bitcoin's breakthrough with ETF approval has overcome a major regulatory barrier, attracting capital inflows and entrepreneur attention back into the Bitcoin ecosystem. BlackRock and Fidelity are activating Wall Street's slow but powerful engine. Trading platforms are eagerly seeking every marginal source of Bitcoin liquidity. This may soon draw them into the decentralized finance space, especially with the emergence of new institutional-grade decentralized finance gateways like Fordefi.

Failures of Native Crypto Institutions: When counterparties like FTX, BlockFi, Celsius, and Genesis encountered issues, it became a global financial crisis within the crypto space. An entire generation of investors lost confidence in entrusting their Bitcoin to centralized financial services.

In hindsight, it is clear that there will be a breakthrough moment, where technological breakthroughs and macro trends are converging towards decentralized finance on Bitcoin. Now is the time to seize this moment.

3) Trillion-Dollar Opportunity

The prospect of Bitcoin achieving decentralized finance is exciting. Aside from its social and economic significance, every early builder and investor should ask themselves: How valuable is decentralized finance on Bitcoin if it succeeds?

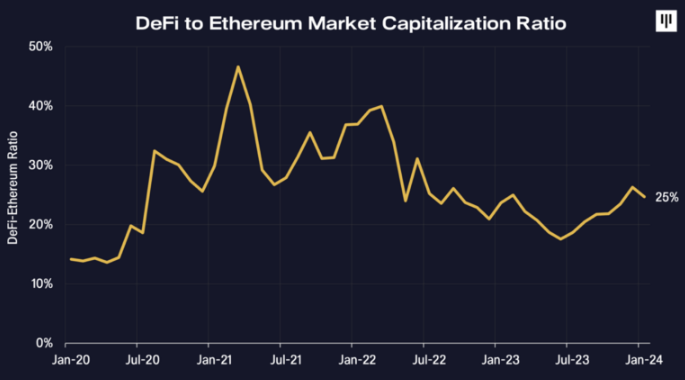

Ethereum's market value is approximately $300 billion and hosts most of today's decentralized finance activities. Decentralized finance applications built on Ethereum historically occupied a range of 8% to 50% of Ethereum's market value. Currently, they account for about 25%. Uniswap is the largest decentralized finance application on Ethereum, with a market value of $6.7 billion, accounting for approximately 9% of all decentralized finance applications on Ethereum.

If decentralized finance on Bitcoin reaches the scale of Ethereum, we can expect the total value of decentralized finance applications on Bitcoin to reach $225 billion (25% of Bitcoin's market value). Over time, its range may be between $72 billion and $450 billion (8% to 50% of Bitcoin's market value), assuming no change in Bitcoin's current market value.

If decentralized finance on Bitcoin reaches the scale of Ethereum, we can expect the total value of decentralized finance applications on Bitcoin to reach $225 billion (25% of Bitcoin's market value). Over time, its range may be between $72 billion and $450 billion (8% to 50% of Bitcoin's market value), assuming no change in Bitcoin's current market value.

Leading decentralized finance applications on Bitcoin could eventually be worth $20 billion (2.2% of Bitcoin), with a range of $6.5 billion to $40 billion. This would make it one of the most valuable assets in the top ten market cap rankings within the crypto ecosystem. Bitcoin is almost back to a trillion-dollar asset scale. However, it still holds an untapped opportunity of half a trillion dollars.

4) Looking to the Future

In the past three years, progress in Bitcoin's programmability has gradually formed a wave. Examples include Stacks, Lightning, Optimistic rollups, ZK-rollups, Sovereign rollups, and Discreet Log Contracts. More recent proposals include Drivechains, Spiderchain, and BitVM.

However, winning solutions for achieving decentralized finance on Bitcoin rely not only on technological advantages. Successful methods for achieving decentralized finance on Bitcoin require the following:

A. Consistency with the Bitcoin Economy: Any programmable Bitcoin layer should be directly related to the economic value and security of Bitcoin. Otherwise, users may perceive it as hostile or parasitic to Bitcoin. Consistency can be achieved by bridging BTC as second-layer collateral and fuel payments. It can also involve using the Bitcoin network for settlement and data availability.

B. Feasibility without Changing the Base Layer: Some proposed solutions require hard forks or soft forks of Bitcoin, which means system-wide upgrades. Given that such upgrades are very rare, these solutions are unlikely to be early contenders. However, some solutions are worth pursuing in the long term.

C. Modular Architecture: Successful solutions need to have enough scalability to integrate new technological advancements. We have already seen changes in the technological frontier of areas such as blockchain hosting, consensus design, virtual machine execution, and zero-knowledge applications. Closed, proprietary technology stacks will not be able to keep up.

D. Trustless Bridging: Bridging assets from one chain to another is very difficult. If done correctly, its challenge level is as high as interstellar travel, as it may involve various potential issues, from latency mismatches to fatal flaws. In practice, few decentralized bridging attempts have been verified. An example is tBTC, which is continuously evolving its design and decentralization.

E. Persistent Efforts: Growth requires attention to two audience groups: 1) current Bitcoin holders and 2) future Bitcoin builders. Both of these groups are dispersed in elusive ways. Trading platforms hold approximately 10-20% of the total Bitcoin supply. Around $10 billion worth of Bitcoin exists in various token forms on Ethereum. Developer focus is dispersed across multi-chain, multi-layer technology stacks. Attracting these two groups requires a mindset of "meeting them where they are."

The era of Bitcoin being overlooked may finally be coming to an end. After the ETF era, Wall Street has finally realized the obviousness of Bitcoin as an asset. The next era will be about the excitement of Bitcoin as a technology and the rekindling of Bitcoin building.

3. Protocols with Fundamental Appeal

We believe that the digital asset investment field is at a turning point, where traditional and more fundamental frameworks will be applied to digital asset investment.

Our approach is to create a sustainable, repeatable investment process, and we believe that the most consistent way to achieve excess returns is to invest in tokens with fundamental reasons that surpass Bitcoin and the entire industry.

Our main point is that tokens are a new form of capital that is replacing equity in a generation of enterprises. Tokens with product-market fit, guided by a strong management team, and with a sustainable unit economic path at the protocol layer will perform best in future cycles.

We believe that this approach will generate significant risk-adjusted returns relative to market indices as investors begin to understand how to evaluate the value of digital assets.

Below are our case studies in some areas, which include examples of specific protocols that are investable in these categories.

1) Increased Bitcoin Activity

Bitcoin activity is on the rise - not just in trading of the asset itself, but with the launch of Bitcoin ETF, new use cases have surged, many of which are brought about by programmability from second-layer solutions, bringing new possibilities to the originally rigid Bitcoin protocol.

Throughout Bitcoin's history, it has been positioned as "digital gold," and many still see this as its primary value proposition. This is true now and in the future. Recently, the idea of expanding Bitcoin beyond just a store of value has started to gain attention, and it's exciting to see innovation at the base layer, such as ordinal engraving in the underlying protocol, the Bitcoin version of decentralized non-fungible token (NFT), which was introduced as early as last year.

Data shows that transaction fees for Bitcoin protocols have skyrocketed this year due to sustained user participation driven by ordinal activity.

Due to the limited throughput of the Bitcoin blockchain, miners have an incentive to prioritize processing transactions with higher fees. Therefore, to compete for block space, participants pay higher transaction fees, which is why Bitcoin transaction fees are rising with the increase in ordinal participants. The increase in fees and user activity has two exciting aspects.

Due to the limited throughput of the Bitcoin blockchain, miners have an incentive to prioritize processing transactions with higher fees. Therefore, to compete for block space, participants pay higher transaction fees, which is why Bitcoin transaction fees are rising with the increase in ordinal participants. The increase in fees and user activity has two exciting aspects.

First, the higher fees paid by more complex trading platforms translate into increased earnings for Bitcoin miners. This helps further strengthen the security of the Bitcoin network, especially as block rewards for miners gradually decrease with each halving. At some point, to sustainably incentivize mining power to protect the network, transaction fees will need to grow sufficiently to replace the reduced block rewards.

Second, user activity is exciting to us, as it indicates an organic demand for using the Bitcoin protocol in novel ways, not just as digital gold or permissionless value transfer. Bitcoin is the most valuable, widely adopted, secure, and decentralized cryptocurrency, making it the best candidate as a global settlement layer, yet the scale of the crypto economy based on Bitcoin is relatively small. There is enormous value creation potential if only a small portion of the capital base of over $850 billion is used for liquidity in decentralized finance applications.

If the demand for these new applications and use cases continues to grow, a significant portion of the activity will have to occur on second-layer networks that support higher transaction throughput and complexity, such as Stacks.

2) Case Study of Revenue-Generating Protocol: Stacks

Stacks is a general-purpose smart contract network that brings Ethereum-like smart contract programmability to Bitcoin (similar to second-layer networks like Arbitrum on Ethereum, discussed in previous blockchain briefings). It uses a consensus mechanism called "Proof of Transfer," essentially anchoring Stacks to Bitcoin and benefiting from the security of the most time-tested blockchain network. Bitcoin can be bridged to Stacks and used in applications, and participants in Stacks earn Bitcoin-denominated revenue by securing the blockchain.

For a variety of converging reasons, Bitcoin is at a special moment in its history, driving increased interest in it: the increase in ordinal activity, the launch of spot Bitcoin ETF, and the upcoming halving in April. Users are expressing their choices through actions and indicating their desire to find new ways to use the Bitcoin protocol with previously underutilized large-scale capital bases.

Stacks is committed to bringing innovation to Bitcoin, a mission that is both exciting and timely. Interestingly, at present, Stacks is the only general-purpose smart contract second-layer network actually running on Bitcoin, while there are dozens of competing second-layer networks in the Ethereum ecosystem. While multiple viable Bitcoin second-layer networks may emerge over time, given its market leadership, we believe that Stacks will have a competitive advantage over any new competitors for a considerable period, and we expect new competitors to emerge.

A noteworthy event is the Nakamoto upgrade for the Stacks protocol in April. This will substantially improve the user experience by increasing network throughput, reducing transaction costs, and enhancing security. A core theme for us is that as second-layer networks and massively scaled blockchains grow, the blockchain is currently experiencing a moment from "dial-up" to "broadband," similar to the unforeseen surge of internet businesses after the speed of the internet increased, and improvements in blockchain infrastructure may spawn a multitude of new use cases. Therefore, we believe the Nakamoto upgrade may stimulate more Stacks innovation, creating a more vibrant ecosystem for DeFi, NFTs, and other areas based on Bitcoin as the base layer.

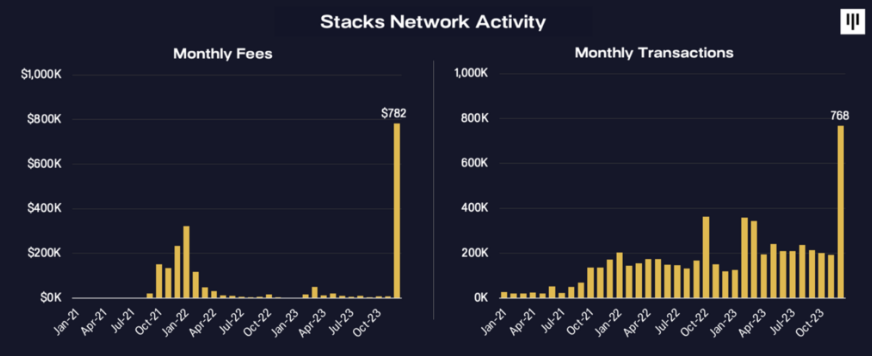

In recent times, monthly transactions and fees on the Stacks network have surged, further proving the demand for new use cases on Bitcoin. We believe that after the Nakamoto upgrade, as attention on Bitcoin continues to increase during the ETF launch and halving processes, this trend will become more pronounced.

3) Growth of Decentralized Exchange Platforms

Today, the most commonly used blockchain applications are related to trading, whether on centralized exchanges like Coinbase and Binance or on decentralized exchanges like Uniswap and dYdX. Trading is a core human activity that has existed for thousands of years and has an inevitable demand. Even during last year's low volatility bear market, trading venues continued to generate significant revenue.

In the broader category of trading platforms, decentralized exchange (DEX) platforms have been gaining a major share from centralized exchange platforms (CEX). We believe that there are several long-term structural tailwinds driving the growth of decentralized exchange terminal markets, making them attractive.

Trust in centralized exchange platforms took a significant hit after the FTX collapse, and the industry still faces some negative effects. While the situation is improving, centralized exchange platforms have strengthened their business models and compliance practices, but traders are also increasingly turning to decentralized trading venues, where asset custody is more secure and order books are more transparent.

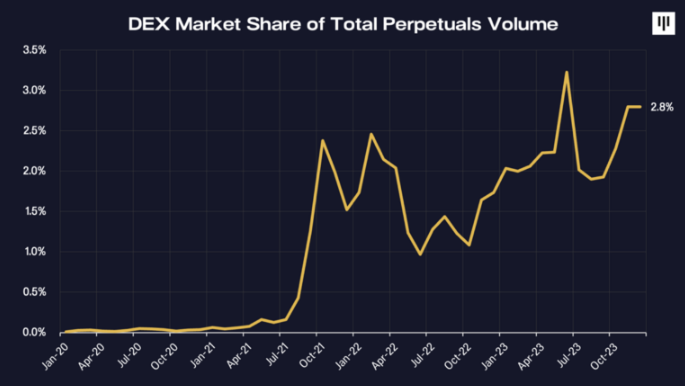

The second structural tailwind is that in the trading space, the growth rate of perpetual contracts far exceeds spot trading. This is because perpetual contracts have higher capital efficiency, just like traditional markets. Therefore, the relatively new decentralized perpetual contract market is steadily growing compared to the perpetual contracts offered by centralized exchange platforms. Decentralized perpetual contracts now account for 3% of the trading volume on centralized exchange platforms.

We believe that decentralized exchange platforms have greater potential to gain market share as they offer many advantages to traders, including better asset flexibility and control, privacy, security, and potentially lower trading costs.

We believe that decentralized exchange platforms have greater potential to gain market share as they offer many advantages to traders, including better asset flexibility and control, privacy, security, and potentially lower trading costs.

4) Revenue-Generating Protocol Case Study: dYdX

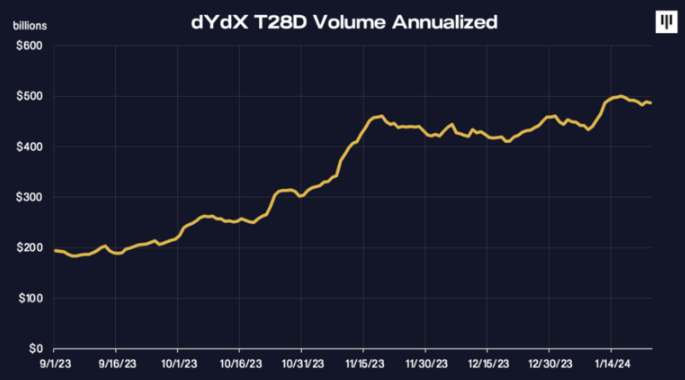

dYdX is an on-chain decentralized trading platform for trading perpetual contracts, also known as "perps." dYdX is the market share leader, with over 40% of the trading volume in the decentralized perpetual contract trading platform market, and we believe this leadership position will continue.

As fundamental investors, we focus on sustainable positive unit economic indicators. We find dYdX interesting for a key reason: over the past year, its unit economic indicators have shown positive changes. Its business model is very simple. They charge commission fees, approximately 2.5 basis points of the trading volume, and pay customers acquisition costs. With a healthy 40% profit margin, dYdX earns approximately one basis point of trading volume profit.

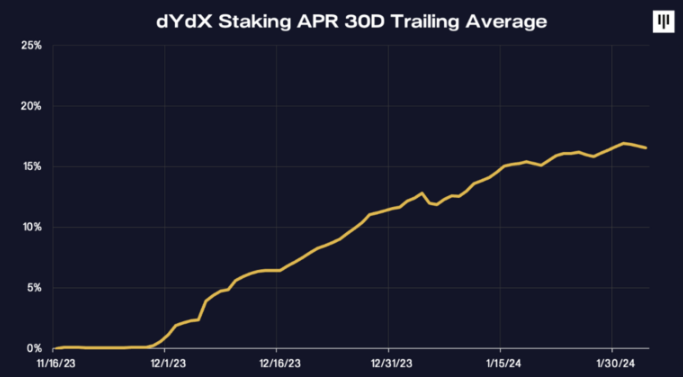

The second reason is the turning point in capital allocation that began at the end of last year. dYdX started returning capital to token holders in the form of equity dividends in the v4 upgrade in December. Now, profits from the dYdX protocol are directly distributed to token holders, making the appreciation of token value tangible.

From a protocol valuation perspective, dYdX is attractive. With the current dividend yield, its dividend yield is approximately 15%, attractive relative to any other traditional asset, especially in the context of a high profit margin and double-digit monthly growth rate, making this valuation particularly cheap.

In summary, within the next year, a reasonable scenario can be envisioned in which the value of the dYdX protocol will exceed $10 billion, more than tripling its current market value. During this period, token holders will continue to benefit from the dividend yield, and there is potential for underlying protocol price appreciation as it continues to grow.

4. Impact of Bitcoin Halving

The currency supply function of the Bitcoin protocol is completely opposite to that of fiat currency. Bitcoin's supply and coin distribution rules are entirely based on mathematics and are designed to be predictable and transparent.

"The total circulation will reach 21,000,000 bitcoins. When network nodes generate blocks, bitcoins will be allocated to them, halving every four years. First four years: 10,500,000 bitcoins. Next four years: 5,250,000 bitcoins. Following four years: 2,625,000 bitcoins. Following four years: 1,312,500 bitcoins. And so on…"

— Satoshi Nakamoto, "Cryptography Mailing List," January 8, 2009

It is predicted that the next halving will occur on April 20, 2024. Mining rewards will decrease from 6.25 BTC per block to 3.125 BTC.

In our view, it's relatively simple: if demand for new bitcoins remains stable or increases, and the supply of new bitcoins is halved, this will force prices to rise.

1) Impact of Halving on Price

The efficient market theory suggests that if everyone knows what is going to happen, it must already be priced in. Quoting a phrase attributed to Warren Buffett, "The market is almost always efficient, but the gap between 'almost' and 'always' is worth $80 billion to me." Therefore, even if we think everyone knows a fact, it doesn't mean there isn't a lot of profit to be made.

"In an efficient market, at some point, the price you pay for a stock is the same as the price you pay for a bridge that you've been told has no tolls."

— Warren Buffett, 1984, cited in Davis (1990)

If demand for new bitcoins remains stable and the supply of new bitcoins is halved, this will force prices to rise. Historically, demand for Bitcoin also increases before the halving event as people anticipate price increases.

For years, we have emphasized that halving is a significant event, but it takes several years to fully take effect.

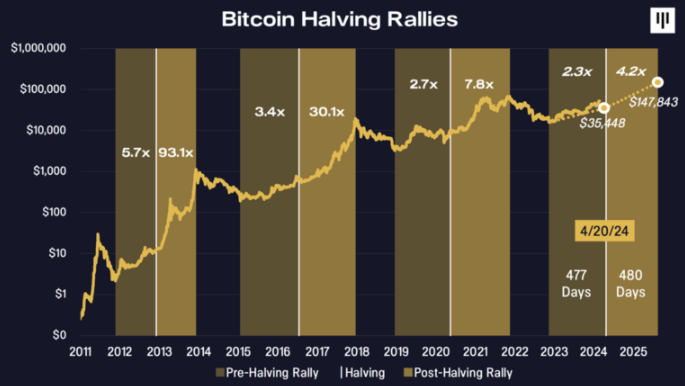

In our November 2022 blockchain letter, we analyzed the impact of halving on prices by studying the change in stock-to-flow ratio after each halving. Here are the charts included in our analysis, which also predict what might happen next.

At the time of this prediction, the price of Bitcoin was $17,000. According to the model's prediction, Bitcoin will reach over $35,000 at the next halving in April 2024. Based on the average duration of past rallies, the post-halving peak will be reached in August 2025, when Bitcoin could reach $148,000.

At the time of this prediction, the price of Bitcoin was $17,000. According to the model's prediction, Bitcoin will reach over $35,000 at the next halving in April 2024. Based on the average duration of past rallies, the post-halving peak will be reached in August 2025, when Bitcoin could reach $148,000.

Currently, the price of Bitcoin has already exceeded our predicted $35,500 per Bitcoin on the halving date, now exceeding that prediction by 60%.

2) Development of RWAs

In the blockchain space, one area we have been researching and investing in is RWAs, which involve tokenizing real-world assets. We believe that certain assets represented in token form may benefit greatly from being localized on blockchain-based platforms. These benefits include enhanced liquidity, democratized ownership, better security and transparency, and lower costs compared to traditional systems.

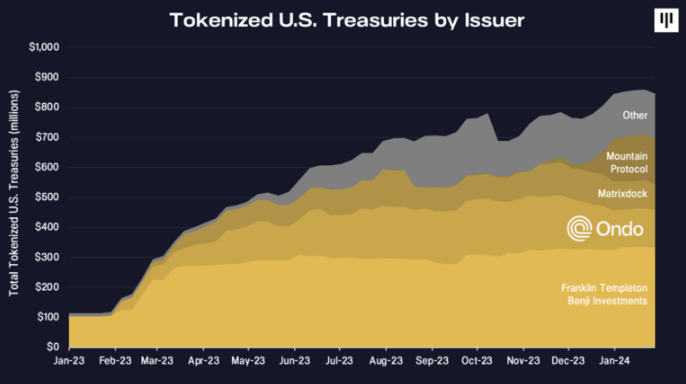

In the realm of RWAs, a rapidly growing segment is tokenized U.S. Treasury bonds, especially in the context of rising interest rates in recent years. Since early 2023, the total value of tokenized government bonds has grown 7.4 times.

In addition to the aforementioned benefits, global accessibility has been a significant breakthrough achieved through RWAs. During my interactions with people in Korea and Singapore, they talked about the seamless access to tokenized U.S. Treasury bonds through DeFi.

In addition to the aforementioned benefits, global accessibility has been a significant breakthrough achieved through RWAs. During my interactions with people in Korea and Singapore, they talked about the seamless access to tokenized U.S. Treasury bonds through DeFi.

Source: https://panteracapital.com/blockchain-letter/the-absence-of-bad-things/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。