As the airdrop event of Starknet comes to an end, investors are facing a crucial decision: Is it time to sell the STRK tokens in hand? We will provide important references for decision-making by analyzing the operating mode of the well-known market maker Wintermute in the cryptocurrency market.

Wintermute, as a well-known market maker globally, is active on major centralized and decentralized trading platforms, including but not limited to Binance, Coinbase, and Uniswap. By providing liquidity and market efficiency, they have supported the backbone of the market for over 50 important digital assets on more than 50 exchanges and platforms, such as OP, ARB, and BLUR.

By the end of 2023, Wintermute's total trading volume approached nearly $3.7 trillion, a figure that not only demonstrates its significant market influence but also reflects its complex and sophisticated market-making strategy. It is widely believed in the community that Wintermute's operating style involves various strategies such as high opening, low absorption of funds, and market washing, and often combines market trends and news in comprehensive strategies.

By comparing the market performance of OP, ARB, and other non-Wintermute market-making tokens, it can be observed that their price trends are influenced by various factors, including but not limited to their market position in the industry, token issuance timing, and overall market trends. We will focus on the market-making of OP and ARB tokens by Wintermute, as well as the performance of similar Layer2 technology token STRK, in order to reveal possible market patterns and provide investment advice for users holding STRK tokens.

OP Token Analysis

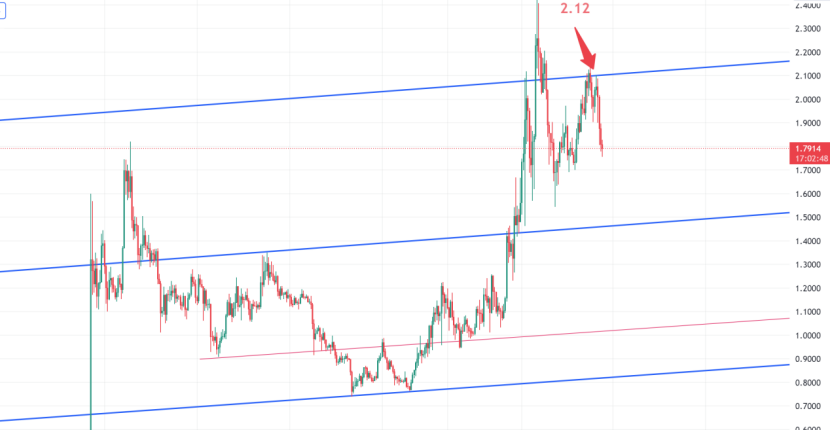

The market performance of the OP token once drew attention due to a mistake made by Wintermute in one of its operations. In a trade, a large amount of OP tokens temporarily went missing due to an address error. Although most of the tokens were eventually recovered, the incident still raised doubts in the market about Wintermute's operating motives. The price of the OP token experienced significant fluctuations in the early stages, plummeting from an initial $2 to $0.5, and after several rounds of market operations, the price stabilized at around $3.8.

Observation of ARB Token

The situation with ARB is closely related to governance-related controversies. On the eve of the ARB airdrop, an address believed to be owned by Wintermute received a large number of ARB tokens. Subsequently, a series of governance proposals by the ARB Foundation raised questions in the market about governance structure and transparency, leading to poor performance of the ARB price during this period, which gradually recovered after a long period of decline.

Current Situation of STRK Token

For STRK, although Wintermute's share of participation is smaller compared to OP and ARB, its market influence should not be underestimated. The price of the STRK token experienced significant fluctuations at the initial listing, but with StarkWare announcing an updated token lock-up plan, market confidence has somewhat recovered, leading to an increase in token price.

StarkWare recently updated its token lock-up and unlock schedule, which mainly affects early contributors and investors. According to the new arrangement, the originally planned 134 million tokens to be unlocked on April 15th were adjusted to 64 million. Subsequently, 64 million tokens will be unlocked each month, and this pattern will continue until March 15, 2025.

From then on, 127 million tokens will be unlocked monthly for the next 24 months, until March 15, 2027. This adjustment indicates a slower token distribution pace than the original plan, which may alleviate selling pressure in the market. Nearly 74% of the airdropped STRK tokens have been claimed, and the market seems to have absorbed this impact to a certain extent.

It is worth noting that Wintermute's market share in STRK is relatively small compared to other tokens such as OP and ARB, which means that their trading in the market may have a smaller impact. In addition, the liquidator of Three Arrows Capital also received a large number of STRK tokens this month and became the ninth largest holder of STRK. This event is worth paying attention to, as it may indicate that assets are being reallocated or processed during the liquidation process of Three Arrows Capital.

Historical data shows that tokens like OP and ARB tend to experience a price drop within 10 to 20 days after listing, followed by a period of fluctuation and eventually a significant increase. Both tokens encountered FUD (fear, uncertainty, doubt) crises after listing, but they also benefited from the overall trend of the market transitioning from a bear market to a bull market, which had a positive impact on their price trends.

For investors holding STRK tokens, referencing the performance of other Layer2 tokens in which Wintermute participates in the market may reveal some short-term trading opportunities, but a good entry point for the long term has not yet been established.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。