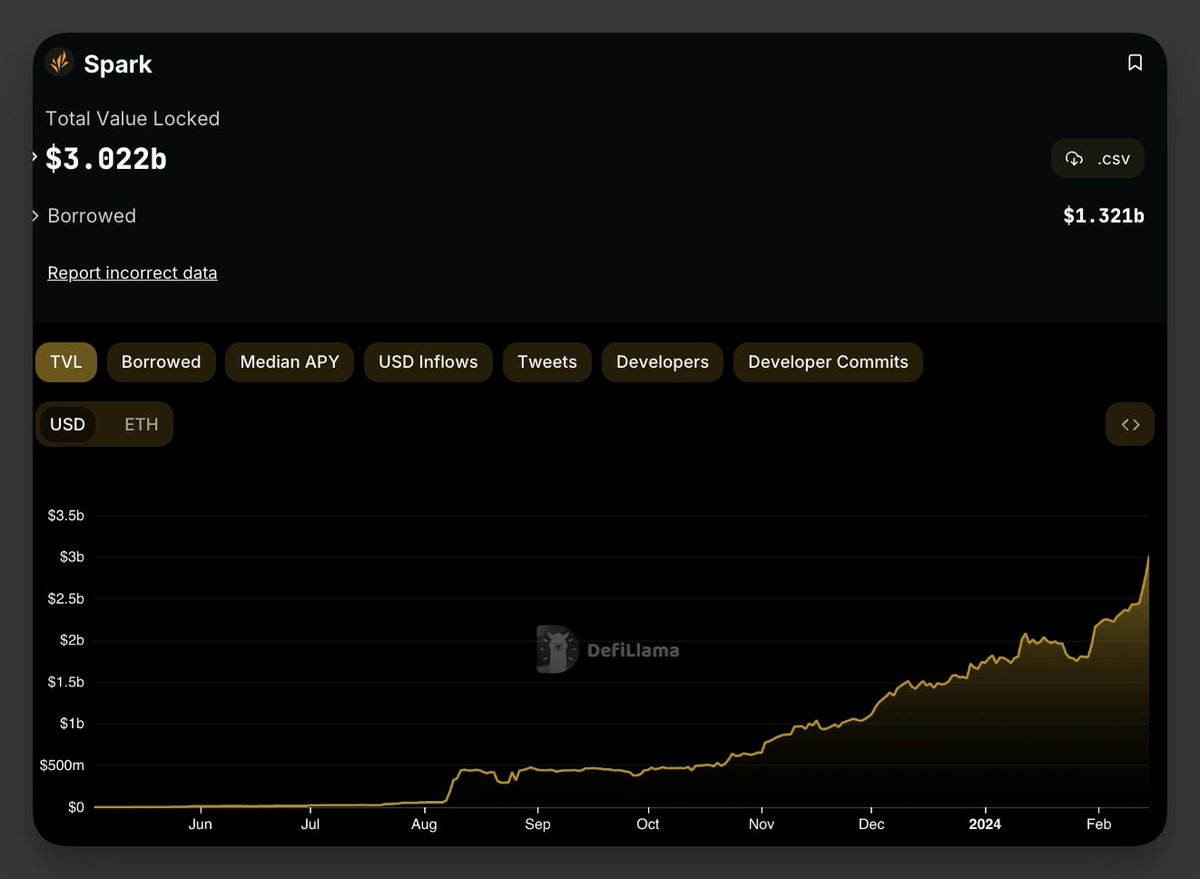

Although it has 3B in TVL, no one in CT is talking about $SPK.

Maker forked Aave and launched its own Lending protocol, @sparkdotfi, with airdrop "pre-farming" rewards.

Combine that with another "airdrop" pre-farming, like Morpho Aave (600M TVL, new product just launched), and you have yourself double-digit APYs on blue chips like ETH and BTC.

🐦 Coming back to 2Birds1Stone:

→ Deposit ETH in Spark 1% APY, $SPK pre-farm

→ Borrow DAI 6.5% APY, $SPK pre-farm

→ Lend that DAI ether using sDAI (5% APY, so negative -1.5%) or Morpho, which is closer to 6% APY, but still negative APY.

However negative DAI returns, this farms a share of 24M SPK and $MORPHO.

The opportunity cost of this example is projects like BLAST, EigenLayer, (if you are using ETH) which will be big. Spark also accepts other collateral (WBTC and stablecoins).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。