Author: Frank, PANews

Shiba Inu, also known as Meme tokens, is the first track that many ordinary investors enter the cryptocurrency field. From the beginning to the present, it is still a hot track in the cryptocurrency field. Its characteristic of small capital investment reduces the threshold for investment, and the high return meets the imagination of many investors for financial freedom. The short and fast cycle has also become an indicator of the heat of public chains. The current popularity of Solana is to a certain extent inseparable from the assistance of Shiba Inu. Projects such as Dogecoin and Shiba Inu, initially seen as community jokes, have sparked widespread market trends and created a large number of "coin circle" billionaires.

At the same time, the uncertainty and risk of the Shiba Inu market are relatively high, which requires investors to not only have keen market insight, but also need to master certain technical knowledge and trading strategies. Regarding how to profit from Shiba Inu trading, it is not just about gambling based on luck, but rather involves a certain scientific strategy. PANews aims to provide readers with a comprehensive guide to Shiba Inu investment by combing through Shiba projects, from establishing reasonable trading strategies, finding high-quality projects, identifying common vulnerabilities, to introducing common tools for Shiba trading.

I. Establishing a Scientific and Reasonable Trading Strategy

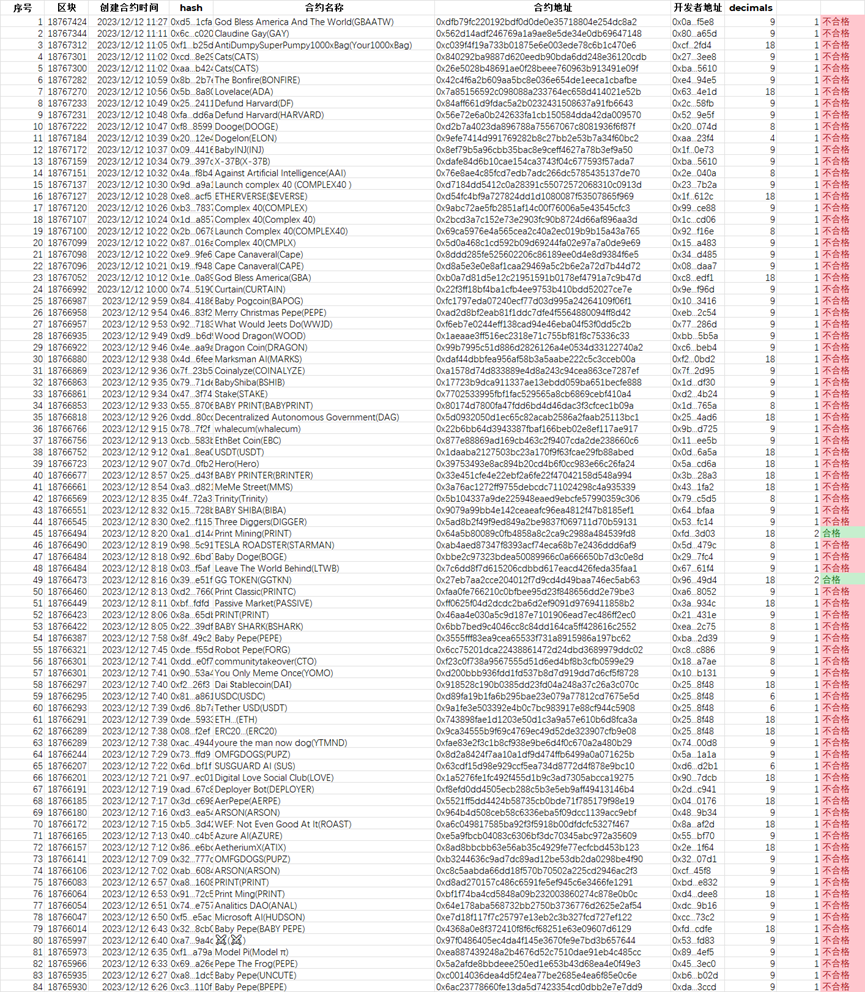

Previously, PANews interpreted the calculation of the daily issuance of Shiba on the Ethereum and Solana chains and the win rate from the perspective of the Kelly formula (related reading: ). According to the statistical results, the win rate of Ethereum is 7/213=3.28%. Solana's win rate is 1.6%. Such win rates suggest that we should not invest in Shiba projects. Therefore, if you want to profit from Shiba projects, you need to consider the issue of win rate and return. In this regard, there are generally several strategies. 1. Pursue high returns and tolerate a lower win rate. 2. Pursue moderate returns and maintain a higher win rate. 3. Lower returns, but maintain a very high win rate.

Overall, from the perspective of the Kelly formula, the product of the win rate and the odds minus the loss rate must be kept greater than 0 for the trading strategy to be worth investing in. Through public derivation, we can see that p(b+1)-1>0 is a hard condition, which means p>1/(1+b). Interpreting this, when we pursue a 9x (excluding principal) return, p should be greater than 10%. Otherwise, it is not suitable to invest funds. The suggestion given here is that, first, based on your trading habits and the achievable space for increase, infer a reasonable win rate and make improving the win rate your goal. For example, judging a certain type of Shiba project, the space for profitable trades each time is about 3 times (excluding principal), then the win rate that needs to be maintained should be above 33%. After determining the win rate target, it is to find a method that can achieve this win rate through various available tools or indicators and conduct small capital experiments and statistics. Of course, in addition to the win rate, scientific position management is also required for long-term trading. In Shiba projects, small positions are a consensus, but one point that cannot be ignored is the on-chain transaction fees and the priority fees for some tools (to ensure that your transactions can be completed quickly). Regardless of the position input method used, it is recommended that investors invest in a fixed ratio during the investment process, rather than a fixed amount. Because a fixed amount will eventually be depleted, but a fixed ratio can help reduce losses when incurring losses.

II. Finding High-Quality "Gold Shiba" Projects

This part is always the core part of Shiba trading and the most direct way to improve the win rate. There are many bloggers on the internet who will recommend the high-quality Shiba they have discovered, but there are few who teach users how to find "gold Shiba". There are several issues here. One is that there is no one-size-fits-all method to continuously screen high-quality "gold Shiba" and completely exclude "Shiba". Second, even if there are some good methods, they are mostly the wealth secrets of experienced players, and few are willing to contribute for free. PANews has summarized the following methods based on some mainstream methods on the market and the exploration of the essence of Shiba projects, in order to provide readers with some advantages. Finding high-quality "gold Shiba" projects can be summarized in two ways: 1. Exclude contracts with problems. 2. Look for opportunities for growth in contracts without problems.

First, let's discuss how to exclude contracts with problems.

Contracts with problems, or projects that go to zero shortly after going online, are generally referred to as "trash Shiba" projects. The characteristics of "trash Shiba" generally include the following aspects:

Smart contract coding problems or intentionally set backdoors.

Lack of community foundation and hot gene.

Common contract coding vulnerabilities:

Not open source: If the code of a smart contract is not public (not open source), external auditors and users cannot verify the functionality and security of the contract. This lack of transparency may hide malicious code or defects in the contract.

Minting function: If the contract retains the minting function, it may allow the project owner to take away all tokens through minting after the token issuance.

One-way risk: Many projects make it impossible for users to sell by setting up white lists, black lists, suspending trading, preventing whales, and allowing changes to transaction taxes. This often looks promising on the candlestick chart, but in reality, the vast majority of users cannot sell.

Owner has not given up: The owner may have the ability to update the contract code or change key parameters, which may be used to abuse power, such as modifying the contract for self-interest. A high-quality contract should set the owner as the address 0x0000…00 (of course, some genuine project parties will also retain Owner permissions).

DEX liquidity pool is too small or not locked: A small DEX liquidity pool can lead to insufficient liquidity in trading, making prices fluctuate easily. If the deployer does not lock the liquidity pool, it is likely that the deployer will withdraw the liquidity after running for a period of time, causing the price to instantly go to zero.

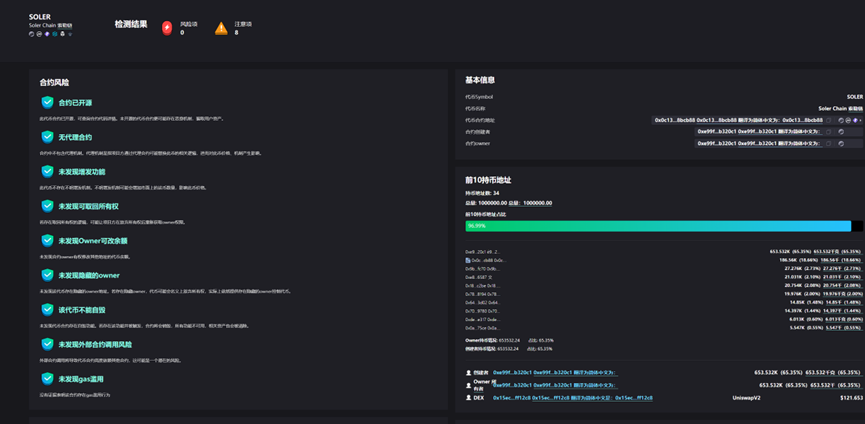

According to PANews statistics, the proportion of Ethereum chain contracts without the above vulnerabilities is only about 2%. The vulnerabilities in Solana chain contracts are much better, generally only including minting and contract permissions. Therefore, if you are participating in Shiba trading on the Ethereum chain, you have to focus on analyzing the security of the contract. Of course, there are many mature analysis tools on the market that can analyze contract vulnerabilities, and what traders need to do is to carefully analyze the contract security before each transaction.

Community foundation and hot gene: For Shiba projects, contract security is like the foundation of a building. The community foundation is the appearance and capacity of this building. Only tokens with good themes and a certain community foundation or hot gene have the possibility to stand out in Shiba projects. There are several methods to examine a project's community foundation:

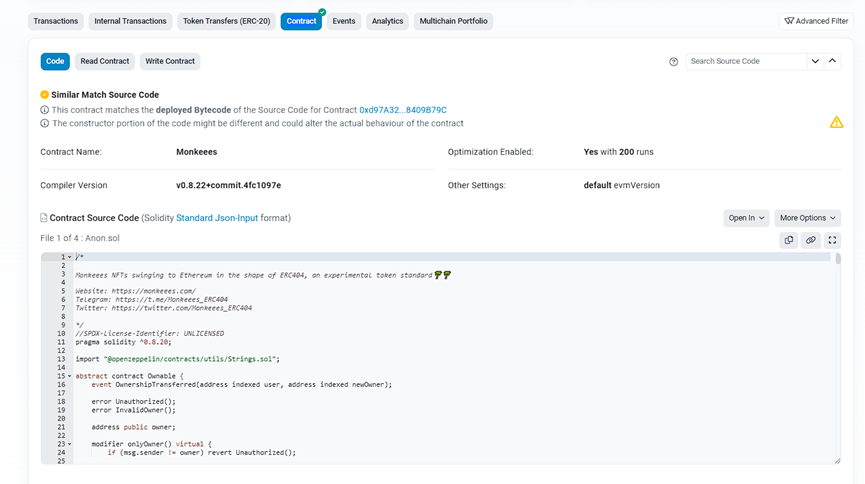

- Find social media information from the contract: Generally, Shiba projects will write their social media information in the contract, such as links to Twitter, Telegram groups, websites, whitepapers, etc. Investors can see this information by querying the contract code. Of course, the methods for Ethereum and Solana are not exactly the same. General method for Ethereum: Open the Ethereum browser - enter the contract address - click the Contract button - in the first few lines of the contract, you can see links to information such as Website, Telegram, Twitter, etc., copy these links and open them in the browser to view.

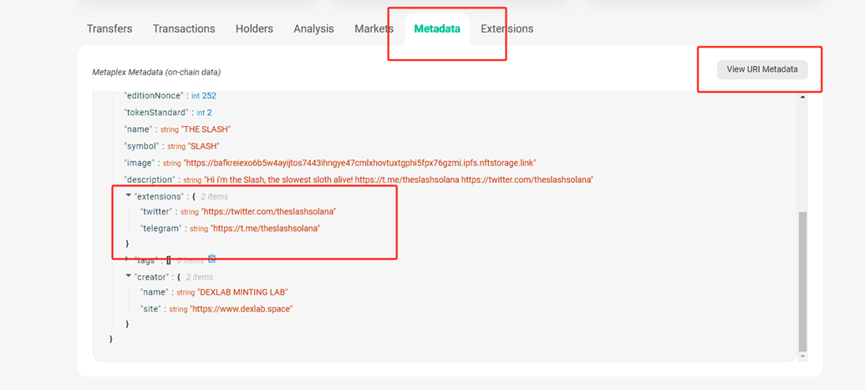

Method for Solana: Open the Solana browser: https://solscan.io/

Click on Metadata - Click on View URI Metadata - In the code, you can see information about Telegram, Twitter, and other information.

After finding social media information, check this information. Generally, there are some characteristics. Website information: Generally, obviously rough websites are made at very low cost, and can only be browsed and not clicked on any options. Or it is obviously a beautifully made project website with full functionality. In this case, check the official Twitter or information, compare the contract address with the queried contract address to prevent imitation. Twitter and Telegram: Check the number of followers and community members. The number of followers of ordinary trash Shiba is relatively small, and many are newly registered accounts. Some may purchase a certain number of followers, but the Twitter views are very low, and there is almost no interactive content. (If you follow many KOLs in the cryptocurrency field, you can also see if any cryptocurrency bloggers are following this account. Trash Shiba generally does not have bloggers following them.)

Check the project's popularity on the internet through contract information. Another method to check the popularity of a project is to directly search the contract address on Twitter or Telegram, and judge whether this Shiba has a community foundation based on the contract information found through the search. If there are no bloggers discussing this smart contract, it is very likely that this project is a trash Shiba.

Avoid imitation. Some projects may have good website information and a large number of Twitter followers, and are obviously a very high-quality project. At this time, the first reaction should not be to think that you have found a treasure, but to enter the official Twitter account or Telegram community to confirm that the official smart contract address matches the address you have queried. Many token issuers create imitations to attract careless traders and then exploit vulnerabilities.

III. Channels for Finding High-Quality Projects:

In addition to the above exclusion methods, there are also proactive methods to find high-quality hotspots and projects.

Pay attention to KOLs who often trigger Shiba hotspots, such as Elon Musk, Vitalik, and other top KOLs in the cryptocurrency field. The keywords they use in their tweets often become hotspots and trigger a certain Shiba effect. However, not all tweets can become keywords for Shiba, and it is necessary to judge the sustainability of this hotspot. The logic here is whether the keyword is hot enough: for example, Elon Musk's previous public swearing response to advertisers, which sparked a GFY hotspot and sparked discussions across the internet, making this hotspot significant. Therefore, the corresponding token also has greater potential for growth. Another key point is how much potential this hotspot has for sustainability. Taking Elon Musk as an example again, his new generation AI product GROK eventually grew into a leading meme token, the reason being that this keyword will continue to be mentioned by Musk with the launch of the AI product, thus the hotspot effect will be more sustainable.

Pay attention to projects with high daily trading frequency, which is also a good method for screening "gold Shiba". Sometimes when the source of some hot information is unclear, you can check by filtering the trading situation of some DEX tokens on the day. For example, set filtering conditions through some tools: tokens that have been listed in the last hour, and then analyze the tokens with the highest trading frequency and volume.

Track the addresses of some professional Shiba players: Profiting from others' actions is a more convenient method. Many tools now provide the function of tracking other addresses. It is also a good method to obtain information about high-quality projects by tracking the actions of smart money addresses. However, this method does not mean that all analysis can be omitted, because the rise and fall of Shiba often changes rapidly, and the effect of buying in one second and buying in the next second can be vastly different. Smart money addresses that continue to make money also know that others will pay attention to their actions, so even if you see some smart money buying into certain projects, you should still conduct a detailed analysis of contract security and community foundation using the above methods before making a trade.

IV. Trading Strategies:

Finding good trading targets does not guarantee definite profits in the Shiba race. There is a classic saying in financial investment: "The apprentice knows how to buy, the master knows how to sell." Next, let's analyze the choice of trading strategies for buying and selling.

Trading strategy for buying:

There are often two choices when buying, one is to pursue extreme speed, and the other is to pursue stability.

Pursuing extreme speed: Buy at the first moment the token is listed, which may be at the lowest point. Once the token's market stabilizes, the earlier the buyer enters, the higher the likelihood of profit. However, there are several problems here.

The risk of buying in early increases. Because the token issuance process of many Shiba projects is very short, from deploying the contract to trading online takes only a few minutes. It is difficult to judge the quality of a project in these few minutes, and some projects may initially appear to have no problems with the contract, but after a period of trading online, the contract owner may harvest users by modifying the contract.

Being caught at a high price. Many professional Shiba traders use programs to increase the gas fees and slippage of trades to ensure they buy in at the first moment. Ordinary users often do not want to pay high fees and slippage, resulting in buying at a price much higher than the lowest point, and it is very likely to buy at the highest point. Therefore, unless you have extensive experience in getting in on the ground floor, it is not recommended to buy in at the first moment (even if you have a trading bot).

Pursuing stability: Another trading style. It is to avoid buying at the first moment and choose to wait a while, analyze the contract security, community heat, and market conditions after opening, and then decide to enter when the project stabilizes. The benefit of doing this is to avoid buying into a trap, but the downside is that you may miss a good opportunity or entry point. However, based on the market characteristics of Shiba projects, generally, Shiba projects will experience a wave of profit-taking and a significant price pullback in the first few minutes after opening, which can provide more reasonable trading prices for traders seeking stability.

Trading strategy for selling:

Selling Shiba is a key issue, and many traders who have finally chosen the right project often end up either selling too early or too late, often experiencing the phenomenon of "selling too early".

There are several common strategies for selling:

Double the initial investment and stop loss at a 50% drop. This is a strategy used by many Shiba players. When the price increase of the purchased token exceeds 2 times, choose to withdraw the initial investment, and keep the remaining profit in the market for further development, which can safeguard the safety of the initial investment. Or choose to sell all when the price drops by 50% to preserve funds. It is worth noting that transaction fees should be taken into account here.

Sell based on a preset odds. Earlier, we mentioned using the Kelly formula to calculate the investment ratio based on win rate and odds. Therefore, when selling, you can also execute based on a strict trading strategy. For example, under a certain trading strategy, the win rate is 40%, so in order to maintain continuous profitability, the odds for traders should be at least 2.5 times (excluding the initial investment). Only in this situation can continuous profits be achieved.

V. Common Tool Types:

Shiba trading now has more and more tools emerging with the maturity of the cryptocurrency market, and using different tools can sometimes become the core advantage in defeating other traders. Below are some common types of tools and the functions they can achieve. Traders with the ability to take action can also develop their own suitable types of tools based on these principles.

- Contract security tools: These tools are mainly used to check for security issues in contract code. They are used to analyze whether there are vulnerabilities in the contract code at the beginning. Basic market-watching tools currently integrate these functions.

Ethereum: https://gopluslabs.io/ https://honeypot.is/

Solana: https://birdeye.so/ https://www.dextools.io/ https://dexscreener.com/

- Shiba Trading Bots: Through these trading bots, users can participate in Shiba trading more quickly. However, due to the limitations of on-chain transactions, these trading bots require access to the user's private keys. Therefore, when using these trading bots, it is important to carefully assess security and ensure that only a small amount of funds is placed. Additionally, reasonable slippage and gas fee standards need to be set.

Unibot, pepeboost, Banana Gun, etc.

- Contract Screening Push: These tools are in the form of Telegram bots and can push the latest contract information at the first moment of listing. This allows for capturing the latest Shiba projects at the earliest opportunity, but traders still need to further analyze Shiba projects.

https://t.me/SolanaNewListing https://t.me/bountyhuntertext_bot

- On-Chain Heat Query: These tools have statistical functions and can show which Shiba projects are currently the hottest in the market. They are suitable for finding Shiba projects that have already been listed. It is worth noting that even projects with high trading volume may not necessarily be of high quality.

https://77dao.io/ https://www.coinscan.com/

- Smart Money Address Tracking: These tools can help users find new trading targets by analyzing and tracking the transaction activities of some smart money wallets. However, they are mostly paid services, and as mentioned earlier, smart money addresses do not guarantee definite profits and may sometimes increase costs.

https://pc.diting.ai/ https://www.candlestick.io/

- Browsers and API Interfaces:

Ethereum: https://etherscan.io/ https://www.infura.io/

Solana: https://solscan.io/ https://getblock.io/

Summary:

There are significant trading risks in Shiba trading. Even with various tools and project screening strategies, it is not guaranteed to achieve stable returns. Therefore, before deciding whether to enter the Shiba race, it is best to thoroughly analyze and understand the track and form a set of personal trading strategies. During Shiba trading, it may be necessary to spend a lot of time tracking and analyzing on-chain information every day, which can be relatively tedious. Therefore, in Shiba trading, what needs to be invested is not just money, but also a significant amount of time and energy. The above content is not investment advice, and it is recommended to make reasonable judgments.

PANews Red Packet "Dragon", read articles, collect crypto! Win 100 U in the New Year Red Packet!

Collect today's mnemonic phrase

Follow @PANewsCN on Twitter to participate, activity link:

https://twitter.com/PANewsCN/status/1756118030571249787

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。