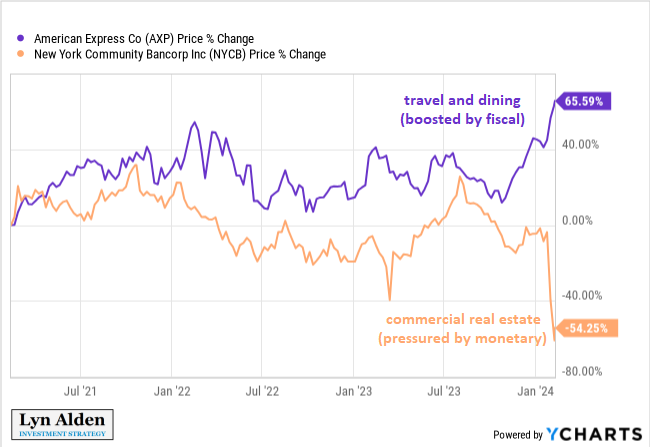

The wider-than-normal divergence between loose fiscal policy (which is stimulating) and tight monetary policy (which slows things down) contributes to wider-than-normal divergence between the performance of different economic sectors.

In particular, it results in a wider-than-normal gap between sectors that are directly or indirectly on the receiving side of the deficits (eg business that rely on spending from upper and upper-middle class spenders) vs those that are the most sensitive to interest rates and thus are the most hurt by tight monetary policy (eg commercial real estate).

And because some sectors of the economy are doing great partially due to the fiscal stimulus, it makes it unlikely that monetary policy or other assistance will arrive to the weaker areas any time soon.

And then ironically, because public debt levels are high, tight monetary policy *contributes* to looser fiscal policy by increasing the overall interest expense of the government, which goes to various entities in the economy and strengthens some of the sectors that are not sensitive to interest rates.

This is a condition known as fiscal dominance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。