Author: The DeFi Investor

Translation: Luccy, BlockBeats

Editor's note: The DeFi Investor has analyzed the important events and trends that may occur in the cryptocurrency field in February. He has predicted several important events, including the launch of a Bitcoin spot ETF in Hong Kong, Starknet token issuance, EigenLayer staking rewards, Frax Finance's L2, anticipated upgrades for Dencun, as well as the unlocking of APT and SAND.

At the time of publication, some of the predictions have already been realized. BlockBeats will now translate the original text as follows:

Is February a bullish or bearish month for cryptocurrencies?

Interestingly, historically, February has been one of the best-performing months for Bitcoin, with only two red Februarys in its entire history.

For Ethereum (ETH), the situation is even better, as it has only had one red February in its history. However, Bitcoin has never closed higher for six consecutive months, and it has been in an upward trend for about 5 months now.

Regardless of the future price trend of Bitcoin, this month will be another narrative-filled and full of new trading opportunities. Therefore, here are some significant events expected to occur in February:

The First BTC ETF Launch in Hong Kong?

Harvest Global Investments, a major asset management company in China, applied to launch the first BTC ETF in Hong Kong a few weeks ago. Another financial giant, VSFG, has set the first quarter of 2024 as the target for launching a BTC ETF.

In addition, the Hong Kong regulatory authority confirmed in December last year that they are seriously considering accepting applications for a Bitcoin spot ETF. Harvest Global Investments seems to be targeting the launch of the first Bitcoin spot ETF in Hong Kong after February 10.

It sounds incredible, but perhaps we will get the approval for a Bitcoin spot ETF in Hong Kong this month. Furthermore, if this happens, VSFG has revealed their plans to launch a spot ETH ETF in Hong Kong in the second quarter.

The launch of the US Bitcoin spot ETF has been hugely successful, with a total net inflow of over $1.5 billion, despite significant selling pressure from Grayscale. The Hong Kong Bitcoin spot ETF may also attract a significant amount of funds.

Starknet Token Launch

Starknet is a key project in the Ethereum L2 space and one of the first ZK-Rollup L2 networks built on Ethereum.

Although there is no official confirmation, many people familiar with the Starknet ecosystem expect the STRK token to go live in February.

The project team confirmed that they took a snapshot of token distribution over 60 days ago, so the token release should not be too far off.

Why is this important?

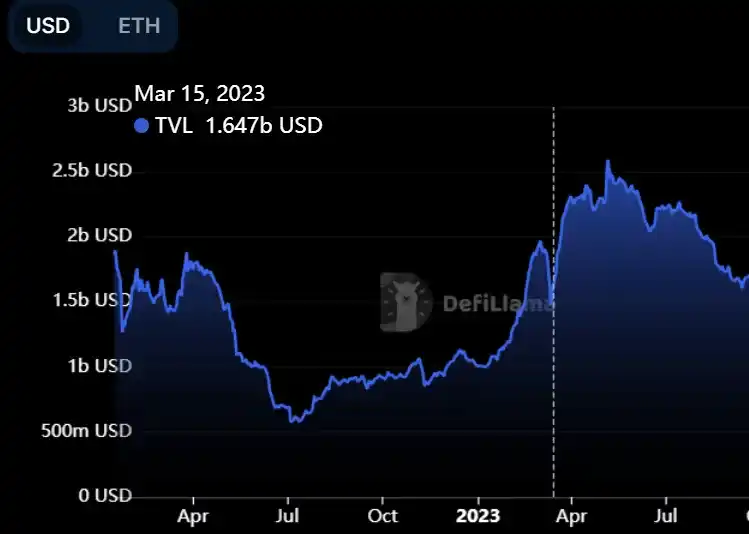

Whenever a significant L2 project announces the launch of its token, ecosystem activity and TVL usually surge from that moment until the token generation event ends. For example, in the case of Arbitrum, the TVL increased by $500 million within a week of the confirmation of the ARB token launch.

Before the launch of the ARB token, the prices of many tokens in the Arbitrum ecosystem also surged, followed by gradual selling after the ARB token generation event. Therefore, the token release ultimately proved to be a selling news event.

In the coming weeks, a similar situation may occur in the Starknet ecosystem, so this is something to keep in mind, especially if you are trading narratives.

Reopening of Deposits for EigenLayer

Later today, the largest re-staking protocol, Eigenlayer, will reopen deposits.

They have removed the individual 200k ETH limit for LST, but the re-staking points allocated for any staked token or re-staked token will be limited to a maximum of 33% of the future issuance total.

Personally, I am using a relatively large amount of ETH holdings to mine EigenLayer airdrops, as I believe it is one of the best earning opportunities for ETH at the moment. In short, I am using 4 re-staking protocols to mine EigenLayer airdrops:

- Kelp DAO: Currently, a reward of 100,000 Kelp points is available for each minted rsETH, for a limited time.

- Eigenpie: Until February 12, Eigenpie points have a 2x bonus.

- EtherFi: Using EtherFi, an additional 20 EigenLayer points can be obtained for each staked ETH (using my referral link for re-staking each ETH can earn an additional 1k EtherFi points).

- Renzo: Until February 11, 200 ezPoints can be earned for each re-staked ETH.

The EigenLayer TVL has currently reached $2.1 billion. Its growth rate this year is incredibly fast, and there are many ecosystem airdrops announced every week. I don't think its popularity will fade quickly.

Next, the final testnet for the second phase of EigenLayer is scheduled for February 7. The second phase will allow re-stakers to finally start delegating their ETH to operators running active validation services. Here is a good overview of the second phase of EigenLayer:

L2 Launch of Frax Finance

Frax Finance is a DeFi product ecosystem on Ethereum, with its most popular products including the FRAX stablecoin and the staked token frxETH.

The team has long been dedicated to Frax's own L2 blockchain, and now it appears that its launch is expected on February 7. Fraxtal (the name of Frax's upcoming L2) is not just another simple Optimism fork, as it will bring several interesting innovations.

Gas Token Flexibility: Fraxtal will use both frxETH and FRAX as Gas tokens simultaneously.

Block Space Incentives: Users, applications, and developers will be rewarded for using the veFXS network, which is the staked version of FXS.

BAMM: A new type of lending AMM (developed by the Frax team) will allow users to leverage any token on Fraxtal's new L2 without the need for oracles within 1 to 2 months after its launch.

Curve Finance and Ra (a DEX created by the Ramses Exchange team) have confirmed their deployment on Fraxtal. The founder of Frax Finance boldly predicts that Fraxtal will attract hundreds of millions of dollars in the first month.

Ethereum's Dencun Upgrade Final Testing

The planned release of the final testnet for one of the most important Ethereum upgrades is scheduled for February 7. If all goes well, Ethereum's Dencun upgrade may go live on the mainnet in March or April.

The Dencun upgrade is crucial because it introduces proto-danksharding. It is expected that proto-danksharding will significantly reduce L2 transaction fees by lowering the "rent" that L2 must pay, making it more affordable.

Over the past two years, L2 has experienced significant growth, and if Dencun can meet the community's expectations, it is likely to attract a large number of new users to Ethereum L2, making it more affordable.

Major Token Unlocks

New month, new token unlocks.

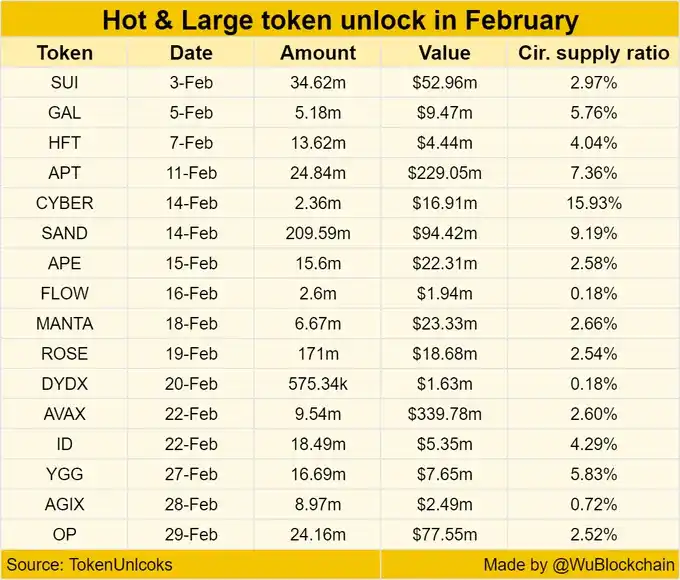

Wu Blockchain has created a table showing the largest token unlocks expected in February, with two in particular catching my attention:

- APT: APT worth $229 million (7.3% of its circulating supply) will unlock on February 11.

- SAND: SAND worth $94 million (9% of its circulating supply) will unlock on February 14.

Additionally, a token unlock of $330 million worth of AVAX is scheduled for February 22. However, despite its large scale in USD terms, the $330 million worth of AVAX only accounts for 2.6% of the token's circulating supply.

Other Events

If you want to know about other important events happening in the cryptocurrency field this month, take a look at the cryptocurrency calendar below. I believe there are some other key dates worth paying attention to:

- February 13: US CPI data

- February 12: Next key date in the Ripple-SEC lawsuit

- February 23: CZ's hearing

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。