The Bitcoin ecosystem is becoming increasingly complex, with halving, inscriptions, runes, and various Layer 2 solutions all in full swing. In addition, the influx of off-exchange funds following the approval of ETFs has made it the center of attention. To illustrate, there are Ordinals, Atomicals, Stamps, and Runes. Further subdivision of derivative protocols reveals just how intricate the concepts are.

ARC-20

SRC-20

Runes

BRC-420

BRC-100/102

Unlike the commonly heard ERC-20 and ERC-721, the former two respectively define the standards for FT and NFT on Ethereum. The entire EVM ecosystem is being transformed by them. Various protocols on Bitcoin are still competing, and I believe the specific token competition is yet to come.

This situation has already been demonstrated in Ethereum's scaling process, which generally consists of three steps:

Technical paradigm competition: Plasma, Rollup (ZK/SNARK/STARK, OP), state channels, and sidechains. Rollup emerged as the winner.

Specific protocol competition: ZK-based Rollup zkSync, Starknet, Scroll, OP-based OP Mainnet, and Arbitrum One ecosystem competition.

Token issuance completion: OP-based projects were the first to issue tokens, while ZK-based projects followed suit.

After token issuance, most projects will essentially plateau, and the industry narrative focus will shift. These tokens will only occasionally experience short-lived surges or declines in value when sector rotation occurs.

From a promotional perspective, this pattern will be evident in all blockchain race tracks, including DA competition, DEX competition, decentralized sorters, and even public chain competition. This is also why I previously believed that BTC L2 would follow the Ethereum scaling route.

Will this pattern occur on top of Bitcoin?

The BTC L2 is currently in progress, and it is difficult to make a final judgment. Inscription protocols may, and it is a fact that native Ordinals are ignited by BRC-20. However, the situation with Runes may be different. On the one hand, Casey Rodarmor, the founder of Runes, has explicitly stated that Runes will not issue tokens. On the other hand, Runes complement the asset issuance function on Bitcoin, ultimately enhancing BTC's value capture capability, just like how Uniswap empowers the Ethereum ecosystem and ETH, not UNI. (My condolences to UNI holders for a second)

Interestingly, Bitcoin may evolve differently from any other blockchain paradigm. Based on this, a potential pattern of asset issuance on Bitcoin can be inferred, from BTC, Ordinals, to Runes, representing the native token of the mainnet, NFT issuance protocol, and FT issuance protocol, ultimately flowing back to BTC itself.

Of course, this inference may not necessarily be correct. Inscription protocols, such as BRC-20, have already launched ORDI tokens (ORDI tokens are not related to the Ordinals protocol), effectively implementing the FT asset issuance function of Runes.

Understanding Bitcoin: Halving and UTXO

Runes may begin issuance at block height 840,000 in April this year.

Let's break down this statement:

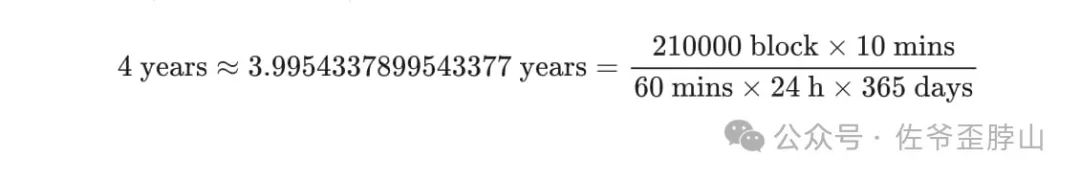

The halving in April 2024, or what people commonly refer to as the 4-year halving cycle, is based on Satoshi Nakamoto's design. A block is generated every 10 minutes, and 210,000 blocks make up one cycle. There are 1440 10-minute intervals in a day, and 365 days in a year, so roughly every four years, there is a halving.

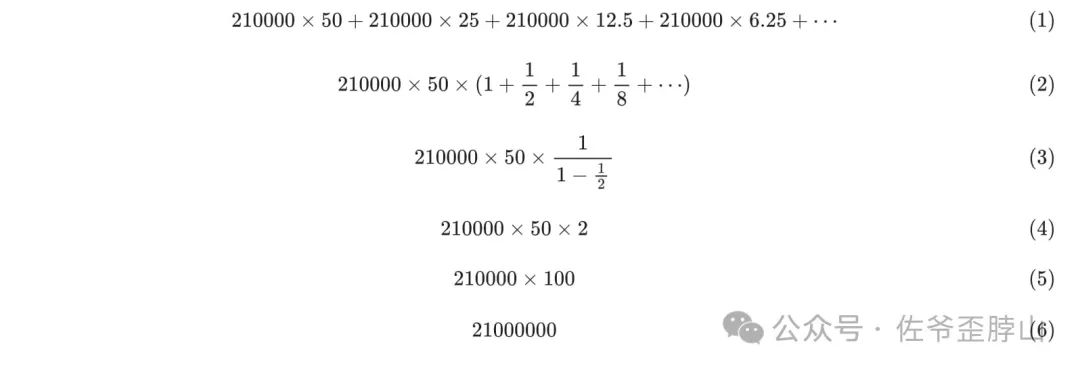

The halving refers to the block reward mechanism designed by Satoshi Nakamoto. Every 210,000 blocks, the block reward is halved. In the first 210,000 blocks, 50 bitcoins were mined per block, then 25, and now in the third cycle, it is 12.5 bitcoins per block. 210,000 x 4 = 840,000, so at the time of the next cycle, the block reward will be 6.25 bitcoins. Ultimately, based on the halving cycle, the total number of bitcoins can be calculated as 21 million.

Following this line of thought, after this cycle ends, it can be calculated that 18.375 million bitcoins will have been mined, accounting for 87.5% of the 21 million issuance, and miners' income will increasingly rely on transaction fees.

Here, transaction fees refer to the cost of miners packaging block transactions. Generally, miners' income consists of two parts: transaction fees and mining rewards. Bitcoin mining is purely a competition of computing power, rather than solving any specific problem.

In the past, transaction fees accounted for only 1/100 or even less of mining rewards, but that may not be the case in the future. Inscription and rune protocols will lead to a significant increase in Bitcoin mainnet transaction activity, while mining rewards will gradually halve, eventually approaching zero. At that time, transaction fees must cover miners' costs to fundamentally maintain the security of Bitcoin.

Digging deeper, Bitcoin transaction fees stem from the UTXO concept, which is the foundation of Ordinals and Runes and the source of their independence from off-chain data. The current public chain system can actually be divided into three mainstream mechanisms: UTXO, smart contracts (EVM), and Cosmos. Most major blockchains can be classified into these categories.

In fact, UTXO is counterintuitive. It stands for "Unspent Transaction (Tx) Output," which refers to unspent transaction outputs.

This is not the case for Ethereum. On Ethereum, addresses (excluding smart contract addresses) can directly display balances. Even in non-EVM systems like Solana, addresses can still display balances and execute complex operations, which is why they are all classified as smart contract type blockchains.

However, Bitcoin's UTXO mechanism also needs to display balances. In this case, a bit of imagination is required. If a person's address balance cannot be displayed, then all transaction records are displayed. If everyone can know the transaction records of all addresses, they can naturally "calculate" how much Bitcoin they have.

For example, if Alice, Bob, and Case use BTC for transactions, with Alice having 10 BTC, and Bob and Case having 0 BTC, and the miner generously not charging any transaction fees:

Alice sends 10 BTC to Bob, leaving Alice with a balance of 0, Bob with a balance of 10, and Case with a balance of 0.

Bob sends 5 BTC to Case, leaving Alice with a balance of 0, Bob with a balance of 5, and Case with a balance of 5.

Case sends 2.5 BTC to Alice, leaving Alice with a balance of 2.5, Bob with a balance of 5, and Case with a balance of 2.5.

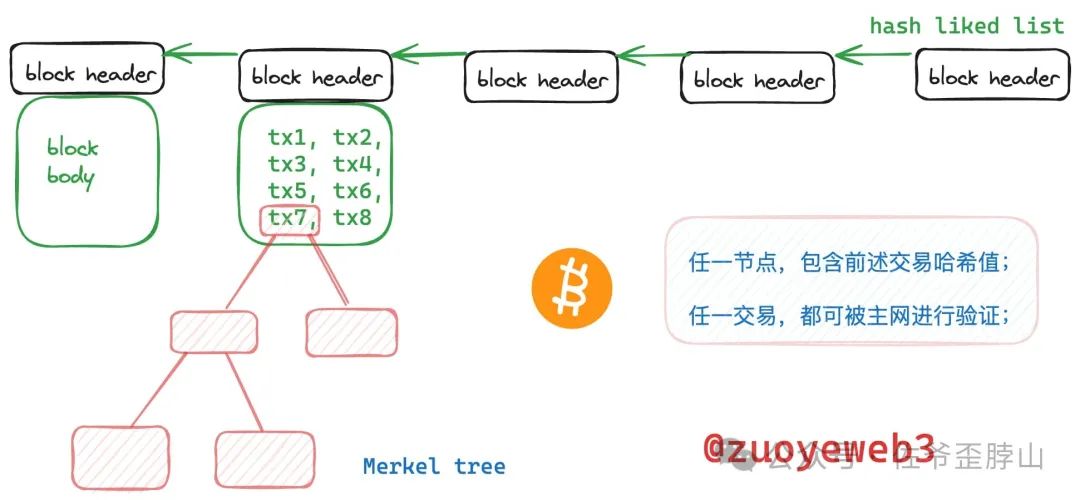

Thanks to the hash-linked list structure of Bitcoin, all network nodes only need to update the last transaction information to verify all transaction records. This indirectly allows the "calculation" of the balance of each address. As you may have realized, the Bitcoin mainnet records only transfer information, so it can track BTC transfer records without the need to record address balances, which is the fundamental reason for its simplicity.

It should be noted that the balances of the three parties only indicate transfer information. Essentially, Bitcoin does not have an account system. Remember this.

If it were Ethereum, the process would run as follows:

Alice sends 10 ETH to Bob, resulting in Alice -10 ETH, with a balance of 0, and Bob +10 ETH, with a balance of 10, unrelated to Case, so it does not need to be recorded;

Bob sends 5 ETH to Case, resulting in Bob - 5 ETH, with a balance of 5, and Case +5 ETH, with a balance of 10, unrelated to Alice, so it does not need to be recorded;

Case sends 2.5 ETH to Alice, resulting in Alice + 2.5 ETH, with a balance of 2.5, and Case - 2.5 ETH, with a balance of 2.5, unrelated to Bob, so it does not need to be recorded.

Here, the balance represents the actual amount of ETH in the Ethereum address, rather than simply recording transaction information.

Within one block, multiple transactions can be packaged, and these transactions have a specific order, with higher Gas transactions taking priority in the queue.

In summary, the order can be established, recorded, and even some "remarks" can be written during the transaction. By combining these remarks in a specific order, meaningful text, images, or even audio and video can be generated. These are essentially expressed as binary data. Combining these orders is called indexing, and combining them into meaningful text is called inscription.

If certain inscription information must follow the same rule, such as using the same text symbols, numbers with a certain precision, and a specific number representing ownership of a specific address, then a simple but usable FT protocol is born, which is Runes.

In summary, whether it's inscription or runes, both are based on the transaction order of UTXO, which is the main reason why both are based on Bitcoin. Even if there are errors in the indexer or sorting, it does not affect the data generation on Bitcoin.

To expand a bit, there are two special types of Bitcoin transactions that have no inputs or outputs:

Coinbase transactions, not the exchange, but the way Bitcoin is generated, called Coinbase. After a successful mining, one BTC is generated. This is the only way Bitcoin is produced. This type of transaction has no input, only output, because it is created out of thin air, without any previous transaction information;

Bitcoin at Satoshi's address has no output because Satoshi has never spent it. This is not a technical limitation, but his own choice, equivalent to passive destruction, also known as a black hole address.

UTXO is not mysterious; it is simply a collection of unspent records. When spent, it is automatically removed. Every transaction must have an input and an output, meaning there are two transaction objects. Except for Coinbase transactions, which have no input, all transactions follow this rule.

(The technical principles and implementation methods of UTXO are not elaborated here. Professionals are welcome to supplement~)

Evolution from Inscription to Runes

Understanding the halving mechanism and the working principle of UTXO brings us very close to the implementation of the Ordinal protocol. For example, the order of Chinese characters does not affect reading. However, computers cannot process information with errors, and humans have the ability to decode information in their brains, so sorting is necessary.

If each character is sorted according to the normal sequence, it would be (汉, 0), (字, 1), (的, 2), (顺, 3), (序, 4), (不, 5), (影, 6), (响, 7), (阅, 8), (读, 9).

At this point, we only need the computer to remember the order of 0123456789. If we want to change the meaning, such as displaying "汉的字顺序不响影阅读," then the computer can display 0213457689.

The only flaw is that the mechanism for displaying the order, the indexer, cannot be deployed on top of Bitcoin and needs to record and organize information off-chain to balance costs.

On Bitcoin, record the Chinese characters "汉字的顺序不影响阅读" or "汉的字顺序不响影阅读" and the corresponding numbers for each character. The order of these ten characters is not important;

On the indexer, organize the numbers corresponding to the Chinese characters and output them in the format the user wants.

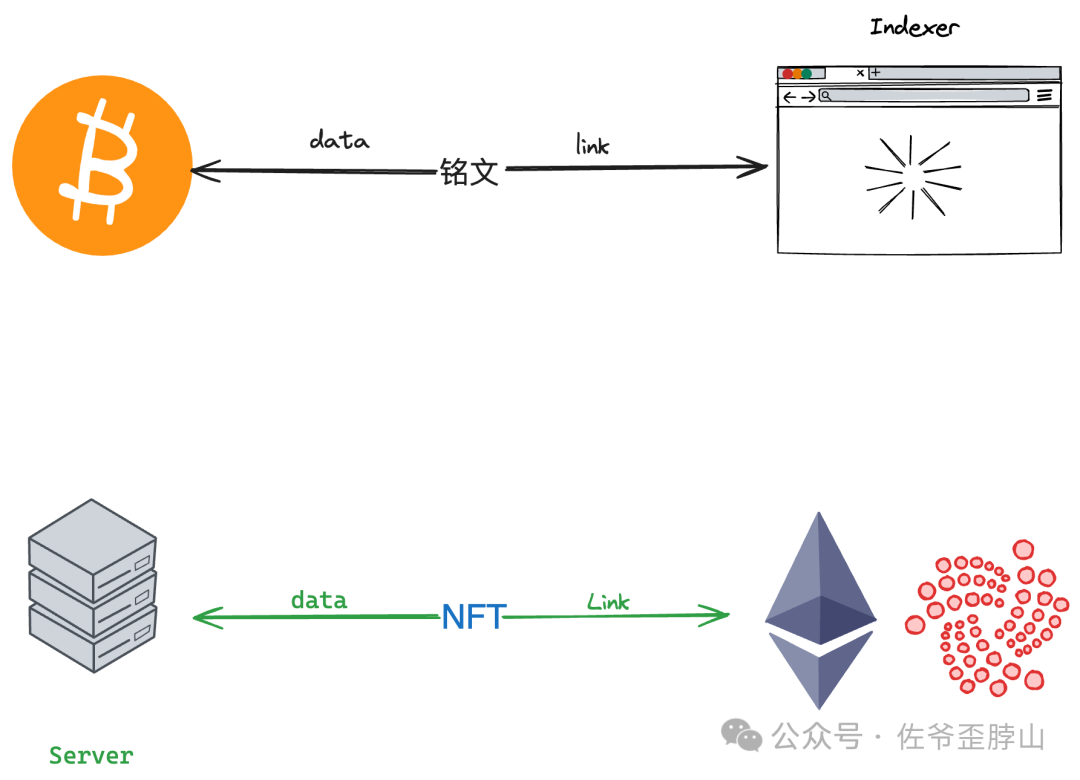

In comparison with NFT, Inscription believes that it is the on-chain storage. In terms of data storage, this is indeed the case. However, in terms of decentralization, opinions may vary. The indexer of Inscription is not always decentralized or running on-chain. Even if it runs on-chain, having a single node or too few nodes can lead to centralization issues.

NFT stores images in cloud providers such as AWS or in decentralized storage solutions like IPFS/Filecoin and Arweave, and then writes the storage pointers on the chain. Usually, the deploying party of NFT can change the link. However, the benefits are obvious: extreme cost-effectiveness. On the Bitcoin chain, storage is simply too expensive. For more details, you can refer to my previous article: "Storing Gibberish for 1.5 BTC, Is Satoshi Alive? Unraveling the Truth~".

In fact, at this point, the working principles of most inscriptions/runes or various XRC-20 tokens have been explained. They are nothing more than adding a bit of centralization to improve efficiency and conducting some airdrops to attract attention.

Or, in the words of Casey Rodarmor, RGB, Taproot Assets, etc., cannot simultaneously meet three conditions:

- Not using off-chain data

- Not issuing new tokens

- Based on the UTXO mechanism

To avoid misunderstanding, let's clarify the above three points. Not using off-chain data ≠ cannot use an indexer. The indexer only sorts, and the data is still stored on-chain. Not issuing new tokens means the protocol itself does not issue tokens ≠ cannot use the protocol to issue tokens. For example, you can use Runes to issue your own tokens, but Runes itself does not have a protocol token and operates entirely using BTC. Based on the UTXO mechanism is to avoid adding additional burden to the Bitcoin mainnet and to minimize interference with normal Bitcoin transactions, which was Casey's original intention in inventing the Runes protocol.

In other words, BRC-20 can issue tokens, but Casey believes it does not use the UTXO mechanism and would "distort" the original intention of Ordinal. Therefore, he decided to create a FT asset protocol on Bitcoin.

From this perspective, Runes is the orthodox sequel to Ordinal, and both will be responsible for issuing FT and NFT type assets on Bitcoin, potentially putting an end to the standard protocol competition.

Various types of blockchain tokens

Various types of blockchain tokens

Different from Ethereum, which first had the ERC-20 standard and then the ERC-721 standard, the process on Bitcoin is reversed. Therefore, Runes will be more like Ordinal, transforming the way FT is issued in NFT.

Specifically, it's not complicated. I'll briefly explain it:

- Issuance: Referring to the ERC-20 design, the issuer must design the token name and maximum precision.

- Transfer: Since Bitcoin does not have an account system, transfers are simulated by recording information.

The implementation process will not be further explored because it is indeed very rudimentary. In the fan-made sequel Rune Alpha, through PBST (partially signed Bitcoin transactions), multiple parties can sign the same transaction, such as matching the signatures of the seller and buyer, and then broadcasting the result to the mainnet after completion. This method is in line with human intuitive logic, especially for Ethereum users.

Although this article is about Runes, it can also be felt that a large amount of ink is spent on the principles of Bitcoin. However, this is the advantage of Inscription and Runes. They are the reinforcement of Bitcoin's functionality, rather than their own creation. All their actions are the application and transformation of the existing functions of Bitcoin.

The subsequent appearance of Rune Alpha, RSIC, and Runestone, which closely follow Runes, are all popular works. Whether they can continue the dominance of BRC-20 over Ordinal is still unknown.

Conclusion

From protocol evolution to token issuance, this pattern has been repeatedly tried and tested in blockchain. Even Ordinal, which does not issue tokens, has been overshadowed by BRC-20. However, Runes itself does not need tokens to support its operation, and BTC is qualified from any angle. Casey himself sympathizes with "Bitcoin maximalism" in terms of ideology, but more importantly, he recognizes the heavy gravity of reality and does not support blocking Inscription. However, he also acknowledges the congestion caused by UTXO, hence the proposal of the Runes protocol. Behind what seems to be a contradiction, or rather, he is "implementing ideology in reality, rather than in name."

Since last year, the trend of Inscription, ETF, BTC L2, and Runes has been coming one after another. However, the disregard for the principles of Bitcoin has led to various XRC-20 tokens flying around. Bitcoin is the god that governs miner income, and Satoshi is the master who paints with mathematics and programming. In order to maintain the control of Bitcoin in an era of increasingly reduced mining rewards, it is better to end the protocol competition as soon as possible.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。