Author of the original text: ROUTE 2 FI

Original translation: Luffy, Foresight News

EigenLayer opened its staking window again yesterday and will continue until February 10th.

I have written an article about different opportunities with EigenLayer, but today I will explore the potential value of these points.

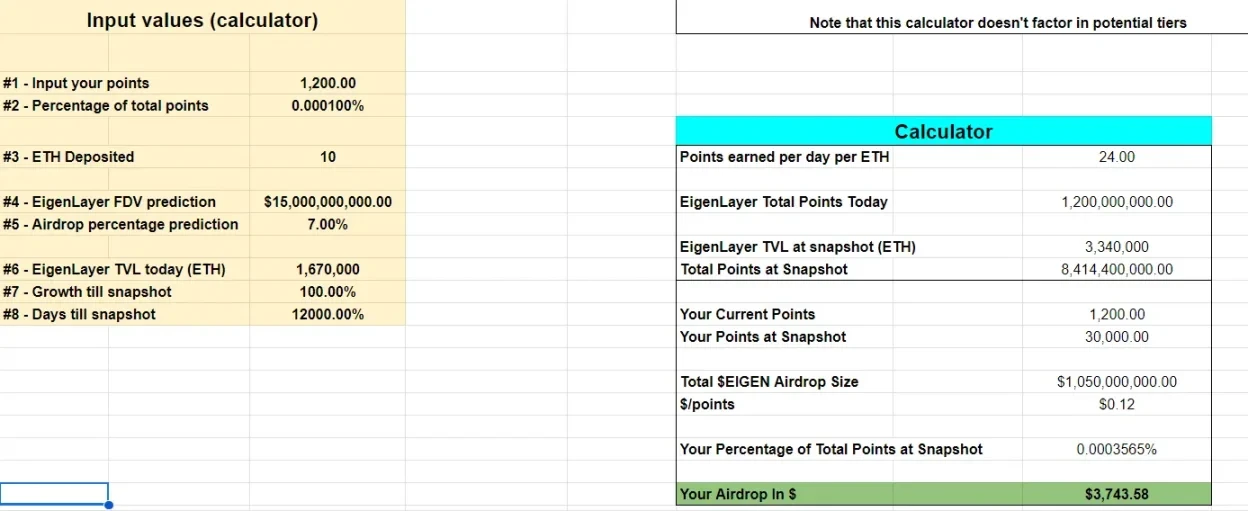

The calculation formula for EigenLayer points is as follows:

ETH amount x 1 x 24 = EigenLayer points per day

For example: 10 ETH x 1 x 24 = 240 EigenLayer points per day

How much is a point worth?

Currently, this is just speculation, but some people have made predictions based on assumptions.

Assumptions:

- You can earn 24 EigenLayer points for each ETH deposited per day

- TVL is 1,670,000 ETH (39 billion USD)

- TVL growth before airdrop snapshot: 100%

- 120 days until the snapshot (June 2024)

- Airdrop percentage prediction: 7%

- FDV prediction: 15 billion

- Initial capital: 10 ETH

As you can see, there are many assumptions. The most difficult part is to determine whether they will adopt a points tier mechanism and what the FDV is. Celestia's current FDV scale is 18 billion USD, and with EigenLayer's extensive promotion, I am quite certain its FDV scale is around 15 billion USD, and may even reach 20 billion USD.

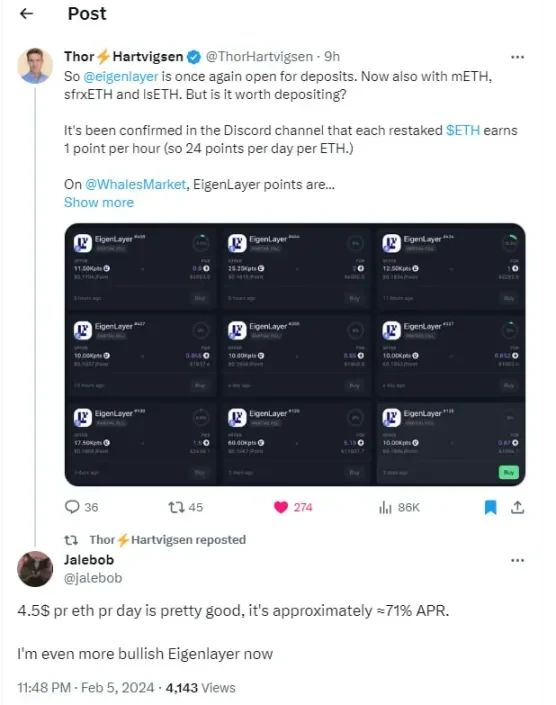

Based on the current assumptions, each EigenLayer point is worth 0.12 USD. I have spoken with several people who estimate the value of each point to be around 0.05 - 0.20 USD. On Whales Market, people are trading points at a price of 0.15 USD. I expect this number to be lower. You can personally check here.

You can try Thor Hartvigsen's EigenLayer airdrop calculator.

In summary, if you stake in the next 120 days, each of your ETH will earn approximately 400 USD in profit. This number may be lower, possibly 200 USD, but it could also be much higher, with each ETH earning 1,000 USD in profit, which is not entirely unrealistic. Although the range is wide, it should be one of the most interesting airdrops this year. Is it worth putting your ETH into the smart contract? I cannot give you an answer, but if you do not like locking up capital, you should look for opportunities to buy points on Whales Market, but you may ultimately pay a high price for the points.

For me, a flashing warning sign is that the narrative of LST/LRT is starting to feel a bit too simple.

For example, buying mETH and earning a 7.2% annualized return. Then depositing into EigenLayer to earn EigenLayer points, re-staking rewards, and ETH appreciation (if ETH price rises).

I don't know, but when everyone is winning… what's the problem?

Suddenly, I have a feeling that we are back to the "pleasure" state when Anchor Protocol appeared.

I hope I am wrong, but this is worth discussing.

I mentioned this in the previous issue, but here I am just repeating what I am currently involved in with the LRT/LST projects. They all have pros and cons, depending on how you view them.

If you are an airdrop hunter:

Swell, EtherFi, Kelp, Puffer, EigenPie, Renzo

If you want the highest return:

Mantle ETH (mETH) = 7.2% of ETH + EigenLayer points

If you want "safety":

I put "safety" in quotes. Because nothing in cryptocurrency should be declared as safe, even stETH experienced a serious decoupling in the summer of 2022.

However, the safest among them (based on their existence) are Lido, RocketPool, Binance Staked ETH.

I think Puffer has solid support, and I have a feeling that after a while, it may be considered one of the safer choices.

What I am involved in:

I am participating in all airdrop activities and mETH. Personally, I also like the comparison, and mETH with a 7.2% APY is very good.

If you are bullish on ETH, you can buy 10 wstETH, deposit it into AAVE, and then borrow. For example, borrow 50% of ETH (5 ETH), then buy swETH, mETH, ETHx, and follow the advice above to get airdrop + EigenLayer points.

Also, remember that multiple LRT tokens are about to be launched: Genesis and Inception are two of them. In addition, Pendle also has some degen strategies, where you can get up to 30% yield.

Do not bet more than you can afford in EigenLayer, good luck!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。