This report provides an in-depth analysis of the Magpie ecosystem, aiming to fully understand its potential impact and future development prospects in the decentralized finance (DeFi) field.

Author: Greythorn

Project Name: Magpie XYZ

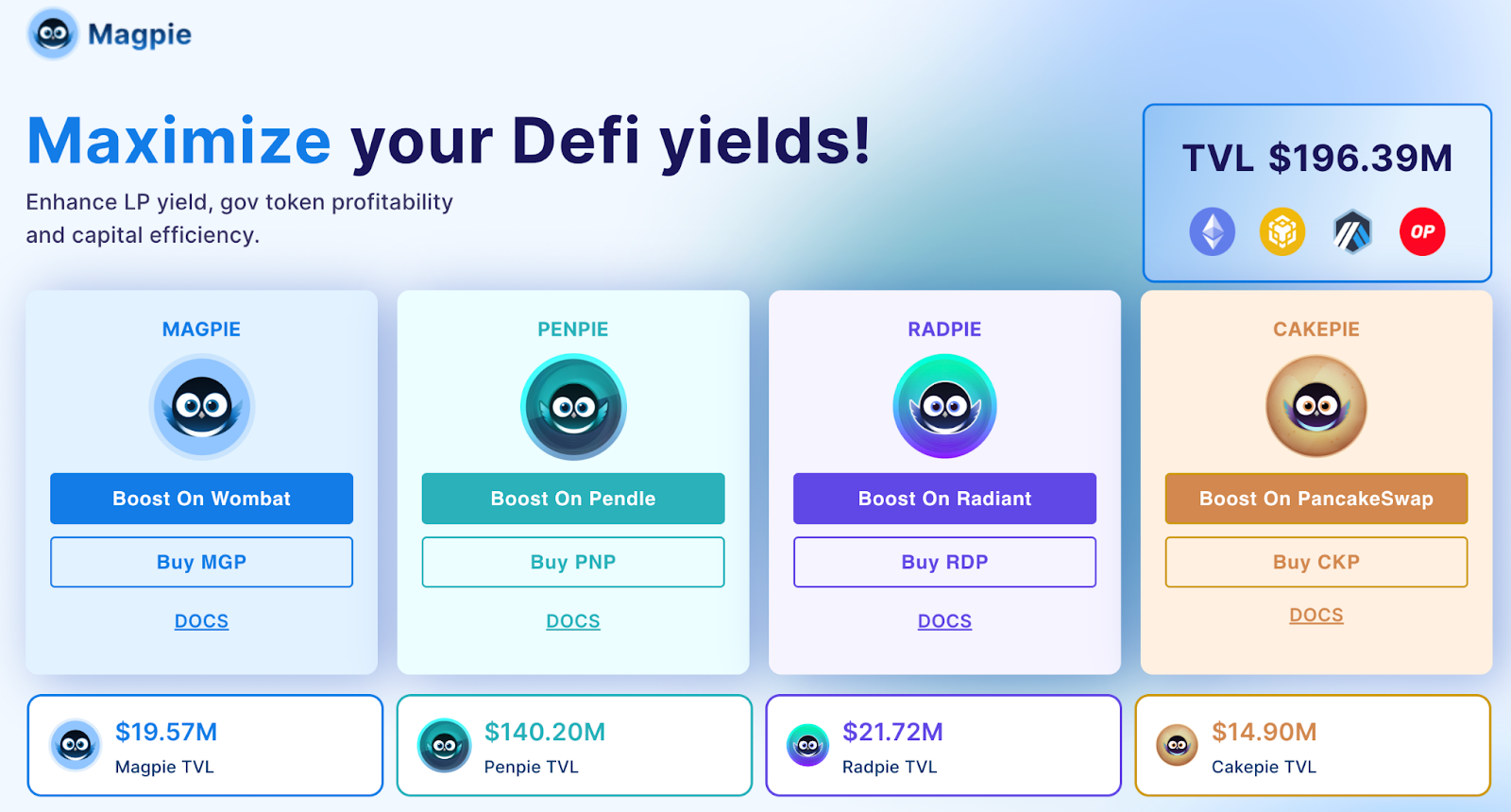

Network Support: Arbitrum, Binance Smart Chain

Project Type: Multi-chain yield provider platform

Token Symbol: $MGP (native cross-chain token)

Cryptocurrency Market Ranking: #752

Market Capitalization: Approximately $29.3 million

Fully Diluted Valuation (FDV): Approximately $92.2 million

Circulating Supply: 319.44 million MGP (31.94% of total supply)

Total Supply: 1 billion MGP

Introduction

Magpie XYZ, as a leading multi-chain yield protocol, recently announced a strategic integration with the Ethereum-based staking protocol EigenLayer. This significant move has led to the emergence of SubDAO Eigenpie, which greatly enhances the capability of staking services through the use of EigenLayer technology. Additionally, Eigenpie is preparing to launch its governance and profit-sharing token EGP.

This report provides an in-depth analysis of the Magpie ecosystem, aiming to fully understand its potential impact and future development prospects in the decentralized finance (DeFi) field.

Project Overview: Magpie XYZ Ecosystem

Magpie XYZ represents a comprehensive DeFi protocol ecosystem that enhances yield capabilities and veTokenomics models across multiple blockchains. Magpie, as its flagship protocol, developed by Pionex, plays a core role. Key features include:

● Innovative veTokenomics: This model breaks the traditional user-centric model, innovatively combining user benefits and protocol growth.

● mWOM token conversion: Provides users with the convenience of staking and earning without locking funds for a long period.

● Diversified yield opportunities: Allows multiple assets to be deposited for additional yield.

● Vote-Locked MGP (vlMGP): Enhances cost-effective governance participation.

Wombat Exchange Features

● Multi-chain capability: Known for its scalability and low slippage trading.

● Single-sided staking: Specifically designed for stablecoins and pegged assets.

● veWOM token: Provides additional benefits based on user lock-up period.

Revenue distribution from Wombat Exchange:

● 80% allocated to liquidity providers

● 12% allocated to mWOM stakers

● 8% allocated to vlMGP holders

MGP Token Economics: Magpie's Governance and Revenue Sharing Framework

As the core of the Magpie protocol, the MGP token plays a crucial role in governance and revenue sharing. Its design reflects a balancing mechanism aimed at optimizing user participation, revenue distribution, and the long-term sustainability of the ecosystem. Through this approach, Magpie aims to achieve a balanced ecosystem that incentivizes user participation while ensuring the stability and growth of the protocol in the long term.

Key Features

● Token name: MGP

● Network support: Arbitrum, Binance Smart Chain

● Total supply: 1 billion MGP

● Circulating supply: 319.44 million MGP (31.94% of total supply)

● Market cap: $22.3 million

● Fully diluted valuation (FDV): $70.2 million

● Total value locked (TVL): $19.57 million

● Cryptocurrency market ranking: #883

Vote-Locked MGP (vlMGP) Mechanism

Vote-Locked MGP is the locked form of the MGP token, which can be converted on Magpie at a 1:1 ratio.

Advantages:

● Includes platform revenue sharing

● $MGP staking rewards

● Enhanced voting influence

● Participation in governing the entire community

● And receiving bribes and cancellation rewards.

Upon initiating the "start unlocking" process, a 60-day cooling-off period will begin. During this period, vlMGP will gradually transition into liquid assets.

Holders have the option to pay a certain percentage of fines to achieve early "forced unlocking," with the fine starting from the first day of the lockup, accounting for 80% of the total locked MGP, and decreasing over the following 60 days.

During this 60-day cooling-off period, holders can still receive passive income, but their voting rights will be temporarily frozen. After the cooling-off period, vlMGP will be fully unlocked without any fines, and all token rights will be fully restored.

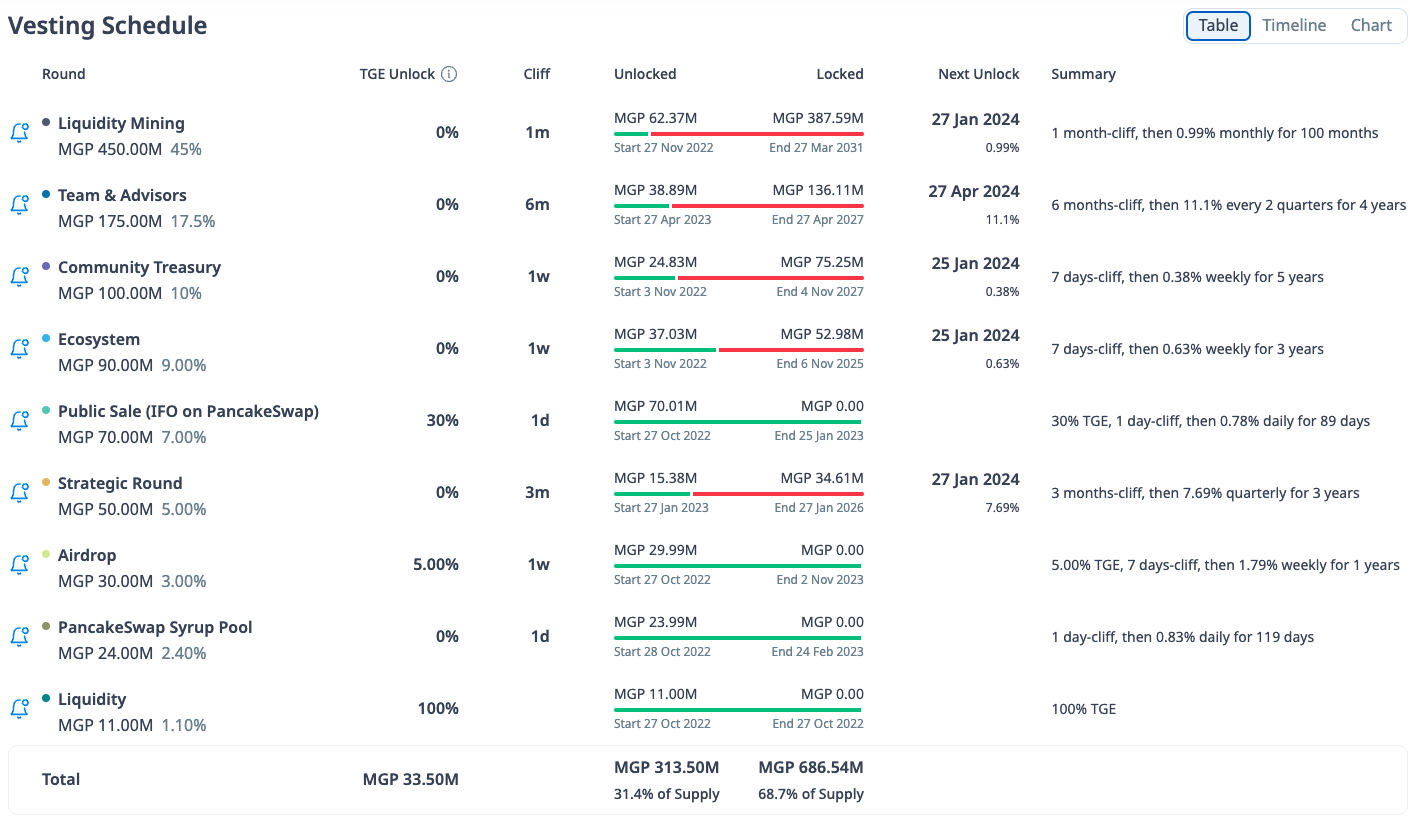

MGP Token Allocation

● Liquidity mining: 450 million tokens (45%), with a maximum monthly unlock of 2%.

● Team and advisors: 175 million tokens (17.5%), distributed over four and a half years after a 6-month cliff.

● Community treasury: 100 million tokens (10%), unlocked every 5 years in blocks.

● Ecosystem: 90 million tokens (9%), unlocked every 3 years in blocks.

● PancakeSwap IFO: 70 million tokens (7%), with 30% initial unlock, followed by quarterly unlocks.

● Strategic sales: 50 million tokens (5%), distributed over three years quarterly after a 3-month cliff.

● Airdrop: 30 million tokens (3%), with 5% initial unlock, followed by yearly weekly distributions.

● PancakeSwap syrup pool: 24 million tokens (2.4%), unlocked every 2 months in blocks.

● Liquidity and exchanges: 11 million tokens (1.1%), with 100% initial unlock.

Equity Ownership

Source: https://cryptorank.io/price/magpie/vesting

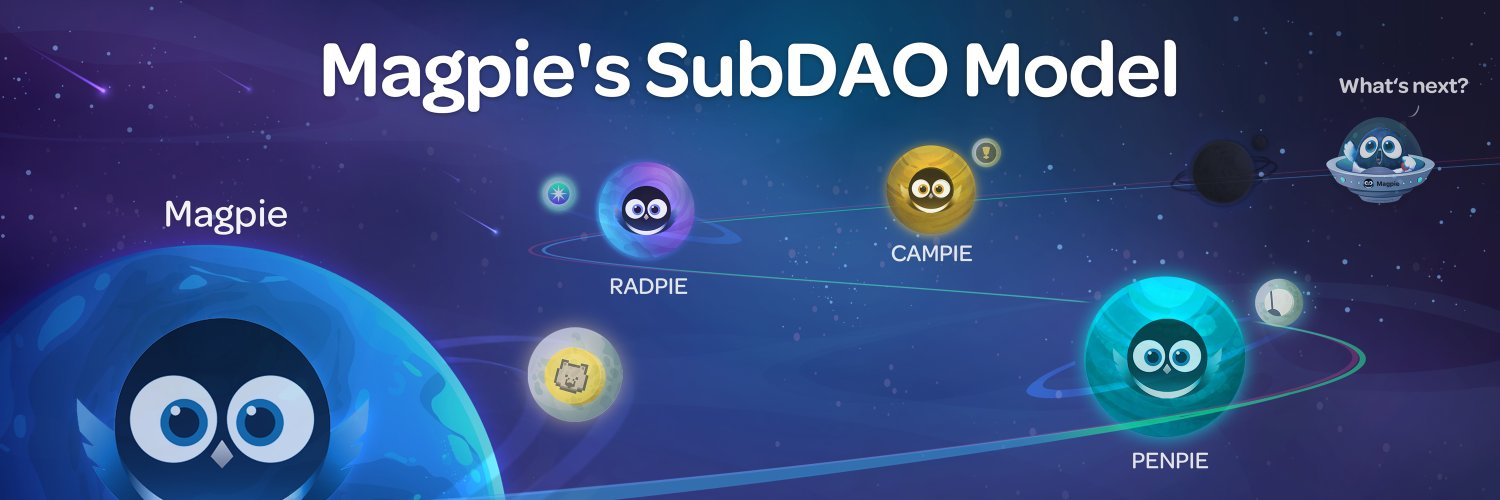

SubDAO Model in the Magpie Ecosystem

The SubDAO model in the decentralized finance (DeFi) ecosystem represents a significant innovation, creating dedicated decentralized autonomous organizations to enhance veTokenomics-based protocols. This model establishes a symbiotic relationship between Magpie and its supported SubDAOs, driving mutual growth and contributing to the broader DeFi space.

Key features include:

● Strategic partnerships: Achieving mutually beneficial cooperation.

● Treasury and governance interests: Receiving 20% of token supply from each SubDAO's equity ownership.

Benefits for vlMGP holders

● Access to SubDAO's IDO: Priority access to the initial DEX offering of SubDAO tokens.

● Revenue sharing: Sharing the income generated by SubDAO.

● Voting rights: Significant influence in internal decision-making within SubDAO.

Current SubDAO Overview

Penpie: Maximizing yield using Pendle Finance.

Key Innovations: Enhancing the Annual Percentage Rate (APR) and enabling the conversion of mPENDLE tokens through Pendle Finance.

PNP Token: Serving as the core of governance, vlPNP enhances passive income and governance influence.

Total Value Locked (TVL): $1.4364 billion.

Radpie: Optimizing yield in Radiant Capital

Innovative Highlights: Utilizing dLP tokens for governance and distributing RDNT tokens, increasing yield through mdLP conversion.

RDP Token: With governance functionality, vlRDP provides passive income and the opportunity to participate in governance.

Total Value Locked (TVL): $23.66 million.

Cakepie: Enhancing governance and yield capabilities in PancakeSwap

Core Features: Cakepie's bribery market provides a unique platform for vlCKP holders to influence CAKE distribution and efficiently earn rewards compared to traditional veCAKE locking methods.

CKP and vlCKP Tokens: Having a significant impact on Cakepie, vlCKP allows participation in governance and the Cakepie bribery market. The protocol on PancakeSwap can provide additional voting support to vlCKP holders by offering bribes, liquidity providers can potentially enjoy higher Annual Percentage Rates (APR) without locking CAKE, and governance voters can strengthen their influence cost-effectively through CKP tokens.

Total Value Locked (TVL): $16.41 million.

Upcoming SubDAO: Eigenpie

Eigenpie, as an innovative SubDAO under the Magpie framework, is dedicated to enhancing the functionality and user interaction of Ethereum through the integration of EigenLayer technology, employing a novel liquidity restaking strategy.

Analysis of Liquidity Restaking Protocols:

Basket-style Liquidity Restaking (bLRT)

a. Function: Allows multiple LST to be deposited into the same LRT, achieving asset diversification.

b. Advantages: Provides asset diversity, integrated liquidity, and user convenience.

c. Challenges: Complexity in management and potential concentration risk.

Isolated Liquidity Restaking (iLRT)

a. Function: Targeted at depositing a single LST into an LRT.

b. Advantages: Achieves risk control, simplifies the incentive acquisition process, and enhances the composability of DeFi.

c. Challenges: May lead to liquidity dispersion.

Super Liquidity Restaking

a. Concept: A new approach to restaking LP positions, with detailed content yet to be explored.

Eigenpie's Isolated Liquidity Restaking Approach:

Eigenpie innovatively adopts the isolated liquidity restaking model, allowing users to deposit LST and obtain their unique restaking versions. This aims to add additional layers of income to Ethereum investments and improve capital efficiency.

To mitigate risks associated with individual LST, Eigenpie customizes exclusive restaking variants for each LST, effectively reducing potential risks within the platform.

EGP Token Economic Model

Token Name: Eigenpie Token (EGP)

Total Supply: 10 million tokens

Token Type: ERC-20

Allocation Scheme: 40% for the initial decentralized exchange offering (IDO), 35% for community incentives, 15% for Magpie Treasury, and 10% for early supporter airdrops.

EGP serves as the token for governance and revenue distribution, driving decentralized decision-making and financial incentives. Through extensive integration with various protocols, it aims to enhance its utility and attract a wide user base.

Eigenpie is collaborating with key players in the DeFi space and is currently undergoing a comprehensive audit. Additionally, to enhance platform security and integrity, it is implementing advanced multi-signature contract mechanisms.

The launch of Eigenpie focuses on enhancing user participation, improving reward structures, and promoting interaction with the EigenLayer infrastructure.

Furthermore, Eigenpie plans to implement a reward system to recognize and encourage active participation, especially in LST deposits and user referrals. Those interested in the development of Eigenpie can find detailed information about the EGP IDO here.

According to the latest information on its social media, Eigenpie has opened an LST pre-deposit window, where users can pre-deposit specific LSTs such as stETH, rETH, mETH, and sfrxETH, and this opportunity will continue until 7 PM UTC on February 9th.

For every LST deposit worth one ETH, users will earn one Eigenpie point per hour, with point rewards doubled in the initial 15 days. These points will impact 10% of the total EGP supply and 60% of the EGP token IDO. Starting from 8 PM UTC on February 5th, depositors can also start accumulating EigenLayer points.

Bullish Fundamental Factors

Rapid growth of the $MGP ecosystem: Within 12 hours of the opening of Eigenpie's pre-deposit window, over $30 million worth of $ETH liquid staking tokens were restaked.

Stable growth in Total Value Locked (TVL): Demonstrating the health and attractiveness of the ecosystem.

Active $MGP community: Strong community engagement is a key factor for the success of the $MGP ecosystem.

Magpie's DAO and SubDAO model: Focusing on stable governance by creating new pie tokens for each project, promoting user participation. This model helps enhance liquidity and balance between mPENDLE and PENDLE.

Bearish Fundamental Factors

Intense market competition: Many projects similar to Convex, Aura Finance, and Yearn Finance focus on yield enhancement, posing challenges to $MGP.

Relatively small market capitalization: Due to intense competition, the market value of $MGP is relatively small.

High concentration of TVL: Most TVL is concentrated in Penpie, closely related to the success of Pendle, indicating concentration risk.

Competition faced by EigenPay: Facing competitive pressure from many new projects as a strategic move to capture the staking market.

Limited exposure on exchanges: $MGP has not yet been listed on mainstream exchanges, limiting its market exposure.

Intense competition in staking services: Many entities provide similar services, intensifying competition.

Locking of staked assets: Staked ETH will be temporarily locked and cannot be immediately converted back.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。