- / Title: Old Li Mortar

Table of Contents for This Week's Research Report:

I. Preview of Key Macroeconomic Data and Events in the Cryptocurrency Market This Week;

II. Review of Key News in the Cryptocurrency Industry;

III. Community Interaction and Sharing;

IV. Interpretation of Important Events, Data, and Research Institute;

V. Institutional Perspectives and Overseas Views;

VI. Ranking of Cryptocurrency Market Gains and Selection of Community Hot Coins Last Week;

VII. Attention to Project Token Unlocking and Negative Data;

VIII. Ranking of Cryptocurrency Market Concept Sectors;

IX. Summary of Global Market Macroeconomic Analysis;

X. Research Institute's Post-Market Judgment.

I. Preview of Key Macroeconomic Data and Events in the Cryptocurrency Market This Week:

February 5th (Monday): Eurozone PMI final value, Sentix investor confidence index, MoM PPI; ECB Vice President speech; US Markit Composite PMI final value, US ISM non-manufacturing index; Powell speech; Galaxy Ethereum spot ETF resolution time.

February 6th (Tuesday): Atlanta Fed President speech, Reserve Bank of Australia announces interest rate decision and monetary policy statement, MoM retail sales in the Eurozone, QoQ GDP in the Eurozone for the fourth quarter. EigenLayer restarts the redelegation window; Dymension community Mod team plans to launch the mainnet.

February 7th (Wednesday): Cleveland Fed President, Philadelphia Fed President Harker, Minneapolis Fed President speeches, Boston Fed President speech. US December trade balance. Ethereum Holesky testnet will execute the Dencun upgrade.

February 8th (Thursday): Federal Reserve Board of Governors member Kugler, Boston Fed President, Richmond Fed President, Federal Reserve Board of Governors member Bauman speeches; ECB publishes economic bulletin, ECB Governing Council speeches; Richmond Fed President interview; US 10-year Treasury auction. Ethereum developers determine the mainnet launch date for the Dencun upgrade.

February 9th (Friday): US January University of Michigan Consumer Sentiment Index final value; A-shares, KOSPI Lunar New Year holiday closure; HKEX afternoon closure; US 30-year Treasury auction. CoinList will launch the public offering of the DePIN project MSN.

II. Review of Key News in the Cryptocurrency Industry (Exclusive Summary):

Overview Analysis: The cryptocurrency market has shown an active trend recently, with data showing record-high Bitcoin trading volume and Ethereum options trading volume. This indicates that market participants' enthusiasm is increasing, but the driving force behind it may be diverse. From the perspective of projects and platforms, new token unlocks and the dynamics of whales show market liquidity and investor interest in specific projects. However, the direction of macro policies and regulations, such as the decisions of the Federal Reserve and the bankruptcy of FTX, remind us that the market is still influenced by the traditional financial system and regulatory environment. The divergence in institutional research reports and perspectives also highlights the complexity and uncertainty of the market. Researchers generally believe that despite the vibrant market, investors still need to be vigilant against potential risks and make wise investment decisions by considering various factors.

Data Aspect: Recently, the cryptocurrency market data has shown a series of notable trends. In January, Bitcoin's on-chain transaction volume exceeded $1.2 trillion, reaching a new high since September 2022, indicating a continuous increase in market activity. At the same time, the daily bridging volume of the Solana network increased by 335% in the past seven days, indicating that the platform is attracting more users and developers. In addition, the trading volume of ETH options in January approached $20 billion, setting a new historical high, highlighting the strong performance of the Ethereum market. Tether's net profit in the fourth quarter also reached $2.85 billion, also setting a new historical high.

Project and Platform Aspect: APT tokens worth over $200 million will be unlocked this week, which may bring new investment opportunities to the market. Meanwhile, a whale withdrew 19,980 ETH worth about $46 million from Binance in the past week, demonstrating the significant liquidity in the cryptocurrency market and investors' confidence in Ethereum. In addition, spot Bitcoin ETF IBIT and FBTC successfully entered the top ten in terms of all ETF inflows in January, indicating that cryptocurrency ETFs are gradually becoming an important choice for investor asset allocation. The total assets under management of global Ethereum ETFs reached $5.7 billion, with 81% being European products, showing strong demand for Ethereum ETFs in the European market.

Macro Policy and Regulatory Aspect: Federal Reserve Chairman Powell stated that the Fed may wait until after March to cut interest rates, which may have a certain impact on market interest rates and cryptocurrency prices. Meanwhile, the Fed's decision to maintain interest rates unchanged is in line with market expectations, which helps stabilize market sentiment. However, the bankruptcy liquidation event of FTX still attracts attention in the market. The company expects to fully repay customers in the bankruptcy liquidation and abandon the plan to restart the exchange, which may have a certain impact on confidence in the cryptocurrency market.

Institutional Research Reports and Perspectives: The founder of SkyBridge stated that at least 70 million Americans own cryptocurrency, indicating the increasing popularity of cryptocurrency in the US market. CryptoQuant pointed out that when ETF trading volume exceeds that of centralized exchanges, the impact of institutions on BTC prices will be more pronounced, reminding investors to pay attention to the influence of institutional investors' behavior on market prices. The president of ETFStore stated that the asset lead managed by GBTC has decreased by more than half in three weeks, reflecting the intensity of market competition. Coinbase's report stated that the downward pressure on Bitcoin prices is "exhausting," which may indicate that the market is gradually stabilizing. In addition, some reports also pointed out that Bitcoin mining accounts for 0.6% to 2.3% of US electricity consumption, and the increasing dominance of Tether has a negative impact on the cryptocurrency ecosystem. Meanwhile, German authorities seized Bitcoin worth $2.17 billion in a piracy operation, once again reminding us that the cryptocurrency market still faces challenges in terms of regulation and compliance.

III. Community Interaction and Sharing:

In the coming week, there will be continuous major events in the global market. In terms of global macroeconomics, the US January ISM non-manufacturing index will be released on Monday, and Japan, Germany, the EU, and the UK will release the January service PMI. The EU will release the Eurozone PPI data for December 2023; several senior officials of the Federal Reserve will deliver important speeches, and Germany will release the January CPI data on Friday.

IV. Interpretation of Important Events, Data, and Research Institute:

Regarding the current price of federal funds futures, market participants expect the Fed to start an interest rate cut cycle in May, and the market has already digested the possibility of the Fed starting to cut interest rates in March. Some institutions predict that the cryptocurrency market may have a delayed reaction to the interest rate cut, and Bitcoin and other cryptocurrencies may initially face selling pressure until the situation improves in May.

Our research institute believes that this reflects investors' responsiveness to macroeconomic regulation. It is worth noting that the market has already digested the expectation of an interest rate cut in March, which means that if the Fed does not take action in March, it is unlikely to have an immediate impact on the market.

For the cryptocurrency market, due to the complex interaction between it and the traditional financial market, the delayed interest rate cut cycle may have a lagging impact on cryptocurrency asset prices. Bitcoin and other cryptocurrencies may face short-term selling pressure as the market digests the news of the interest rate cut, reflecting investors' concerns about the connection between macroeconomic regulation and asset prices.

However, in the long run, if the interest rate cut can be implemented as expected in May, it may have a positive effect on the cryptocurrency market, especially in a loose economic environment. Therefore, although the market may experience volatility in the short term, it is expected that as the interest rate cut cycle progresses, the performance of Bitcoin and other cryptocurrencies will improve.

In summary, our research institute believes that in the face of the potential interest rate cut cycle by the Fed, cryptocurrency market investors should pay attention to macroeconomic trends and be prepared to deal with short-term market fluctuations. In the long run, if the interest rate cut can be smoothly implemented, the cryptocurrency market is expected to benefit.

Regarding whale hoarding. According to Glassnode's data, whale entities (holding at least 1,000 BTC) withdrew about 100,000 BTC from exchanges in the past two weeks, marking an almost uninterrupted trend lasting for 14 days. These transactions only involve direct transfers from exchange wallets to whale entities. The increase in whale activity began around January 16, shortly before Bitcoin experienced a 7.5% single-day decline, the largest since the FTX collapse in November 2022. It is worth noting that the number of these whale entities increased from 1,513 to 1,563 during this period, almost offsetting the decrease in the number of whale entities in 2022.

Our research institute believes that, according to the data, whales have withdrawn approximately 100,000 BTC from exchanges. This dynamic is mainly manifested as direct transfers from exchange wallets to whale entities, indicating that these large investors are actively adjusting their Bitcoin holdings.

This increase in whale activity began around January 16, shortly before Bitcoin experienced a 7.5% single-day decline, the largest since the collapse of the FTX exchange in November 2022. This timing may suggest that whale entities, after significant fluctuations in Bitcoin prices, have become more proactive in adjusting their investment strategies and holdings.

It is worth noting that the number of these whale entities is also increasing. The downward trend that began in 2022 seems to be reversing, with the number of whale entities increasing from 1513 to 1563, almost offsetting the decrease in the previous year. This growth may indicate that more large investors are entering the Bitcoin market, or existing whale entities are expanding their holdings.

We believe that there may be a certain correlation between the increase in whale entity activity and the fluctuation in Bitcoin prices. After significant declines in Bitcoin prices, whale entities may see this as an opportunity to increase their holdings, thus beginning to withdraw a large amount of Bitcoin from exchanges. At the same time, the increase in the number of whale entities also indicates that the Bitcoin market is attracting more large investors, which helps to improve the overall stability and liquidity of the market. However, this may also increase market volatility, as the behavior of large investors often has a significant impact on market prices. Therefore, when participating in the Bitcoin market, investors need to closely monitor the dynamics of whale entities and changes in market prices to make wise investment decisions.

V. Institutional Perspectives and Overseas Views:

Arthur Hayes, co-founder of BitMEX, tweeted that Federal Reserve Chairman Jay Powell and US Treasury Secretary Janet Yellen will soon start printing money. New York Community Bank (NYCB) issued a loss announcement, with a 10-fold increase in loan loss reserves leading to a sharp drop in 10-year and 2-year yields, and the market expects a bank bailout to be initiated. Bitcoin may experience a temporary decline, followed by a rapid rise in price similar to March 2023.

Despite the evolving narrative of spot ETH ETFs, traders still prefer Bitcoin over Ether. A week ago, Standard Chartered Bank stated that Ethereum (ETH) could surge to $4,000 in the next three months, with performance potentially surpassing that of Bitcoin (BTC), as the US SEC may approve Ethereum spot exchange-traded funds (ETFs). According to data tracked by cryptocurrency asset management company Blofin, the forward term structure of ETH/BTC futures (calculated as the ratio of Ethereum futures and Bitcoin futures prices at different maturities) has been consistently downward-sloping. Blofin trader Griffin Ardern stated, "The downward-sloping structure is backward, which means that over time, traders expect ETH to underperform BTC, indicating that investors relatively favor the performance of Bitcoin."

Huatai Securities recently released a research report on the electronics industry, analyzing three major themes and eight predictions for 2024. Among them, Huatai Securities analysts predict that the price of Bitcoin will reach a new all-time high in 2024, citing the following reasons: 1) Halving of Bitcoin's new issuance (April 2024). According to the Bitcoin algorithm, the new issuance of Bitcoin is halved every 4 years. Historically, after the previous three halvings, Bitcoin has experienced price increases. In April 2024, Bitcoin will undergo another halving. 2) On the afternoon of January 10, Grayscale, BlackRock, Fidelity, and other institutions' Bitcoin spot ETF applications were approved by the US Securities and Exchange Commission (SEC) and officially listed for trading from January 11. According to Bloomberg's statistics, the first-day trading volume exceeded $4.6 billion.

Data compiled by Bloomberg shows that three weeks after the trading of 10 spot Bitcoin ETFs began, as of January 30, open interest in CME Bitcoin futures contracts decreased by about 24% to 20,679 contracts. After Bitcoin surged 157% due to expectations of ETFs last year, open interest reached a historical high. Vetle Lunde, senior analyst at K33 Research, stated that investors turning to US ETFs and the cooling of Bitcoin's rally may lead to "reduced activity" in CME Bitcoin futures, but they remain a key source of liquidity in the cryptocurrency market. He pointed out that they have the potential role of hedging tools for authorized participants creating and redeeming units of ETFs.

The latest data from K33 Research shows that over 150,000 BTC has been accumulated in spot BTC ETF trading in the past two weeks. According to BitMEX Research, the net inflow of these new spot ETFs is quite substantial, exceeding $1 billion in just one day. According to IntoTheBlock's data, the surge in fund inflows marks a significant shift in market dynamics, with the trading volume market share of GBTC, which once dominated, shrinking to 36%. This decline sharply contrasts with the peak of 63.9% set on January 17.

Glassnode's market report states that the majority of long-term Bitcoin investors are still unwilling to sell at current prices, and the vast majority of holders "seem to be calmly riding the market waves." Referring to the last active supply indicator for Bitcoin (measuring the proportion of circulating supply held for many years), analysts stated, "The vast majority of the Bitcoin holder base remains stable, with the supply percentage in multiple holding ranges slightly below historical highs." The report added, "The vast majority of the supply is still strictly held, possibly waiting for a rise in spot prices, or perhaps increasing volatility as a spending incentive."

Our research institute's summary and analysis: Recent market dynamics for Bitcoin and Ethereum have been noteworthy. Despite optimism about Ethereum's future performance, data shows that traders still prefer Bitcoin. The forward term structure of ETH/BTC futures indicates a downward-sloping trend, suggesting that traders expect Ethereum's long-term performance to be weaker than that of Bitcoin. Additionally, the activity of whale entities also reflects confidence in Bitcoin. With a large amount of Bitcoin being withdrawn from exchanges and an increase in the number of whale entities, this may indicate a future upward trend for Bitcoin. Market optimism for Bitcoin is further supported by other factors. Measures that the Federal Reserve and the Treasury may take to support the market, as well as factors such as the halving of Bitcoin's new issuance and the approval of spot ETFs, may drive an increase in Bitcoin prices. In conclusion, the current market's confidence in Bitcoin remains strong, and the behavior of multiple institutions and long-term investors, as well as market analysis, all indicate that Bitcoin may continue to show strong performance in the future.**

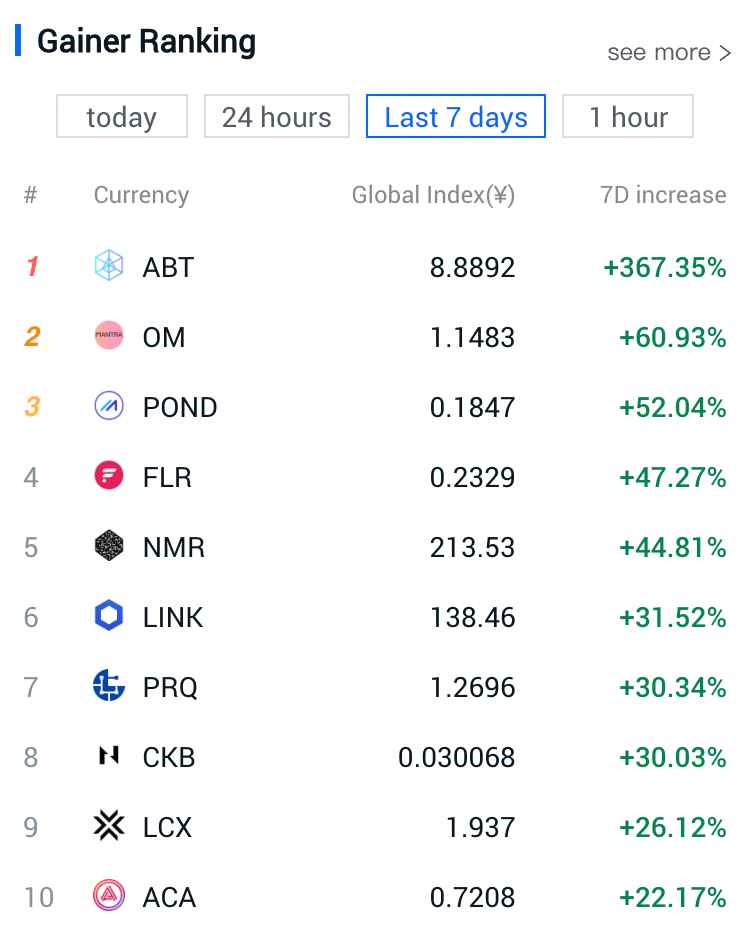

VI. Ranking of Cryptocurrency Market Gains and Selection of Community Hot Coins Last Week:

The past week's ranking of gains for altcoins is as shown above. ABT saw a significant increase, nearly tripling in value, and its daily gains have also been among the top. OM saw an increase of about 60%, while POND, FLR, and NMR saw gains of approximately 40-50%. Other coins also ranked high in terms of gains, and potential trading opportunities can continue to be monitored this week. It's important to seize the opportunity when the market trends change.

The following are the hot coins discussed in the DC community, selected as follows. The views are for reference only and do not constitute trading advice:

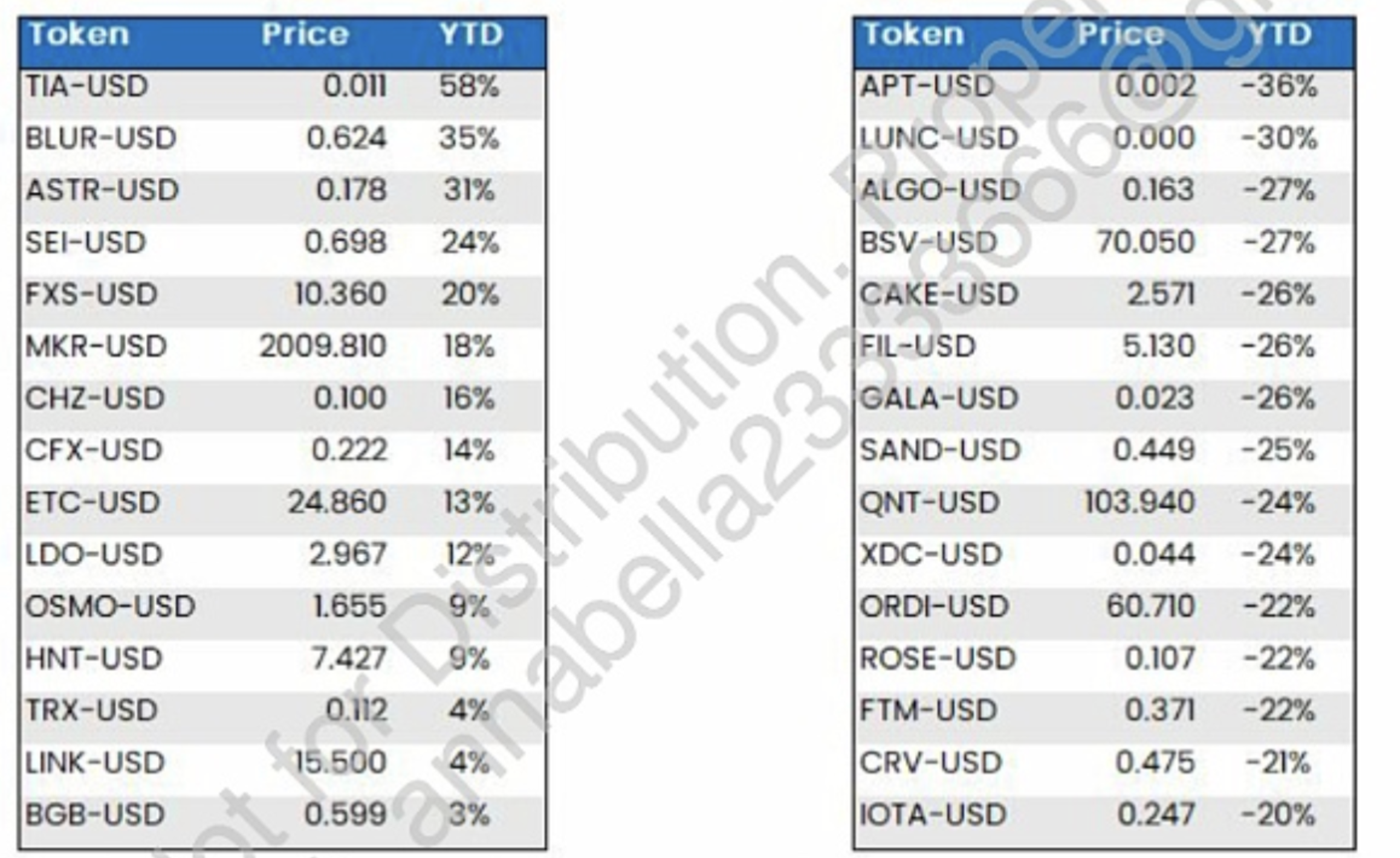

According to data disclosed by Matrixport, since the beginning of the year, only 10 tokens in the top 100 by market capitalization have seen increases of over 10%, while 15 tokens have seen decreases of 20% or more. Among them: BTC has only increased by 1%, and ETH has only increased by 2%, while TIA has increased by 58%.

On-chain indicators suggest strong upside potential for ETH in the future. With the upcoming Ethereum Dencun upgrade, analysts expect a 50-60% increase in the future. Recent research shared by cryptocurrency analyst Ali Martinez shows that nearly 510,000 ETH has been withdrawn from identifiable cryptocurrency exchange wallets in the past three weeks. The estimated total value of this massive outflow is approximately $12.2 billion.

VII. Attention to Project Token Unlocking and Negative Data:

[No further content provided in the original markdown.]

Token Unlock Data shows that this week, tokens such as APT, GAL, and HFT will undergo one-time large-scale unlocking, with a total release value exceeding $235 million. The details are as follows:

- HFT (Hashflow) will unlock 13.62 million tokens on February 7th at 8:00, worth approximately $4.25 million, accounting for 4.02% of the circulating supply.

- GLMR (Moonbeam) will unlock 3.04 million tokens on February 11th at 8:00, worth approximately $1.06 million, accounting for 0.37% of the circulating supply.

- APT (Aptos) will unlock 24.84 million APT tokens on February 11th at 8:00, worth approximately $228 million, accounting for 7.34% of the circulating supply.

This week, attention should be paid to the bearish effects of these tokens due to unlocking, avoiding spot trading, and seeking short opportunities in contracts. In particular, APT's unlocking magnitude is significant and requires close attention.

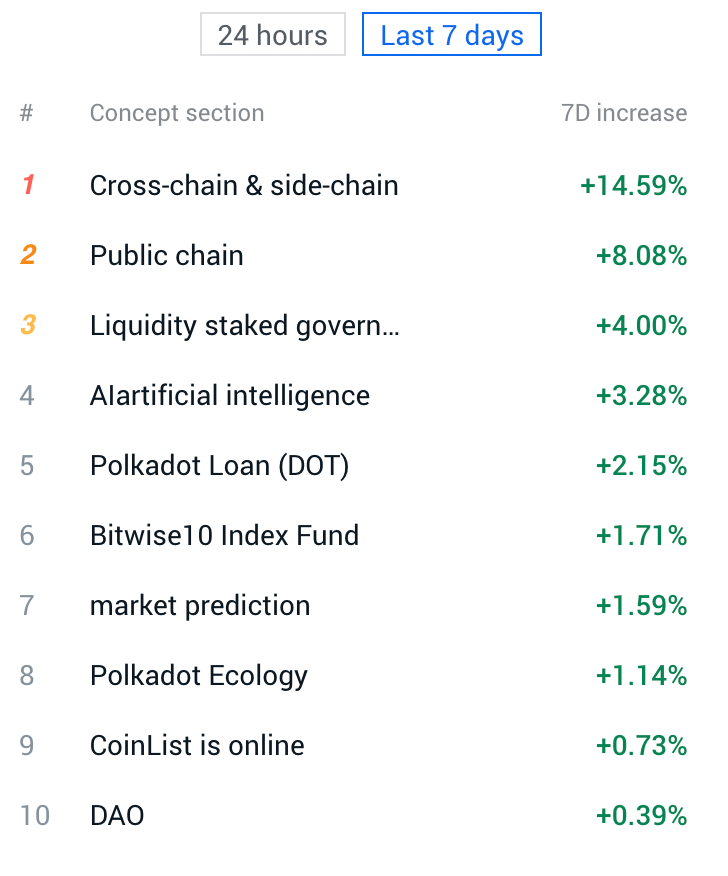

VIII. Concept Sector Ranking of Cryptocurrency Market Gains Last Week:

In the past week, the performance of concept sectors is as shown above, with cross-chain & side-chain, public chain, liquidity staking governance tokens, AI artificial intelligence, and Polkadot lending leading the gains in the last seven days. Attention should be given to the rotational speculative market of the above-mentioned sectors with significant gains.

IX. Global Market Macro Analysis Overview:

Last week, driven by positive news from the tech stock earnings reports, the US stock market continued to rise and reached new highs. This trend reflects the market's optimistic expectations for large-cap tech stocks and investors' confidence in these companies. The Dow, S&P 500, and Nasdaq all achieved four consecutive weekly gains, demonstrating the market's strong performance. Notably, the Nasdaq saw the most significant increase, reaching 1.74%, indicating the strong performance of tech stocks in the market.

In terms of large-cap tech stocks, Meta, Nvidia, and Amazon all saw weekly gains exceeding the market average, further confirming the market's optimistic expectations for tech stocks. However, it is worth noting that not all tech stocks saw increases despite the strong performance of these companies. For example, the stock prices of Apple and Google fell by over 3% and 6% respectively, possibly due to their respective business characteristics and the different market environments they operate in.

In the popular Chinese concept stocks sector, most companies saw declines in their stock prices. Pinduoduo, NIO, XPeng, JD.com, and Baidu all saw weekly declines exceeding the market average. This may be due to the regulatory pressure and market uncertainty faced by Chinese concept stocks. However, the stock price of Li Auto saw an increase, possibly due to its unique business model and market prospects being recognized by the market.

Overall, the performance of the US stock market last week showed a certain degree of differentiation. While large-cap tech stocks overall performed strongly, not all companies saw increases. Additionally, most popular Chinese concept stocks saw declines, reflecting the current market's uncertainty and the impact of regulatory pressure. Therefore, investors need to fully consider these factors and carefully assess the risks and returns of various assets when making investment decisions.

According to the latest "Fed Watch" data from CME, market expectations for the Federal Reserve's future interest rate policy are changing. The probability of maintaining interest rates in March is high, but the possibility of a rate cut still exists. However, compared to before the release of the non-farm payroll data last Friday, the market's expectations for a rate cut in March have decreased.

Fed Governor Bowman stated after the release of the non-farm payroll data that it is currently too early to consider a rate cut, as progress in combating inflation has not stalled. He emphasized that if the risk of upward inflation persists, the Fed is still willing to raise interest rates. This indicates that the Fed remains cautious in its interest rate policy and is monitoring changes in inflation and financial conditions.

Fed Chair Powell also expressed similar views today, emphasizing the importance of credibility in decision-making and stating that it is unlikely for the Fed to cut rates in March. He mentioned that the Fed's interest rate forecasts may not have changed much since December last year, implying that policy rates will remain stable. However, he also stated that if there is evidence of labor market weakness or a significant decline in inflation, the Fed may take action earlier.

In addition, former US Treasury Secretary Summers warned that the Fed's policy rate may remain above 3% in the coming years. He believes that the economy is showing strong momentum even under Fed tightening policies, increasing the possibility of a rise in the neutral interest rate.

On the institutional front, Deutsche Bank predicts that the Fed's rate cut this year may be much lower than market expectations, similar to the situation in 1995. Deutsche Bank analysts pointed out that the current economic situation is similar to that of 1995, with artificial intelligence technology driving a new productivity cycle, leading to reduced sensitivity of the US economy to interest rates. Therefore, the rate cut may be lower than market forecasts.

In summary, our research suggests that market expectations for the Federal Reserve's future interest rate policy are changing. Although the possibility of a rate cut exists, the Fed remains cautious in its decision-making and is monitoring changes in inflation, financial conditions, and the labor market. In addition, there is a divergence in institutional forecasts for the magnitude of the rate cut, indicating uncertainty in future interest rate policies.

X. Future Market Judgment:

The BTC daily chart shows that the overall volatility space was relatively small last week, fluctuating within the range of $41,865 to $43,888, with a fluctuation range of approximately $2,000. In the short term, it is running above the upward trend line at the hourly level. If it can continue to operate above $42,800, there is a possibility of continuing the recent rebound. However, if it falls below the vicinity of $42,800, it is likely to test the vicinity of $41,360 and the support level near $40,220.

As the market has not seen significant changes, technical levels can still refer to last week's views. If it can create a new high above $43,888 in the near term, the resistance above can be referenced to the Fibonacci rebound position near $44,900, as well as the secondary high point near $45,880. Currently, the long and short positions have returned to normal levels, which is conducive to maintaining the rebound in the short term. Attention should be given to whether there will be pressure to fall back after encountering resistance in the future. The downside support continues to be around $40,250, and if it falls below, there is a high probability of testing the previous high-density trading area near $34,800 to $38,000.

In addition, it is important to note that the weekly level may be building a MACD high-level death cross in the future, which will likely suppress the height of this rebound, affecting market confidence in the technical aspect and potentially causing a certain degree of pullback in the market.

Follow us: Lao Li Mortar

February 5, 2024

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。