Author: Colin Harper, Hashrate Index

2023 is an absolute godsend for Bitcoin miners.

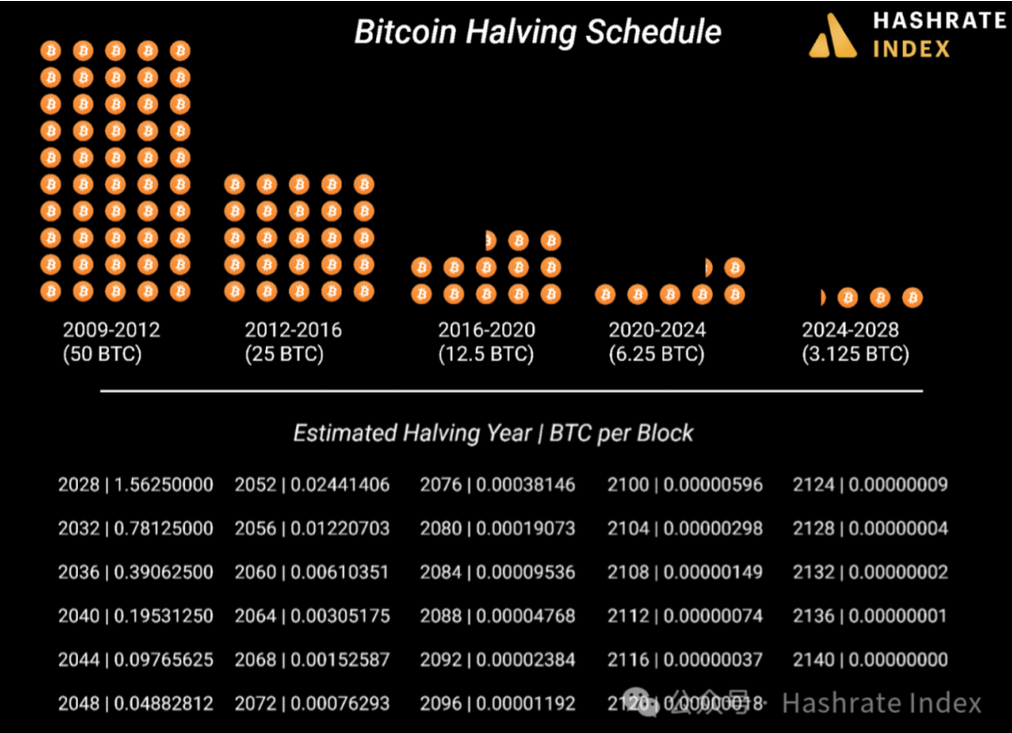

It provides a necessary second chance for an industry weakened by the sluggish market in 2022, but as 2024 approaches, miners are facing another huge challenge, the fourth halving. Bitcoin's fourth halving will reduce the block subsidy from 6.25 BTC to 3.125 BTC, meaning miner revenue will decrease by 50%.

Figure 1: Bitcoin halving events over the years

Like past halvings, the 2024 Bitcoin halving will undoubtedly leave an indelible mark on the current Bitcoin mining market.

Although the third halving (2020-2024) was not a direct catalyst, the ban on Bitcoin mining in China in 2021 and the subsequent large-scale migration of hash power created conditions for a mining market that is fundamentally different from the period of the second halving (2016-2020).

We believe that the fourth halving will bring about greater changes and may be accompanied by a redistribution of Bitcoin hash power to new geographical regions. For 2024 and the coming years, we (roughly) predict the following scenarios:

More global distribution of Bitcoin hash power

The dominance of hash power in North America will diminish. During the second halving, China dominated the hash power share of the Bitcoin network, peaking at 70-90% of the total hash power. After China implemented the ban on Bitcoin mining, this power balance shifted to North America, with the United States and Canada collectively occupying about 50% of the global hash power share from the summer of 2021 to the present (fluctuating).

It is expected that the proportion of North America in the global hash power share has already peaked and will gradually decrease after the halving in April 2024, as miners' profits will be squeezed, leading them to continuously seek cheaper electricity. This will create significant growth opportunities in South America, Africa, and other underdeveloped regions.

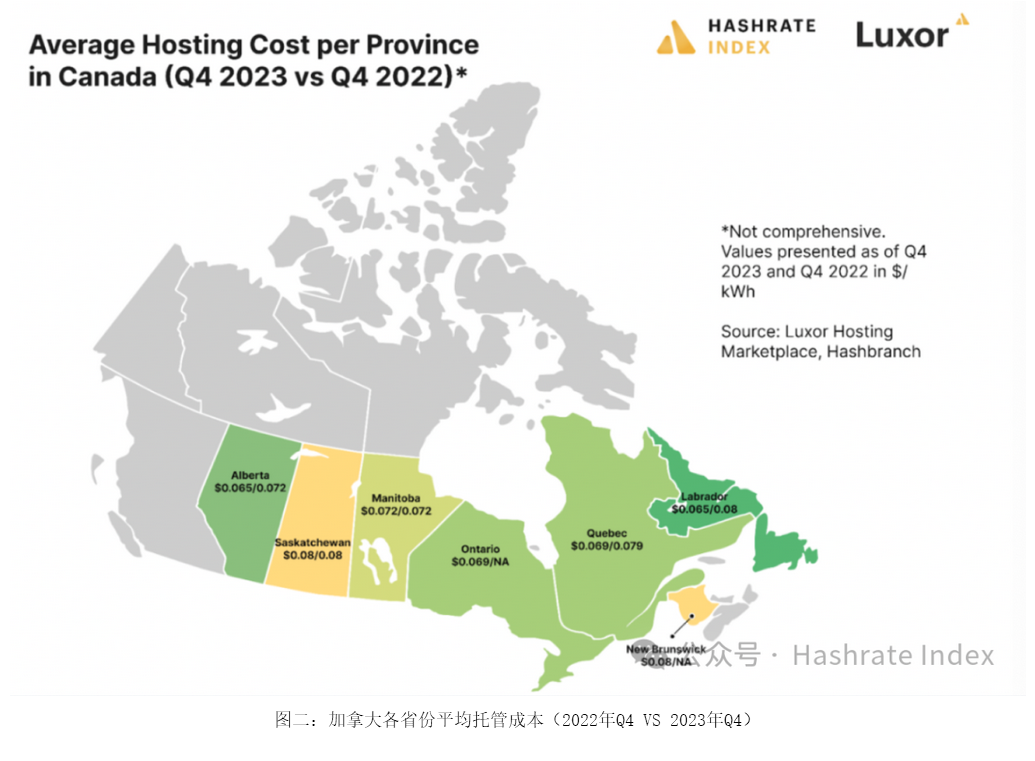

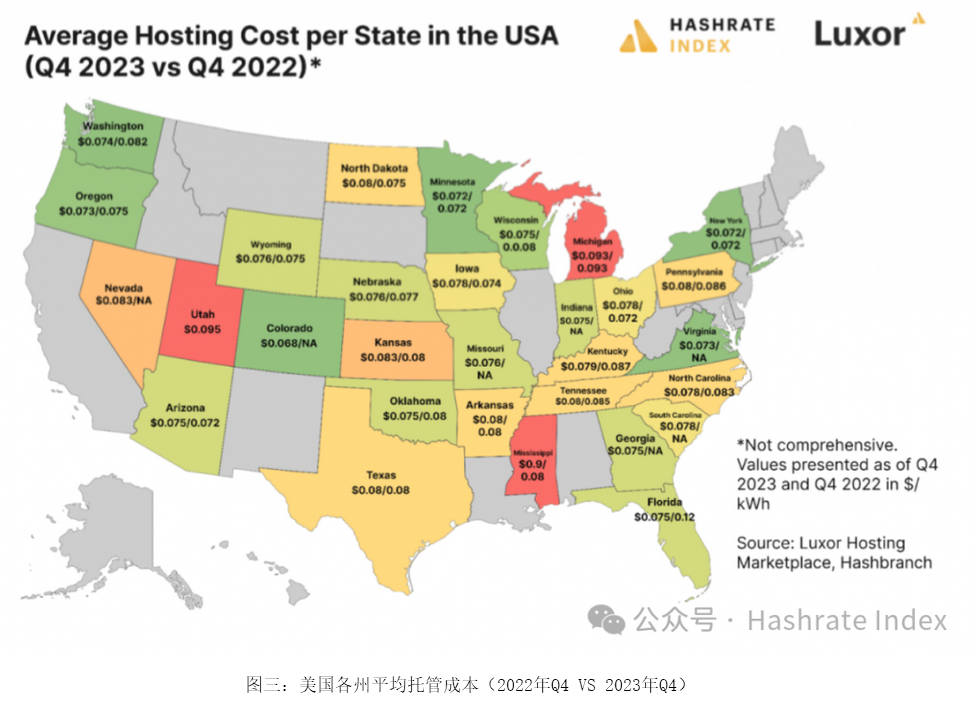

Retail hosting services industry will suffer a major setback

In North America (and elsewhere), the retail hosting services industry will decline due to the compression of mining profits for both hosting providers and customers.

In 2023, the average all-inclusive hosting cost in the United States was $0.078 per kilowatt-hour, and in Canada, it was $0.072 per kilowatt-hour. By the fourth quarter of 2023, the average all-inclusive rates were $0.078 per kilowatt-hour and $0.071 per kilowatt-hour, respectively.

Considering the mining economy after the halving, miners operating at average or higher cost levels are likely to struggle to remain profitable in 2024.

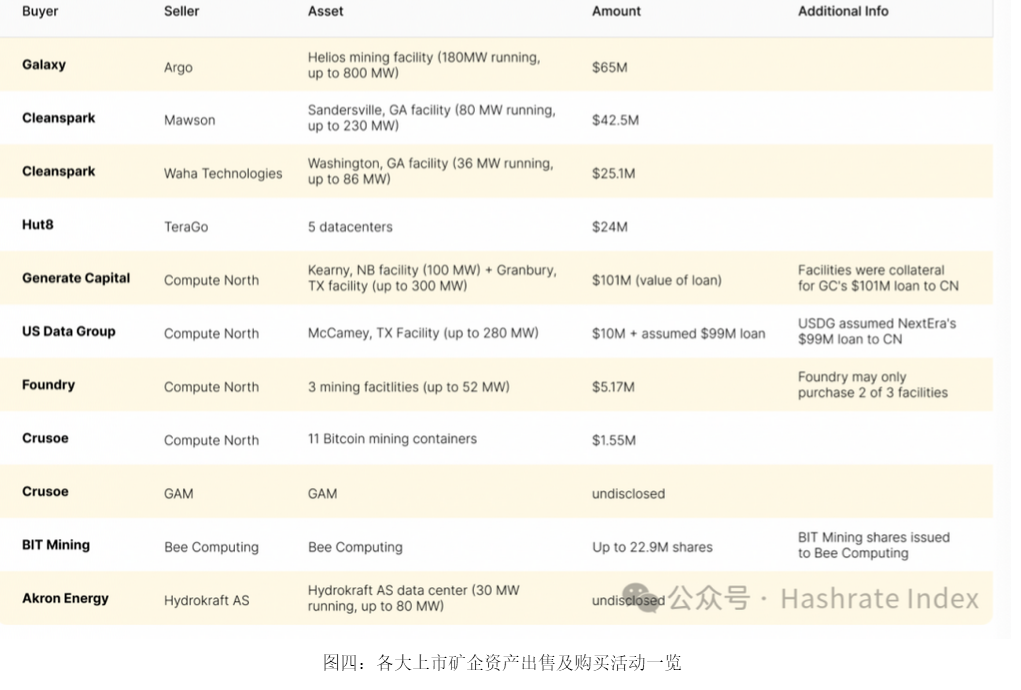

2024 will spur more merger and acquisition activities

In an environment of compressed hash power prices, there will be more mergers, acquisitions, and asset sales in 2024 and 2025.

The prelude was actually sounded in 2022. With hash power prices plummeting and reaching historic lows in Q4, one of Bitcoin's largest hosting service providers, Compute North, declared bankruptcy and liquidation, while Argo and other mining companies engaged in asset sales.

Financial difficulties in 2023 did not see much asset purchasing and acquisition activity, but it witnessed the largest merger in Bitcoin mining history—Hut 8 and US Bitcoin. It is expected that the level of asset acquisition activity in 2024 will match or exceed that of 2022.

Engraving and other block space utilization activities will continue to increase transaction fee income

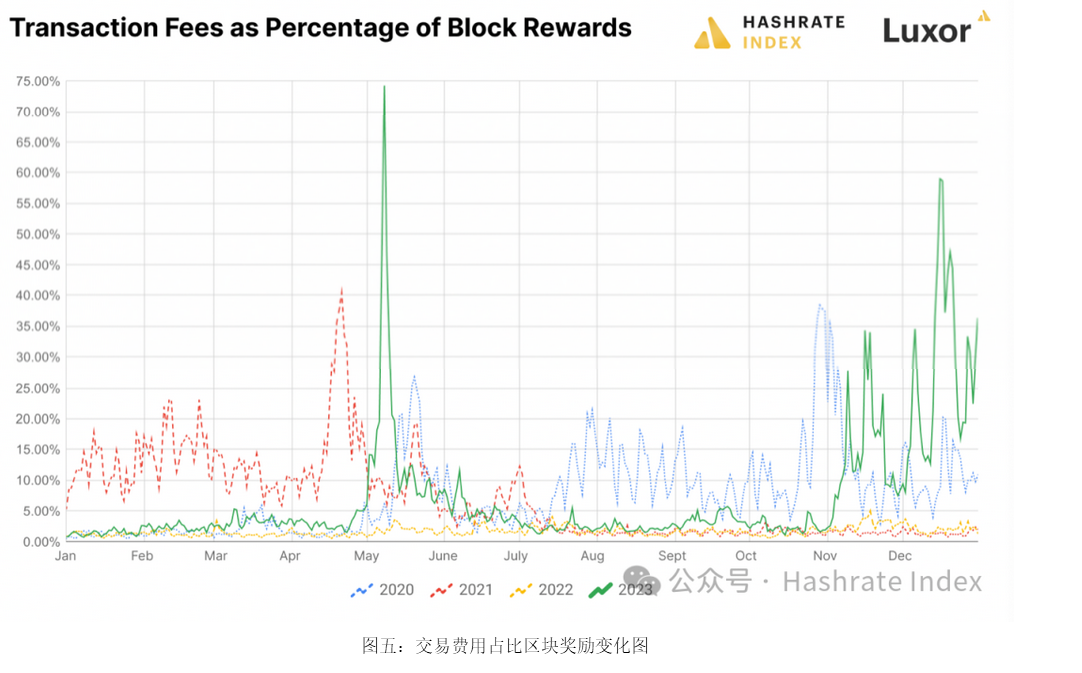

Engraving activities and alternative uses of block space in 2024 will result in transaction fees reaching levels comparable to or higher than the average levels in 2023.

The biggest dark horse in 2023 was the entry of Bitcoin-based non-fungible token (NFT) new technology standards—ordinal and engraving—into the market. This new method of creating digital artwork and artifacts on Bitcoin made transaction fees an important source of mining income.

In fact, the total amount of Bitcoin transaction fees in 2023 was second only to 2021 in Bitcoin history; miners earned $797,867,915 in transaction fees in 2023, second only to the record $1,019,725,113 in 2021. Transaction fees accounted for 7.6% of block rewards in 2023, compared to only 1.5% in 2022.

Engraving activities generated $188 million in transaction fees from December 2022 to the end of 2023, and miners earned $129.5 million in the fourth quarter of 2023 (accounting for 69% of total fees). In addition, miners' earnings in the fourth quarter of 2023 accounted for 63% of the total transaction fee rewards in 2023 ($501.8 million).

If Bitcoin continues to rise this year, it is expected that engraving activity transaction volume will continue to increase in 2024.

Bitcoin mining stocks may lose their price premium

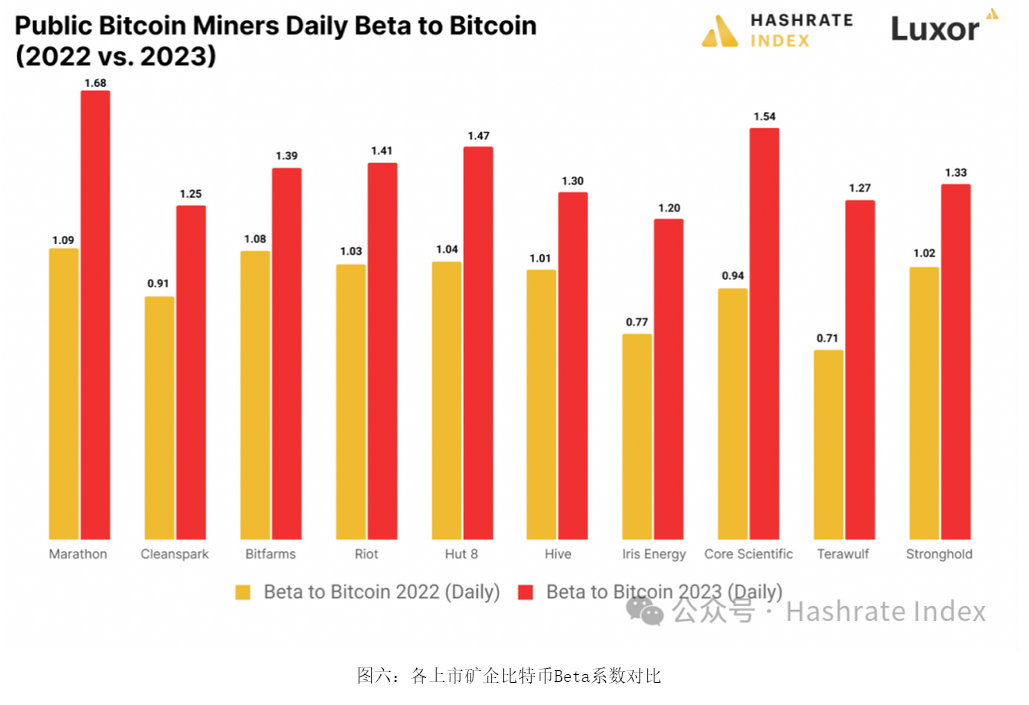

Historically, investors have used Bitcoin mining stocks as a high-beta play for Bitcoin trading, both as a substitute for Bitcoin and as assets that can generate excess returns when Bitcoin rises.

According to the beta chart analysis below, Bitcoin mining stocks show their correlation trends in bull and bear markets. In bear markets, the volatility of stock prices is more closely related to daily price fluctuations. In bull markets, due to the strong beta correlation between stocks and Bitcoin, they exhibit strong upward returns relative to Bitcoin. Traders can better grasp return on investment by observing the closer correlation between Bitcoin miners and the daily price fluctuations of Bitcoin. When this trend rises (>1.15 beta), Bitcoin miners are transitioning to a stronger return period.

Given the recent approval of various Bitcoin ETFs, it is expected that Bitcoin mining stocks will lose some of their investment premium as a substitute for Bitcoin, as investors can now directly gain exposure through multiple Bitcoin ETFs. Investors may still view them as high-beta tools for exposure to Bitcoin prices, but ETFs may reduce their price premium.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。