Author: Daniel Li, CoinVoice

Author: Daniel Li, CoinVoice

In the rapidly developing world of blockchain technology, Berachain is causing a stir with its active community culture and innovative consensus mechanism. As a next-generation Layer 1 blockchain, Berachain aims to provide high security, decentralization, and scalability, while harnessing the power of meme culture and community to create a vibrant ecosystem.

Berachain, with its unique three-token model and Proof of Liquidity (POL) mechanism, seeks to address liquidity issues in the DeFi field. The three-token model divides tokens into base currency, staking currency, and liquidity currency, providing users with more participation and incentive mechanisms. Meanwhile, the POL consensus mechanism enhances network security and performance through a dual consideration of equity and time. On January 10th, Berachain launched the testnet Artio and plans to launch the mainnet in the second quarter of this year.

Origin of Bera: From Bong Bears to Berachain

Berachain is a public chain built on MEME culture, and its initial origin can be traced back to the non-fungible token (NFT) series Bong Bears, initiated by four anonymous founders (Smokey the Bera, Papa Bear, Homme Bera, and Dev Bear), who claim to be cryptocurrency natives. The name "Bera" is intentionally misspelled as a tribute to one of the most famous single words in the crypto community, "HODL."

Inspired by the OlympusDAO protocol, the Bong Bears team, following in the footsteps of OlympusDAO, quickly gained attention in the crypto community and soon created the first rebase NFT collection, giving rise to multiple new collections such as Bond Bears, Boo Bears, Baby Bears, Band Bears, and Bit, featuring different types of bear-themed NFTs. The total value of the Bong Bears NFT series has reached 400E+.

With the development of the blockchain, the Bong Bears team realized that the traditional Proof of Stake (PoS) mechanism, while enhancing the security of the chain, would reduce on-chain liquidity, affecting operations such as trading and liquidity provision. Additionally, the staking mechanism also faced issues of centralization and limited rewards. To address these problems, the Bong Bears team decided to develop a new layer1 public chain to solve the long-standing liquidity dilemma in DeFi.

Smokey The Bera, co-founder of Berachain, previously shared the development history of Berachain, emphasizing the significance of liquidity in DeFi after experiencing the ups and downs in the crypto community. Compared to decentralization, scalability, security, and interoperability, liquidity is the foundation of everything. The Bera team absorbed the concept of POL (Protocol Owned Liquidity) from Olympus DAO and the native stablecoin concept from Terra, avoiding the shortcomings of these successful projects.

In terms of consensus mechanism, Berachain adopts the cutting-edge Proof of Liquidity consensus mechanism, coordinating network liquidity, equity centralization, and protocol and validator coordination through mechanisms such as liquidity providers, liquidity mining, liquidity proof, and liquidity governance. In the overall framework, Berachain uses the Cosmos SDK and Polaris EVM to build a modular EVM framework, providing an execution environment for smart contracts on Berachain, allowing any project to integrate and build new modular EVMs. In terms of token model, Berachain has innovated the three-token model, separating gas tokens and governance tokens, to some extent solving the problem of liquidity loss due to token staking. In terms of culture, the Berachain community has a good atmosphere, with MEME culture and no aversion to Ponzi, greatly accelerating the construction and development of the Berachain ecosystem.

The development of Berachain has attracted widespread attention and support. It has achieved significant success in fundraising. On April 20, 2023, Berachain announced its Series A funding of 42.069 million. This round of funding was led by multiple well-known institutions and individuals, including Polychain Capital, OKX Ventures, Hack VC, Dao 5, Tribe Capital, Shima Capital, Robot Ventures, Goldentree Asset Management, and others. In addition to these institutions, 20 DeFi project founders participated in the investment, including Mustafa Al-Bassam, former partner of Dragonfly Capital, and Zaki Manian, co-founder of Tendermint.

PoL + Three-Token Model: Berachain's Technical Features and Advantages

Although Berachain originated from meme culture, it is not a technologically weak MEME chain. This was fully verified when Berachain announced the launch of its public testnet Artio, which attracted over 1 million testnet users and over 70 ecosystem DApps in less than 10 days. The biggest core advantage of Berachain over traditional MEME chains lies in its unique token model and consensus mechanism.

Berachain's Token Model

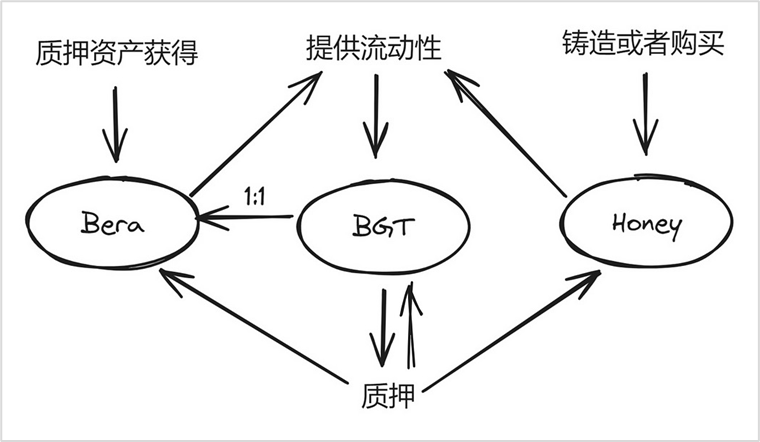

Berachain uses a three-token mechanism, namely BERA, BGT (governance token), and HONEY stablecoin. Each token plays a specific role in the network and collectively builds the Berachain ecosystem.

BERA (Layer 1 native token):

BERA is the native token of the Berachain network, used to pay for transaction gas fees and block rewards.

BERA maintains the health and vitality of the network through the gas fee mechanism, while also serving as an incentive for user participation in network activities.

BGT (governance token):

BGT is the governance token of Berachain and is non-transferable.

Users can obtain BGT by providing liquidity on BEX, lending HONEY, and providing HONEY in Berps' bHONEY vault.

BGT holders can participate in on-chain governance decisions, such as voting on block rewards for staked assets and the selection of tokens eligible for staking.

Separating governance tokens from the basic gas token enhances the fairness and transparency of governance, ensuring that the most active users do not lose governance rights due to paying transaction fees.

HONEY (native consensus collateral stablecoin):

HONEY is the native consensus collateral stablecoin of Berachain, aiming to be valued close to 1 USDC.

Users can mint HONEY by collateralizing other assets on the Berachain platform.

As an on-chain stable currency, HONEY provides a stable trading medium for decentralized applications, increasing the platform's usability and attractiveness.

It has not been released yet, and when the mainnet is launched, HONEY will be available for minting through the HONEYdApp or for purchase on BEX.

In addition to the three-token model, Berachain has introduced the concept of Block Capturing Value (BCV). BCV comes from transaction fees in DApps such as BEX, Honey, and Perps, and validators will receive these fees as rewards. By staking BGT, users can earn a portion of the BCV income and have the opportunity to receive rewards in BERA, BGT, and HONEY. Additionally, Berachain has drawn inspiration from Canto's public DeFi infrastructure concept and launched native decentralized exchange (DEX), lending platforms, and on-chain perpetual contract platforms. The income generated by these native chain protocols will be distributed to BGT holders, further increasing the value of BGT and providing more income opportunities for holders.

Proof of Liquidity (PoL) Mechanism

Berachain's Proof of Liquidity (PoL) mechanism is a consensus mechanism based on Proof of Stake (PoS), and its operation is as follows:

Users provide liquidity to the liquidity pool and receive governance token BGT.

Users delegate BGT to validators.

Validators generate blocks based on the proportionate weight of delegated BGT and both delegators and validators receive rewards on-chain.

Validators vote on the future BGT inflation settings for different liquidity pools.

Validators receive vote bribes from the liquidity pool and distribute them to delegators.

Unlike traditional Proof of Stake (PoS) systems, the PoL mechanism requires users to contribute to network security by providing liquidity for on-chain DeFi primitives. The purpose of PoL is to incentivize users to provide liquidity to the network, create new BGT tokens, and reward validator contributions. The PoL mechanism has the following characteristics and advantages:

Multi-asset staking: Unlike traditional consensus mechanisms that only use native tokens for staking, PoL allows users to stake various assets such as ETH, BTC, etc. This diversified staking approach helps reduce reliance on a single asset and enhances the overall health and stability of the network through liquidity support from multiple assets.

Coordinated relationship between validators and liquidity providers: In the PoL system, users provide liquidity to certain pools to earn BGT tokens, which they then use to delegate to validators. Validators generate blocks based on the proportion of BGT delegated to them, and both delegators and validators receive rewards on-chain. This mechanism encourages validators to increase liquidity by incentivizing specific LP pools, and the protocol can help validators accumulate BGT staking through bribery mechanisms.

Integration of liquidity and governance: The PoL mechanism integrates the concept of liquidity into the governance structure of the blockchain. Validators can vote on the allocation of BGT in different liquidity pools, further enhancing the overall liquidity and governance efficiency of the network.

Long-term impact on network health: Through the PoL mechanism, liquidity can be systematically established, promoting effective trading, price stability, network growth, user adoption, and successful operation of decentralized applications. This mechanism also helps address the centralization of staking in PoS systems, thereby helping maintain the integrity of the chain and prevent manipulation.

Through the Proof of Liquidity consensus mechanism, Berachain can promote consistency between liquidity and network security, enhancing the overall health and stability of the network. Additionally, this mechanism integrates liquidity with governance, improving the governance efficiency of the network. Most importantly, PoL has a positive impact on the long-term development and health of the network, addressing long-standing issues such as liquidity shortages and stake centralization in Proof of Stake systems.

Berachain Ecosystem Project Overview

While the Berachain mainnet has not yet been launched, its ecosystem is still in the early stages of development. However, with its unique PoL mechanism and active community culture, Berachain has attracted a number of outstanding projects. Here are a few noteworthy projects to keep an eye on:

Ambient

Ambient is a decentralized trading protocol (DEX) that allows for the combination of centralized and perpetual product liquidity on any single blockchain asset in a bi-directional AMM. Ambient operates the entire DEX in a single smart contract, combining a bi-directional AMM model with centralized and ambient stable product liquidity, making it the most efficient Ethereum-based decentralized trading platform. There are reports that Ambient will be deployed on the Berachain mainnet.

honey jar

Honey jar is an ecosystem project built on Berachain by seed investor janitooor.eth and 11 other team members. It has already launched two rounds of NFT sales on the Ethereum mainnet. The purpose of honey jar is to provide access to the entire Berachain ecosystem with the ownership of Honeycomb, which serves as a call option on the Berachain ecosystem.

Beradrome

Beradrome is an essential part of the Berachain ecosystem, serving as a trading center for liquidity and low slippage. It combines the functionality of various automated market maker (AMM) models, providing unique strategies for liquidity mining, token management, and on-chain incentives. The Beradrome platform aims to coordinate incentive measures within the Berachain ecosystem, providing users with a comprehensive and efficient trading experience. Beradrome launched its Tour de Berance NFT series a year ago and conducted multiple testnet tests. Its NFTs also clearly indicate that they will receive a governance token $Bero airdrop based on rarity when the mainnet is launched.

Sudoswap

Sudoswap is an NFT trading market that will be deployed on the Berachain mainnet in the future. It uses the same AMM model as DeFi DEXs like Uniswap and Curve to provide liquidity for NFT market trading. Sudoswap's main feature is that it allows NFT holders to become liquidity providers by creating trading pools, which is very useful for NFT holders or traders with a large number of similar NFTs who want to set reasonable floor prices. With the official launch of Berachain, it is expected to open the bridge for many NFTs on the mainnet to be bridged to the bear chain and provide incentives. Sudo is one of the first NFT markets to announce its involvement in Berachain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。