The rest of this article aims to explain the differences and trade-offs between tokens, off-chain points, and on-chain points.

Authors: Katie Chiou, Graeme Boy

Translation: Luffy, Foresight News

The most comprehensive term for consumer technology in the 2010s is gamification. Looking back, it seems natural given the technological level at the time. We entered the era of mobile internet and social media, and now almost everyone has a networked gaming device in their pocket.

The early trend of gamification brought a wave of companies that tried to turn everyday activities into games and transform them into thriving businesses. They turned sightseeing into a game (Foursquare, 2009), traffic monitoring into a game (Waze, 2008), and language learning into a game (Duolingo, 2011), among many other examples. These companies realized that gamification was an effective strategy to promote user marketing, engagement, and loyalty.

One common element of gamification is the point system, which allows you to quantify qualitative measures of progress. Point systems essentially achieve two goals: binary, clear results (numeric increase or decrease) and easy guidance of intrinsic motivation to extrinsic motivation (benefits, rewards) channels.

Blockchain serves as a natural infrastructure for point systems because they are designed as general ledgers with records of entities that can be programmatically allocated value based on certain operations.

Historically, this value has been primarily distributed through tokens on Ethereum, which are financial assets with real-time value fluctuations in the public market. Tokens are powerful tools for identifying, coordinating, and compensating users contributing to the network, providing economic incentives and ownership stakes to users.

Token incentives are crucial for the adoption of blockchain. The promise of tokens as economic rewards can offset the high costs and risks of transactions on L1 such as Ethereum. However, this may also lead to a vicious cycle. The high costs of on-chain transactions often mean that rewards tend to flow to users willing to pay high fees (usually profit-driven capital), rather than favoring participants who are less willing to pay high fees or averse to risk (usually new users).

As blockchain transactions become rapidly cheaper (through L2 and L3), a wider range of on-chain non-financial activities becomes possible without the need for necessary economic rewards to compensate users. This new paradigm marks the emergence of new on-chain primitives used to identify, coordinate the participation of users in complex decentralized networks.

On-chain proof is a method for identifying and classifying users, allowing users to self-prove their attributes and prove the attributes of others. However, proof has its limitations. Proofs are often qualitative, making them difficult to use in environments like blockchain that lack contextual information. For example, comparing the number of kills a player completes in the same game is much easier than comparing the color of the boss killed. This can be improved by adding contextual information and further combined with the development of artificial intelligence and machine learning to make such analysis easier. However, given these limitations, more quantitative forms of proof may be most suitable for the current state of blockchain scalability.

We have seen experiments with point systems in cryptocurrencies become popular, such as Blur points, which use forms such as "order points" and "lending points" to incentivize specific behaviors and distribute token rewards. Recently, Rainbow started issuing Rainbow points to reward users for transactions in the Rainbow wallet. So far, most of these point experiments have been conducted off-chain, making them very similar to Web32 points.

In addition to traditional point systems, on-chain points also provide an interesting opportunity to use points in a trustless manner in blockchain for purposes such as token exchange in ownership allocation, resistance to witch attacks in access control, and improving market functions in DeFi.

The rest of this article aims to explain the differences and trade-offs between tokens, off-chain points, and on-chain points, and to explore to what extent on-chain points can serve as new primitives for builders and users, and what advantages and challenges they have.

Why choose points

As for tokens, there are many characteristics that need to be carefully reviewed before release, which may have a significant impact on the attractiveness of the project and the token price. Some of these factors include but are not limited to:

- Supply and issuance: Will the token inflate or deflate?

- Use: Will the token be used for governance? If so, does holding governance tokens represent any claim to fees generated by the project and control over the project treasury allocation? Or will the native token be used for practical purposes? Will it become the accounting unit for using this project?

- Value accumulation: Are there staking or locking mechanisms? Does the token have a burning mechanism?

- Distribution: Will the token be distributed through airdrops or emissions? Will there be a redemption schedule?

As for points, they are typically non-financial, variable, and controlled by the issuer, meaning that point systems can be easily adjusted without immediately affecting any market dynamics. Point supply can be unlimited, and the ways points are used and redeemed can be modified. In addition, the tradability of points is also determined by the issuer, while tokens are always tradable.

Without fundamentally changing market dynamics, product mechanisms, and user behavior, project teams can adjust point systems in real time and receive community feedback, allowing more time to understand and better retain users. In the case where points are used as precursors to tokens, points help eliminate the urgency of defining token models and distributing tokens prematurely.

It is worth noting that since point systems have been extensively practiced in Web32, they are also risk-free from a regulatory perspective.

For builders, the design and implementation of points are simpler, and for users, points are also simpler. Given the dynamic nature of token prices, users may find it difficult to conceptualize a token: should I consider it as an investment or a practical tool? For example, imagine an arcade game where you have to pay 0.25 tokens to play. If you know that this 0.25 token could be worth $10 tomorrow, you may hesitate to put it into the machine.

Points can be seen as "meta-currency," as points can be converted into financial value and affect usage, but the degree of correlation of this conversion can be designed according to the situation. In this model, point redemption becomes more flexible.

In terms of point utility, point redemption can have multiple options, including direct product benefits, project ownership, governance rights, or income. These can be chosen by users themselves.

Why choose on-chain points

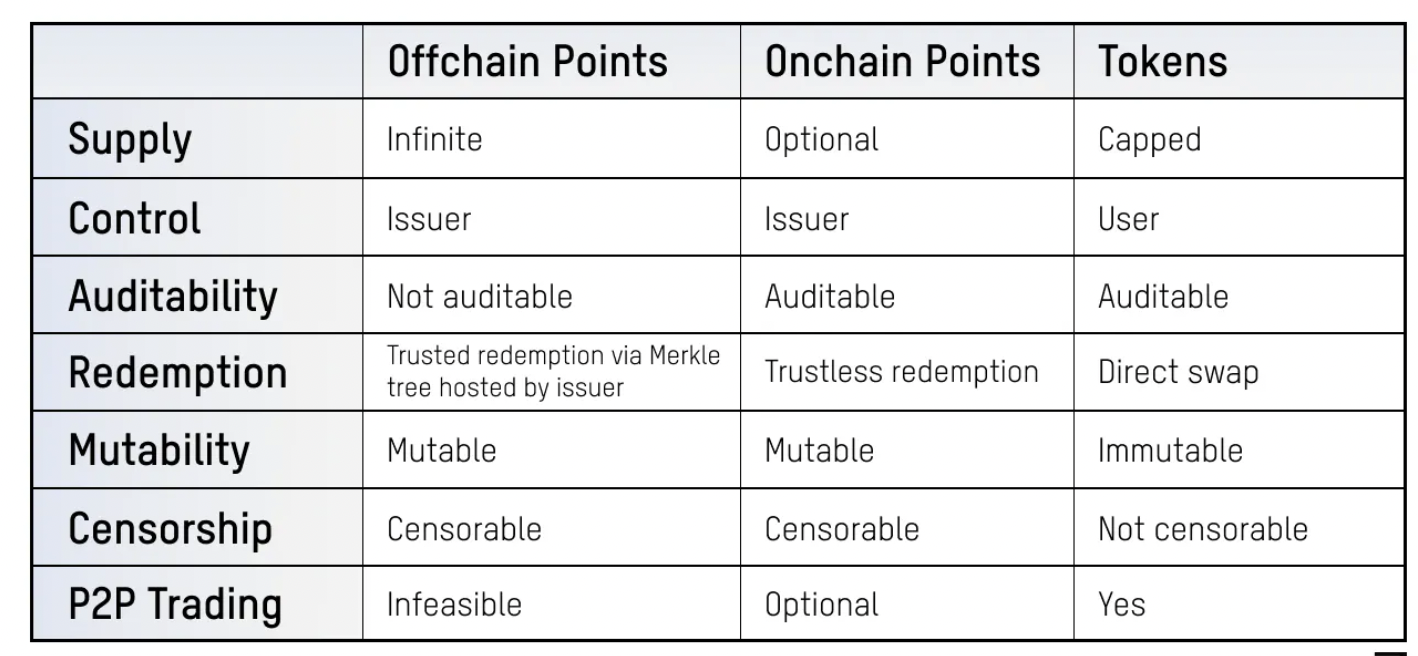

The more flexible nature of points raises an obvious question: what are the differences between on-chain points and off-chain points? A key contradiction that arises when considering tokens and points is that ERC20 tokens maximize composability and minimize issuer flexibility, while off-chain points minimize composability and maximize issuer flexibility.

Implementing points on-chain instead of off-chain may sit between these two, allowing flexibility while retaining the benefits of blockchain auditability and composability.

So, in practice, what does this mean and why is it important?

Composability

In a sense, we can view on-chain points as quantifiable proofs that people can view and utilize globally. Anyone can issue points to others on-chain, and point systems can be built based on third-party product usage or local point systems. On-chain points can add new dimensions to users' on-chain identities, similar to accumulating other on-chain credentials, and can be integrated into various modular protocols. With this framework, on-chain points can become a powerful tool for projects and brands to identify advanced users across products, and even attract potential customers through discounts and airdrops.

Source

On-chain points also ensure transparency of the total allocation of points in the system and the history of allocation methods, providing transparency for the community value brought by the point system and fairness in the allocation process.

For example, brands and institutions often collaborate with influencers based on engagement metrics on platforms such as YouTube, TikTok, and Instagram. However, these platforms configure and manipulate their algorithms in a black box environment for distribution, making it difficult to discern the logic behind the metrics.

Trust Assurance

Blockchain allows for clear assurances on the current point allocation and redemption options for users. These assurances enable points to be exchanged for other on-chain assets with minimal trust assumptions, giving on-chain points potential value unprecedented in Web32 point systems. Without blockchain, point systems would face the same criticisms in the crypto community as Web32 platforms: that they cannot meet the level of trust commensurate with their value.

Resistance to Witch Attacks

Point systems may also impact "airdrop farming" activities in Web33 products. Bots can acquire points just like they acquire tokens, but point systems can explicitly indicate reward types unrelated to tokens, serving as a useful communication mechanism between project teams and early adopters and used to incentivize certain contributions to the product or network. For example, providing liquidity to a protocol or stress testing certain features.

Community Accountability

Point allocation can also undergo community review before disclosing any redemption mechanisms, reducing the risk of post-airdrop disputes. Even timestamp verification by a third party can be used to audit on-chain point allocation.

Implementation

As mentioned earlier, points can be designed for various types of rewards, from discounts to product benefits, project ownership, governance rights, and direct income. Similarly, the implementation specifics for different projects may vary significantly, from some form of proof to modified ERC20 tokens to Soulbound tokens. While each approach has its own advantages and trade-offs, we will outline a possible common process: redeeming ERC20 tokens.

While ERC20 tokens are the most composable reward distribution method, they often minimize issuer flexibility and maximize speculative behavior. You can make modifications to make them non-transferable or have unlimited supply; however, you still encounter the common confusion between tokens and currency forms.

Redeeming points for ERC20 tokens also needs to consider costs. The transaction costs of transferring ERC20 tokens on-chain can be very expensive for issuers every time a user joins and updates their point balance. Alternatively, you can accumulate points in an off-chain database into a Merkle tree and periodically publish the Merkle root on-chain in a smart contract. When users want to claim tokens, they submit a transaction to the smart contract containing a Merkle proof. By verifying the submitted address and claimed amount against the published Merkle root, the verification can be done (essentially how Merkle airdrops work). This is a common method of token distribution as it pushes the transaction costs onto end users rather than the project, distributing the total cost (potentially millions of dollars) among all token holders.

Stack has built a solution to exchange points for ERC20 tokens in a trustless manner on any EVM chain, which is cheaper than traditional Merkle airdrops.

While the exact specifications of point or token systems may vary depending on the specific circumstances, we provide a general description of off-chain points, on-chain points, and token characteristics below for guidance.

In addition to technical or specific cryptocurrency implementation considerations, there are many other key design decisions when creating a point system. Some ideas include:

The primary goal of a project's point system should be to encourage product usage, not point accumulation. Ensuring that the point plan ultimately brings users back to your own product ecosystem is key to successfully launching a point-driven flywheel, rather than encouraging wool-gathering behavior. This is especially important for the sustainability of value. The value lost by providing rewards must be compensated for by value elsewhere, such as more users, higher-value transactions, sales revenue, advertising, etc. Directly converting points into product advantages is particularly helpful for maintaining a closed-loop feedback cycle and testing specific features or products for success. Farcaster Warps is an example where points earned in the app can be used as gifts to other users or for discounts when purchasing NFTs within the app. This explicit use case for points in the product reduces the risk of speculative influx, serving as the basis for future financial incentives.

Effective point systems also need to have an intuitive understanding of what will drive your users and your product. For example, if your users are relatively price-insensitive, discounts may not be as interesting; for products benefiting from strong network effects, other levers such as personalization or social access/rewards may be more appealing. If your product is driven by session time, frequently and consistently providing smaller rewards may be more effective than reducing higher-value rewards.

The Future of Points

The story of gamification is not new, and many case studies show that gamification can bring positive user habits, incentivize coordination, and increase loyalty between brands and users.

Looking ahead, decentralized, user-owned networks will define the new internet. In the on-chain world, gamified points can serve as a unique way to identify and reward user behavior and contributions, in ways that are more powerful and comprehensive than in Web2. Therefore, it is important to understand the goals and roles of empowerment and ownership in your product and design the point system accordingly. While tokens are extremely powerful tools for coordinating and governing these networks, they have proven to be more rigid than initially envisioned. On-chain points, as a potential new primitive, can be used alongside tokens by teams to explore paths for better user identity, user ownership, and incentive adjustments. However, points will only be beneficial in achieving these goals if carefully leveraged while keeping these objectives in mind.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。