bitSmiley's business model of stablecoin + decentralized lending is also known as the "MakerDAO + Compound" of the Bitcoin ecosystem.

Author: Severin, MT Capital

bitSmiley fills the gap in the BTC ecosystem stablecoin market

Since the second half of last year, the popularity of DeFi has brought a large amount of funds and user traffic to the Bitcoin network, driving the development of the Bitcoin ecosystem. The demand for DeFi transactions has led to the establishment of a large number of Bitcoin wallets and DeFi trading market infrastructure. The limitations of Bitcoin network transaction throughput and high Gas costs have also led developers to focus on the Bitcoin expansion track. With a large amount of funds accumulated in DeFi, the need for new use and interest scenarios for Bitcoin and other ecosystem funds has become urgent, leading to the emergence of numerous cross-chain projects.

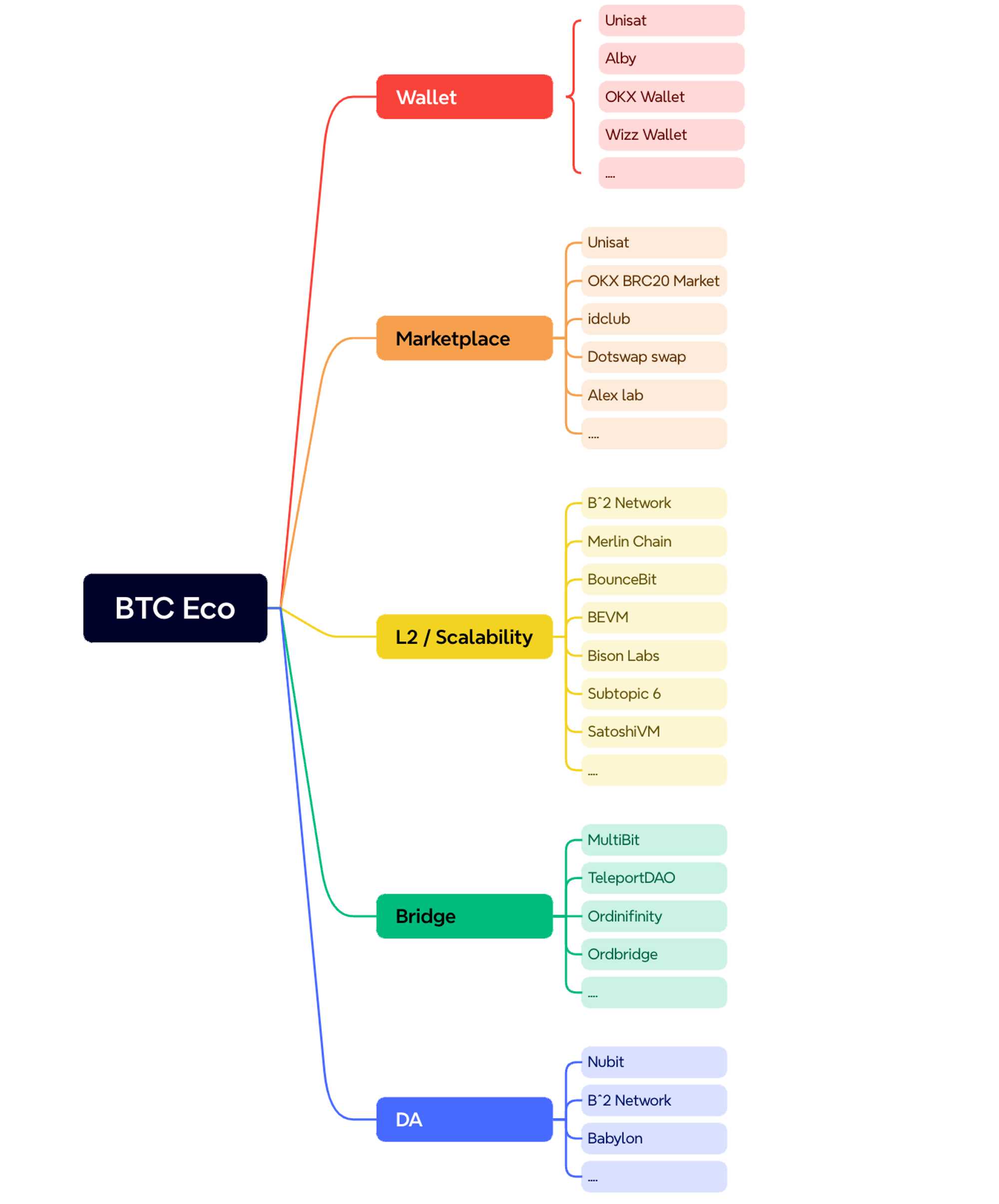

Although the overall Bitcoin ecosystem is still in its early stages, a batch of high-quality infrastructure has emerged to fill the market gap. For example:

- Wallets: Unisat, Alby, OKX Wallet, Wizz Wallet…

- Trading markets: Unisat, OKX BRC20 Market, idclub, Dotswap swap, Alex lab…

- L2 / Scalability: B^2 Network, Merlin Chain, BounceBit, BEVM, Bison Labs, SatoshiVM…

- Bridge: MultiBit, TeleportDAO, Ordinifinity, Ordbridge…

- DA: Nubit, B^2 Network, Babylon…

source: MT Capital

The popularity of the Bitcoin ecosystem brings to mind Ethereum's DeFi Summer. However, compared to Ethereum, the Bitcoin ecosystem still lacks DEX, Lending, and Stablecoin projects. In particular, the jewel in the crown of DeFi, the native stablecoin market of Bitcoin, still has a significant gap. With the continuous launch of BTC L2, stablecoins are needed to leverage BTC DeFi and release the liquidity of funds on the Bitcoin mainnet. As the frenzy of DeFi gradually fades and the market becomes rational, the funds remaining on the Bitcoin network also need to find new interest and use cases, and stablecoins are undoubtedly the best choice. Therefore, we have also set our sights on bitSmiley, the first stablecoin project based on BTC over-collateralization in the Bitcoin ecosystem. bitSmiley is expected to fill the gap in the BTC ecosystem stablecoin market and become a core component of the new round of BTC **** ecosystem.

BTC's "MakerDAO + Compound"

bitSmiley consists of the stablecoin bitUSD minted based on BTC over-collateralization and the decentralized collateralized lending bitLending based on bitUSD. Its business model of stablecoin + decentralized lending is also known as the "MakerDAO + Compound" of the Bitcoin ecosystem.

bitUSD

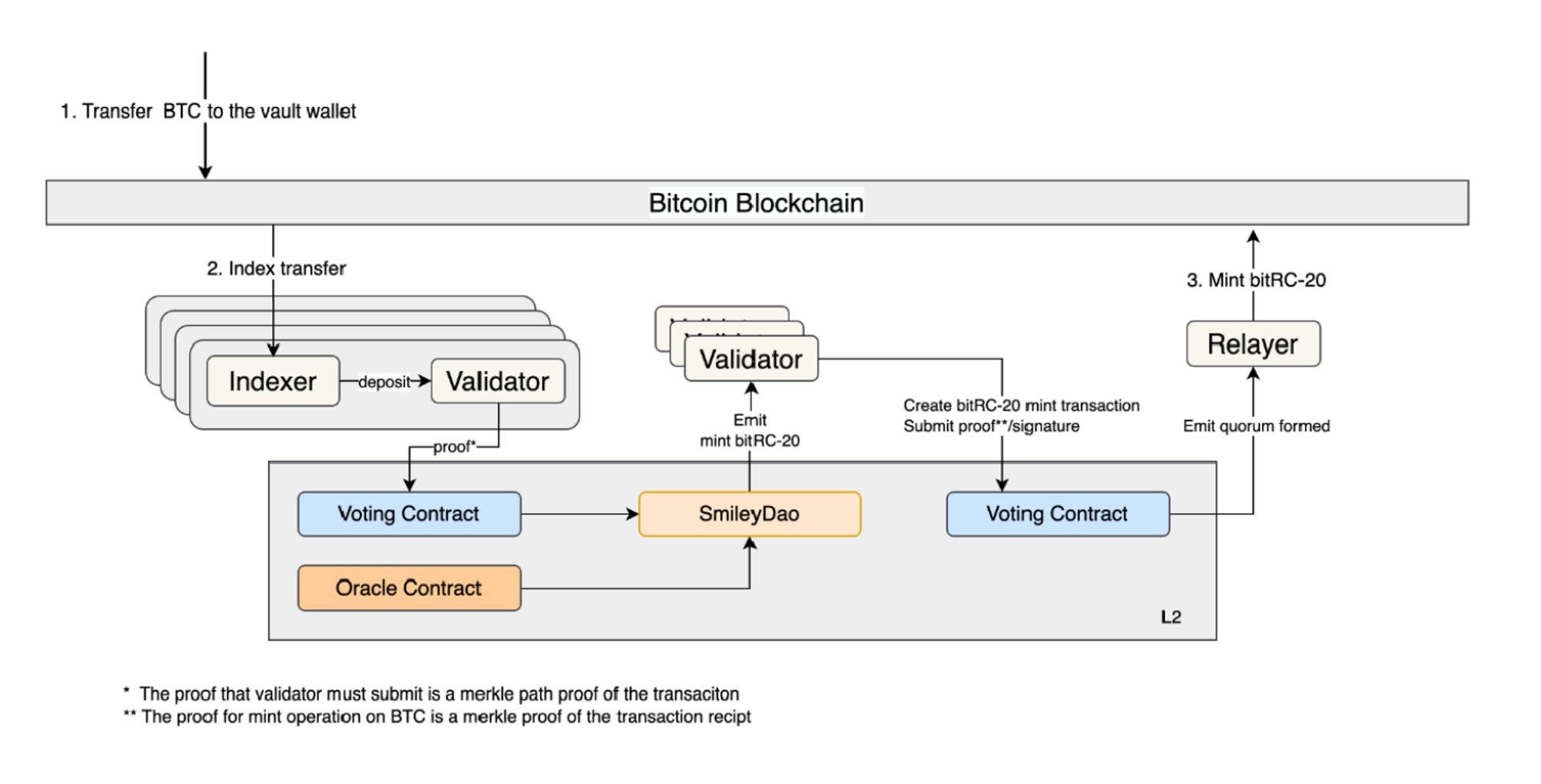

bitUSD is the core of the bitSmiley ecosystem. As the functions that Brc-20 can achieve are relatively limited, the bitSmiley team has further optimized the Brc-20 protocol to meet the business needs of stablecoins, proposing an enhanced version of the Brc-20 protocol: bitRC-20. bitRC-20 is compatible with Brc-20 and adds operations such as Mint and Burn to meet the needs of stablecoin minting and burning.

The overall minting logic of bitUSD is similar to MakerDAO. First, users need to over-collateralize BTC on the Bitcoin mainnet. Subsequently, the oracle will transmit the information to L. The bitSmileyDAO deployed on L2 will receive the oracle information and undergo consensus verification, and then transmit the information to the Bitcoin mainnet validators to achieve the minting of bitUSD on the Bitcoin mainnet.

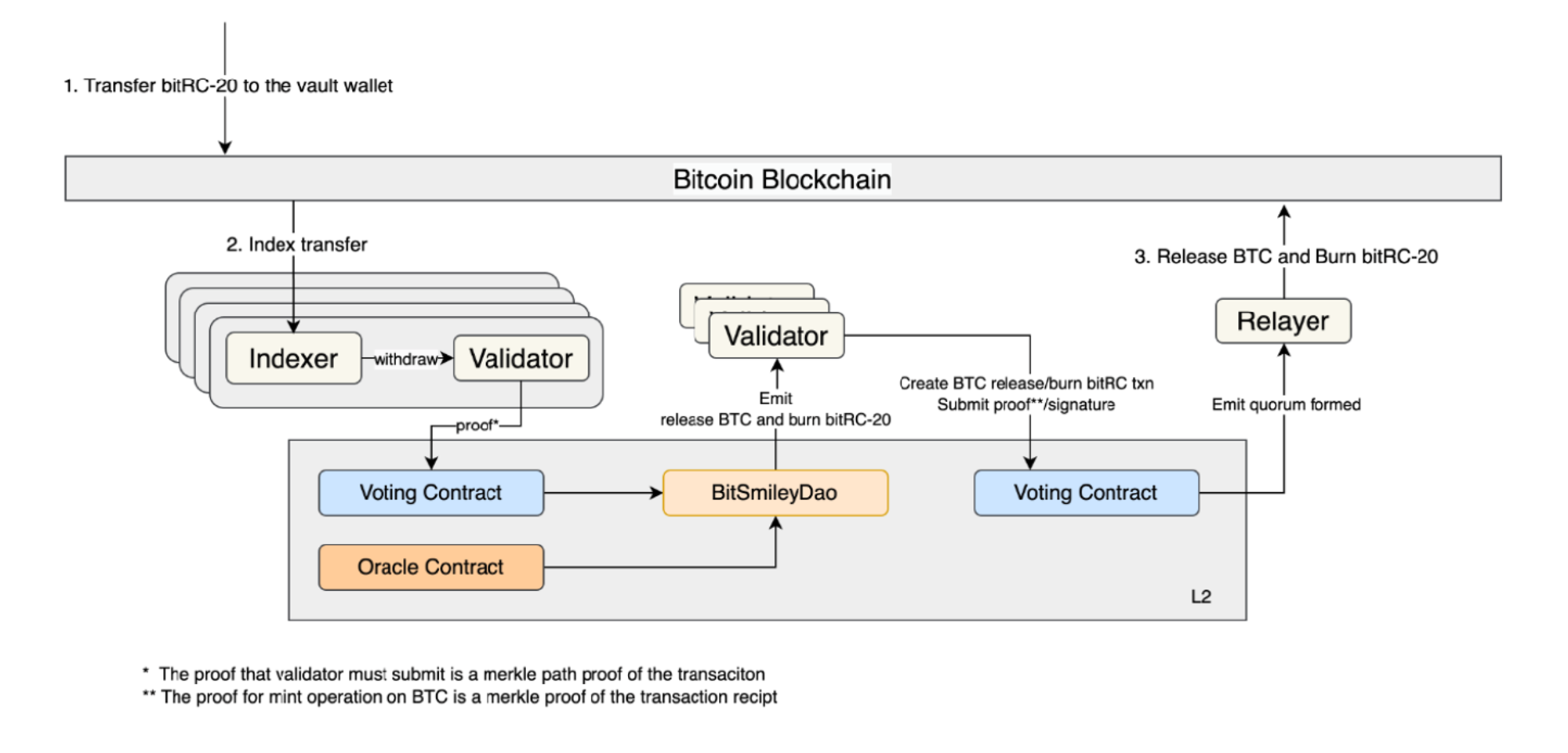

The redemption logic is similar to the minting logic. When the user retrieves the collateral, the corresponding bitUSD will also be destroyed.

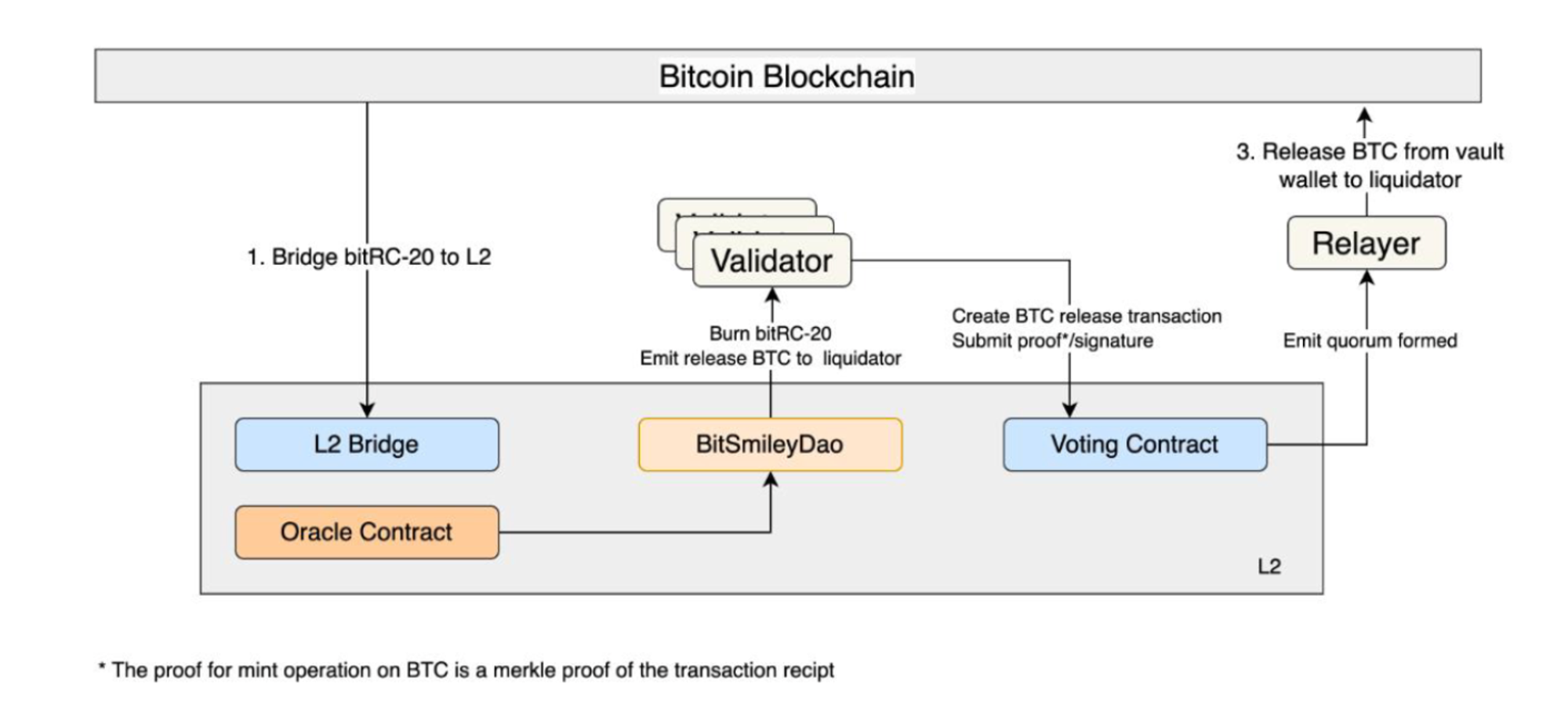

If the collateral ratio falls below the threshold, bitSmiley will initiate the liquidation process and auction off the collateral assets. Similar to MakerDAO's liquidation mechanism, bitSmiley's liquidation will also use a Dutch auction, starting with a high price and gradually decreasing. bitSmiley will also use 90% of the stable fee income and auction income as a liquidation buffer to ensure the overall system's security. In addition, when the liquidation buffer is unable to offset the debt, bitSmiley will use the platform's future income as collateral for debt auctions to minimize the occurrence of bad debts and better withstand the damage caused by extreme market fluctuations to the platform.

The implementation approach of MakerDAO's decentralized over-collateralized stablecoin has been validated by the market. bitSmiley cleverly references MakerDAO's implementation approach and innovates in a more refined manner in token standards and liquidation mechanisms, thereby better meeting the stablecoin market needs of the Bitcoin ecosystem.

bitLending

In addition to the stablecoin demand, bitSmiley also keenly noticed the Bitcoin users' need for decentralized lending. Therefore, bitSmiley can also provide decentralized lending services native to Bitcoin.

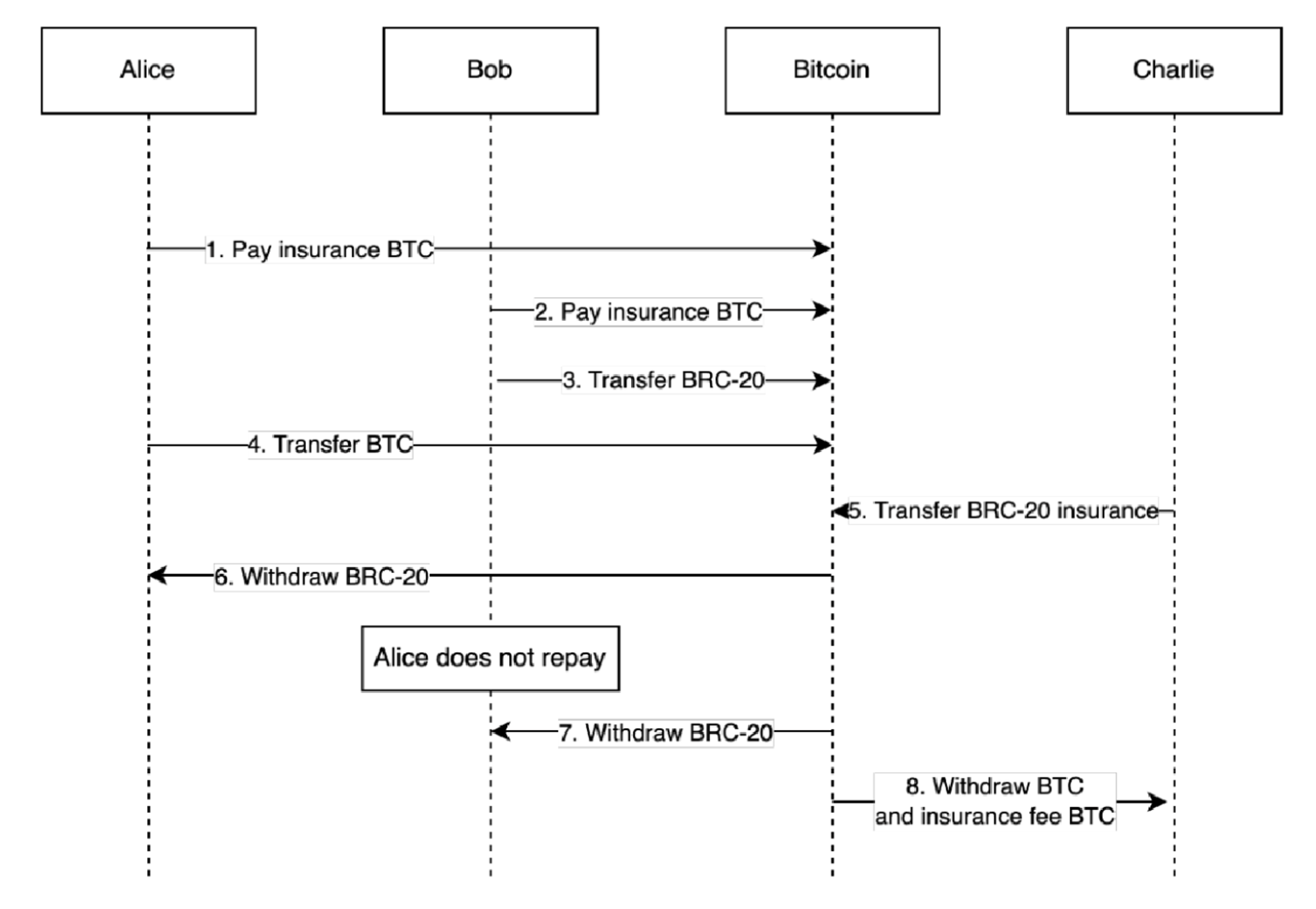

The implementation approach of bitLending is similar to other peer-to-peer lending protocols in other ecosystems. Lenders can post loan offers on bitLending, including the type and quantity of bitRC-20 tokens they are willing to provide, the loan term, and the loan interest rate. Borrowers can choose to accept their preferred offer. After the match is made, bitLending will generate a multi-signature address for fund transfer. The borrower and lender need to transfer the assets to the multi-signature address and undergo network consensus confirmation. Once confirmed, the borrower can withdraw the loan.

Due to the long block time limit of the Bitcoin network, bitLending cannot perform liquidation based on oracles like other lending protocols. If the price of the borrower's collateral assets drops significantly, the borrower may refuse repayment, resulting in substantial losses for the lender. To address this issue, bitLending introduces loan insurance. Before transferring the loan funds and collateral, both the borrower and lender need to transfer an insurance fee to the multi-signature address. The guarantor can receive the insurance fee in the multi-signature address and choose to guarantee the borrower's losses. Once the borrower defaults, the funds in the multi-signature address will be used to compensate the lender, thereby safeguarding the interests of the lender.

As the protocol matures, bitSmiley also plans to further optimize the lending mechanism of bitLending, enabling bitLending to support the splitting and merging of orders, thereby further improving capital efficiency. In addition, bitSmiley also plans to introduce CDS credit default swap products for bitLending, bringing more complex traditional financial instruments into the Bitcoin ecosystem.

In summary, bitSmiley not only brings the gameplay of stablecoins and lending into the DeFi ecosystem, but also makes more refined optimizations to stablecoin and lending protocols based on the uniqueness of the Bitcoin network. With the landing of BTC L2 and the gradual maturity of bitSmiley's business, the gameplay of bitSmiley, which combines stablecoins and lending, is expected to become the liquidity hub of the Bitcoin network, further aggregating the liquidity of the Bitcoin network, improving the efficiency of fund utilization, and injecting ecological vitality into the Bitcoin network. The first-mover advantage of bitSmiley may make bitUSD the hard currency of value exchange in the Bitcoin network and, by continuously expanding its network advantage, form its own ecological barrier, thereby achieving a downward impact on other products.

Recent Developments

In addition to having a high-quality founding team and excellent product capabilities, bitSmiley's strength in market promotion, publicity, and event operations should not be underestimated. Recently, bitSmiley's promotional efforts have been increasing, with continuous promotion of funding institutions and partners on Twitter, active participation in AMA and Twitter Space, and a gradual increase in discussions about bitSmiley and the number of users paying attention to bitSmiley in the community. In order to further enhance community stickiness, reward early supporters, and attract more new users, bitSmiley has also launched a series of NFT activities.

First, bitSmiley has launched a limited edition of 100 OG NFTs: bitDisc-Gold, which is distributed to Bitcoin OGs and industry leaders. Users with bitDisc-Gold will be invited to the private Bitcoin OG Club and will have priority access to the full range of bitSmiley products and future benefits.

Secondly, bitSmiley has also launched a limited edition of 10,000 bitDisc-Black NFT series to reward ordinary users, early supporters, and contributors. Users with bitDisc-Black NFT will also have a series of benefits, including priority access to bitSmiley products, potential airdrops, and more.

Currently, bitSmiley has taken a snapshot of the early 1999 community followers, and the remaining whitelist will be distributed through subsequent activities. KOLs on Twitter have also started activities to retweet and draw whitelists. In addition, bitSmiley has launched a new round of Discord active user whitelist lottery, where users can join bitSmiley's Discord community, actively comment, and compete for whitelist qualifications.

Conclusion

After in-depth research and analysis, we at MT Capital are very optimistic about the development potential of bitSmiley and have participated in the recent round of financing for bitSmiley. bitSmiley has a keen insight into the blank market of stablecoins and lending products in the Bitcoin ecosystem. By launching innovative native Bitcoin over-collateralized stablecoins and decentralized peer-to-peer lending products, they have successfully achieved a perfect fit between product and market. In addition, bitSmiley's stablecoins not only provide a new standard for value anchoring and a medium of value exchange for the Bitcoin network, but their lending products also open up new application scenarios and value areas for these stablecoins. We believe that with its first-mover advantage in the market, bitSmiley will quickly build a strong ecological barrier and become a leading DeFi product in the Bitcoin ecosystem with its unique combination of stablecoins and lending products.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。