The cryptocurrency market is in a downtrend, and the ETF craze is gradually fading.

Author: Mike

A. Market View

I. Macro Liquidity

Currency liquidity has improved. The FOMC meeting on January 30th set the tone for current US monetary policy, and the market has adjusted its optimistic sentiment, with the probability of a rate cut in March estimated to be less than 50%. The weekly US dollar index broke through to a 2-month high. US stocks continued to hit historical highs, with impressive financial quarter data. The cryptocurrency market is in a downtrend, and the ETF craze is gradually fading.

II. Overall Market Performance

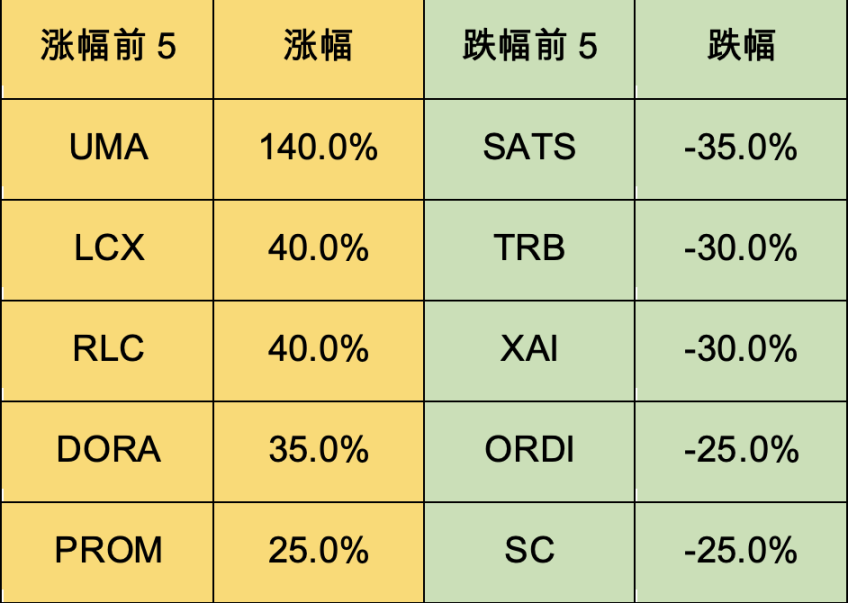

Top 100 market cap gainers:

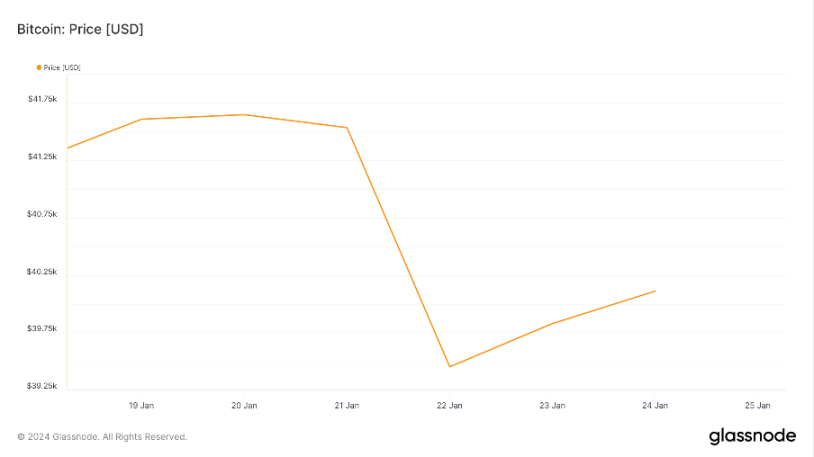

BTC rebounded after a sharp drop this week, influenced by a large outflow of funds from Grayscale. The market tends to favor defensive projects, with airdrop projects leading the way. The market's hotspots are mainly focused on staking mining and soccer fan tokens.

MANTA: A Layer 2 project based on ZK technology founded in 2020. The product includes Manta Pacific, an L2 network using Celestia as the DA layer on ETH, and Manta Atlantic on the Polkadot L1 network. Manta currently offers mining and staking yields as high as 60-90%, attracting a significant increase in TVL.

ALT: A new IEO project on Binance. Altlayer is a modular and re-staking infrastructure that helps B-side clients launch Rollups with one click, similar to Cosmos's SDK. ALT is based on Op Rollup technology upgrade, mainly providing customized services for the EVM ecosystem.

SANTOS: A fan token for a leading Brazilian football club. Fan tokens historically move independently from the overall market. According to previous patterns, with the European Cup and Copa America opening in June, there is usually a several-fold increase in market value until May, ending a month in advance.

III. BTC Market Performance

1) On-chain Data

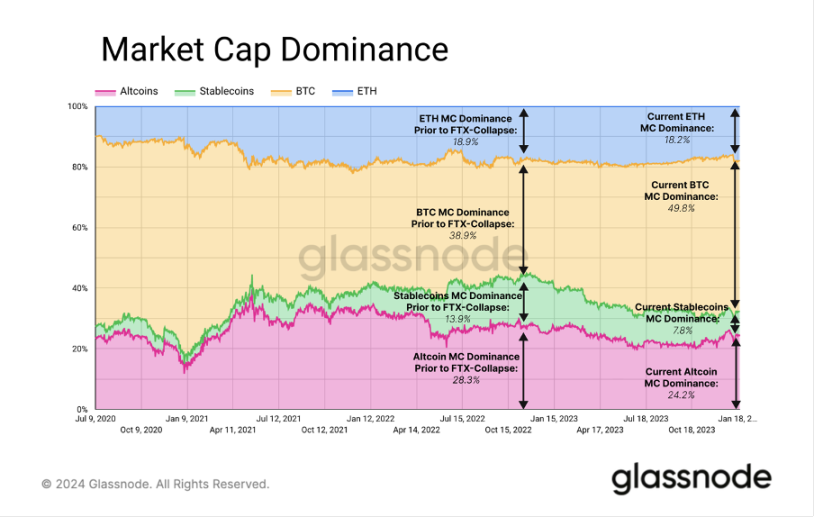

BTC's dominance has strengthened. Since BlackRock's initial application for a spot ETF, BTC's market cap has grown by 70%, and the total market cap of altcoins has also grown by 70%. However, ETH's relative momentum is weaker, performing 15% lower than the broader altcoin field. BTC has been more dominant in recent years. Since the FTX exchange crash at the end of 2022, BTC's market dominance has risen from 40% to 50%.

Stablecoin market cap remains stable. The past week's capital situation differs from before, with USDT's market cap shifting from positive growth to negative, especially with more impact on altcoins.

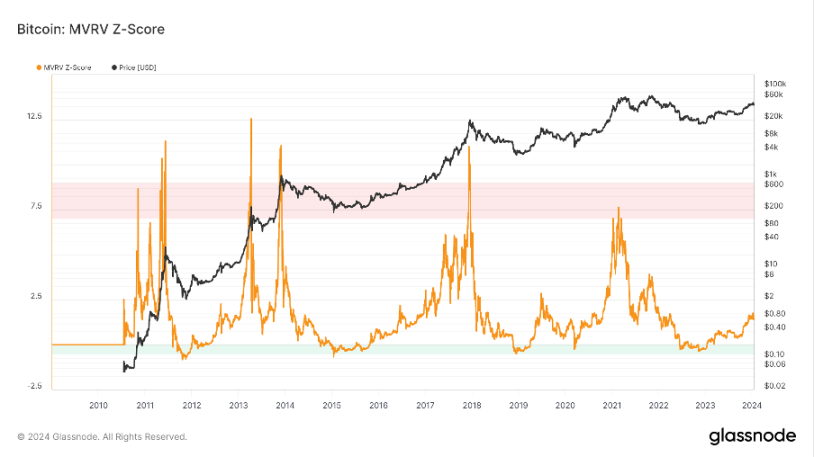

The long-term trend indicator MVRV-ZScore uses the total market cost as a basis, reflecting the overall market profit status. When the indicator is greater than 6, it's in the top range; when the indicator is less than 2, it's in the bottom range. MVRV has fallen below the key level of 1, indicating that holders are generally at a loss. The current indicator is 1.43, entering the recovery phase.

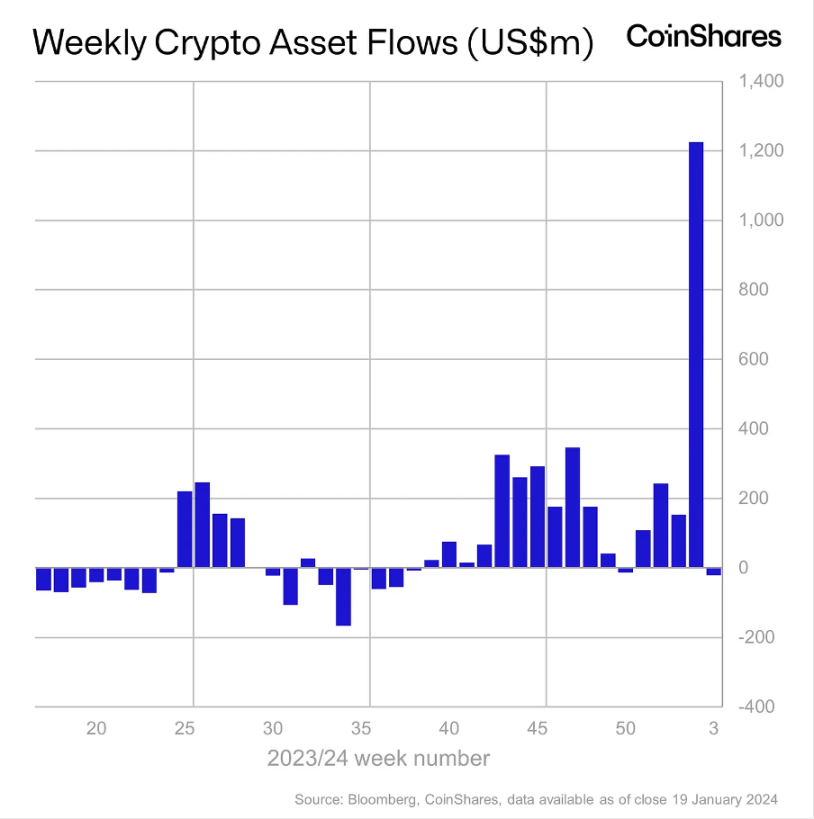

Institutional investment in cryptocurrency products has turned to net outflows, with funds gradually withdrawing.

2) Futures Market Performance

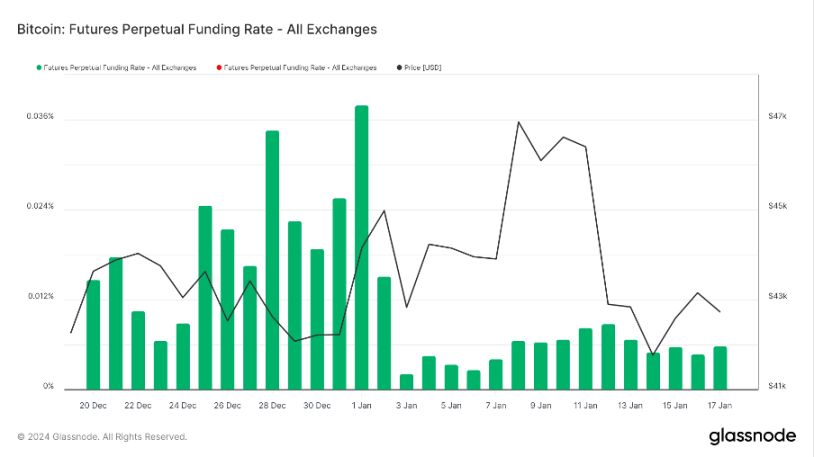

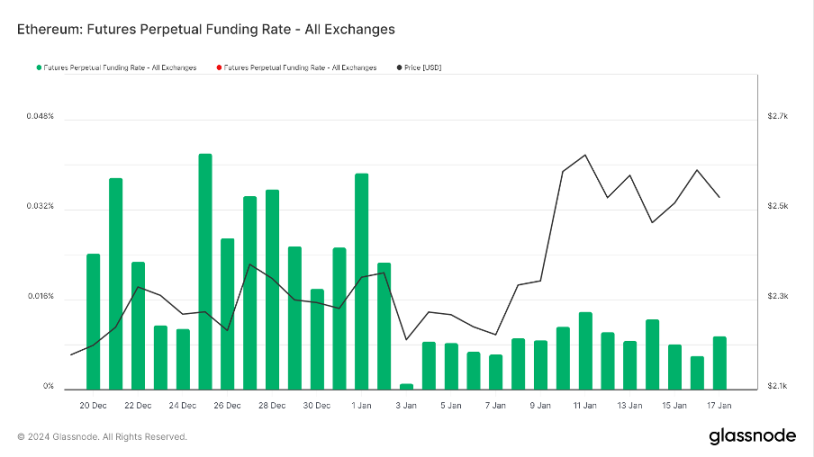

Funding rates for futures: Rates have returned to normal this week, with neutral market sentiment. Rates of 0.05-0.1% indicate a majority of long leverage, suggesting a short-term market top; rates of -0.1-0% indicate a majority of short leverage, suggesting a short-term market bottom.

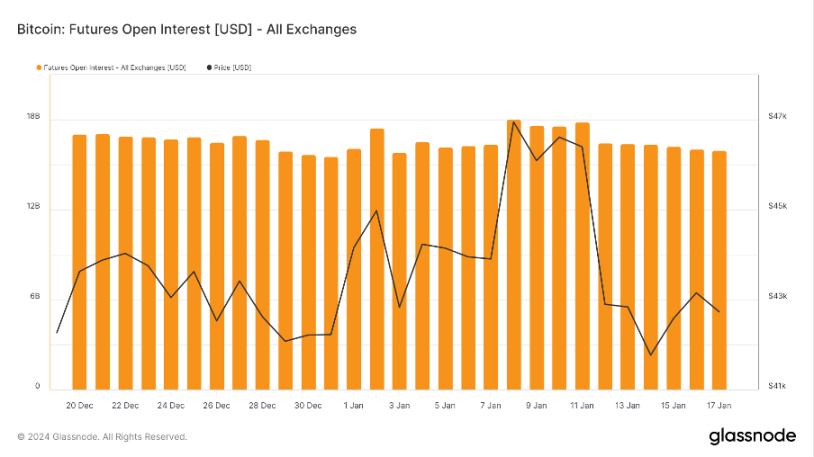

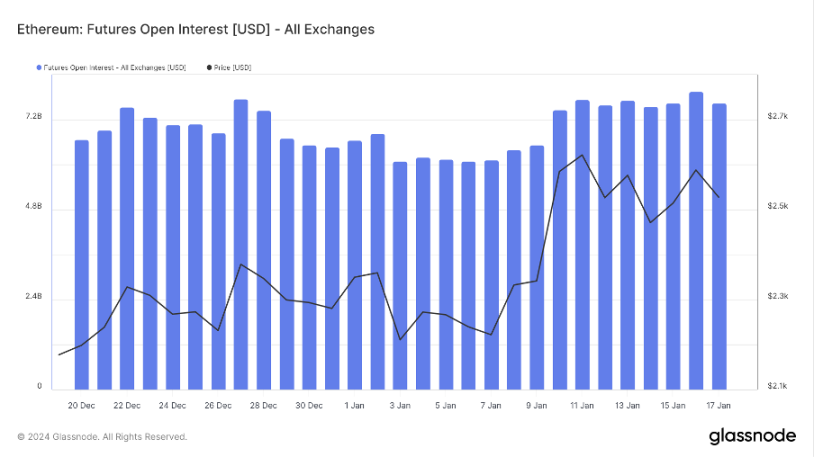

Futures open interest: BTC's open interest has decreased this week, with the market's main players retreating.

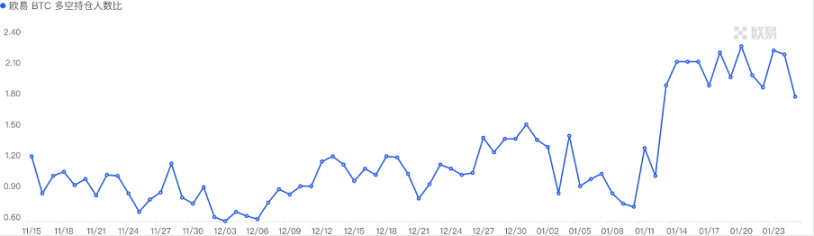

Futures long/short ratio: 1.8. Retail investors' sentiment is driven by FOMO. Retail sentiment is often a contrarian indicator, with below 0.7 indicating fear and above 2.0 indicating greed. The fluctuating long/short ratio weakens its significance as a reference.

3) Spot Market Performance

Both BTC and ETH have broken weekly support levels, with an expected 2-3 month decline and potential rebounds during the process. There are several important support levels, including the halved mining cost at 37000 and the average cost for short-term traders at 32000. In the worst-case scenario, referring to the major rebound in 2019, BTC retraced the monthly line twice, with the current monthly line at around 28000. It is advisable to wait for a major market decline before bottom fishing.

B. Market Data

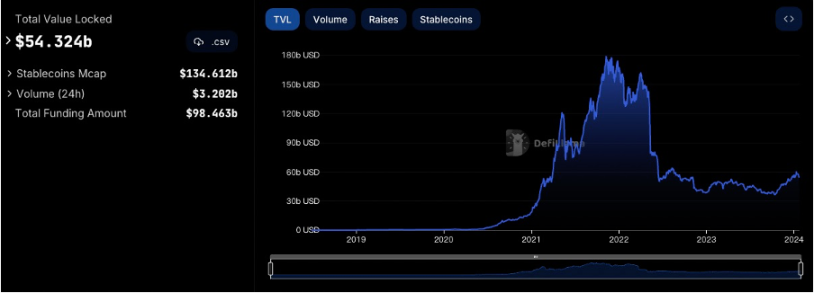

I. Total Locked Amount on Public Chains

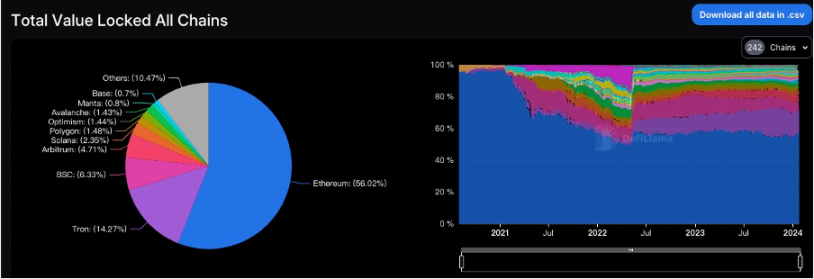

II. Proportion of TVL on Various Public Chains

This week's total TVL is $543 billion, a decrease of approximately $34 billion, or about 5.9%. BTC continued to decline this week and is currently above $38,500. The TVL of mainstream public chains has all seen significant declines this week, with ETH down 13%, BSC down 9%, SOLANA down 16%, OP down 12%, POLYGON down 8%, and ARB down 5%. As of today, the overall DeFi TVL has increased by over 50% in the past three months. ETH remains the leader in DeFi, currently occupying 56% of the market. Lido, as the DeFi protocol with the highest TVL, currently has a total TVL of nearly $21 billion, with an increase of nearly 11% in the past three months.

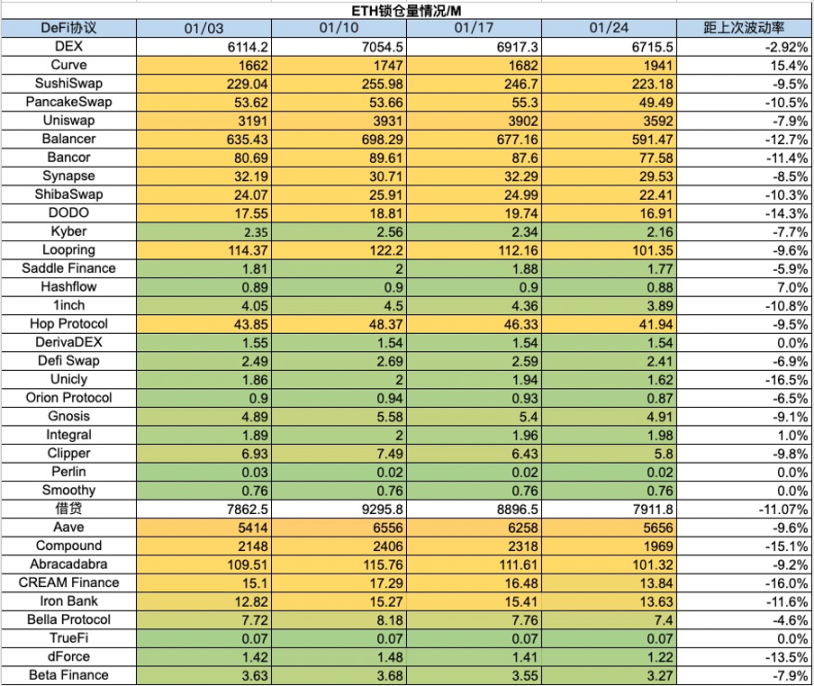

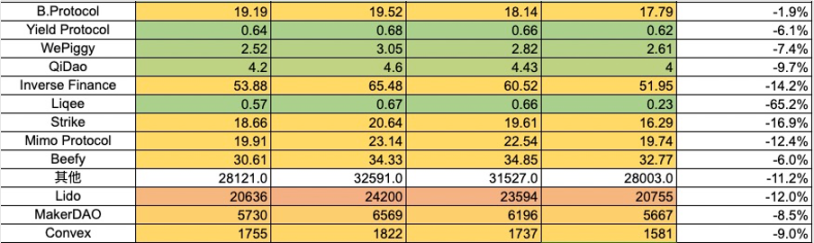

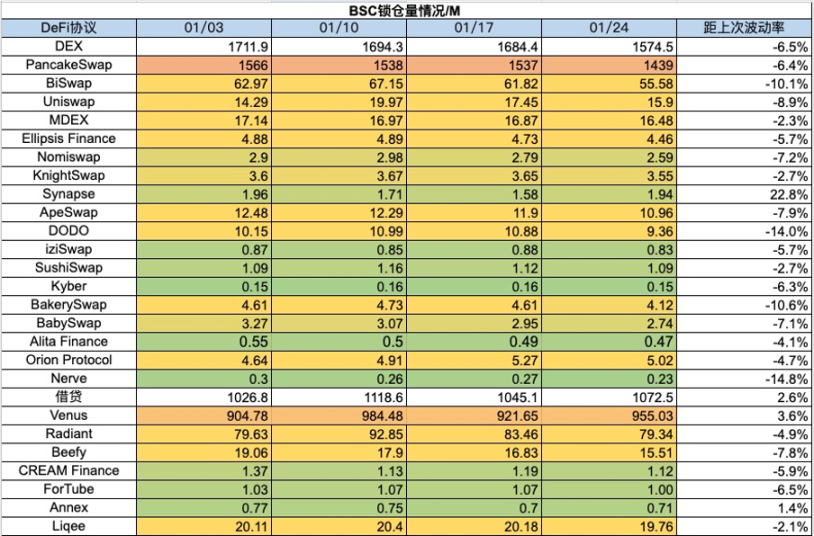

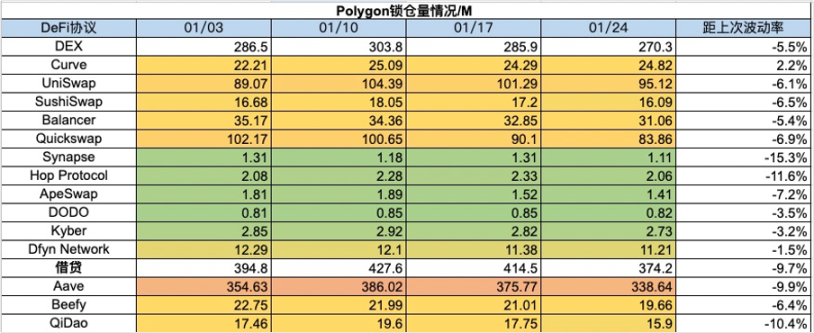

III. Lockup Amount of Various Chain Protocols

1) ETH Lockup Amount

2) BSC Lockup Amount

3) Polygon Lockup Amount

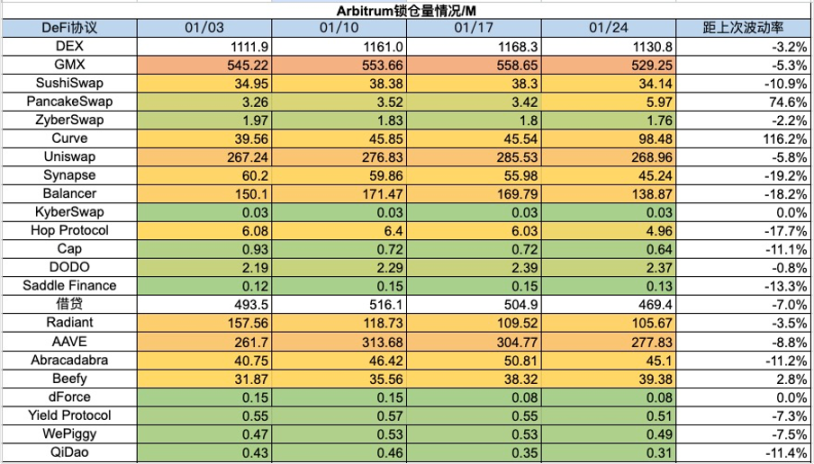

4) Arbitrum Lockup Amount

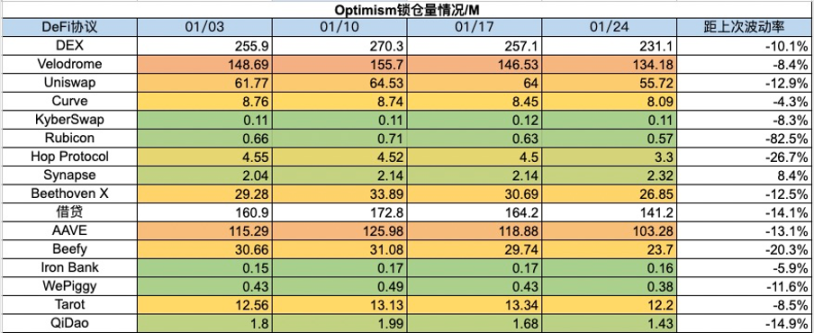

5) Optimism Lockup Amount

6) Base Lockup Amount

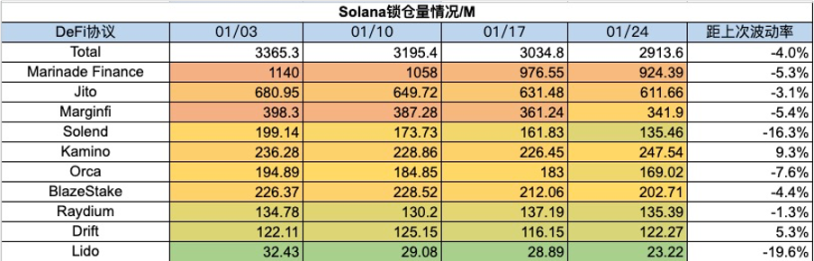

7) Solana Lockup Amount

IV. NFT Market Data Changes

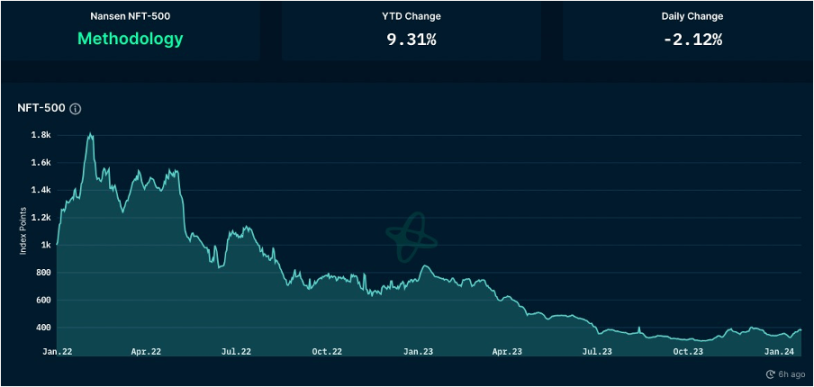

1) NFT-500 Index

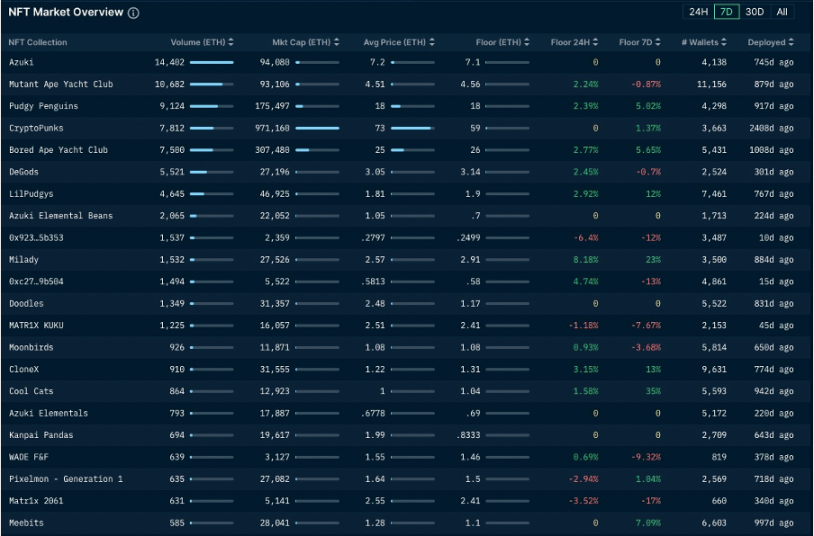

2) NFT Market Situation

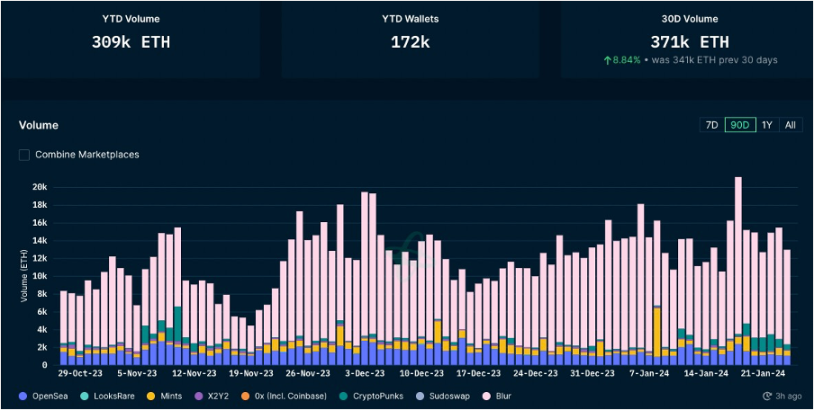

3) NFT Market Share of Trading Volume

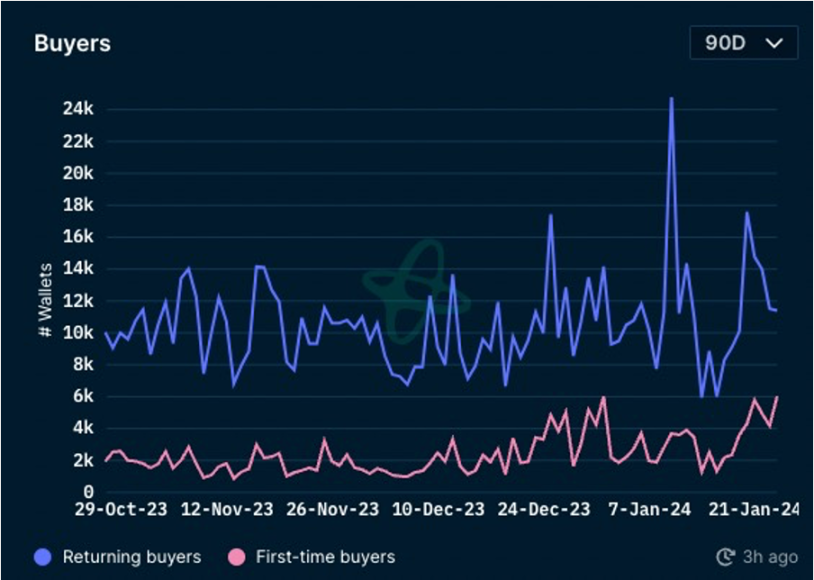

4) NFT Buyer Analysis

The overall market trend this week is upward, with the top blue-chip NFT projects in the market mainly experiencing price increases. Apart from a 1.4% decline in MAYC, BAYC rose by 5.7%, Pudgy Penguins by 5%, LilPudgys by 12%, Milady by 23%, and CloneX by 13%. There is no significant change in overall NFT market trading volume, with a significant decrease in BAYC trading volume. NFT market sentiment is gradually recovering from the low point a few months ago, with a gradual increase in the number of first-time NFT buyers. As NFT has gradually become an indispensable part of the Play-to-Earn (P2E) model, the number of NFT holders and trading volume is expected to reach new heights in the next one to two years.

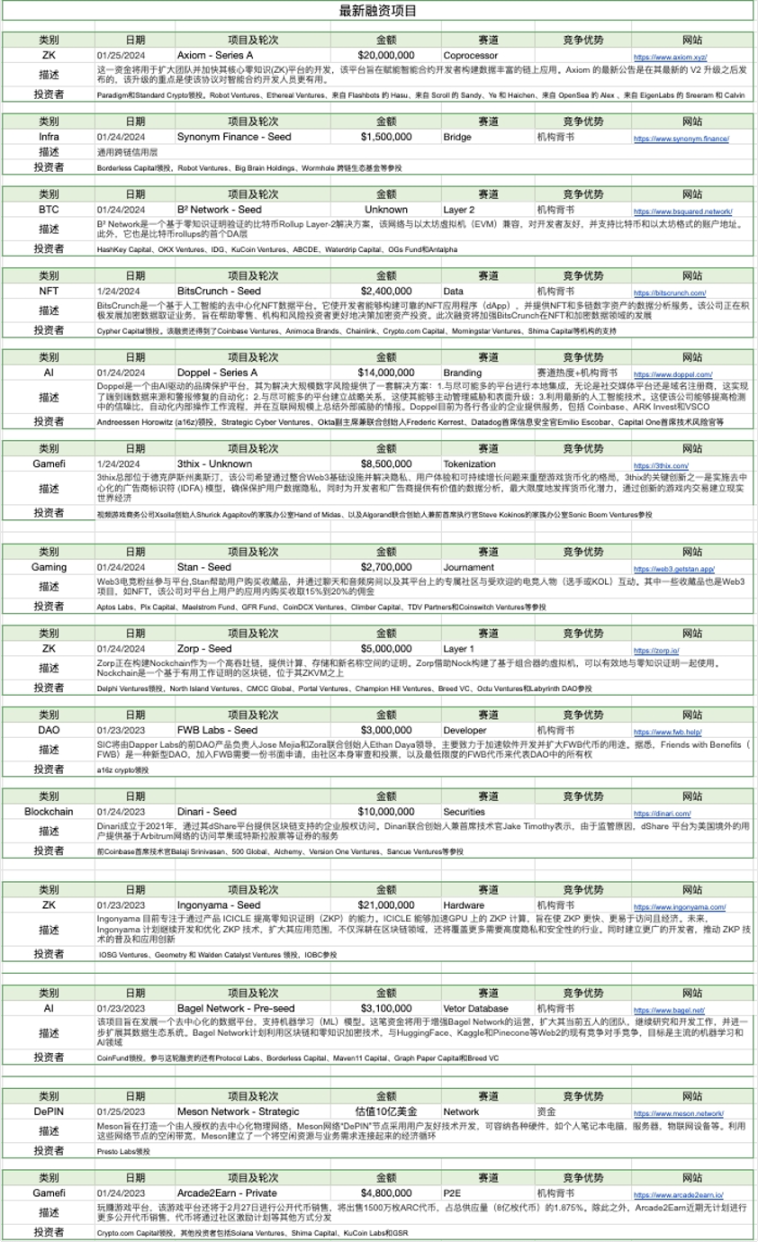

V. Latest Project Financing Situation

VI. Post-Investment Dynamics

1) Xterio - Blockchain Game Publisher

Xterio has partnered with Particle Network to integrate Particle Network's Modular Smart Wallet-as-a-Service, enhancing user login and on-chain transaction experience.

Xterio and Blocklords jointly held an airdrop event, giving participants the chance to win $10,000 worth of LRD.

2) Accseal - ZK Hardware Acceleration

Accseal has completed the development of the Zero-Knowledge Proof (ZKP) SoC acceleration chip (Accseal LEO chip) and will begin mass production in the first quarter of 2024. The chip uses a 12nm process and can perform complex MSM and NTT operations, supporting programmable design. It can support dozens of projects based on ZK-SNARK algorithm such as Aleo, Scroll, zkSync, Taiko, Aztec, and Linea, and can also be applied to computing projects in the DePIN track.

3) Polyhedra Network - ZK Cross-Chain Interoperability Protocol

Polyhedra Network is collaborating with 17 Bitcoin ecosystem builders to construct a Bitcoin interoperable ecosystem based on zkBridge. The initial partners include OKX Wallet, UniSat, EigenLayer, Babylon, Syscoin, Bitmap, BitLayer, B² Network, BEVM, Rootstock, Lumibit, Bitsmiley, Atomicals Market, BTCbot, ReadOn, StakeStone, and Particle Network, covering infrastructure, Bitcoin Layer 2 networks, wallets, DeFi protocols, and tools. This system ensures that Bitcoin can seamlessly interoperate with various Layer 1 and Layer 2 blockchain networks through zkBridge, and assets will no longer be limited to the Bitcoin network or any single other blockchain network. Developers no longer need to worry about message transmission between Bitcoin and other blockchain networks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。