On the evening of January 23, AICoin researchers conducted a live graphic and textual sharing of the "MACD Profit Strategy (with Membership Giveaway)" in the AICoin PC-end Group Chat Live. Here is a summary of the live content.

I. Introduction to the Practical Use of MACD Divergence

1. MACD is the king of indicators, the most important technical indicator, considering both left-side trading and the overall trend direction.

(1) Key points of use: When the trend of the candlesticks peaks higher and higher, while the trend of MACD peaks lower and lower, it is a bearish divergence; when the trend of the candlesticks peaks lower and lower, while the trend of MACD peaks higher and higher, it is a bullish divergence.

(2) Conclusion of use: Bullish divergence for bottom, bearish divergence for top.

2. Examples

(1) Analyzing OKB with MACD, a top divergence signal appeared.

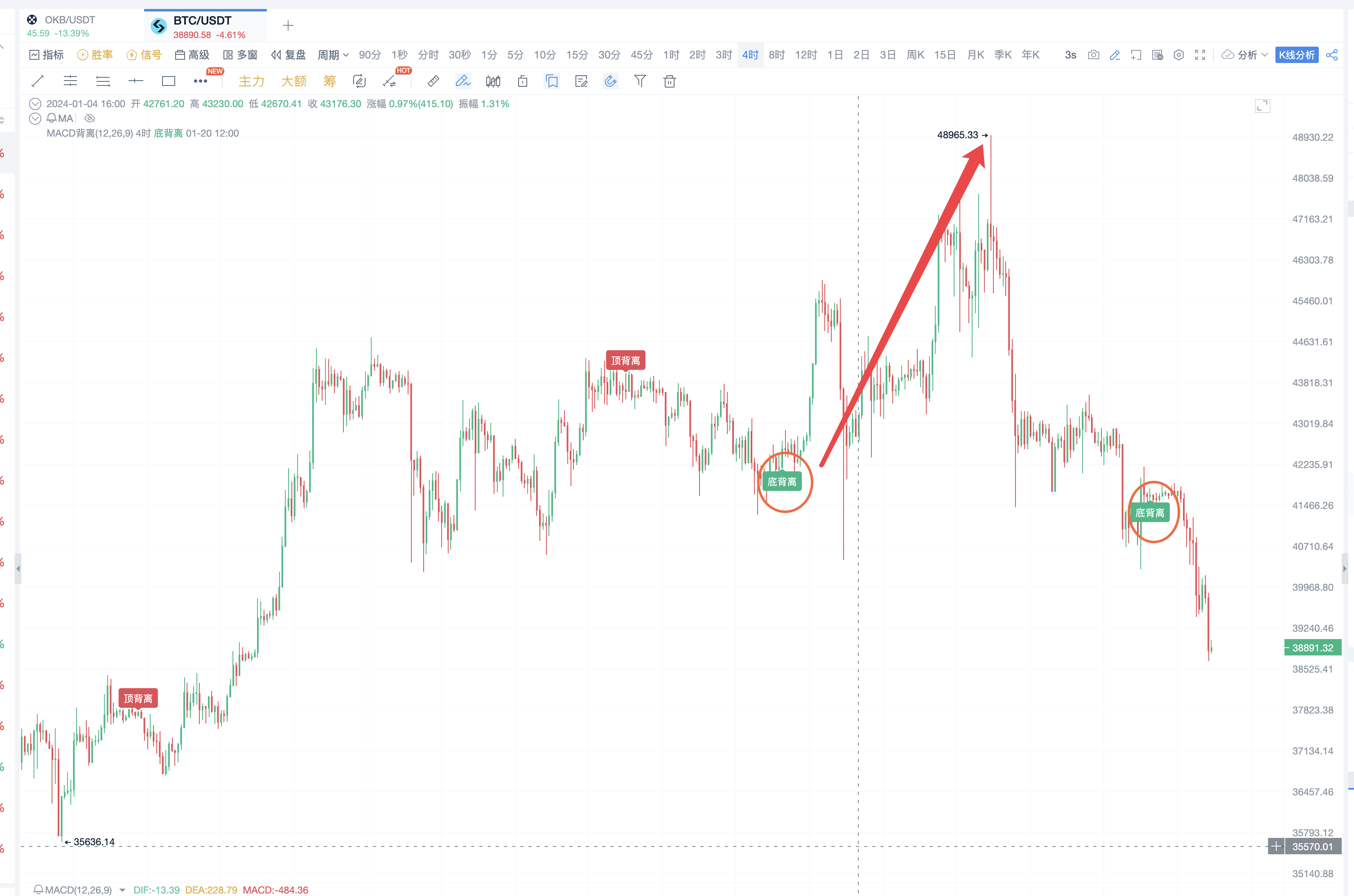

(2) Analyzing BTC with MACD, looking at the 4-hour BIGET of BTC.

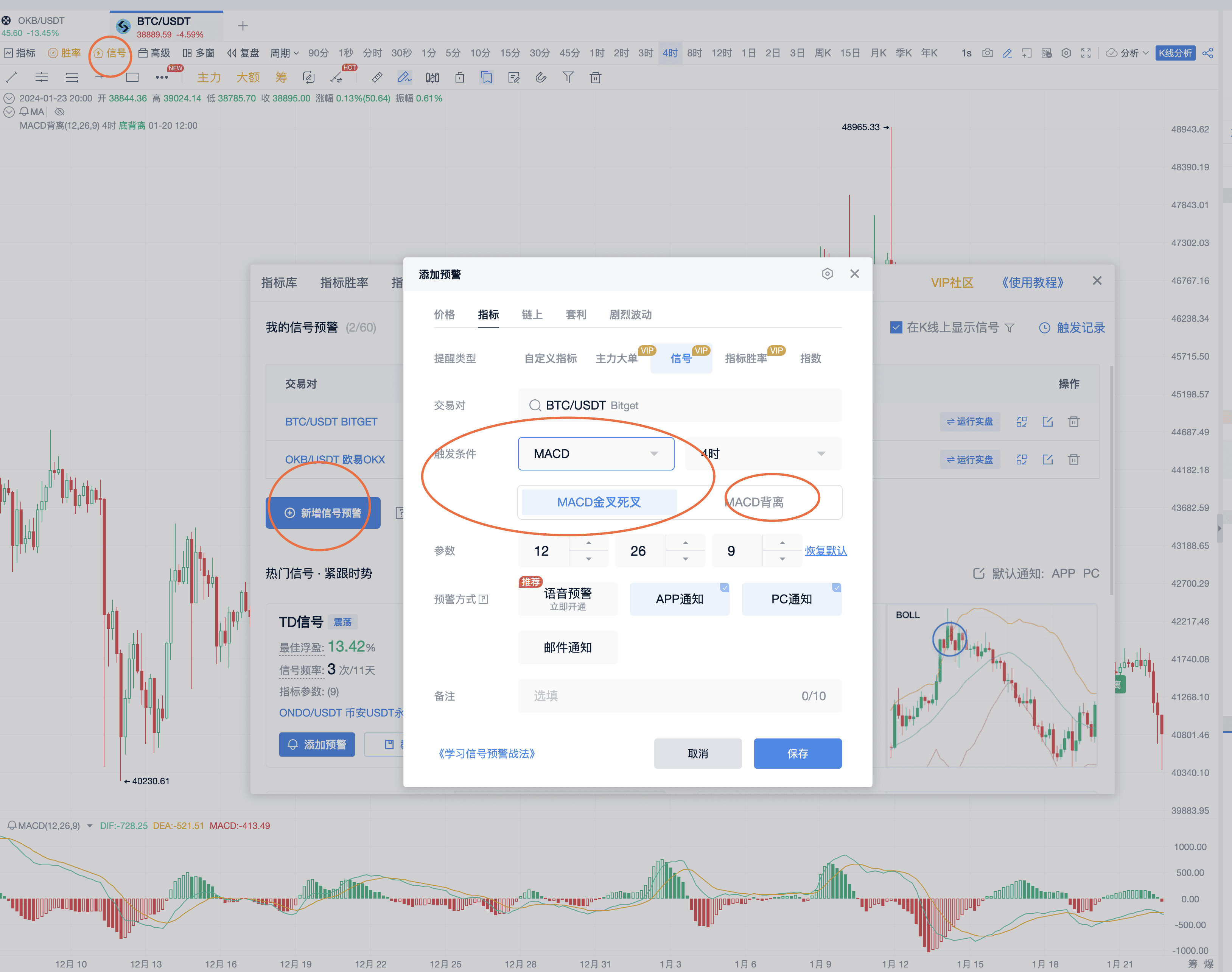

Set up a signal alert for easy viewing of top and bottom divergences.

A. The bottom divergence circled in the following image occurred at the bottom of the chip-intensive area; circling the bottom divergence of MACD is worth entering the market.

Then set the stop loss at the lowest point in this range.

B. The previous bottom divergence in the following image led to a major market trend.

Combining the use of Fibonacci retracement lines, the bottom divergence signal in the 4-hour chart circled in the following image is at the 0.618 position, serving as a retracement support level above the market trend.

3. To see MACD divergences more clearly and receive signal alerts for this indicator, click on the signal alert tool in the image.

AICoin PC-end signal alert membership supports all currency types, customizable parameters, and voice alerts; automatically analyzes hot coins in the market and recent signals with excellent win rates. Open now: https://aicoin.app/vip/signal

II. Use of DIF Line

1. DIF Line

Click to view the DIF line in the MACD indicator as shown in the image.

(1) Use of DIF line:

Suitable for large funds, crossing the zero axis method.

Crossing above the zero axis indicates a bullish trend; crossing below the zero axis indicates a bearish trend.

(2) Recommended periods for using the DIF line:

4 hours, 1 hour, 30 minutes, and 15 minutes.

Specific periods can be selected based on your own trading cycle.

2. Examples

For BIGET's BTC, the MACD indicator circled in the image shows the DIF crossing the zero axis, capturing two major market trends.

(1) When the DIF line crosses the zero axis, it can be combined with divergence signals; the first top divergence circled in the image, with the MACD yellow-white line double pullback, slightly dips below the zero axis, then immediately rises above, indicating a continued bullish trend. If the MACD yellow-white line double pulls back to the zero axis, the effect is still present!

There was another pullback to the zero axis, leading to another significant market trend.

(2) The bottom divergence circled in the image below.

The image above circles the bottom divergence signal and describes two key points; at the same time, the MACD histogram reverses, with an increase in volume upwards.

III. MACD Ultra-Short-Term Use

Long-term: DIF line crossing the zero axis

Early entry: MACD divergence

- MACD Ultra-Short-Term Use

Reference period: 4 hours

Indicator selection: MACD

Reference standard: Trend of the MACD yellow-white line + standard of MACD histogram

Operation method: During a super upward trend: the MACD yellow-white line continues to rise, while the bottom of the histogram shrinks, but the volume of the histogram starts to decrease; if a dead cross appears in the MACD, it will be a good short-term short signal.

2. Examples

When there is a divergence between the volume column and the yellow-white line, a dead cross can be considered as a shorting point.

If there is a mismatch between the yellow-white line and the volume column, it can be a signal for early bottom fishing.

It can also track the MACD bottom divergence signal, and the most important thing for confirming the trend is the DIF line crossing above the zero axis.

IV. Conclusion

1. Focus on the DIF line of the MACD indicator

When the DIF line crosses above the zero axis, go long;

When the DIF line crosses below the zero axis, go short.

Recommended periods: 4 hours, 1 hour, 30 minutes, 15 minutes.

2. Focus on the divergence signals of the MACD indicator

When the trend of the candlesticks peaks higher and higher, while the trend of MACD peaks lower and lower, it is a bullish divergence; when the trend of the candlesticks peaks lower and lower, while the trend of MACD peaks higher and higher, it is a bearish divergence.

Conclusion: Bullish divergence for bottom, bearish divergence for top.

3. Utilize MACD for ultra-short-term trading

Track the divergence relationship between the MACD yellow-white line and the volume column,

If the trends are inconsistent, it is the best entry point for short-term trend changes.

AICoin PC-end signal alerts support setting MACD top and bottom divergence signals, supporting all currency types, customizable parameters, and voice alerts; automatically analyze hot coins in the market and recent signals with excellent win rates. Open now: https://aicoin.app/vip/signal

Recommended Reading

"Mastering the MA Indicator, Embarking on the Road to Financial Freedom"

"Simple and Effective Profit-Making Methods: Practical Skills of Signal Alert Strategy"

For more live content, please follow the AICoin "News/Information-Live Review" section, and feel free to download the AICoin PC-end app.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。