Although there are valid concerns about centralization and transparency, the diverse benefits provided by Tether should not be overlooked.

Author: Tanay Ved

Translation: DeepTechFlow

Introduction

Stablecoins are often seen as a "killer app" for cryptocurrencies, playing a crucial role in connecting traditional finance with the digital asset ecosystem. In this field, USD-backed stablecoins have experienced remarkable adoption in recent years. Stablecoins facilitate 24/7 value exchange, serving as a store of value, medium of exchange, and providing crucial value propositions for economies with a scarcity of USD, especially in emerging markets where people face high inflation, currency devaluation, or limited access to basic financial services. With the continuous expansion of new issuers, collateral types, and use cases, Tether (USDT) has become a dominant force.

In this article, we delve into the rise of Tether, exploring its main growth paths, adoption trends, use cases, and reserve holdings, comprehensively understanding this stablecoin giant through on-chain data.

USDT Supply: Reaching New Highs

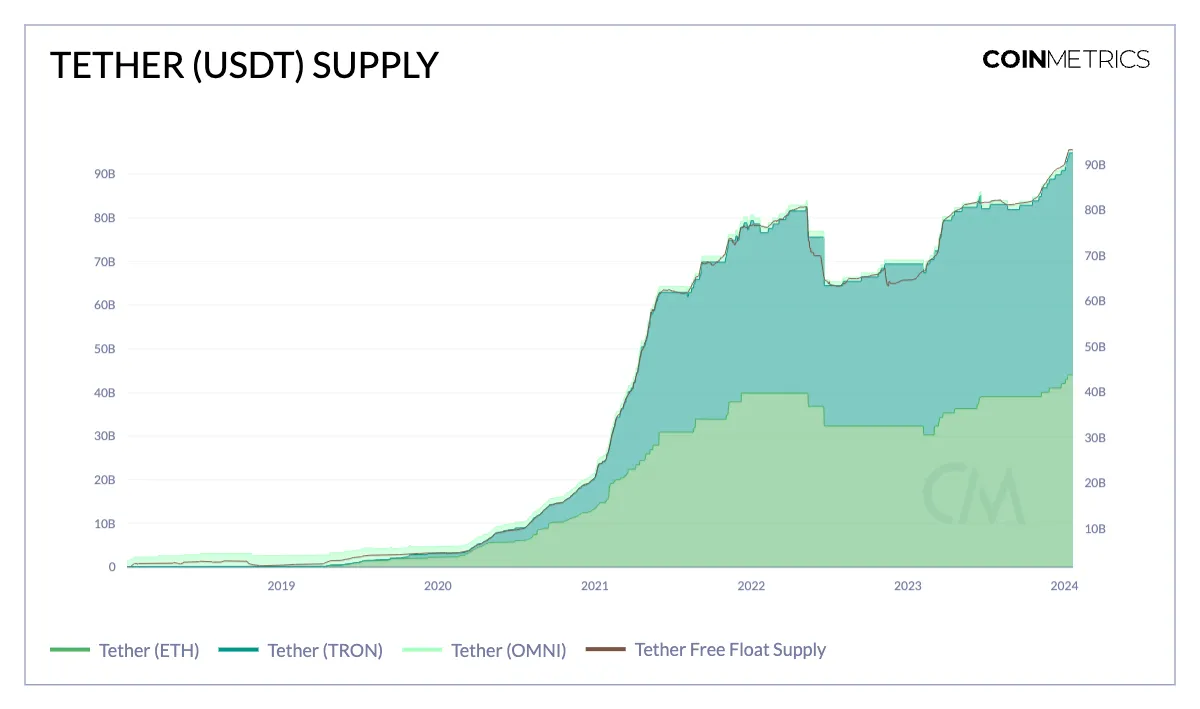

Recent interest in a spot Bitcoin ETF may have inadvertently diverted attention from the significant growth of Tether. Tether recently achieved a new milestone, surpassing its all-time high supply, reaching over $95 billion, a 35% year-on-year increase. Analyzing the distribution of this total supply, 46% of the supply, or $44 billion, was minted on the Ethereum blockchain. In contrast, 53% of the supply, or $50.8 billion, was issued on the Tron blockchain. Meanwhile, in January 2020, Omni's issuance accounted for almost 33% of the total supply, but due to Tether's decision to stop supporting the network, this proportion has now dropped to 1%. As the digital asset ecosystem continues to evolve, Tether's issuance is expanding to alternative Layer 1 networks such as Solana and Avalanche. This expansion enhances the utility of USDT in various on-chain ecosystems.

Shift in Adoption Trends

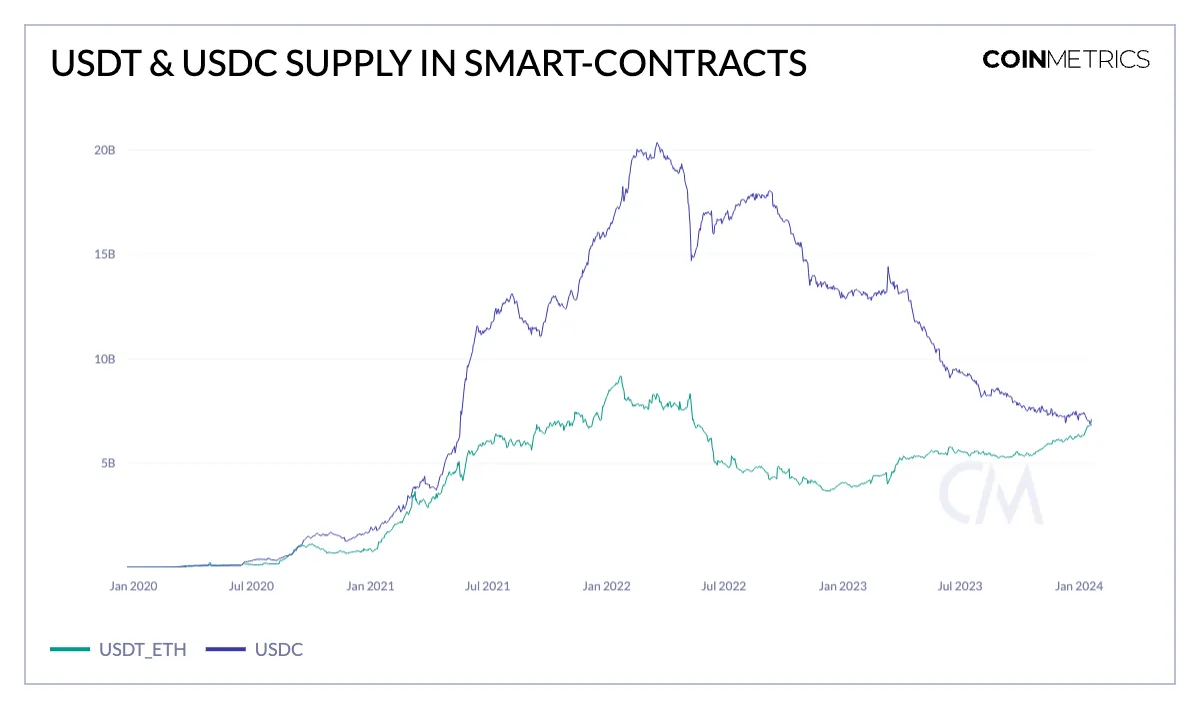

Recent turmoil, particularly the collapse of Silicon Valley Bank (SVB) and the consequences of Operation Choke Point 2.0, may have acted as a catalyst for the surge in offshore stablecoins. A closer examination of the composition of this growth reveals key driving factors. A particularly noteworthy trend is the increasing importance of USDT (ETH) in smart contracts, a domain that has been dominated by Circle's USDC since its inception. The aftermath of the SVB crisis appears to have shaken market confidence in USDC, inadvertently boosting USDT's participation in smart contracts. Since March 2023, USDT's presence in this domain has increased from $4 billion to nearly $6.9 billion. This shift highlights the growing popularity of USDT in decentralized finance (DeFi) applications, a trend reflected in our other market reports. Notably, USDT has surpassed USDC in leading markets such as Aave v2 and Compound, further solidifying its position in the DeFi space.

The increasing influence of USDT in DeFi is evident in lending platforms and exchanges, highlighting its crucial role in trustless USD-related transactions, ultimately enabling broader and more efficient access to financial services.

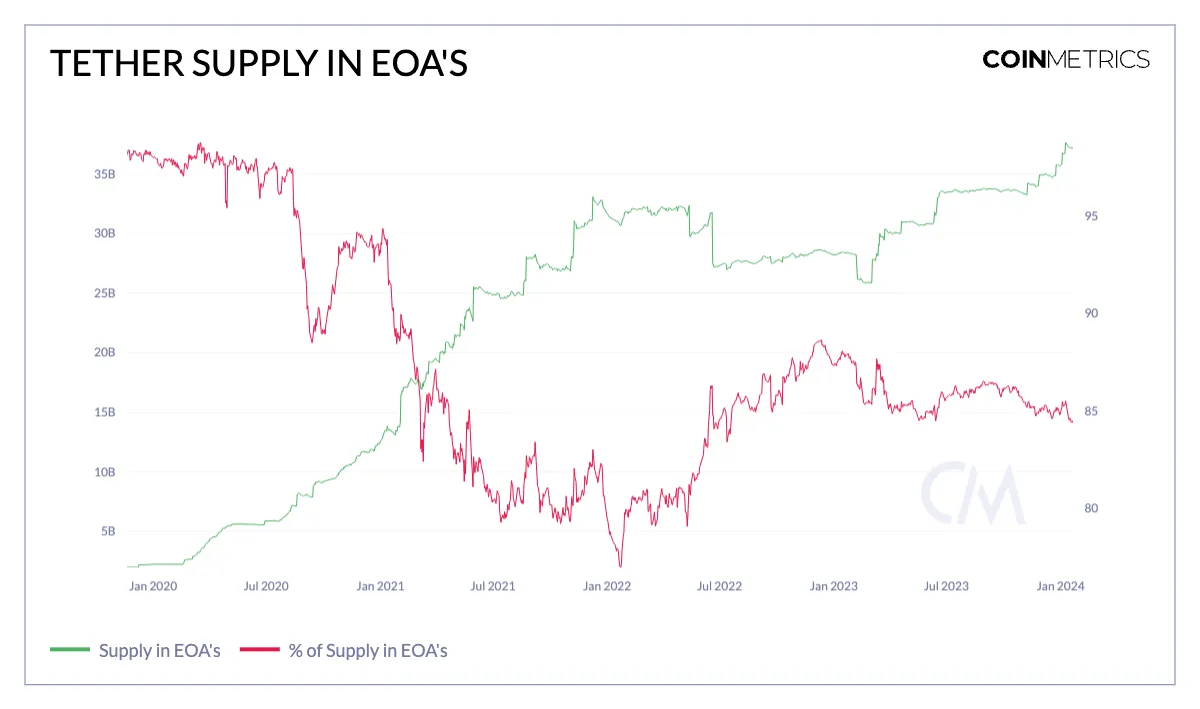

While the use of Tether in smart contracts has expanded, it is primarily held by externally owned accounts (EOAs) or accounts controlled by private keys, similar to accounts owned by individual users. On Ethereum, the supply of Tether (ETH) has risen to $37 billion, accounting for 84% of the total Ethereum supply. These trends reflect the growing use of digital dollars, not only as a store of value or hedge against volatility, but also as a tool for transactional activities such as trading or payments.

Exploring Usage Patterns

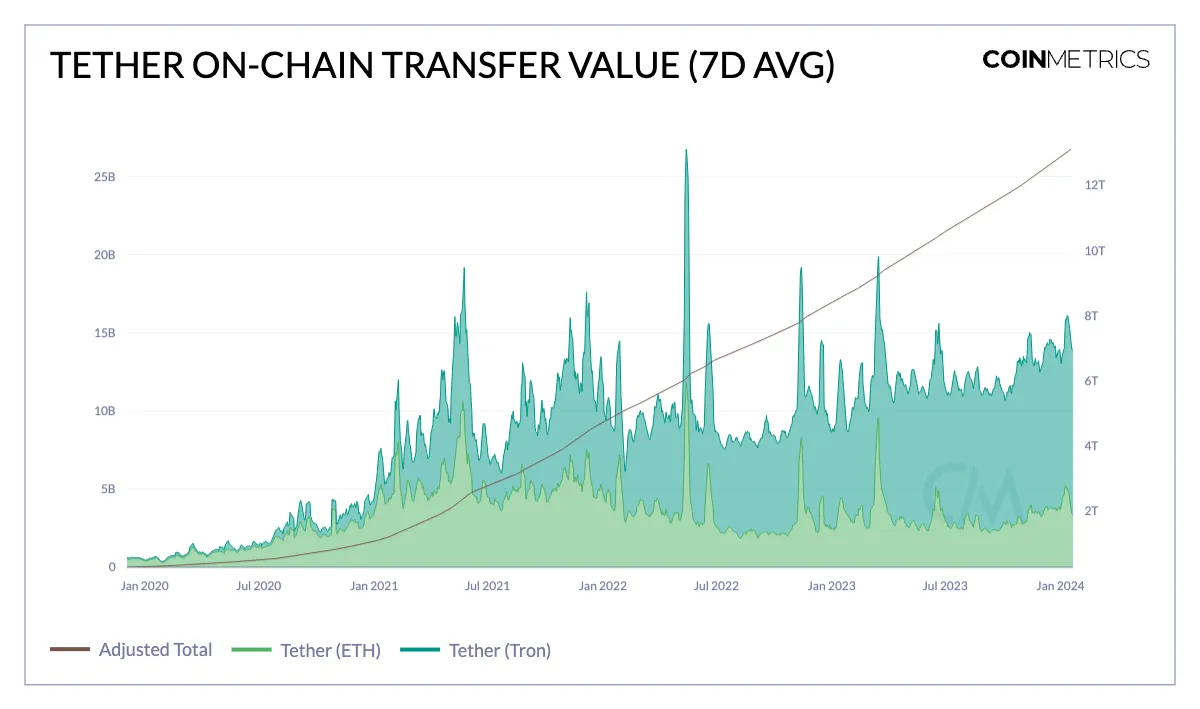

As the largest and most widely adopted stablecoin, Tether has seen extensive usage. This month, on the Ethereum network, the on-chain transfer value involving different USDT addresses exceeded $5 billion. Meanwhile, the transfer value on the Tron network exceeded $11 billion. Since its launch in 2014, Tether has facilitated over $13 trillion in transfers, emphasizing its continued growth. This widespread adoption is particularly notable in emerging markets in Africa, Latin America, South Asia, and other regions. In these areas, Tether often serves as a substitute for the US dollar, providing a means to safeguard savings, seek economic stability, and access banking infrastructure, enabling peer-to-peer transactions for various purposes.

To better understand usage patterns and the people served by Tether, studying the nature of "typical" Tether transactions is insightful. Data shows that the average transfer amount of USDT is typically lower than that of USDC, with the latter currently averaging around $75,000 per transaction. This higher average value indicates that USDC is typically used for larger-scale transactions, consistent with its status as the primary domestic stablecoin and its widespread use in DeFi applications.

In contrast, USDT on the Ethereum network shows an average transfer amount of $35,000, indicating its involvement in large-scale financial activities within the DeFi ecosystem, possibly influenced by Ethereum's higher transaction fees. Conversely, USDT on the Tron network presents a different scenario. Due to lower transaction fees on Tron, the average transfer amount of USDT is approximately $7,000, facilitating more frequent, lower-value transactions. This makes it a practical choice for daily payments and remittances.

In a broader sense, these patterns not only reflect different user demographics and preferences but also underscore the impact of the underlying networks on the operation of these stablecoins.

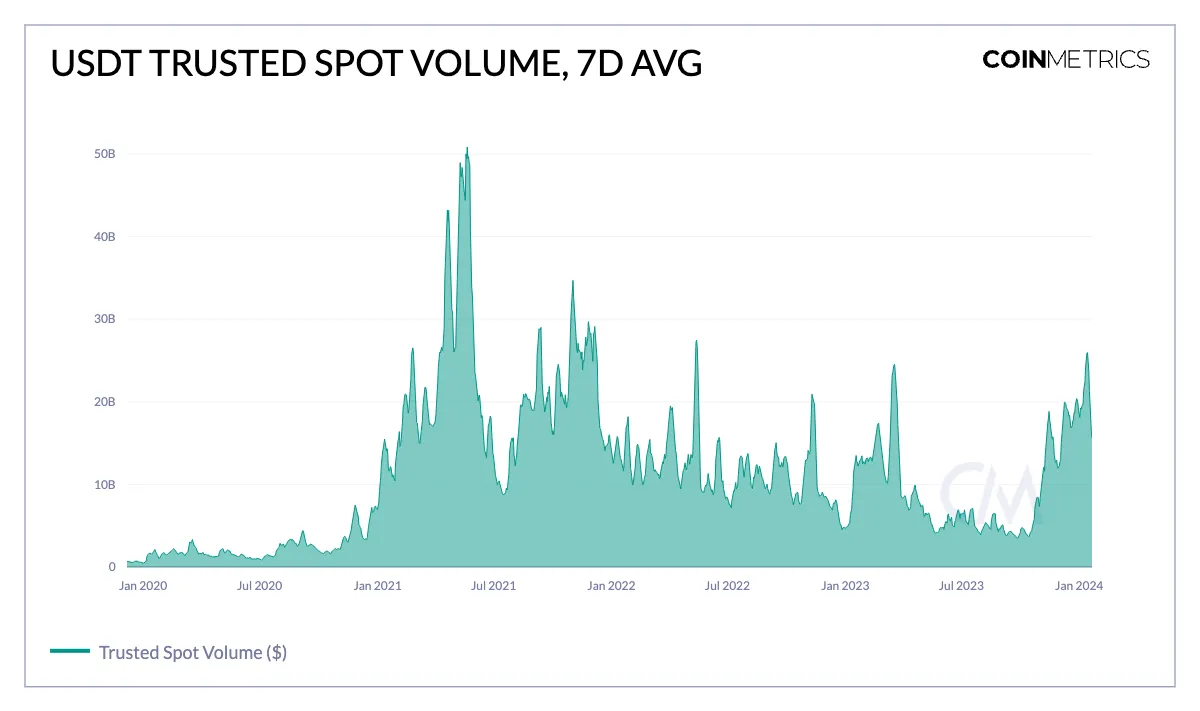

Like other stablecoins, USDT plays a crucial role as a quoting asset, facilitating liquidity trading of digital assets on exchanges. With the recent boom in the digital asset market and the launch of a Bitcoin spot ETF, USDT has facilitated over $25 billion in trustworthy spot trading volume, surpassing the peaks of November 2022 and March 2023. Tether also plays a dominant role in this field, accounting for over 85% of the stablecoin-denominated trading volume.

Nature of Tether Reserves

The composition and transparency of Tether reserves have always been a controversial topic, often leading to speculation about the adequacy of its financial backing. However, Howard Lutnick's confident statement at the World Economic Forum in Davos, confirming "they have the money," has helped alleviate some of these concerns, adding credibility to the discussion about Tether's reserves. The only current method of verifying this is through reports from independent auditors, which provide a detailed breakdown of the assets in the reserves on a quarterly basis.

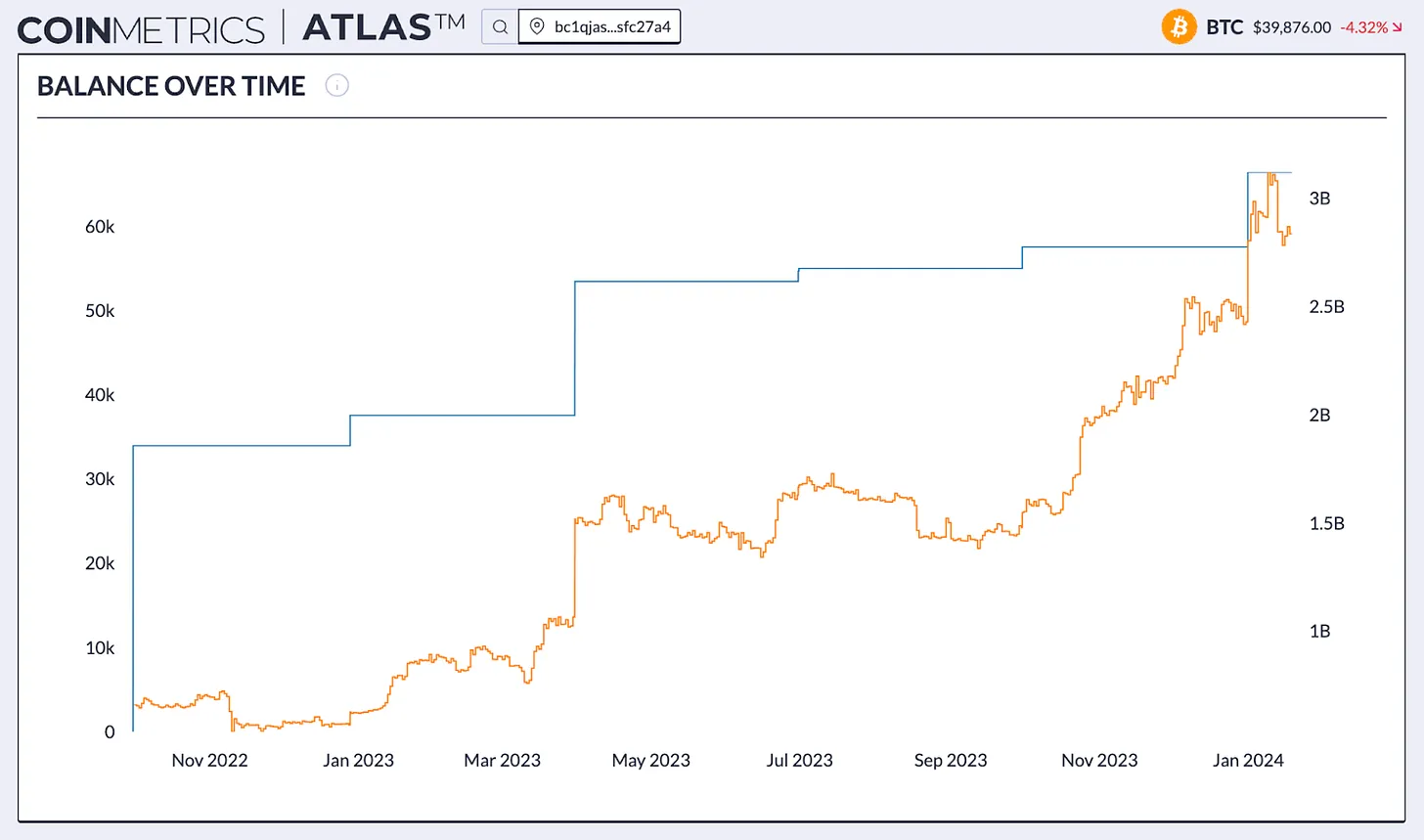

Over the years, the composition of Tether's reserves has changed several times. While debt forms such as commercial paper dominated the reserves in 2021, their latest attestation indicates that the reserves are primarily composed of U.S. Treasury bonds, reflecting the rising interest rate environment. In May 2023, Tether announced that they would allocate up to 15% of the realized profits to purchase Bitcoin to increase the excess reserves of USDT. This has been realized as 57.5K BTC, equivalent to a value of $1.6 billion in Bitcoin holdings, consistent with their latest attestation in the third quarter of 2023. However, if it can be confirmed that this Bitcoin account is explicitly linked to Tether, it would mean that Tether recently purchased an additional 8.9K BTC, bringing the total to 66.4K BTC. This inference is strengthened by the fact that credit to this account seems to be associated with exchanges closely related to Tether, such as Bitfinex.

While quarterly attestations provide insight into Tether's holdings, official and more frequent audits providing detailed transparency would be a welcome development for users and skeptics alike.

Conclusion

The impressive rise of Tether demonstrates its practical utility, especially in developing economies where economic instability and lack of a stable, reliable monetary system make Tether's development even more significant.

Despite valid concerns about centralization and transparency, the diverse benefits provided by Tether should not be overlooked. As one of the gateways to broader digital asset adoption, Tether has propelled the entire stablecoin market forward. While it is the largest stablecoin today, it is interesting to see if it will continue to dominate in an ever-changing environment. The planned listing of Circle, the rise of crypto collateral, and interest-bearing stablecoins make the dynamics of the stablecoin market noteworthy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。