500,000 financial refugees, over 130 billion unable to be redeemed.

By: Yin Ning

Cover Source: Caixin

There are annual financial landmines, and it's not surprising this year, but Ding Yifeng is the first to be so dramatic.

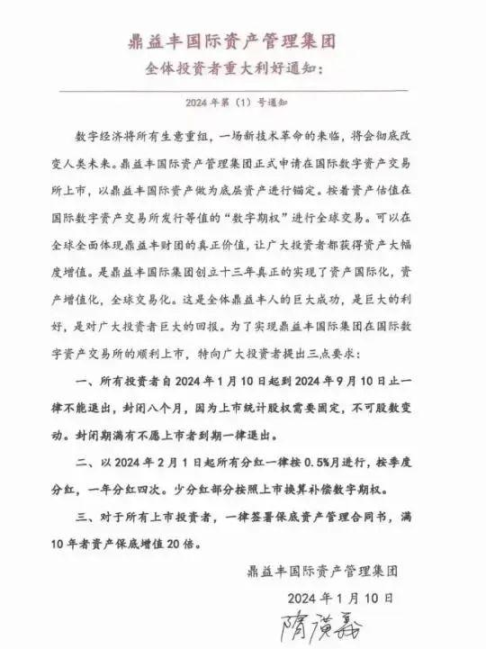

On January 10, a screenshot of an internal document from Ding Yifeng, a Hong Kong-listed company, "Ding Yifeng International Asset Management Group: Major Good News for All Investors," circulated wildly on the internet. The notice stated that Ding Yifeng would transition to digital assets, issue "digital options" of equivalent value on international digital asset exchanges for global trading, and require all investors to close for eight months from January 10 to September 10, with the possibility of receiving up to 20 times the high returns when the 10-year term expires.

The extremely high locked return + no withdrawal guarantee is clearly a prelude to a financial collapse. While it is called a closure on the surface, it is actually a freeze in secret. The intention is undoubtedly to prohibit investors from withdrawing funds. Typically, a temporary measure is taken first, and funds are simultaneously withdrawn. Against this backdrop, this news quickly spread among investors.

Just a few days later, as expected, the financial collapse arrived. Ding Yifeng confirmed its difficulty in redeeming funds to the public. According to the company's investment manager, the number of investors registered in the company's internal computer system is approximately 500,000, facing a debt of up to 132 billion yuan.

Out of curiosity about the so-called digital options, the author also explored Ding Yifeng, but this exploration turned out to be a surprising discovery at this moment. Eastern metaphysics + Ponzi scheme, another self-proclaimed "Chinese Buffett" qigong master, mortgage houses and operating loans, and middle-class elites living in the most developed area in the Pearl River Delta, unfortunately became part of the 500,000 financial refugees through alternative financial operations, and this time, the blame is not on blockchain and digital currency.

36% annualized return, Ding Yifeng's magical operation mode

According to the official website, Ding Yifeng, formally known as Hong Kong Ding Yifeng International Holdings Group, was established in January 2011 with a registered capital of 581 million yuan and manages assets exceeding 100 billion Hong Kong dollars. The company spans Shenzhen, Singapore, and Hong Kong, and is a large multinational comprehensive asset management group. Ding Yifeng Holdings is listed on the Hong Kong Stock Exchange.

In the business section of the official website, Ding Yifeng mainly has two major segments: financial investment banking and industrial capital. Among them, financial investment banking can be further divided into financial investment and asset management, while industrial capital focuses on Changbai Mountain cultural tourism, health industry, and innovative magnetic energy industry. Indeed, financial absorption + innovative industrial investment, due to its high manipulability, is almost the favorite story mode of financial institutions. Although there are many flaws in the innovative industry, there are no major problems from the perspective of business segments. Only by examining its operation mode can some tricks be seen.

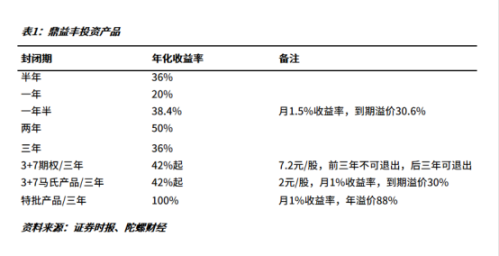

According to insiders, the company mainly absorbs funds from investors in the form of selling equity or packaged funds, attracts some investors with high-yield products, then develops these investors into company agents with high commissions, and invites more people to invest. Currently, Ding Yifeng mainly has eight types of option products, with lock-up periods ranging from half a year to three years, and the yield increases in sequence. The annualized return rate of the half-year product reaches 36%, and for the most common 3-year special products, investing 1 million yuan can yield up to 3.64 million yuan when it matures in 3 years.

The fact that the annual return rate is as high as 36% has been operating in the market for over 10 years and is even listed on the Hong Kong Stock Exchange, already creating an atmosphere of ghost stories. Investors not only believe in it, but are even enticed to mortgage their houses, undoubtedly making this fact even more magical.

Under the attraction of high returns, most investors are first lured by agents to make small short-term attempts, and after receiving returns, they begin to build trust. At the same time, agents use various methods to obtain client asset information, continuously tempting clients to mortgage their assets for investment. With deep ties to the benefits, investors also start to introduce acquaintances and recruit people, ultimately penetrating relatives and friends, and even becoming product agents themselves. According to investors, agents can earn commissions as high as 17.5%.

Agents not only earn business commissions, but also have deep ties to financial institutions, and can provide a "one-stop" service from introduction to loans to investment, forming a complete closed-loop industrial chain. There are rumors that "conservatively estimated, there are tens of thousands of people in Shenzhen who have mortgaged their houses through operating loans to invest in Ding Yifeng."

What's even more ridiculous is that investors transfer funds to the personal accounts of agents, not company accounts. Ding Yifeng even stated in its communication group that it changes the recipient's account every half month, and the recipient's name and account number change each time. In addition, product sales can even be completed through mailing. Investors transfer funds to the corresponding account, and Ding Yifeng mails the product contract. Such large transactions can be completed without meeting in person, revealing the lack of compliance.

02 Borrowing new to repay old, stock market manipulation, the Taoist master emerges

Despite such non-compliance, early investors did make real money, and how could Ding Yifeng maintain its operation for over 10 years with such high interest rates, until it began to collapse in August 2023? In-depth exploration of its profit model reveals that, in addition to continuously borrowing new funds, the stock market has also become an important means for its enrichment.

This was confirmed in Ding Yifeng Holdings' 2023 interim report, which showed that the company's main business is securities investment in listed and unlisted companies, and income comes from interest income from banks and financial institutions. This inevitably brings up the company's key figure, the ethereal and lofty, known for his great love and dedication, Sui Guangyi, the "Taoist Master."

From the equity structure, the main shareholders of Ding Yifeng include Hong Kong Ding Yifeng International Holdings, Ding Yifeng International Holdings, Ma Xiaoqiu, and Sui Guangyi, holding 12.68%, 12.68%, 13.36%, and 22.26% of the shares, respectively. Sui Guangyi and Ma Xiaoqiu are the main initiators of this fund, and it is rumored that they are a married couple, but this has not been confirmed.

Sui Guangyi, with the Taoist name "Wanmingzi," was born in 1962. According to the official website, he has a background and experience in business, politics, and sinology, and upholds the core spirit of "selflessness, altruism, dedication, and integrity." He created the "Zen investment method," combining Eastern philosophy with finance to form the "Eastern classical philosophical value investment theory system." From the internal resume circulating within Ding Yifeng, Sui Guangyi was not only appreciated and appointed as the deputy mayor of Dunhua City, Jilin Province in 1994 due to his "outstanding sales of skin disease ointment," but also achieved original accumulation in 2014 by investing 1.8 billion yuan in Changbai Mountain Historical and Cultural Park. In stock market operations, he is adept at making big gains with small bets, often making returns tens of times over, truly extraordinary.

However, there are many doubts about Sui Guangyi's identity. There is almost no external evidence of his tenure as deputy mayor, and according to insiders, he was actually a well-known qigong master in Northeast China in his early years, gaining many political and corporate resources during the "qigong fever," and even successfully applied to be a lecturer in success psychology. His so-called Taoist name cannot be found in the religious query system.

But since he is a master, he naturally has to look like one.

When traveling, Sui Guangyi always dresses plainly, only eats fruits and vegetables grown at home, and if there are no homegrown vegetables, he only eats shredded potatoes to fill his stomach. In conversation, he only talks about "Laozi," "Zen," and "dragon veins," and the Tao Te Ching is his favorite. Outsiders say that Sui Guangyi has a mole on his chest that resembles the Big Dipper, with the North Star being red, directly giving him the aura of a chosen one. As the boss, he sacrifices himself for others, doesn't take any of the money he earns, and only seeks to benefit all living beings. Employees achieve financial freedom one after another, while he lives in a narrow room to undergo tribulations.

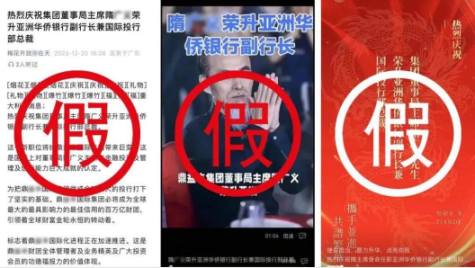

Contrary to his plain image, he has a circle of high-profile connections, including political and business leaders, financial moguls, and overseas princes, all of whom have become his endorsers. Last year, employees even claimed that he had become the Vice President and Head of International Investment Banking at "Asian" Overseas Chinese Bank. The addition of "Asian" in this context implies something different. However, this statement was quickly refuted by Overseas Chinese Bank in December 2023, stating that it had no relationship with Sui Guangyi.

Regardless of the truth, this image has been successfully crafted. At Ding Yifeng's investment sharing meetings, there are no PowerPoint presentations or products, only meditation and worship. People recite the Tao Te Ching in the misty atmosphere, thanking the gods and Sui Daochang for the wealth bestowed upon them.

The scene of Ding Yifeng's investment sharing meeting, source: publicly available on the internet

While brainwashing on a spiritual level is profound, people cannot survive on shredded potatoes alone; stock market manipulation is the key to success. First, they manipulated their own company's stock. Ding Yifeng's stock price skyrocketed from less than 1 Hong Kong dollar in May 2017 to a peak of 28 Hong Kong dollars, a 45-fold increase from 2017 to 2019. However, in 2019, due to suspected market manipulation, the Hong Kong Securities and Futures Commission issued a restriction notice in March, freezing the relevant accounts of China Ding Yifeng for suspected market manipulation, leading to the company's suspension for a year. Interestingly, on the first day of resumption in 2020, Ding Yifeng's stock price plummeted by 90%.

Ding Yifeng's stock price trend, source: Baidu

Second, they manipulated stocks in other companies. According to information provided by insiders at Ding Yifeng, they prefer "penny stocks" with extremely low stock prices. They have multiple listed company platforms, including ST Tianma, Ding Yifeng Holdings, Huayin Holdings, Entrepreneur Group, Jiading International, and Yima International. Jiading International's stock price is less than one cent. In another well-known case, in *ST Tianma, they lurked in the stock market for two years and saw a 145% surge in 2019.

Of course, when it comes to stock selection criteria, Sui Daochang only responds with two words - "Zen enlightenment," using meditation and changes in the principles of Yi to predict data. Stock codes are generated through intuition. It must be admitted that this is a level that ordinary people like us find difficult to reach. Through market manipulation, Ding Yifeng has amassed countless wealth, estimated to exceed 2 billion yuan, and with the influx of new investors, it has ultimately supported this huge Ponzi scheme network.

03 Lost and helpless, digital options still find buyers despite regulatory constraints

It is in this context that the financial collapse of Ding Yifeng has made it difficult for many investors who had placed their trust in it to accept.

On January 16, according to on-site visits by 21st Century Business Herald and Securities Times, many investors gathered at Ding Yifeng's office building in Shenzhen's Jingji Binhe Times to demand fund redemption. Contrary to expectations of hysteria, while a small number of investors were emotionally agitated, the majority remained quite calm. Some investors even inquired whether Sui Daochang was in trouble, believing that he was the reincarnation of a Buddha and would surely overcome this difficulty.

According to a certain Mr. Li, an investment manager at Ding Yifeng International, who was present at the scene, "Ma Xiaoqiu was arrested for illegal emigration some time ago and is currently on bail pending trial. Chairman Sui is currently unable to leave the country and is negotiating with a Middle Eastern financial consortium for cooperation to seek funding. We hope everyone can wait patiently for news. To be honest, the company is out of money and cannot redeem funds. Please give the company time to resolve the issue."

Even in the midst of this crisis, on January 17, Ding Yifeng held its morning meeting as usual, and everyone present continued to recite the Tao Te Ching. They fervently proclaimed that Ding Yifeng "only knows success, not failure," permeating the atmosphere as usual. In this atmosphere, some investors also expressed their continued support by renewing the aforementioned digital options contracts, believing in Sui Guangyi's statement at the end of 2023 that the Dubai Little Prince would establish a $700 billion fund's China office at Ding Yifeng.

Why has such a huge Ponzi scheme network been able to survive to this day?

In this regard, the regulatory authorities are also quite helpless. As early as February last year, the Shenzhen Local Financial Regulatory Bureau issued a warning, stating that after preliminary verification, the "Ding Yifeng" related entities are numerous and distributed throughout the country. The operating entities in Shenzhen do not hold financial licenses and do not have the qualifications to engage in financial business.

In August, Ding Yifeng had already shown signs of delayed payments. In November 2023, the Shenzhen Financial Office continued to issue risk warnings, stating that the affiliated entities of "Ding Yifeng," including "Yuanfeng," "Yuanhui," "Yuanheng," "Wanding," "Tianding," "Jiading," "Huayin," and other branches, promote industrial concepts such as "peptides" and "lightwave magnetic therapy" through online and offline activities such as tea parties, evening parties, reading clubs, and listing release conferences, using the "Zen investment method" to attract investors to subscribe to the "original equity" or "options" of the affiliated entities of "Ding Yifeng," posing a risk of illegal fundraising. Currently, related investment activities have experienced situations such as "delayed rebates," "unreturned funds upon contract expiration," and "difficulty in redemption."

However, for many defrauded investors, the role of regulation is minimal. According to public figures, the delayed response of the regulators is also due to the nature of the setup. Most investors signed contracts with individuals, making it more akin to private lending. Currently, most cases are economic disputes, and the wide-ranging coverage of the cases, combined with the extreme trust of the investors in the company, has also increased the difficulty of obtaining evidence in advance.

On the other hand, Ding Yifeng's particularly cunning move is the choice of jurisdiction in the courts. In its contracts, almost all the jurisdictional courts specified in the subscription contracts are Hong Kong courts, further increasing the difficulty of recovering funds. Zhu Yicong, a senior partner at Beijing Yingke (Shenzhen) Law Firm, said in an interview with Interface News, "There are many unfavorable terms hidden in the agreements, and signing them carries risks. The litigation costs in Hong Kong courts are very high, making it very difficult for investors to file lawsuits."

In this regard, it will be very difficult for investors to recover their funds from Ding Yifeng. Furthermore, Ding Yifeng continues to sell its digital options products and claims that it will use verified domestic digital assets to anchor the issuance of "Dingyuan Coin" with physical assets, issuing digital tokens in the international market, thereby changing its development model. However, at present, the operation of these options is not clear to the staff.

Based on the usual experience in the crypto community, if digital options are replaced with more cost-effective digital currencies, it can only mean greater risk and stronger manipulability, and the investors will face even more unpredictable consequences after signing the contracts.

On Douyin, someone mentioned that if Ding Yifeng had invested in Bitcoin in 2023, the returns would have been quite good. As an insider, I just want to say that Ding Yifeng won't be able to shift the blame to Bitcoin and blockchain for this mess.

References:

First Financial: Investors reveal details of being tricked by "Ding Yifeng" agents, some mortgaged several properties and invested millions

21st Century Business Herald: Over 500,000 people have been hit! "Dry pot, no money!" Employees revealed: the chairman has run off with the money

Interface News: Investigating the redemption crisis at Ding Yifeng: inducing investors to sign "digital options" contracts, "billions in assets after three months"

Golden Stone Essays: Well-known fraudulent company, the metaphysical Taoist Ding Yifeng may really be running away

Star Business Review: May I ask which fellow Taoist is undergoing tribulations here?

Economic Discussion: Making over a hundred billion through metaphysics, who is the sacred "Eastern Immortal" Sui Guangyi with 40,000 followers?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。