EigenLayer's liquidity re-staking protocol Renzo has announced the completion of a $3.2 million seed round of financing, with Maven11 leading the investment and participation from SevenX Ventures, IOSG Ventures, Figment Capital, Bodhi Ventures, OKX Ventures, Mantle Ecosystem, Robot Ventures, Paper Ventures, and others. It is worth noting that this is the first publicly announced investment project by OKX Ventures in the EigenLayer ecosystem.

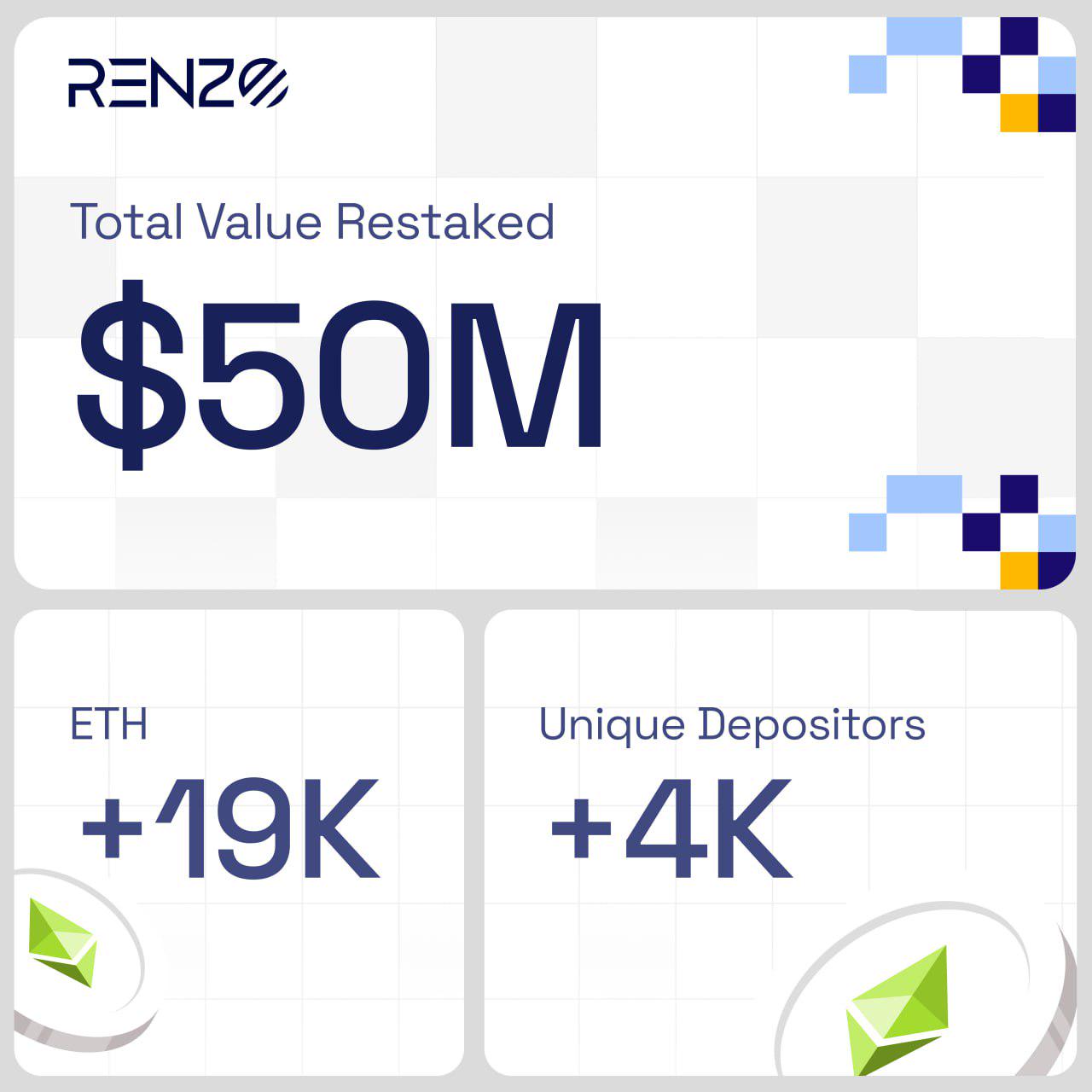

It is understood that Renzo is a liquidity re-staking protocol that is currently running on the EigenLayer mainnet. As a native re-staking product, it allows for full staking without being constrained by EigenLayer LST deposit limits. Renzo entered the mainnet testing phase a month ago, during which time over 2,000 users deposited a total of $20 million, and the mainnet testing phase ran smoothly with rapid growth.

The core of Renzo is the liquidity re-staking token ezETH, which users can mint by depositing Ethereum or LST into Renzo. ezETH can be further used in other DeFi protocols to gain compounded returns. Renzo abstracts all the complexity for end users, enabling them to participate in the EigenLayer ecosystem's re-staking with low barriers to entry.

The following will provide readers with a brief introduction to this project.

Simplifying the repetitive staking process, providing users with multiple earning opportunities: Renzo garners attention in the DeFi market

On October 30, 2023, the EigenLayer-based re-staking protocol Renzo officially launched. Renzo's design philosophy aims to simplify the complex process of users' repetitive staking, freeing stakers from the burden of operator selection and reward strategy management. Through its liquidity re-staking token ezETH, users can not only participate in the DeFi ecosystem but also enjoy higher liquidity while retaining staking rewards.

As a liquidity re-staking token (LRT) and strategy manager in the EigenLayer ecosystem, Renzo provides users with a new way to interact. It protects Active Validation Services (AVS) and provides users with returns beyond traditional ETH staking by offering node services and risk management. This innovative service model not only simplifies the collaboration process between users and EigenLayer node operators but also brings higher efficiency and returns to the entire ecosystem.

Renzo's operational mechanism is also noteworthy. Users can deposit LST (such as stETH, rETH, and other liquidity staking tokens) or ETH to receive the corresponding amount of ezETH. Renzo's smart contracts utilize EigenLayer's technology to effectively allocate the deposited LST/ETH through risk analysis and AVS and node operator selection by DAO. This mechanism not only provides users with staking rewards for ETH but also includes EigenLayer points and ezPoints rewards, indicating the future applications of ezETH in more financial scenarios.

With its rich experience in DeFi product design, the Renzo team has quickly established a presence in the market. Its product design supports Wormhole, enabling Renzo to rapidly expand across chains, further enhancing its attractiveness and user base expansion capabilities in the rapid development phase of the EigenLayer ecosystem.

In terms of token economics, Renzo adopts the veToken model, which not only incentivizes long-term token holding but also guides the direction of incentives. This model, inspired by Rocketpool, allows the acquisition of the right to operate AVS services by staking a portion of Renzo tokens, helping to reduce the circulating supply of tokens. It is also used to acquire and reward early high-quality operators, rapidly driving liquidity bootstrap.

In summary, Renzo not only plays an important role in the EigenLayer ecosystem but also brings new development ideas to the entire blockchain industry through its unique service model and innovative token economic strategy.

Renzo's upward momentum continues in early 2024: TVR increases from $36 million on January 15 to $96 million on January 19

Renzo's momentum continues to grow in early 2024, even as the Ethereum Cancun upgrade approaches.

On January 4, Renzo launched the ezPoints rewards program, aimed at rewarding users who contribute to the protocol. This program not only encourages users to mint ezETH but also plans to announce more ways to earn points as the staking ecosystem matures.

On January 15, Renzo Protocol completed a $3.2 million seed round of financing at a valuation of $25 million, with support from Maven 11, Figment Capital, and other well-known investment institutions. Subsequently,

On January 18, the Mantle Ecosystem Venture Capital Fund, Mantle EcoFund, announced a $10 million investment in six DeFi projects, including Renzo. These investments will enable the fund to provide a large amount of liquidity to the supported decentralized applications, further driving the growth of the entire ecosystem.

On January 19, Renzo announced that its ezETH/WETH liquidity pool had officially launched, making it the first LRT protocol to adopt Balancer technology as its liquidity host. Users can enjoy various benefits, including a 2x boost in DEX LP, 1x boost for deposits, a 10% referral bonus, and EigenLayer points and re-holding ETH, through exchanging or providing ezETH.

Renzo's Total Value Locked (TVL) data also reflects its significant growth. In just a few days, its TVL soared from $36 million on January 15 to $96 million on January 19, demonstrating its strong appeal and growth potential in the market.

In conclusion, Renzo's latest developments and future prospects demonstrate its leading position and innovative capabilities in the blockchain and DeFi fields. With the continuous development and improvement of its products and services, Renzo is expected to continue leading new trends in blockchain staking and liquidity, bringing more value and opportunities to its users and the entire ecosystem.

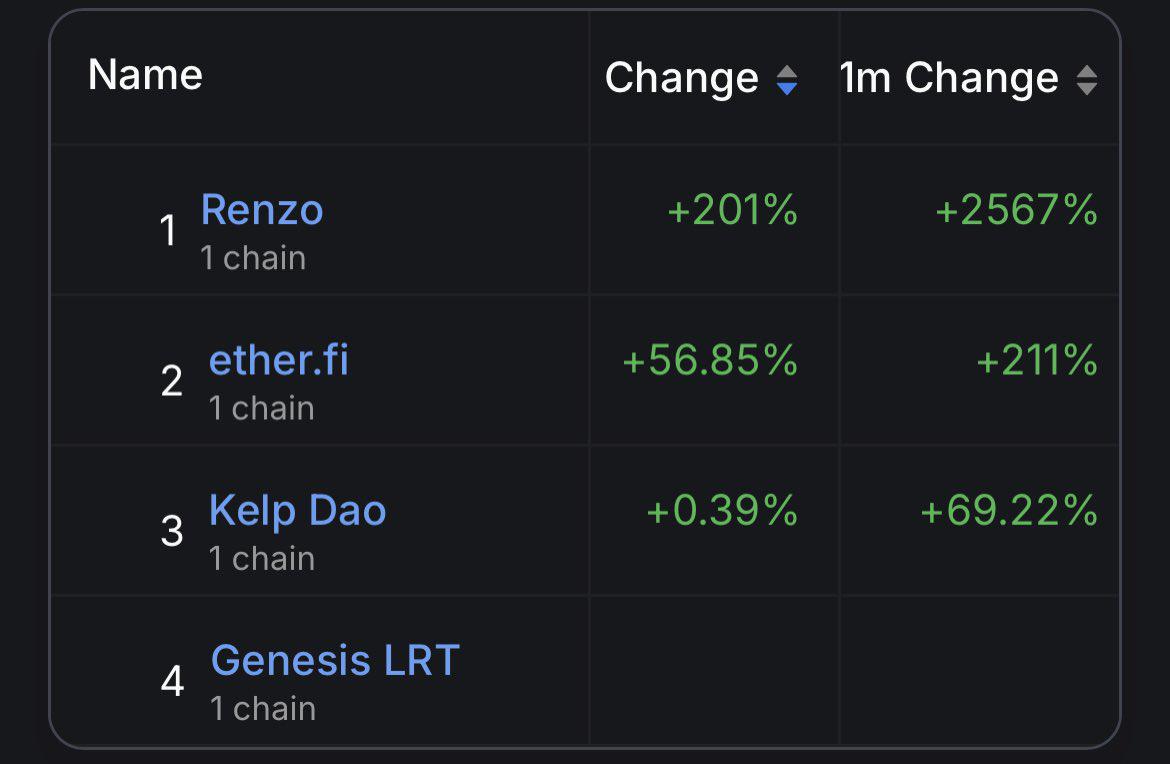

Recent sluggishness in the DeFi race, looking forward to Renzo's data performance bringing more heat and attention to the race

When we examine Renzo's achievements to date and its future potential, we can see that it is not only an important participant in the EigenLayer ecosystem but also a leader. From significant financing to the launch of innovative products and services, and the significant growth in user base and Total Value Locked (TVL), Renzo has proven itself as a force of innovation in the blockchain and DeFi fields.

Renzo's success largely stems from its deep understanding of market demand and continuous investment in technological innovation. By simplifying the staking process and providing efficient liquidity solutions, Renzo not only offers users a more convenient and high-yield DeFi experience but also injects new vitality into the entire blockchain ecosystem. At the core of its strategy is lowering the barriers, enabling more people to easily access and benefit from the progress of blockchain technology.

Looking ahead, as Renzo continues to make progress in product innovation, market expansion, and user experience optimization, its influence in the blockchain and DeFi fields is expected to further strengthen. Renzo is not only a highlight in the EigenLayer ecosystem but also a benchmark for the entire blockchain industry. Its success story provides valuable experience and insights for the entire industry, while also instilling confidence and expectations in investors and users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。