【Open Rug #5 - Three-Plate Theory 4】Each fund plate design is based on a closed system model, which has an audience, applicable conditions, and a bearing limit. Exceeding the limit will lead to a collapse. To prevent this situation, when designing a fund plate, it is necessary to nest different types of models to maximize the scope of application.

This method is often referred to as "shifting" in traditional fund plates because, due to the development structure, it is difficult to make major changes while using the original plate. In Crypto, due to the design of open protocols, we can embed new plate modules into existing products without affecting the current plate surface, or even directly embed a part of another plate. This feature is usually described as "composability".

---

🍽️How to "Combine Three Plates"

Before discussing composability, we need to understand the limitations of the three plates. First, each of the three plates has a core feature, summarized as:

🔒Dividend Plate [Lock]: Locking principal or liquidity

⛽Mutual Aid Plate [Draw]: Drawing profits from fund flows

❌Split Plate [Sale]: Eliminating the bubble in the system by the rise and fall relationships of multiple targets

Combining these features needs to be purposeful, that is, knowing why you need to use this plate model.

Throughout a plate, there are only two words: bubble 🫧

For any plate, apart from the mode, all other control plate requirements are only related to the full life cycle of the bubble, namely:

- Formation of the bubble: Where does the bubble come from?

- Development of the bubble: At what rate does the bubble increase? What is the rate related to?

- Critical point of the bubble: The time point when the bubble is greater than the inflow and an alert appears

- Collapse of the bubble: In what form does the bubble collapse?

Based on these time points, you need to make decisions to adjust your design.

The most important thing to consider is the "collapse of the bubble". The way the collapse occurs determines your fund size, profit size, and most importantly, your profit method. In simple terms, how to cash out? This is one of the most important questions to consider when starting a fund.

For example, the mining machine entry funds of the dividend plate can be directly withdrawn, and when it collapses, the direct income is no longer distributed, or it continues to be distributed but the plate surface collapses directly. These all fall into this category.

If the answer is no, then you need to consider the mutual aid plate, which stops drawing water when there is no water left, or the split plate, which does not promise returns and blames the secondary market.

From past experience, using a single method to suddenly collapse, regardless of domestic or foreign, will attract intense rights protection. Only by nesting each other can the impact of the collapse be reduced, and it can land and be safe.

It's better to boil a frog in warm water than to suddenly drain the pool, which is also an important reason for the importance of composability.

---

📌Combining Three Plates: Using Friendtech as a Case Study

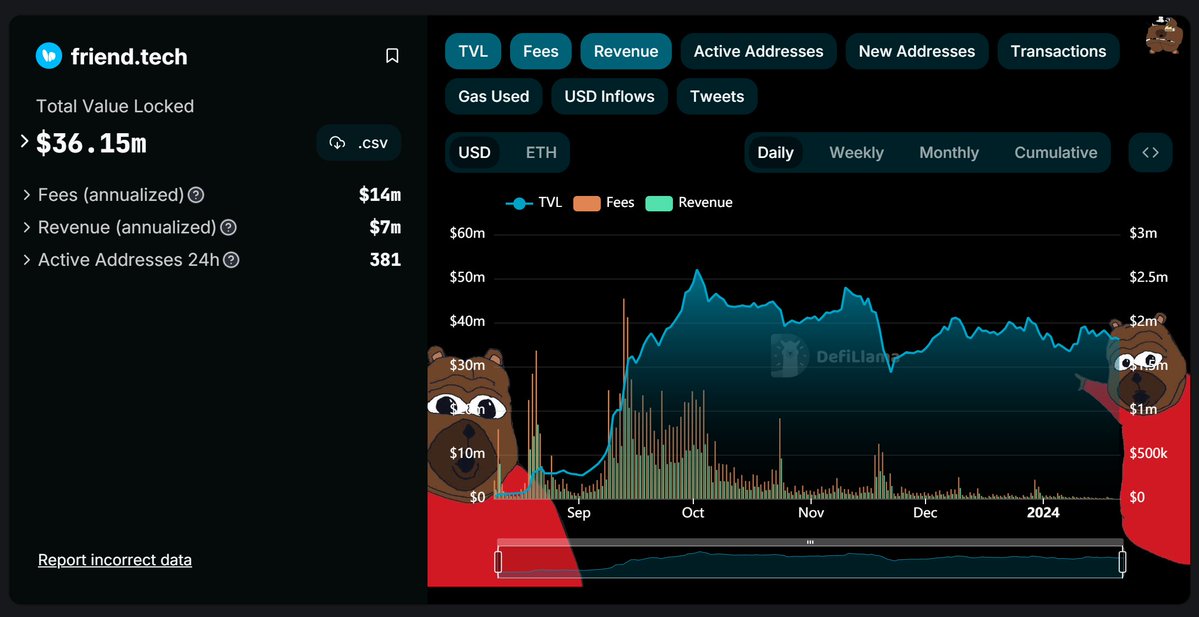

Returning to the well-known FriendTech, it is a very good example of the combination of three plates, although it is not successful.

Let's assume that FT is a paradigm for making a game, and the option of a hard cut in the event of a collapse does not exist, so FT can only be designed based on the mutual aid plate [drawing water], everything revolves around drawing water, and everything revolves around the key index of trading volume.

Why does FT need a split plate: The manifestation of mutual aid plate in FT is the existence of the bonding curve LP and a 5% tax on buying and selling. For the bonding curve, in order to increase the total liquidity, it is necessary to either introduce mainstream assets to increase the liquidity of a few pools, or increase the total number of pools. FT does not introduce mainstream assets, but creates new assets (which are inevitably low-liquidity assets). Therefore, FT must choose the latter, that is, the split plate.

Why does the FT curve need to be steep: In the early stages, the priority of FT's currency was to create enough pools (attracting KOLs), so a high price expectation must be set. Although this led to a decrease in user desire to buy due to the high price, market attention is precious, and more KOLs must be onboarded in a short period of time. Therefore, a steep curve is a feature rather than a bug.

Why does FT need to combine the dividend plate: The bubble of FT rises rapidly due to the split, and the rapid split leads to a large selling pressure on the stock. This is where the dividend plate's [lock] is needed. FT's points are the embodiment of this dividend plate.

The core of FT's initial dividend system lies in PV, which is the price of the key you hold (equivalent to the principal in your plate). The focus of the dividend plate mentioned earlier is on how to continuously increase the sunk cost of users, making it impossible for them to exit. Here, FT has done well in two aspects:

- Positive expectation management: Paradigm quickly jumps positions, highlights the cost of the national treasury, and highlights the visualization of points to give people a positive expectation of token airdrops

- Negative management: Point rewards are tied to PV and activity, and sunk costs increase over time

FT's market beta situation: FT was launched in the cold market of August, at which time there were few projects, the APY of lending was lower than the US bond interest rate, and there were no competitors in the Base ecosystem, so the market beta was low.

For users pursuing airdrops, as long as the national treasury income continues to grow, users can calculate how much each additional point is worth (attracting funds). Only if this value increases and exceeds the market beta, is it worth continuing to strive for points.

🤕The later decline of FT is also for the same reasons

Stagnation of the split: Due to the near limit of new entry for coin circle KOLs, the split speed has almost stagnated, and the market funds cannot obtain a proportionate increase in returns, and the returns of the old head keys are mostly negative 📉

Market beta change: In November, due to the expectation of BTC ETF and the outbreak of new split plates such as inscriptions, the market was driven to rise, and the market beta increased sharply, quickly squeezing FT 😰

Stock flooding: At this time, what FT urgently needed was to match the beta return, for example, creating new split targets to accelerate the split and increase the return rate. At the same time, find ways to further lock up the stock liquidity.

However, the new version of FT changed the airdrop strategy, greatly reduced the weight of PV, and adopted a post-voting bribery system similar to veCRV, trying to keep key holders based on the original sunk cost through operations and incentives. This disrupted the original dividend plate structure and lacked a mandatory principal lock mechanism, resulting in a sharp drop in TVL and almost zero fund flows.

- Expected collapse: Because the fund flows are almost zero, the newly added national treasury income cannot keep up with the distribution of new points, directly causing the market to lose the value expectation of airdrops

From the case of FT, we can summarize:

1️⃣ The combination of three plates first selects the main plate type based on the collapse mode

2️⃣ Select the most priority index based on the main plate type: such as FT's fund flows

3️⃣ Select the required auxiliary plate type based on the index, and select the auxiliary index based on the collapse model of the auxiliary plate type: such as market beta, income-to-point growth rate ratio, and locked-in sunk cost

4️⃣ Adjust and nest the plate types around the index: for example, allowing new split projects such as land to be subscribed based on player points and PV

---

🎢Looking at Restaking from the Composability of Three Plates

FT is an example of a single entity nesting multiple plate types. Below, let's look at an example of combining multiple different projects from a higher dimension - Restaking

Setting aside terms like "shared security" and "DA layer," Restaking is essentially a "P2P" for Ethereum staking. Users stake ETH or the LSD version of ETH in a protocol with "shared security" to earn rent. Users can simultaneously enjoy the returns of LSD and restaking.

I believe you have already noticed that Restaking is first and foremost a logic of mutual aid plate, and the bubble originates from the opportunity cost of staked ETH. For example, if ETH is staked in LSD, and LSD is staked in LRT, when both the LSD node and the LRT staking node are penalized for misconduct, how can one dollar be penalized twice? Isn't this equivalent to leveraging?

🙏We are not discussing technology here. I believe that Blast, Eigenlayer, Altlayer, Picasso, and others must have solutions. I am only discussing the most basic economic logic: ❗️there is a mismatch here.

The most important point of the mutual aid plate is to maximize the fund size. Restaking's fund size is measured by TVL (because water is drawn based on TVL), so what is most needed is the [lock] of the dividend plate.

How to lock?

☝️First, look at what is downstream of Restaking? It is a protocol that needs "shared security," so how is security achieved? The more ETH staked, the more secure it is.

Should staking receive dividends? Yes. 👍Good, then you are a dividend plate.

What Restaking does is essentially to have the dividend plate place its entry funds (TVL) with it, and the dividend plates only need to distribute dividends. The more dividend plates there are, the higher the total TVL of Restaking, and the more water is drawn.

Why are users willing to stake in the dividend plate? 📈Because the coin price rises, the APY rises, and the positive spiral makes users willing to stake.

So how can the coin price rise? A low-liquidity target in the dividend plate is very likely to rise. Yes, here you can see the [sale] of the split plate, and the market beta pressure at the protocol level of the Restaking can be resolved by splitting new dividend plates and boosting their coin price.

---

👷 How to create a plate using Restaking?

Raise a dimension and stand from the perspective of Ethereum. The essence of Ethereum after POS is a staking dividend plate. In order to achieve a high ratio of staking while having enough liquidity to pull out and further alleviate selling pressure by splitting, Ethereum introduced LSD.

But in a bear market, the selling pressure of Ethereum turning into stETH will be released, and chips need to be locked again (the low market beta of the split plate in a bear market does not solve the problem). This is where Restaking comes in.

😂 If you are the "house" of Ethereum: You will release more "infrastructure" dividend plates to the Restaking client at the beginning of the bull market, increase the APY of Restaking, and encourage a large amount of $ETH to be locked, making it easier to boost ETH, and at a lower cost, create a positive flywheel for the entire Ethereum sector.

🧐 However, if you are an "infrastructure" project: Ask yourself, if the cost of "shared security" is that the user's entry funds for the dividend plate are not in your hands, and your native tokens and even the "governance" value have to give some to ETH, what if Eigenlayer goes wrong, will you be in trouble too? As a plate owner, are you really willing?

Therefore, this model requires the interests of the Ethereum "house" group - Restaking provider - "shared security" demander to be aligned, even as a family. And managing such a complex plate involving so many stakeholders requires very good composability, and must be directed through coordinated "central consensus".

😌 As someone skilled in opening plates, do you already know how to create the next public chain plate?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。