I keep receiving alerts for "UMA 5-minute surge", and I smell a very familiar scent—the strong manipulator is at it again!

Early 2024. Just after TRB's bloodbath, BTC has been fluctuating due to the launch and subsequent drop of the Bitcoin spot ETF, and now UMA is causing trouble again! Well, this really tickles my fancy, so let's analyze it decisively!

UMA is undeniably a strong manipulator's coin, but compared to TRB, the manipulator behind UMA is more stable. The methods are similar, but the details are different. The core process involves absorbing funds, washing the market, pushing up the price, and unloading at a high level.

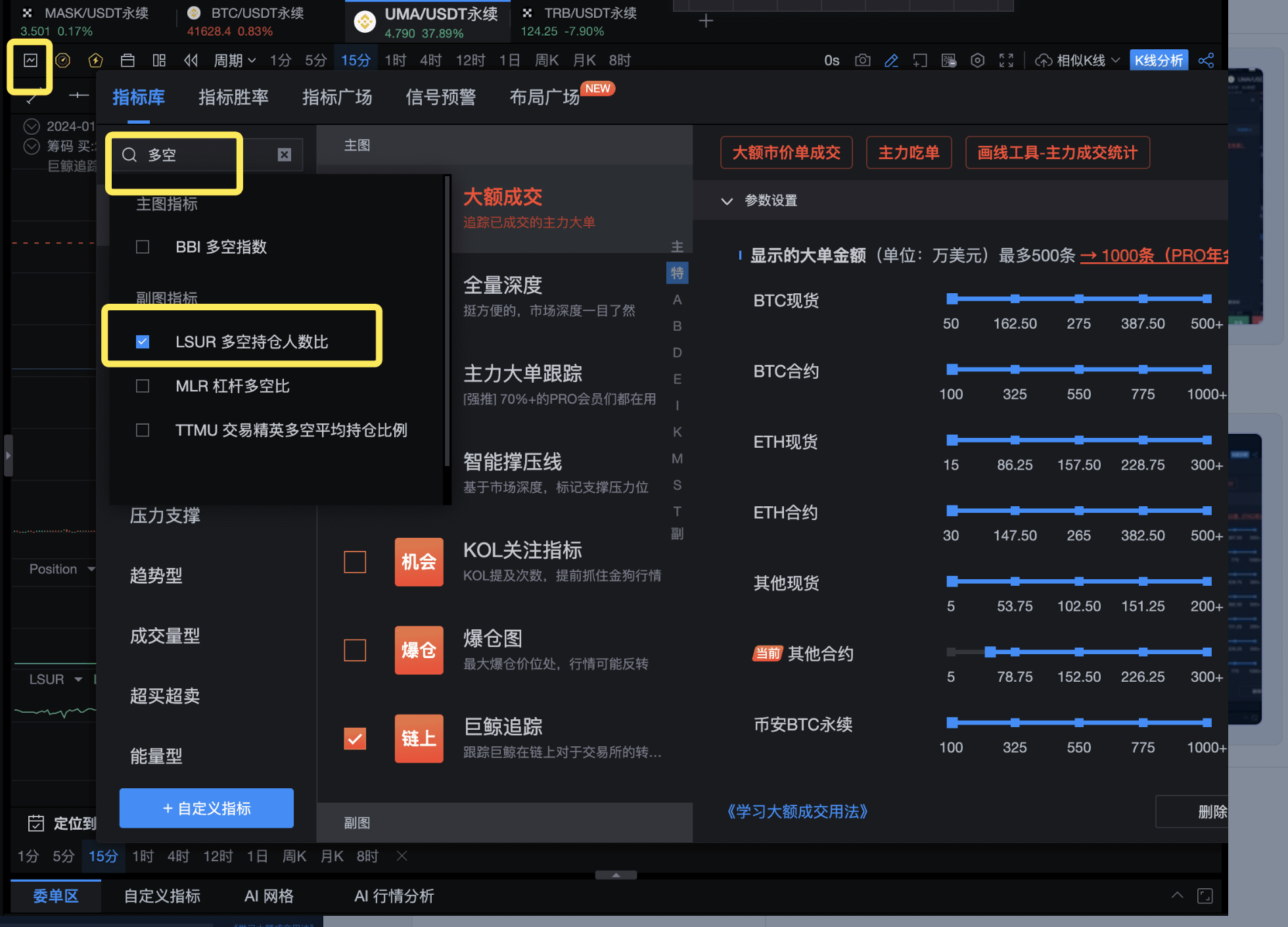

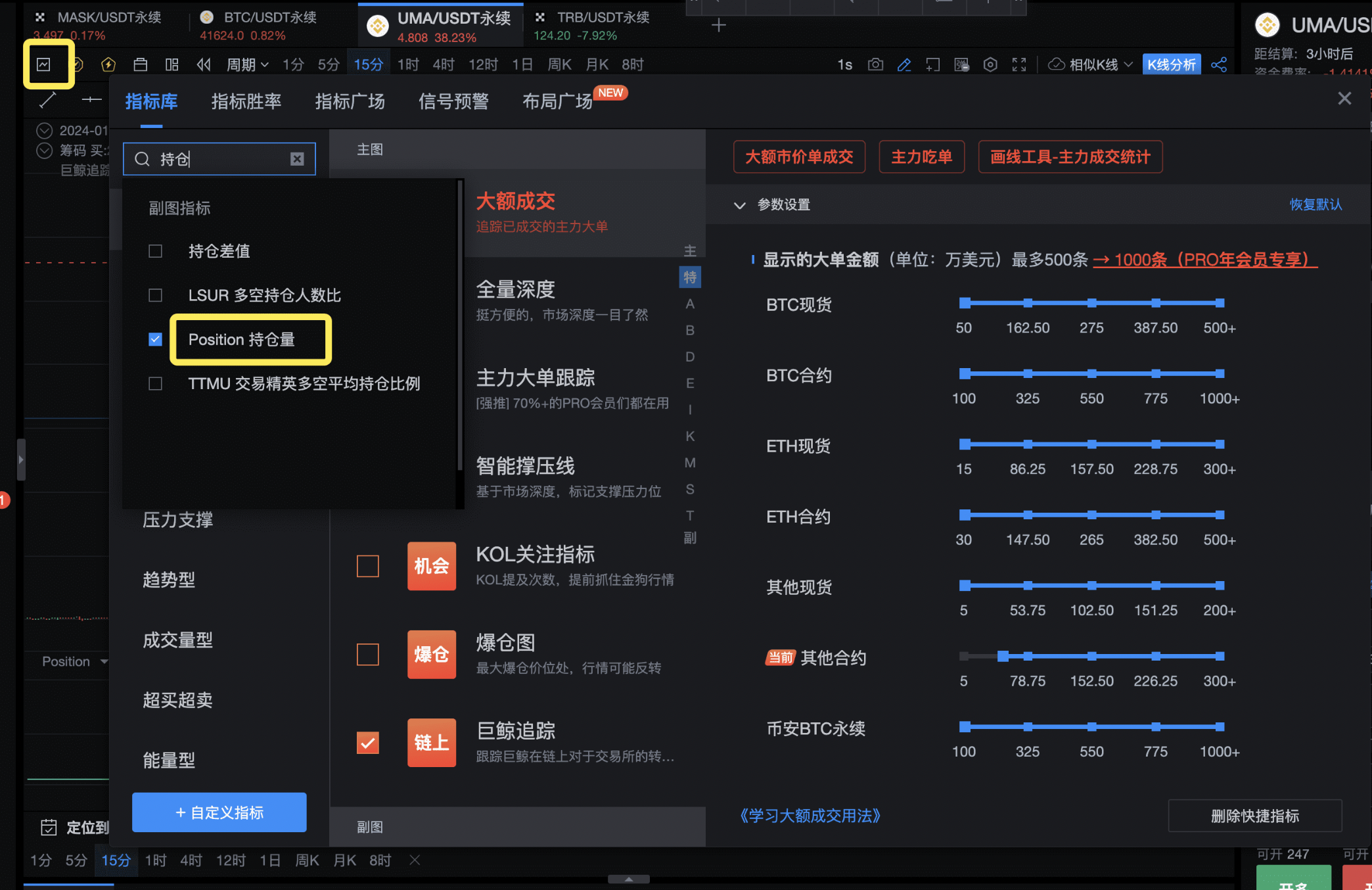

Before we start the explanation, I suggest everyone prepare the AICoin PC client and make good use of the following tools to learn how to identify the manipulator's intentions! (Usage of the tools is provided at the end of the article)

Official download link: www.aicoin.com/download

Identifying strong manipulator coins through on-chain data

First of all, it's clear that UMA is another coin controlled by a strong manipulator. Why do I say "another"? Do you all remember the last time I explained TRB's manipulator tactics? (For details, see "Exclusive: Another Classic Strategy! How did the demon coin TRB manage to bloodbath the market")

UMA is similar to TRB. The details of the manipulator's control may be different, but how do we identify such a strong manipulator coin? The best way is through on-chain data, because the manipulator will not keep a large amount of coins on the exchange, they must be on the chain.

1. UMA Circulation

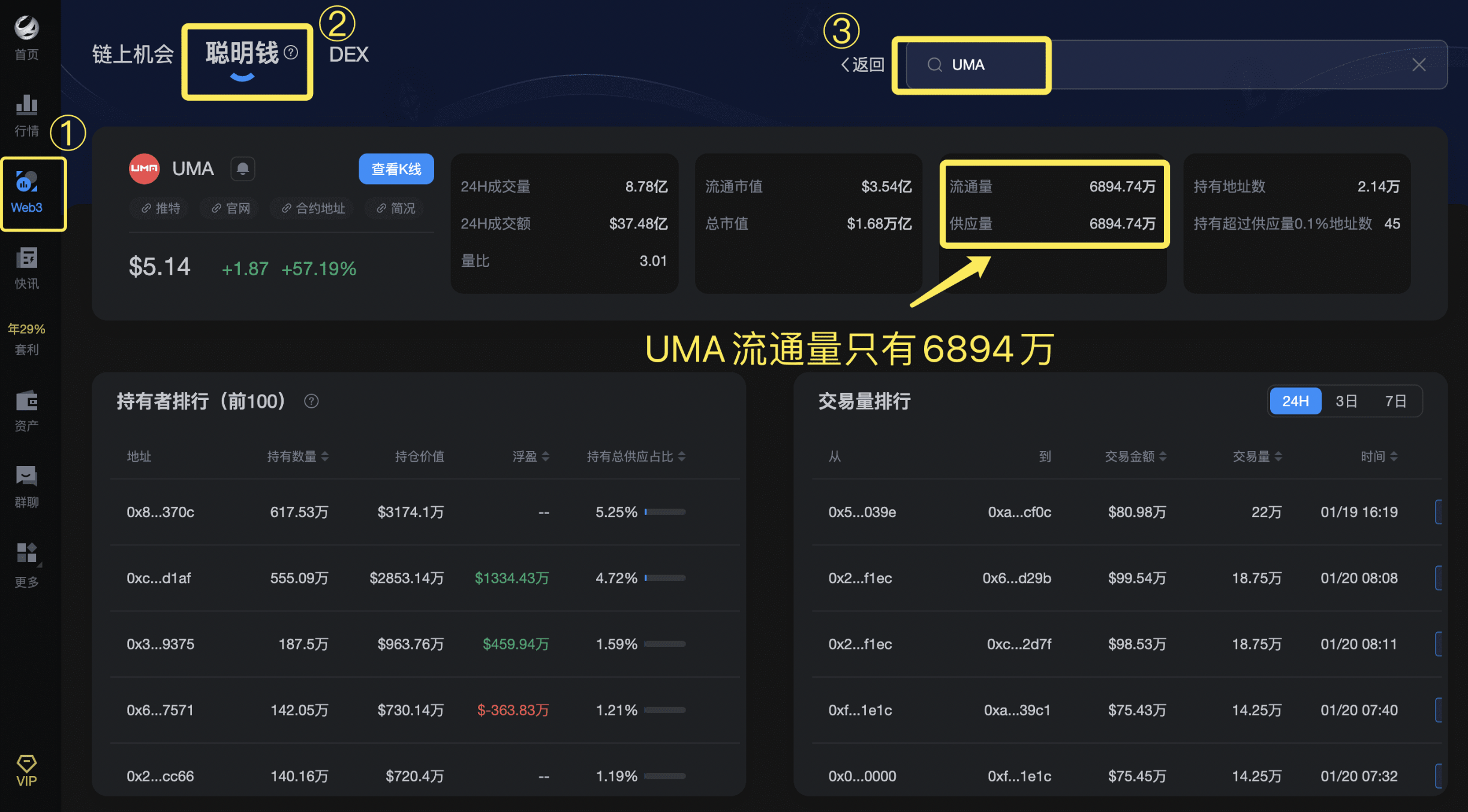

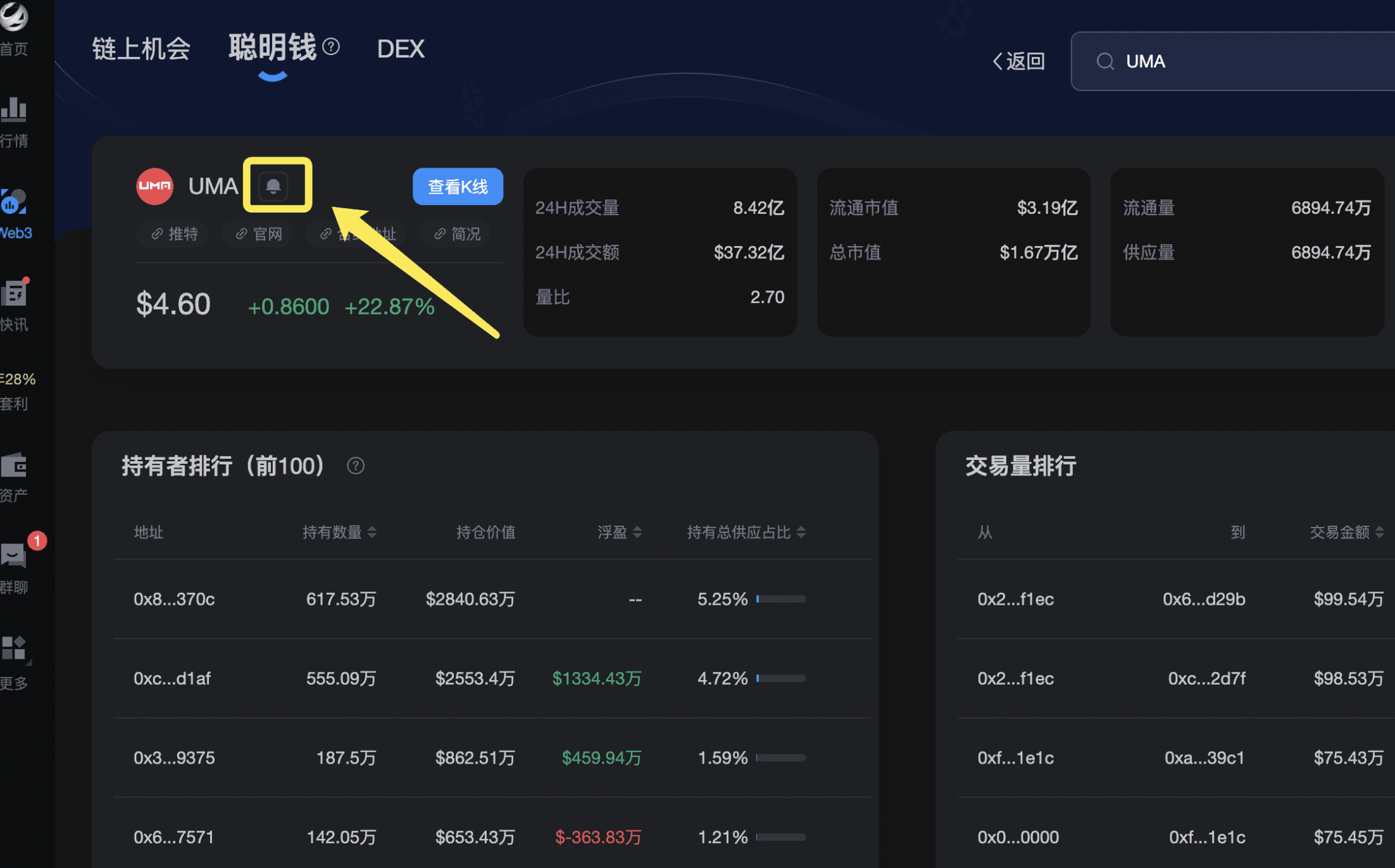

In the image below, you can see that the circulation of UMA is only 68.94 million (AICoin PC client → web3 module → Smart Money → Search for UMA)

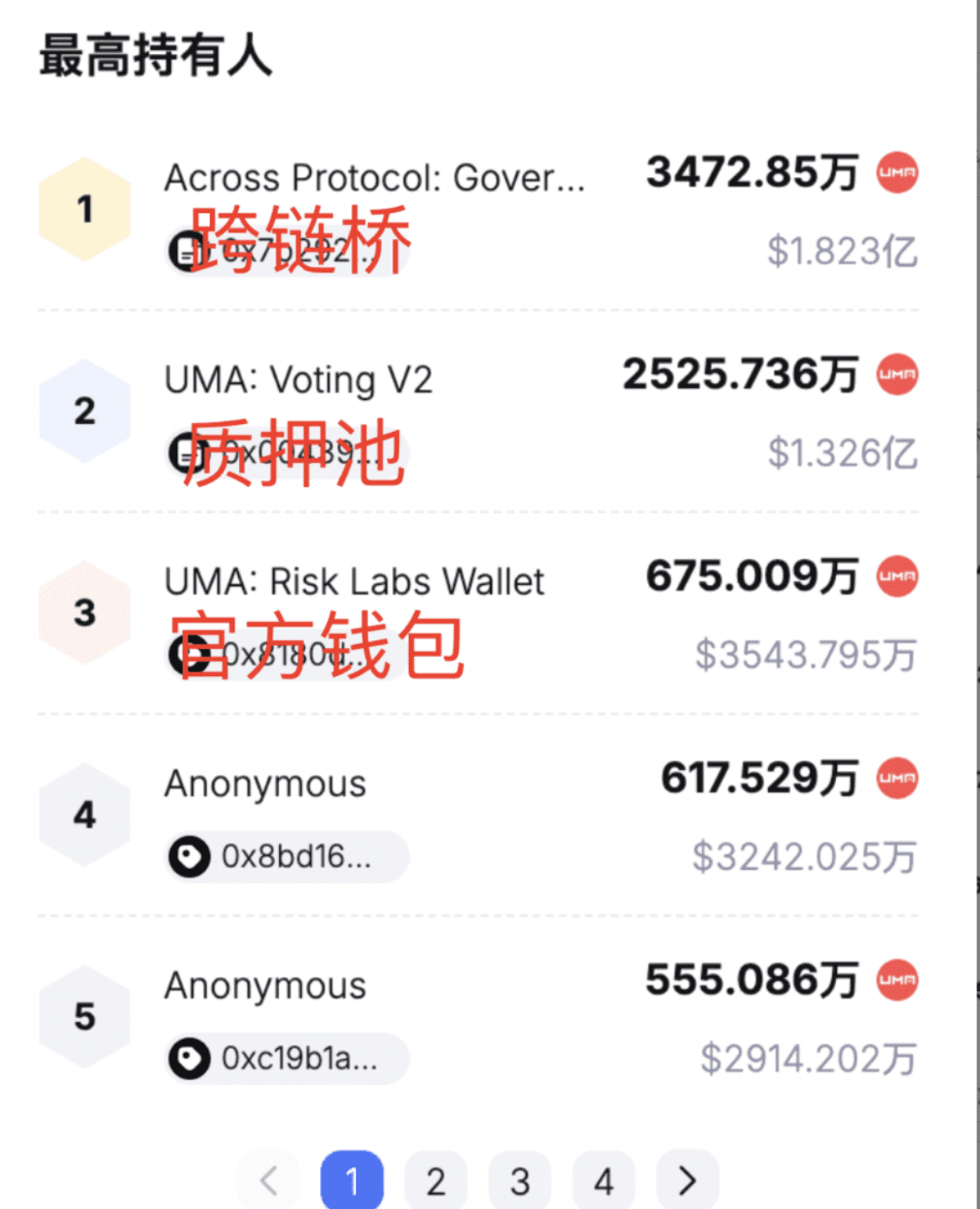

2. UMA Holdings Distribution

In the image, it can be seen that 87% of UMA is in the top 3 addresses: cross-chain bridge + voting pool + official address, with only 13% in personal holding addresses. (Note: Pay attention to the staking voting pool, which will be explained later)

And in the AICoin holder ranking, the ranking of personal addresses already holds most of the 13%.

Fundamental News: Manipulators are aware of news and push up prices in advance

The UMA team released news of a new product at 12:00 on the 19th! It's easy to see that OVAL is empowering UMA, which is good news.

For friends who don't know where the manipulator's news comes from, you can follow UMA's official Twitter through AICoin and set up alerts! That's how I set it up.

With low circulation and positive news, the manipulator can easily control the market, and the price increase is also very smooth!

Review of the manipulator's price increase process

At 1:00 on the 19th, the manipulator made a trial run, and it can be seen that this manipulator is relatively stable and does not engage in uncertain battles. It's a stable manipulation.

At 5:00 in the morning, the formal price increase began! (Once again, it perfectly avoided the GMT+8 time zone, always causing trouble while we're asleep!)

To judge whether the manipulator is bullish or bearish, I once again bring out the essential tool—Long/Short Ratio (LSUR), Position, and Funding Rate. In the future, you can apply the following approach to analyze different manipulator coins.

The K-line chart (15 minutes) of the UMA/USDT perpetual trading pair on Binance shows that during the price increase, the manipulator is bullish.

There is also a funding rate indicator, which shows that the UMA funding rate has plummeted to -2%, and has been maintained, indicating that retail investors are short, while the manipulator is long.

Identifying the Manipulator's Fund Absorption

Let's take a look at another indicator: the chip distribution chart. (Explanation at the end of the article)

From the chip distribution, it can be seen that during the oscillation period after the price increase, the manipulator continued to absorb funds, collecting a large number of chips, and then continued to increase the price by 50%!!

At the same time, from the position indicator, it is very obvious that the position increased significantly during the oscillation period!! This indicates that during this oscillation, the manipulator continued to absorb funds.

※ Here's a strategy to share:

Before the manipulator pushes up the price, they will definitely go long in the futures market. When the price is pushed up, the long positions in the futures market will be profitable. Because I pushed it up, I definitely know how high it can go. When the market is smashed, the long positions will be closed, and short positions will be opened, making a profit from the market crash! This way, you can earn profits from both spot and futures markets!

After analyzing the fund absorption, the next part will discuss how to identify the manipulator's unloading.

Detecting the Manipulator's Unloading

As mentioned earlier, UMA's staking pool has an important time point—unstaking can be seen on the official website after 7 days.

Because UMA has a penalty mechanism, those who do not participate in staking and voting will also lose funds, so most people who hold spot UMA will go for staking. The staking pool holds 33% of UMA's circulation, but once unstaked, it will take 7 days, meaning a large number of profitable chips will be unlocked after 7 days, causing significant selling pressure.

This means that from the 19th when the price was pushed up, stakers started to consider selling, but they need to wait 7 days to unlock, and those staking are mostly retail investors.

The manipulator uses the time difference in the staking pool to push up the price, trapping both small retail and large holders who hold spot UMA, watching the price rise helplessly.

At the same time, the unlocking after 7 days also means that the manipulator may run away during these 7 days, otherwise, a large number of stakers will sell off!

After a certain time frame, how can we detect the manipulator's unloading?

1: Pay attention to on-chain transfers

Pay attention to whether important addresses are increasing or decreasing their holdings. If a large number of the top addresses reduce their holdings and transfer to the exchange, it may be the manipulator transferring to the exchange to unload.

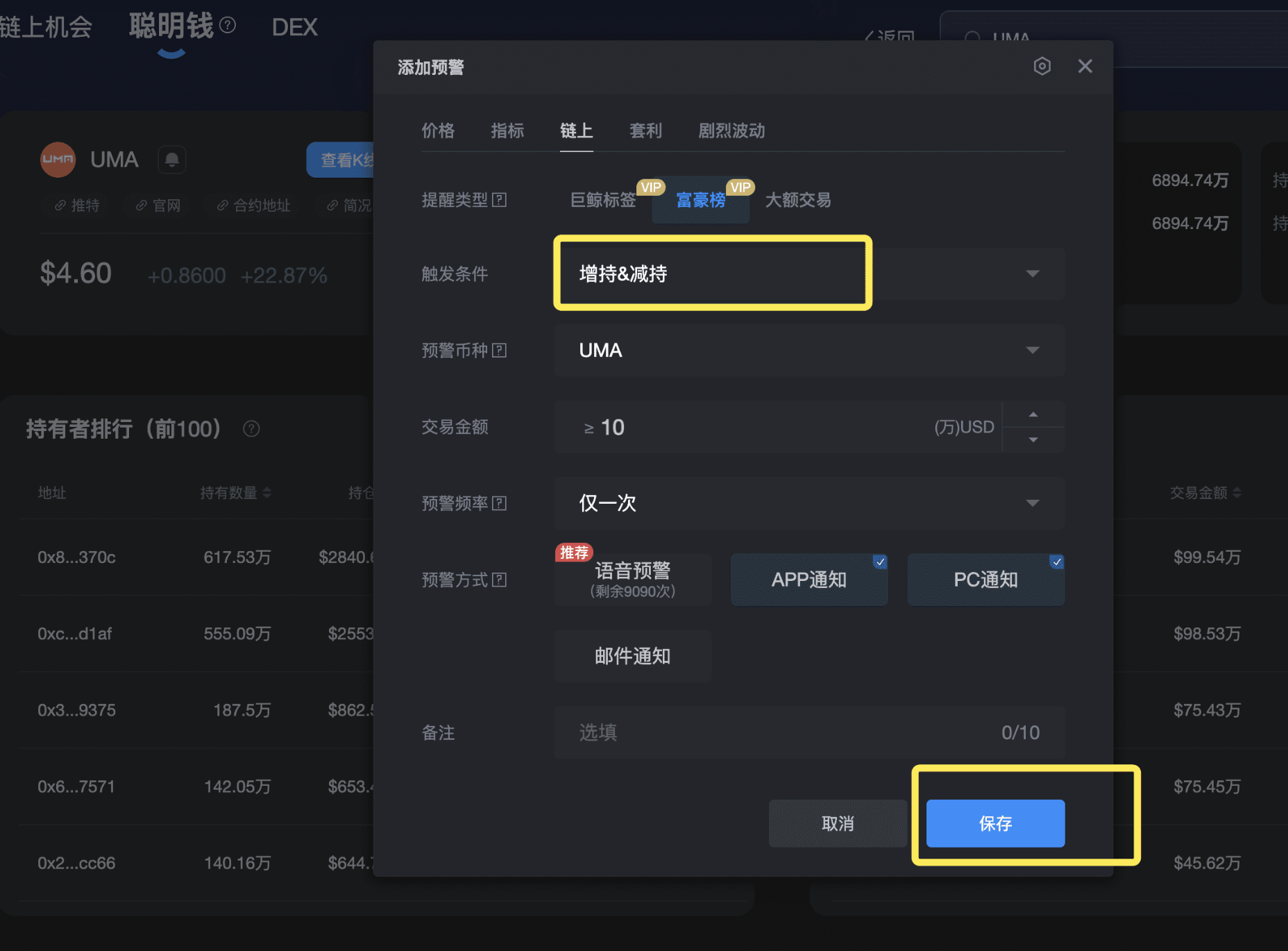

You can set alerts in AICoin, and you will be notified if there are increases or decreases in holdings in the top 100 personal addresses holding UMA. (AICoin has so many great features, make full use of them!)

2: Pay attention to the long/short position ratio and the position size

It can be observed that after the first price increase, the increase in position size was very significant during the oscillation period, while during the second price increase, the increase in position size was actually less than during the first wave.

This indicates that there was no additional capital entering during this period, and the manipulator may be preparing to take action soon. It's important to pay attention to any signs of the manipulator unloading—when the long/short position ratio rapidly increases, and the position size increases significantly/remains unchanged, there may be signs of the manipulator secretly shorting, indicating a potential market crash!

3: Pay attention to chip distribution

After the first price increase, during the oscillation period, it can be seen from the chip distribution that the total volume of transactions was much higher than at the bottom, and the current volume after the increase is similar to the volume during the oscillation period after the first price increase, indicating that there was not much additional capital entering, and the manipulator did not continue to absorb funds.

Another function of chip distribution: support and resistance levels. The chip front can act as a support and resistance level. It can be seen that it has already fallen below the top chip front, and may approach the second chip front, leading to unloading after a price increase, without taking on any risk. Before the price increase, there was also a trial run, so it won't be too risky. This is also why I say that UMA's manipulator is stable.

From the trend chart, it can be seen that the manipulation tactics of UMA are quite different from TRB's aggressive tactics. The market washing is done through oscillation, without a minute of increase followed by a minute of decrease, very stable.

Conclusion

UMA's market continues to move, and a summary must be made:

UMA is a strong manipulator coin, and the manipulator's on-chain holdings can be confirmed through AICoin's web3 module. 87% of UMA's circulation is in the top 3 addresses, making it very easy to control the market.

Through the long/short position ratio, position size, and funding rate, you can identify the manipulator's fund absorption and market washing behavior on CEX exchanges. (This is also why I strongly recommend downloading the AICoin PC client, to use the tools to identify the manipulator's intentions)

Pay attention to the manipulator's unloading

(1) UMA's staking pool has a 7-day freeze period, and the manipulator may run before the selling pressure.

(2) Set up monitoring for the top 100 UMA addresses. When a large amount is transferred to the exchange, it may indicate the manipulator unloading.

(3) When the long/short position ratio rapidly increases and the position size increases significantly, there may be signs of the manipulator shorting, indicating a potential market crash.

(4) Use chip distribution to analyze support and resistance levels, as well as to analyze whether the volume of chips sold at high levels is consistent with the fund absorption.

Classic Tool Usage

- AICoin's Guide to Mining Dogecoin

- One-click Copy Trading, Track Smart Money to Quickly Find Hundredfold Coins

- On-chain Tracking Guide: How to Use the Web3 Module to Track Smart Money

- Understanding the "Long/Short Ratio" in Three Minutes, Don't Be Fooled Again

- AICoin PC Client Launches Line Drawing Tool - Chip Distribution

⭐️ Make sure to download AICoin from the official link to avoid phishing websites: www.aicoin.com/download

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。