The demand for infrastructure in the AI and gaming fields is expanding, and DEPIN will further drive the integration of Web3 industries and large-scale adoption.

Authored by: Zonff Partners

DEPIN Track Investment Logic Guide

Core Sector: Satisfying both institutional funds' fundamental requirements and small funds' expectations for emotional aspects and fair launches

In the current state of just beginning to recover, funds have not yet formed a large-scale force. Retail funds pursue fair distribution of chips and narrative innovation. The key to the outbreak of such assets is effective information dissemination. Institutional funds need assets with longer-term logic and effective moats to reduce investment fluctuations and bear large funds. As a long-standing asset category, DEPIN has clear fundamental logic, optimized cost structure, and clear usage scenarios, serving as a core component of Web3 infrastructure. At the same time, it has a relatively low way of obtaining chips, satisfying the needs of both institutional funds and retail funds.

High entrepreneurial threshold leads to limited overall asset supply, with many past successful cases and a high success rate in investment

We have observed that among the top 1000 projects by market value, there are fewer than 50 circulating assets in the DEPIN category. In the case of high market sentiment, there are significantly fewer than 30 projects that have not yet circulated. Since the entrepreneurial threshold is high and the development cycle is long, it is not easy for the future to be "rapidly dogged" and be massively impacted by low-quality supply.

The demand for infrastructure in the AI and gaming fields is expanding, and DEPIN will further drive the integration of Web3 industries and large-scale adoption

For a long time, increasingly decentralized infrastructure has been one of the core development themes of blockchain massive adoption. Since 2017, the industry has gradually developed from simple protocol projects to DeFi, middleware, NFT, and other track categories, and the demand for technical services has expanded in sync with user scenarios. The growth of AI agents and gaming projects in the current period will further drive the industry's demand for computing, opening up new narrative spaces and landing scenarios for DEPIN.

Three-dimensional user structure and closed-loop capital flow bring longer lifecycles to projects

The success factors of most projects in the industry lie in the monopoly of technology and application scenarios, or in good brands and the distribution of private domain information (Meme type). DEPIN projects not only have the opportunity for a closed-loop business logic but also have a more three-dimensional user hierarchy, including B-side miners and demanders, C-side miners and users, token traders, etc. Once an effective network effect is formed, it will have a stronger effect of capturing value and absorbing funds. The "thick value layer" will have a more stable lifecycle, while projects based solely on brand traffic tend to grow rapidly in the short term and then decline in the long term.

I. Messari Overview of DEPIN

Messari divides the DEPIN track into 4 parts:

Server Network, Wireless Network, Sensor Network, Energy Network

Server Network:

Build computing servers in a neutral manner to provide dispersed storage, computing, and communication resources to demanders.

The server network can be specifically divided into 4 subparts:

- Storage: including file storage networks for long-term data storage and relational database networks designed for dynamic access and updates;

- Computing: including general-purpose computing networks and custom computing networks tailored to specific scenarios, such as transcoding, rendering, and machine learning;

- Content Delivery Network (CDN): using caching to distribute data near end users for faster data delivery;

- Virtual Private Network (VPN): creating a private network while using a public network to provide a secure connection between devices and the internet;

Wireless Network:

Decentralized wireless networks (DeWi) reduce the capital expenditure of traditional network providers and can achieve higher economic benefits. DeWi projects can be divided into several categories based on the form of wireless network implementation, including cellular, WiFi, LoRaWAN, Bluetooth, positioning, and hybrid networks. The largest market is 5G cellular, with leading companies such as Helium and Pollen Mobile;

Sensor Network:

Distributed sensor networks use dispersed sensor devices to collect, transmit, and analyze data from the physical world, including environmental, weather, vehicle and traffic, street view, and aerial image data;

Energy Network:

Distributed energy networks connect energy nodes distributed around the world to provide energy resources for the entire network, such as virtual power plants.

Reference: https://messari.io/report/the-depin-sector-map

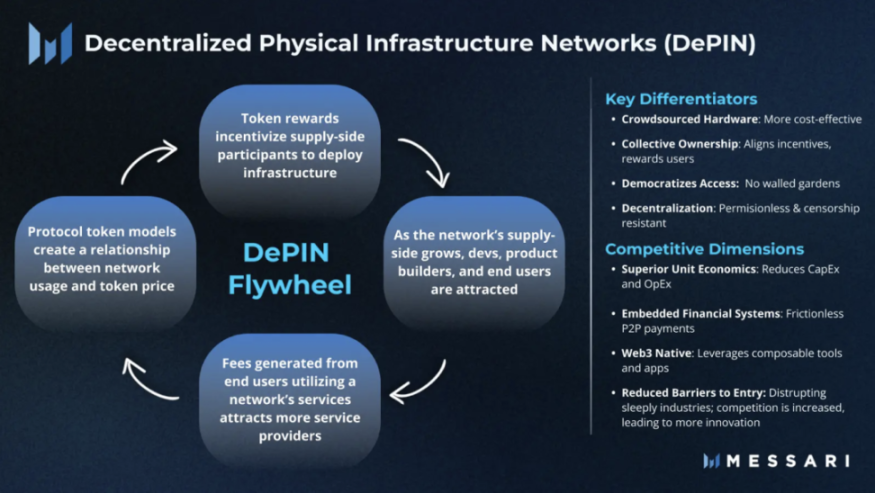

II. Core Mechanism and Flywheel of DEPIN

The industrial logic of DEPIN includes the following three main links:

Hardware equipment providers: They provide physical hardware equipment, including idle computing/storage/communication resources and various sensor devices, such as GPUs, CPUs, storage space, bandwidth, WiFi, etc., and receive token incentives as rewards;

DePIN intermediate layer protocol: The DePIN protocol builds a distributed network, uses blockchain to provide token incentives to hardware providers, and charges network users. It includes various integrations and data tools, wallets and payment gateways, device rights and task statistics, etc.;

Demanders of the DePIN network: Access the DePIN network, use the services of the DePIN protocol, and pay for them. This includes the public chain ecosystem and DAPP of Web3, or the resource demanders of Web2;

As a long-term narrative of large-scale application of Web3, DEPIN has several core growth drivers:

Politically correct: As the initial vision of blockchain construction, preventing the monopoly and wrongdoing of a single centralized platform, decentralized architecture and privacy issues have always been the foundation of industry applications;

The distributed hardware network has a closed-loop business model of supply and demand: Apart from this, only BTC mining/exchanges/DEFI are closed-loop;

Significant cost reduction and economies of scale: Filecoin has already proven that the unit cost of storage can be significantly reduced compared to Amazon S3 in the past, using token incentives to leverage idle resources, which is relatively light in terms of cost structure and operations, and is a significant innovative improvement.

Of course, considering stability and performance, it is indeed impossible to compete with centralized services in every aspect, but the total market size of the three major IT pillar industries of storage/computing/communication exceeds 50 trillion US dollars. The service supply of DEPIN definitely has a space and significance, and even a tiny share is a substantial increase in the total asset size of Web3.

Image source: https://messari.io/report/the-depin-sector-map

III. Two Types of Construction Frameworks for DEPIN Projects

Composition of the Underlying Blockchain Network (Native Demand Types for Blockchain)

This type of project essentially deconstructs the function of the blockchain as a "decentralized server" and uses different Depin networks to implement partial module functions of the server, addressing the different needs of the underlying blockchain network. The main feature is the use of a decentralized hardware network to meet the native demands of the blockchain network.

For example:

- Independent storage layers represented by Filecoin and Arweave, using decentralized storage nodes to meet the long-term file storage and data access needs;

- Numerous PoW projects use GPU or ASIC miners to achieve cryptographic consensus for blockchain networks, such as Kaspa;

- Layer2/Layer3 uses external GPU networks and communication networks to solve specific blockchain problems, such as scalability or privacy modules, with Aleo as a representative;

- Node staking projects combine liquidity staking and hardware validation, playing a key role in validating transactions, protecting networks, and security, such as Rocket Pool;

- CDN-type content distribution networks, represented by Meson Network, improve the efficiency of DAPPs and public chains;

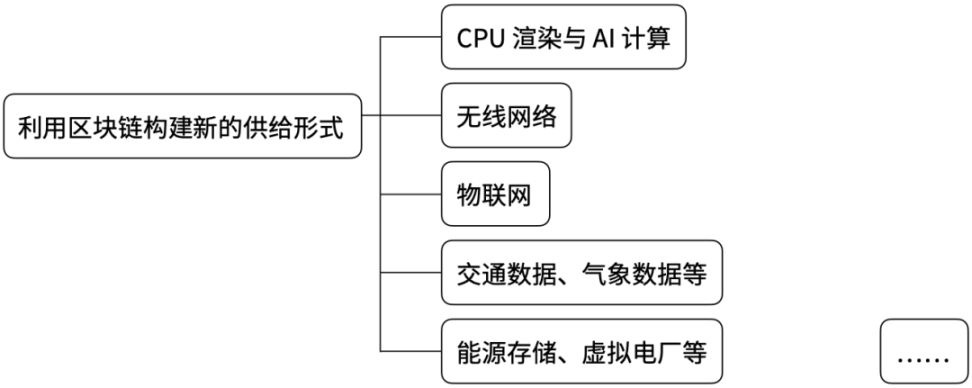

Blockchain as a Collaborative Network Builds New Service Supply Forms (Outsourcing Service Types)

This type of project uses blockchain networks and token incentives to organize decentralized idle resources to generate new hardware supply services, which can to some extent reduce costs and form estimates in a short period, building a protocol layer as a coordination network and service settlement layer. Its main feature is hardware + blockchain, which can be understood as BAAS (Blockchain as a Service), where the blockchain is part of the supply rather than the main audience for the service. It mainly meets the outsourcing needs of Web2 industries and Web3.

For example:

- Render Network as a decentralized GPU network serving GPU computing for 3D rendering and AI industries, categorizing idle GPU users into 3 levels based on different GPU rendering speeds to match and execute rendering tasks, and receiving different token incentives;

- Helium incentivizes users to collectively build wireless networks in a decentralized manner. It uses a token incentive model for encrypted operators to encourage contributors to purchase and install Helium cellular wireless devices, providing cellular coverage for users' phones using unlicensed CBRS bands and eSIM technology;

- Other types of projects include decentralized energy networks (React), vehicle traffic networks (Dimo), meteorological and geographic spatial data (Geonet), etc. The core idea is the combination of hardware devices (sensors or computing devices) and specific data management, combined with token incentives to form new collaborative networks;

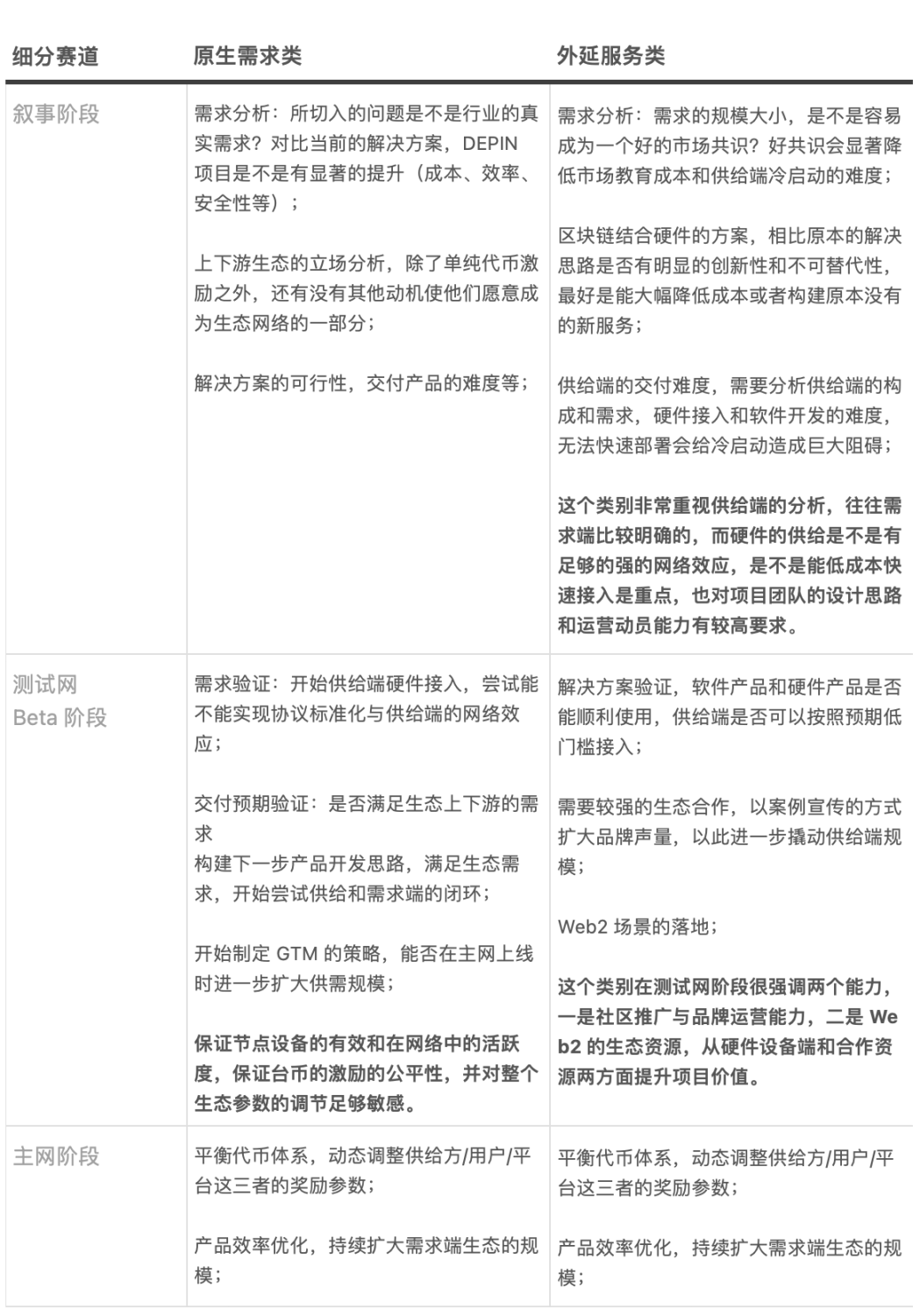

Investment Analysis Approach for DEPIN Projects

Compared to other blockchain protocol or middleware projects, the ecological links of DEPIN projects are more complex, mainly reflected in:

- The complex upstream and downstream links of the industrial chain, with upstream involving hardware production and manufacturing, sensor and chip manufacturing, and downstream involving software services and integration, covering Web2 software development and smart contract development, with high requirements for service acceptance for both B-side and C-side users;

- In the token design of blockchain projects, there are high requirements for the comprehensive understanding and experience of the project party, which should contribute to the overall ecological growth and be able to make rapid feedback and challenges based on the characteristics of supply and demand at different stages of development. It also requires the ability to control changes in technical requirements in the industry and operational strategies for DeFi and token liquidity. DEPIN projects typically adopt the BME token model (Burn-and-Mint Equivalent), where users purchase goods or services by burning tokens, and service providers reward various contributors in the supply chain by minting new tokens.

Image source: https://medium.com/mvp-workshop/burn-and-mint-equilibrium-pros-and-con-s-c27d83748cf5

- DEPIN projects have strong fundamentals and must cooperate with product delivery and milestone achievements in the process of scaling. Pure hype and expectation management are difficult to achieve results.

In summary, the operation and development of DEPIN projects are challenging, with high requirements for comprehensive capabilities. However, once the initial network effects are accumulated, there will be greater stability at a larger scale.

DEPIN projects generally follow the standard development process of blockchain protocol projects, which we divide into three growth stages: narrative stage, testnet stage, mainnet stage. These three stages require different observation focuses, and the two construction approaches of native demand and outsourcing service DEPIN also have different investment analysis criteria:

In conclusion, the core analysis focus of the projects lies in two dimensions: initial narrative analysis and execution plans after testnet delivery.

Native demand projects are closer to the demand-side customers, mainly focusing on Web3 native demand, and place more emphasis on product delivery effects and network scale after market orientation.

Outsourcing service projects are further away from the closed loop of supply and demand, appearing more "virtual," and therefore place more emphasis on narrative quality and brand-building capabilities, requiring significant strengths in Web2 resources or hardware supply to enhance project value.

References:

https://messari.io/report/the-depin-sector-map

https://medium.com/mvp-workshop/burn-and-mint-equilibrium-pros-and-con-s-c27d83748cf5

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。