Preliminary Analysis of the Token Economic System of Lumiterra @LumiterraGame

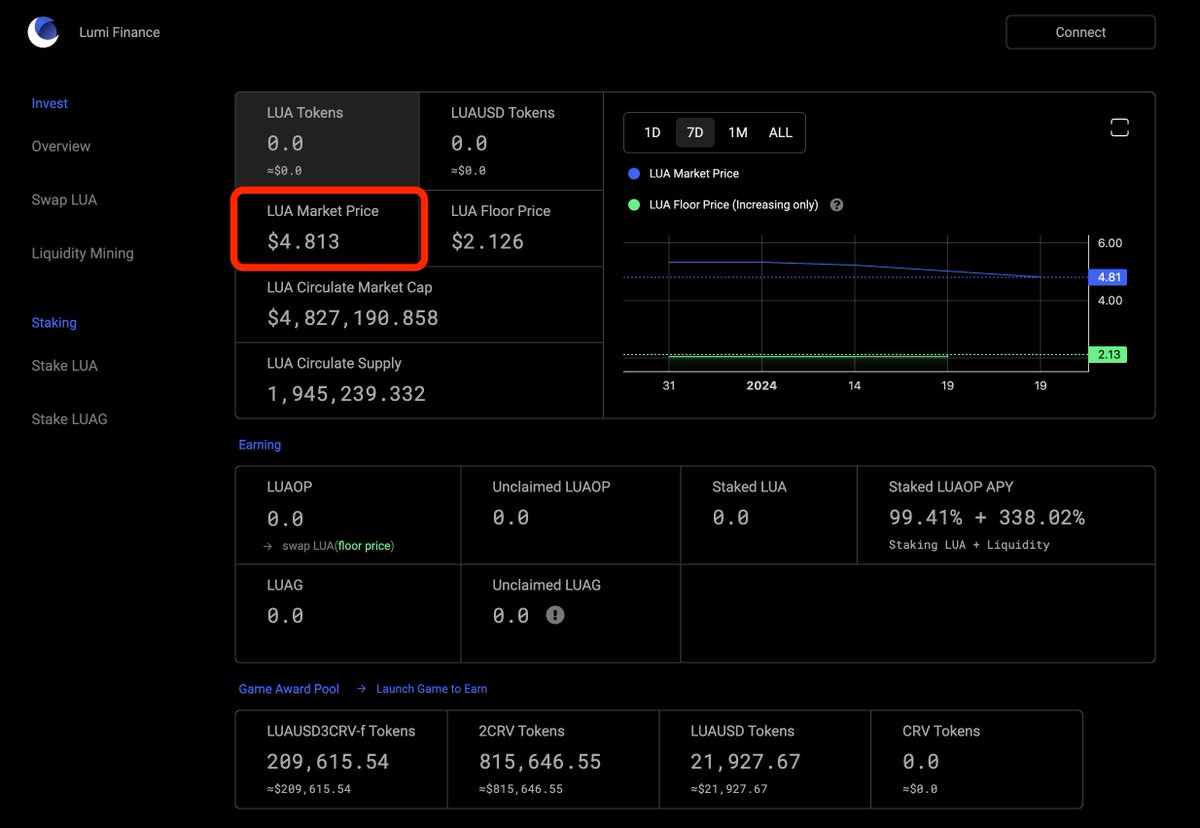

Some time ago, there was a relatively popular game combined with a Defi project. A community member told me about it early on when the price was around $0.5. Later, it rose to about $4.8, and NFTs also increased significantly. The current circulating market value is around $4.8 million. As the game market gradually picks up, the future development of this project is worth paying attention to. Let's take a brief look below:

1) Lumi Finance is the core token economic system of #Lumiterra blockchain game. #Lumiterra is known for its charming art style, free-exploring world, multiplayer adventure, farm elements, and unique production mechanism. This game is not only rich in gameplay, but also has a competitive mechanism with a benign cycle. This article will focus on introducing its distinctive token economic system.

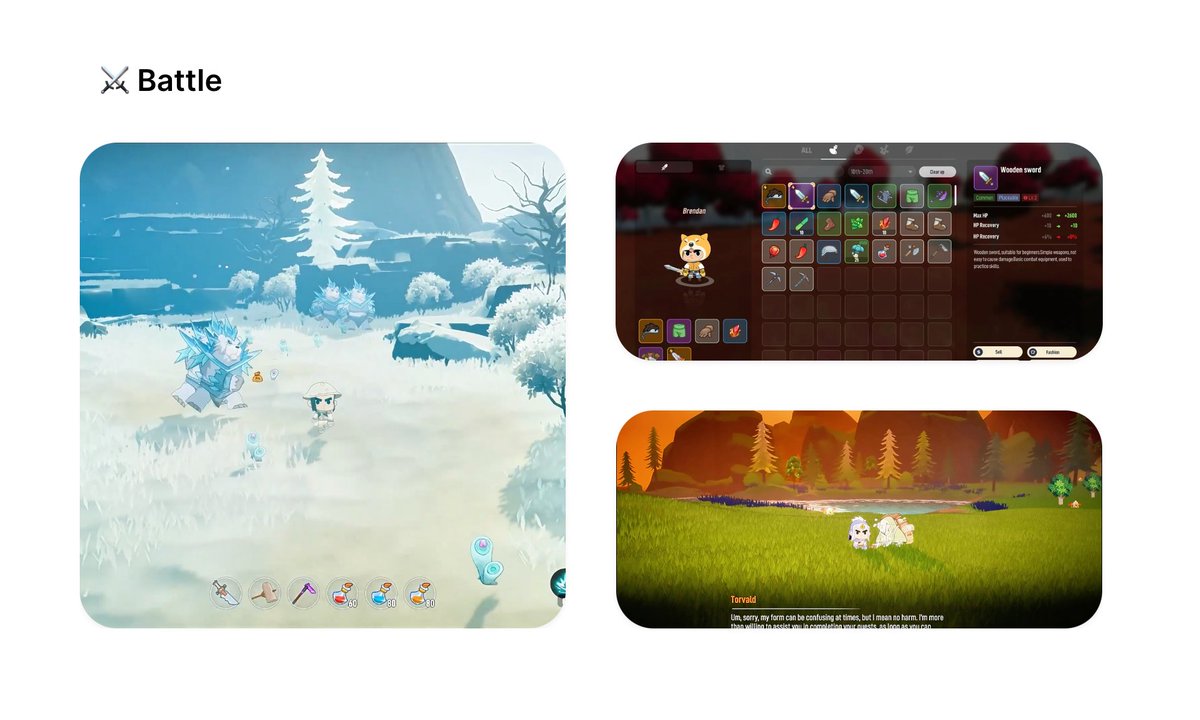

2) Users in the game are divided into three categories: DeFi users, GameFi users, and ordinary gamers. DeFi users can be seen as investors who invest in tokens in the game and earn high returns by providing liquidity pools. GameFi users earn profits through basic investments and in-game labor, aiming to realize game income. Ordinary gamers play for the gaming experience or to earn profits through competition. They are the end consumers in the game. Through the consumption activities of these players, profits are created for GameFi users, thereby promoting the growth of assets for DeFi users. Meanwhile, a portion of the game's earnings will be used to update game content, attract more players, and form a benign economic cycle.

3) In terms of DeFi, Lumi Finance differs from the previous generation of GameFi's dual-token system by introducing four tokens: LUA, LUAUSD, LUAOP, and LUAG. LUA is the main asset token of Lumi Finance, characterized by a continuously rising minimum price guarantee. When the market price is higher than this minimum price, the buying and selling of LUA is no different from a regular AMM (Automated Market Maker). However, when the market price reaches the minimum price, the token's sale will be based on this minimum price. This price guarantee is due to the cash reserve in the liquidity pool. In addition, each purchase of LUA will lock some funds in the cash reserve, thereby raising the minimum price. LUA can also be staked to obtain the right to mint LUAUSD, meaning that for each staked LUA, users can mint the corresponding LUAUSD based on the current minimum price and redeem LUA at any time at the minting price.

4) Next, LUAOP is a reward for staking LUAUSD. LUAOP is equivalent to a purchase option for LUA, allowing users to buy LUA at the current minimum price. Its value is equal to the market price of LUA minus the minimum price. Exercising this option will contribute cash collateral equal to the minimum price to the liquidity pool, thus not affecting the minimum price. However, it may increase the overall token supply, thereby slowing down the rate at which the cash reserve raises the minimum price. Selling LUA after exercising the option may also lower the market price.

5) LUAUSD plays the role of a stablecoin in the economic system, derived from the staking and minting of LUA. Since LUAUSD can redeem LUA at the minimum price, its price is somewhat guaranteed. LUAUSD also serves as the main circulating currency in the game. Staking LUAUSD can earn LUAOP and LUAG; currently, only the acquisition of LUAOP is open, and LUAG is temporarily unavailable. Finally, LUAG is the governance token in the game, derived from sources including liquidity providers of LUAUSD, NFT blind boxes, and possible future airdrops. By staking LUAG to become veLUAG, users can vote in the DAO (Decentralized Autonomous Organization) and receive rewards from the Lumi ecosystem.

6) The token economic system of Lumi Finance builds an environment that enhances player interaction, investor confidence, and market sustainability through unique design elements. The combined effect of the minimum price support and leveraged staking mechanism can attract long-term investors and encourage short-term market participation.

7) The minimum price mechanism sets a bottom line for the LUA token price, providing a barrier to defend against market fluctuations to a certain extent and providing psychological comfort for DeFi users seeking stable investments. This strategy helps strengthen the overall risk resistance of the Lumi Finance ecosystem, as it ensures that even during market fluctuations, the value of LUA will not fall below a certain point. However, this design may limit the appreciation potential of the LUA token in a rapidly rising market, as the buying pressure based on the minimum price may slow down the price increase. It is important to note that this price floor comes from the cash reserve formed by transaction fees, resulting in greater friction in LUA trading and encouraging users to hold for the long term rather than trade frequently.

8) On the other hand, by allowing LUA holders to stake and mint LUAUSD, and then purchase more LUA or stake again, Lumi Finance has created a self-reinforcing cycle. Users can amplify their market influence through leveraged operations, increasing the demand for LUA and further driving up the price. However, this leverage effect is a double-edged sword, as it may amplify profits in a bullish market but also losses in a bear market. Therefore, the stability of this system largely depends on the overall market conditions and user risk management. In addition, as users may tend to lock tokens for the long term to earn more profits, the circulating supply of tokens may decrease, raising the token price while also increasing TVL.

In summary, the token economic system of Lumi Finance seems to be designed to maximize positive feedback, aiming to create a self-driven cycle of value appreciation through interactive strategies. The minimum price provides a safety buffer, while staking and leverage mechanisms increase market activity and drive price increases. Only by continuously introducing new users to the game can this system continue to rotate and maintain its upward momentum. Join Ponzi and embrace Ponzi.

Official website: https://t.co/rsYKjJi1Px

Game entrance: https://t.co/XjFHRl9qkX

Ho sir has written a simple purchasing tutorial for everyone: https://t.co/biaIPJXskp

If you like it, please give us a like and share, and don't miss out on more information by opening the notification bell.

lua #lumiterra

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。