On the afternoon of January 18th, AICoin researchers conducted a live graphic and text sharing of "Spot BTC ETF Information" in AICoin PC End-Group Chat-Live. Here is a summary of the live content.

I. What is an ETF?

"Exchange Traded Fund" (ETF) is a type of open-end index securities investment fund that tracks the changes of the "underlying index" and is listed and traded on a stock exchange. Investors can buy and sell "underlying index" ETFs as easily as stocks and achieve returns similar to the index.

ETF is a special type of open-end fund that combines the advantages of real-time trading of closed-end funds. Investors can buy and sell ETF shares in the secondary market just like closed-end funds or stocks. Additionally, ETF also has the advantage of open-end funds, allowing investors to subscribe or redeem ETF shares like open-end funds.

ETFs are usually managed by fund management companies, with the fund's assets being a basket of stocks. The types and proportions of stocks in the basket are consistent with the constituent stocks of a specific index (such as the SSE 50 Index).

Currently, ETFs are classified into several types based on the asset type or operation mode of the investment target, including stock ETFs, bond ETFs, cross-border ETFs, commodity ETFs, and exchange-traded currency funds. Common examples include the SSE 300 ETF, CSI 500 ETF, NASDAQ 100 ETF, S&P 500 ETF, and Gold ETF. Spot BTC ETF can be considered a commodity ETF.

For example, if there is a "Cake Index" consisting of flour, sugar, walnuts, sesame, etc., a fund company can create a Cake Index ETF to track the changes in this index.

Example: "ARKK," a very famous ETF under the female stock guru "Catherine Wood" (Catherine Wood). It contains dozens of different stocks with different weights, including familiar names such as Coinbase and Block (a payment company created by Twitter founder Jack Dorsey).

Viewing methods: ETF data is already available on AICoin and can also be viewed on Yahoo Finance and Google Finance.

Spot BTC ETF data is now available for viewing, and here are their codes: FBTC, BTCO, BTCW, ARKB

II. What is the impact of Spot BTC ETF?

Trillion-dollar asset management giant BlackRock will bet on it, and other asset management giants such as Franklin Templeton, Fidelity, and JPMorgan's follow-up indicate that traditional funds are pouring into the crypto market, bringing incremental funds and users. It can also be seen as a compromise between regulation and crypto, signaling the legalization of crypto asset industry.

Based on the 2023 data for major asset classes, Bitcoin's return is much higher than the Nikkei 225 and the S&P 500. Similarly, its volatility is also high, far exceeding traditional asset classes such as stocks and bonds. The transition of crypto from speculation to application is a gradual process for the realization of the decentralized concept.

Practical value: Spot BTC ETF increases the accessibility and liquidity of BTC, allowing for diversified asset allocation and increased risk-return.

As of January 17th, the AUM (assets under management) of Spot BTC ETF has exceeded $30 billion. Grayscale's AUM exceeds $28 billion, and the main short-term pressure currently comes from Grayscale.

(1) Due to Grayscale's high fees, some investors are rebalancing and choosing ETFs with more favorable fees. Institutional investors are choosing closely related Spot BTC ETFs.

(2) ARK has abandoned Grayscale and chosen its own ARKB.

On December 28th, ARK Invest sold all of its remaining GBTC positions (a month ago, GBTC was still ARKW's largest holding); on December 28th, ARK Invest used about half of its funds to purchase ProShares Bitcoin Strategy ETF (BITO) shares worth about $100 million; on January 17th, ARK Invest bought $15.89 million worth of ARK 21Shares Spot Bitcoin ETF and sold $15.84 million worth of ProShares Bitcoin Strategy ETF.

(3) After the approval of Spot BTC ETF, investors are expected to take profits.

(4) Recently, Grayscale has been transferring funds crazily to Coinbase, with outflows of funds from Grayscale GBTC and continuous selling pressure.

III. How to use AICoin's features to explore the relevant indicators of Spot BTC ETF?

1. Stock price comparison K-line: COIN (exchange), MSTR (BI, heavy BTC position), MARA (Bitcoin mining company)

(1) The yellow line represents BTC, and the blue line represents the stock target.

Coinbase is a US-based crypto exchange that went public on NASDAQ in 2021 and is the most compliant CEX with over 100 million users. The US SEC has approved 11 Spot BTC ETFs, 8 of which are in partnership with Coinbase.

(2) MicroStrategy, founded by Michael Saylor, is a fervent BTC believer who started buying BTC in mid-2020 and has accumulated about 174,530 BTC, worth about $7.65 billion, by December 2023.

MicroStrategy's market value is $8.5 billion.

(3) Marathon Digital Holdings, a Bitcoin mining company, achieved a record BTC production of 1,853 BTC in December and is expected to produce 12,852 BTC in 2023.

Overall, Coinbase's trend is more closely related to BTC. From a business perspective, most applicants for Spot BTC ETF have chosen Coinbase as the custodian. Combined with the exchange's business, Coinbase has a higher association with the crypto market. Additionally, as a listed company, Coinbase has better risk control, financial auditing, and external regulation.

2. Spot BTC ETF Data

AICoin has now launched Spot BTC ETF data, and the price trend of Spot BTC ETF is more closely related to the trend of Spot BTC, better reflecting price changes.

AICoin's PC end multi-window feature allows for different K-line charts to be set, as well as different indicators, periods, and styles, creating personalized viewing templates. The multi-window feature supports displaying up to 9 K-line charts simultaneously (non-PRO users can display 4 K-line charts). Click here to upgrade to the PRO version of K-line

3. News Flash

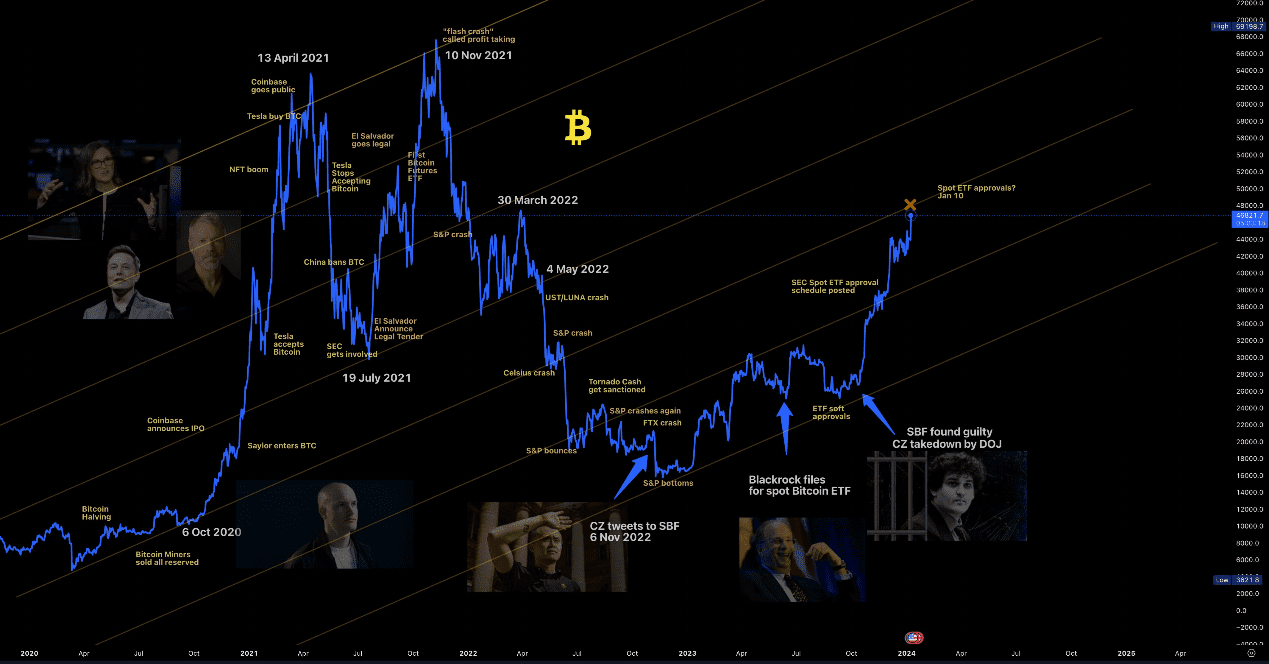

(1) From the perspective of event-driven analysis, the first story (Spot BTC ETF) has now concluded.

December 18, 2017: Bitcoin futures products under the Chicago Mercantile Exchange (CME) were officially launched.

November 12, 2022: FTX bankruptcy.

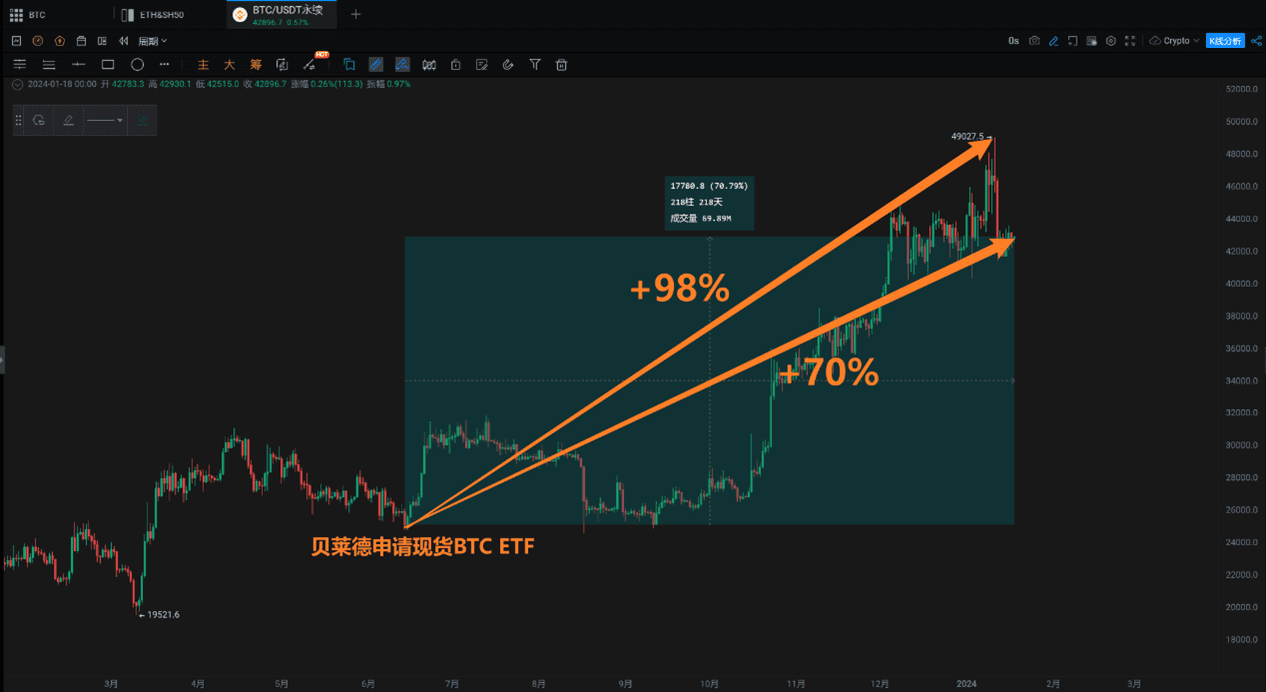

June 15, 2023: BlackRock applied for Spot Bitcoin ETF with the US Securities and Exchange Commission (SEC).

January 11, 2024: The US Securities and Exchange Commission (SEC) approved the listing of Spot Bitcoin ETF.

(2) Currently, about 90 days after the BTC halving, based on the current trend of hash rate growth, mining difficulty will continue to increase, objectively suppressing BTC output (reduced output - increased mining difficulty - price increase).

(3) Other supplementary explanations

Bitcoin Spot ETF directly holds Bitcoin as the underlying asset, meaning the performance of Spot ETF is directly related to the real-time value of holding Bitcoin. When investors buy Spot ETF, they are essentially buying Bitcoin without physically holding it.

The buying and selling in the primary and secondary markets are different. In the secondary market, you are only buying shares of Spot BTC ETF. The fund company and custodian buy BTC from the counterparty and sell shares to you. When investors redeem from Grayscale, Grayscale has to give money to the investors. If Grayscale doesn't have it, they will operate on the held Spot BTC.

IV. How to participate in the Spot BTC ETF market?

Open a US stock account and directly purchase Spot BTC ETF.

Trade BTC spot or futures on a CEX, which requires paying CEX fees.

Trade stocks or ETFs of BTC-related listed companies.

The multi-window feature supports displaying up to 9 K-line charts simultaneously for K-line comparison to understand the price trend (non-PRO users can display 4 K-line charts). Click here to upgrade to the PRO version of K-line

Recommended Reading

Mastering the MA Indicator, Embarking on the Road to Financial Freedom

Simple and Effective Profit-Making Methods: Practical Techniques for Signal Alert Strategies

Mastering the EMA52 Moving Average, Winning the Investment Battlefield

For more live content, please follow AICoin's "News/Information-Live Review" section, and feel free to download AICoin PC End.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。