“Player liquidity will soon become a scarce and highly valuable resource... Strong Web3 communities can become low-cost brand ambassadors, significantly increasing reach and revenue once their attention has been effectively captured.”- 𝐓𝐡𝐞 𝐘𝐞𝐚𝐫 𝐀𝐡𝐞𝐚𝐝 𝐟𝐨𝐫 𝐆𝐚𝐦𝐢𝐧𝐠 𝟐𝟎𝟐𝟒.

Our Year Ahead for Gaming 2024 provides a Comprehensive Deep-Dive into the following Topics:

𝐓𝐡𝐞 𝐘𝐞𝐚𝐫 𝐒𝐨 𝐅𝐚𝐫.

🔷 Recap of 2023 analyzing Key Metrics, notable Projects, and Industry Interest being at ATHs.

🔷 Thorough Review of Blockchain Game Funding.

𝐊𝐞𝐲 𝐓𝐡𝐞𝐦𝐞𝐬 & 𝐅𝐮𝐭𝐮𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐬.

𝑻𝒐𝒑𝒊𝒄 1: 𝑴𝒐𝒃𝒊𝒍𝒆 𝑴𝒂𝒓𝒌𝒆𝒕𝒔:

🔷 Mobile Gaming: Analysis of Growth, Monetization Models & Blockchain Integrations, Dominance of RPGs, and Emergence of Nano-Transactions as a New Business Model.

🔷 Asia Primed for Growth: Dissecting Key Drivers for Dominance of the Asian Market as a Predominantly Mobile-First Gaming Region.

𝑻𝒐𝒑𝒊𝒄 2: 𝑻𝒉𝒆 𝑭𝒊𝒈𝒉𝒕 𝑭𝒐𝒓 𝑷𝒍𝒂𝒚𝒆𝒓 𝑳𝒊𝒒𝒖𝒊𝒅𝒊𝒕𝒚

🔷 War over Player Liquidity: Deep-Dive into the Competitive Landscape analyzing Gaming-Specific Networks, On-Chain Activity, and predicted Outcomes

🔷 Play-to-Airdrop: Key Narrative & Catalyst for the Gaming Airdrop Meta.

𝑻𝒐𝒑𝒊𝒄 3: 𝑭𝑶𝑪𝑮 𝑶𝒇 𝑻𝒉𝒆 𝑭𝒖𝒕𝒖𝒓𝒆

🔷 Comprehensive Review of Key Benefits & Challenges for Fully On-Chain Games comparing Infrastructure Options on @Optimism, @Starknet, and @arbitrum.

🔷 Future Outlook: Challenges to Overcome, Potential Value Capture, and Web3 Games to Study.

𝑻𝒐𝒑𝒊𝒄 4: 𝑬𝒎𝒆𝒓𝒈𝒊𝒏𝒈 𝑻𝒓𝒆𝒏𝒅𝒔

🔷 Deep-Dive into Telegram Crypto Gaming.

🔷 The Future of AI Gaming: A Key Vertical for Disruption.

🔷 New Blockchain Advancements: Account Abstraction, Session Keys, MPC Wallets, and more.

𝑻𝒐𝒑𝒊𝒄 5: 𝑯𝒊𝒈𝒉-𝑷𝒐𝒕𝒆𝒏𝒕𝒊𝒂𝒍 𝑷𝒓𝒐𝒋𝒆𝒄𝒕𝒔

🔷 Deep-Dive on @HYTOPIAgg: A Minecraft-Inspired Open-World UGC platform with Quality-of-Life Upgrades.

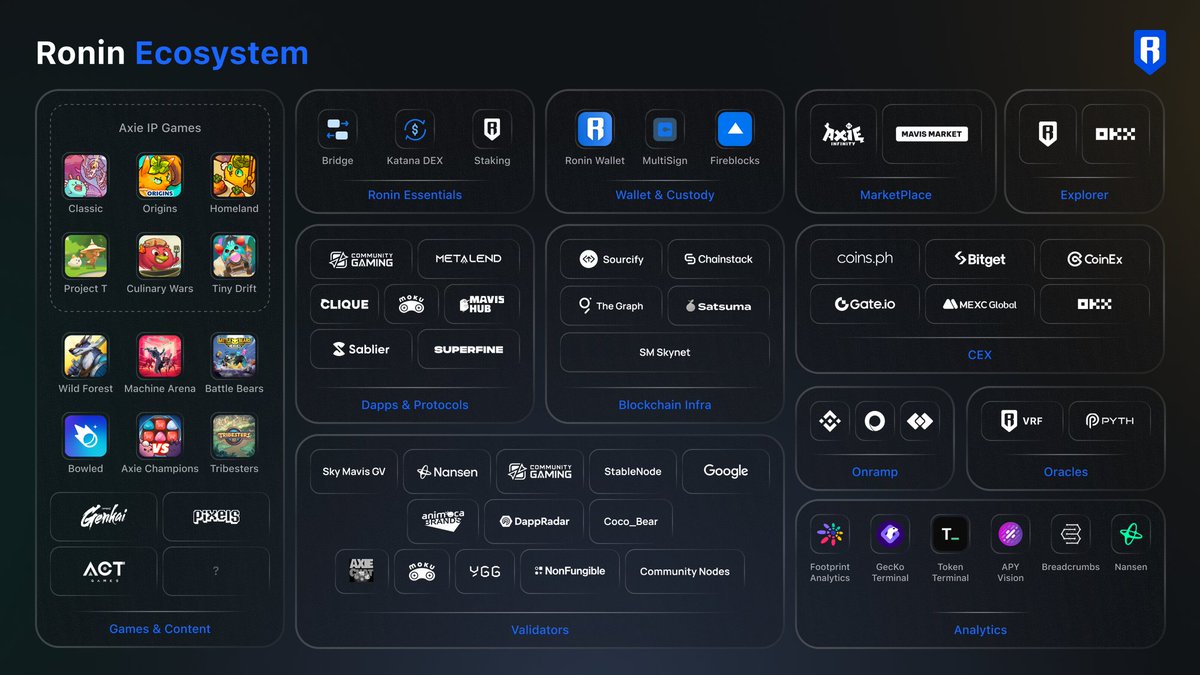

🔷 @Ronin_Network: A Case Study of well executed Player Liquidity.

🔷 The State of AAA Web3 Gaming: Deep-Dive into the most anticipated Blockchain Games.

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧

🔷Our Thoughts on Emerging Trends and Sticky Challenges.

𝐀𝐧 𝐄𝐱𝐜𝐞𝐫𝐩𝐭 𝐟𝐫𝐨𝐦 𝐓𝐨𝐩𝐢𝐜 𝟓: 𝐇𝐢𝐠𝐡-𝐏𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥 𝐏𝐫𝐨𝐣𝐞𝐜𝐭𝐬 👇

“@Ronin_Network’s core value proposition remains the same. A gaming-focused community of active and sticky users that can be funneled to any one of Ronin’s ecosystem products (with the help of some financial incentives). The same can’t be said for many of the other leading blockchain networks.

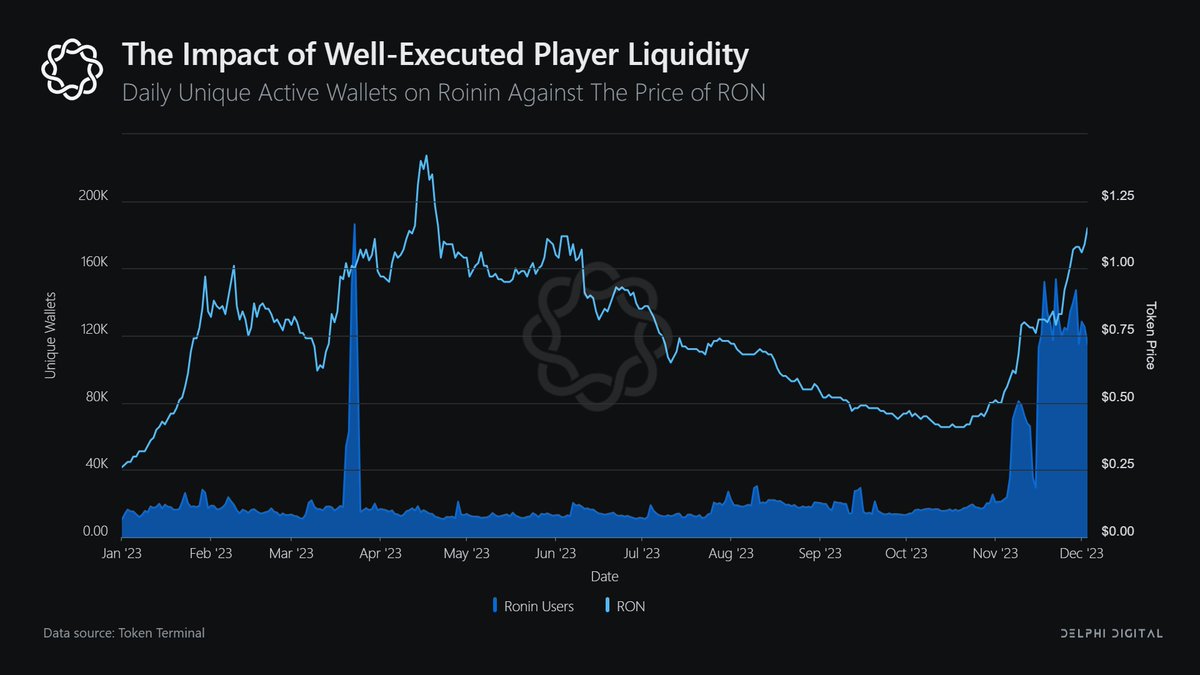

𝐈𝐧𝐜𝐫𝐞𝐚𝐬𝐞𝐝 𝐌𝐚𝐫𝐤𝐞𝐭 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭.

Ronin saw an increase in on-chain wallet addresses of more than 600% between early November and December 2023. The significant growth in KPIs is a testament to increased market interest although it’s difficult to determine how many of these approx. 140k new wallets are genuine users.

The Migration of @pixels_online to Ronin was a large contributing factor to this renewed interest making it likely that onboarded users were farming the $PIXEL token airdrop.

Nevertheless, Ronin's core value proposition remains unchanged: A community centered around gaming, comprising engaged and committed users who can be directed towards any of Ronin's ecosystem products, aided by financial incentives. This distinct characteristic sets Ronin apart from several other prominent competitors.

𝐓𝐡𝐞 𝐁𝐮𝐥𝐥 𝐂𝐚𝐬𝐞.

“The bull case for Ronin is that it is able to onboard more in-demand gaming content and provide this content with its first golden cohort of true fans. Games can then leverage this core user base as brand ambassadors to efficiently scale.”

Ronin's robust and attractive offering aligns seamlessly with the advocacy for player liquidity in the current market. This positions Ronin as a prime contender for projects actively seeking an infrastructure partner with an engaged user base.

Considering Ronin's current value proposition, the platform stands well-positioned to capture the next @AxieInfinity.

With a market cap of ~ $490m, $RON has ample room to grow compared to competing chains. For perspective, ecosystems such as @GoGalaGames and @Immutable have market caps of ~ $790m and $2.5b, respectively.

𝐓𝐡𝐞 𝐁𝐞𝐚𝐫 𝐂𝐚𝐬𝐞.

Ronin fails to maintain a balance between onboarding new players and onboarding new games. If Ronin’s player liquidity becomes diluted, the platform loses one of its key competitive advantages.

Overreliance on financial incentives poses additional risk. The more Ronin leans into extractive user behavior, the more harm can be caused in an early-stage game. In addition, financially incentivized players will easily churn. And a volatile player base is a daunting thought for any development team.

Concerns also arise from a substantial portion of the token supply yet to be unlocked, coupled with relatively low token utility compared to competing ecosystems. Additionally, Ronin faces competition from various projects addressing the same issues of player liquidity, including Ready Games, GameSwift, GuildFi, YGG, Treasure, and XPLA, potentially diluting its market position.

Lastly, a snippet from last year’s gaming coverage unveiling emerging opportunities and pointing out trends early 👇

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。