Original Author: Money Bunny

Original Compilation: Deep Tide TechFlow

Pyth Network has previously confirmed airdrops, and this is just the beginning.

Due to the nature of oracle projects, other projects often use Pyth's oracle price feed, which also creates space for joint marketing activities.

This article will explore the projects that may receive airdrops by staking $PYTH.

What is Pyth Network?

Pyth network is the first-party financial oracle network, aimed at publishing continuous real-world data to the chain in a tamper-resistant environment.

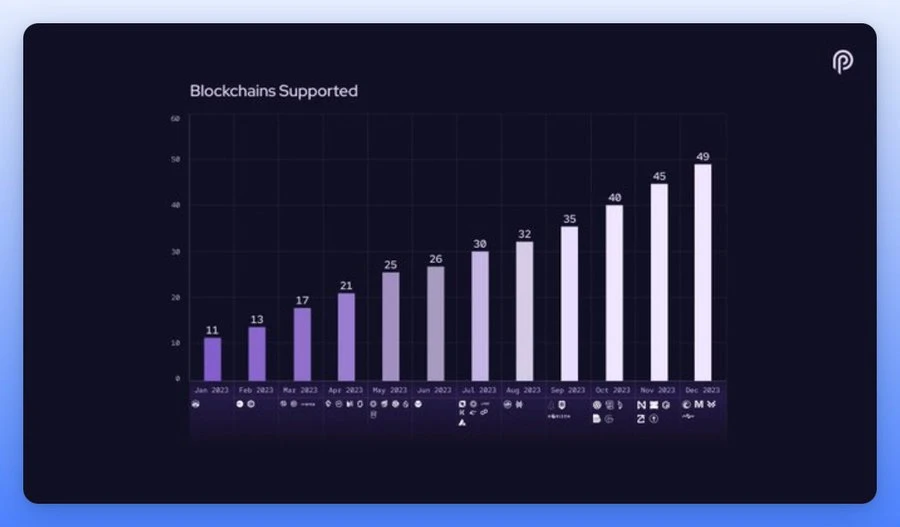

Despite being launched not long ago, Pyth network has already covered over 400 Price Feeds, 290+ dApps, and 49+ blockchains.

Token $Pyth

The total supply of $PYTH is 10 billion tokens, and this total supply will not increase. In addition, 85% of the tokens were initially locked by the contract.

$PYTH data:

Current price: $0.336

All-time high: $0.56

Market cap: $503.91 million

Where to Stake?

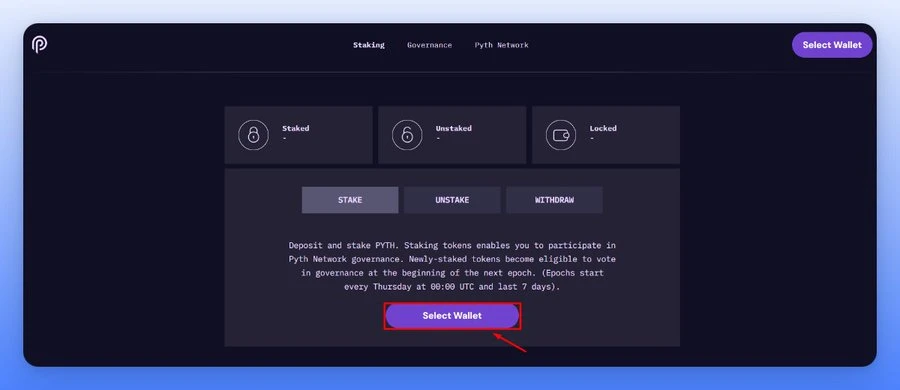

The token is on the Solana network, click here for the staking address.

In addition, users can participate in Pyth Dao's voting, click here.

Staking tokens allows you to participate in Pyth network governance. Newly staked tokens are eligible to vote in the next epoch (Epoch) start. (Epoch starts at 00:00 UTC every Thursday and lasts for 7 days).

If you want to rank in the top 10-20% of all stakers, it is recommended to stake at least 1,000 $PYTH or more (approximately $336).

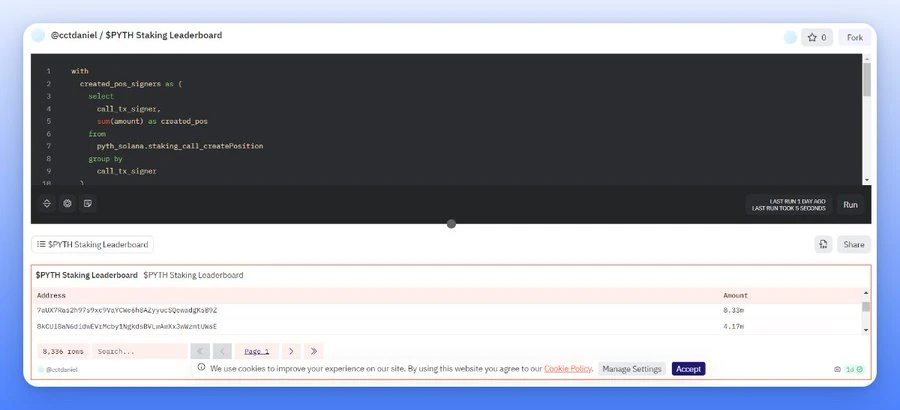

Users can check the scores obtained from staking on the Dune dashboard, click here.

Upcoming Airdropped Projects

1. Monad (Raised $19 million)

Monad is a high-performance Ethereum-compatible L1 that enhances decentralization and scalability.

They completed a $19 million seed round financing led by Dragonfly, with participation from institutions such as Lemniscap and Placeholder.

2. Zeta Markets (Raised $8.5 million)

Zeta Markets is a DeFi derivatives platform that offers the speed and user experience of centralized exchanges and achieves self-custody and transparency on Solana.

Zeta Markets completed an $8.5 million financing led by Jump Capital, with participation from Race Capital, Electric Capital, and DACM.

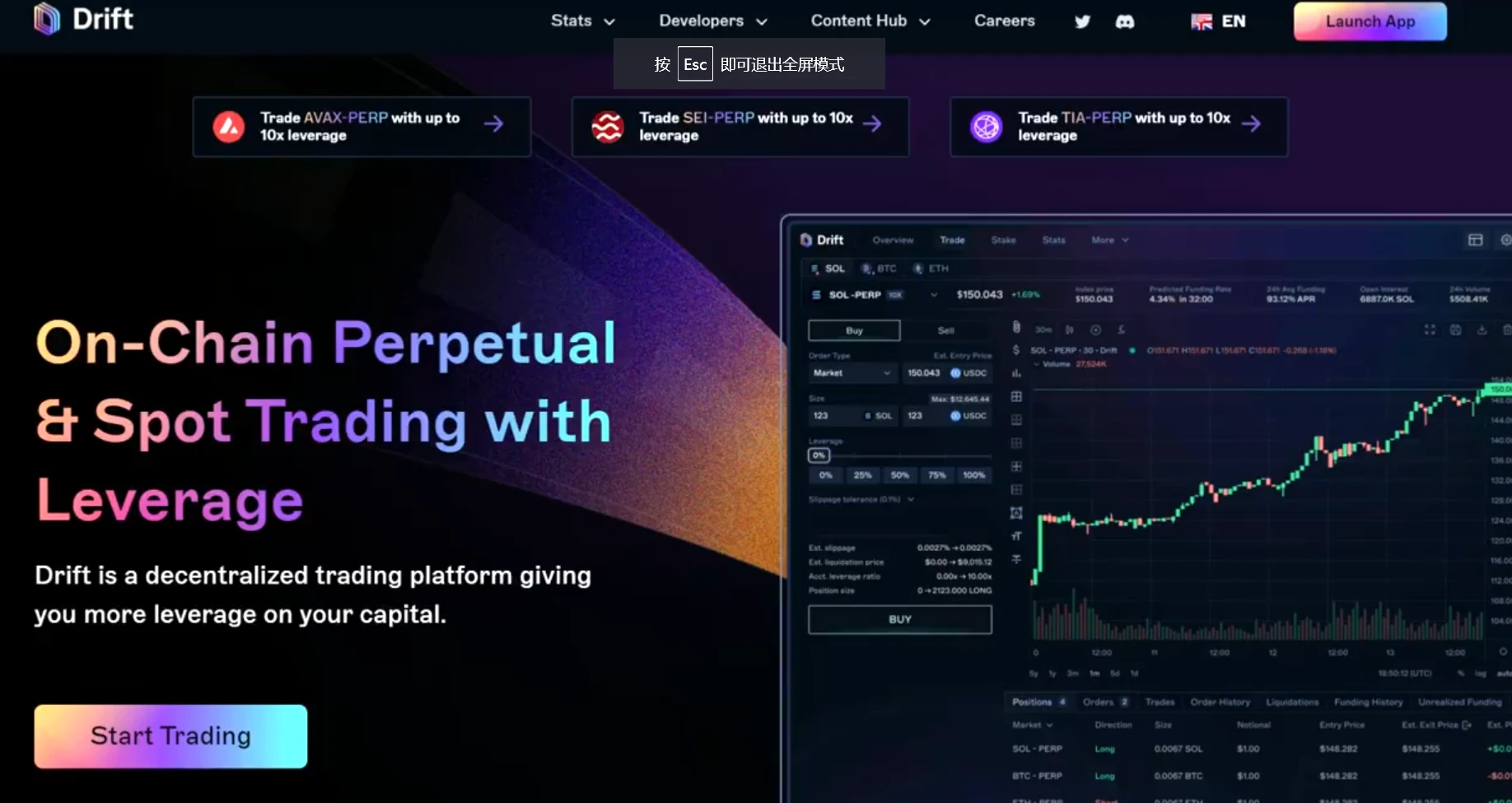

3. Drift Protocol (Raised $3.8 million)

Drift Protocol is a decentralized perpetual contract exchange based on Solana.

They successfully raised $3.8 million in a round of financing led by Multicoin Capital, with participation from Jump and Alameda.

4. Polynomial (Raised $1.1 million)

Polynomial is a decentralized derivatives trading platform supported by the Synthetix protocol.

Polynomial Protocol raised $1.1 million in seed funding, led by Acrylic, with follow-on investments from Caballeros Capital, GenBlock Capital, and other institutions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。