Ten thousand words review of the major events and 10 predictions in the 2023 Polkadot ecosystem development journey.

Author: Polkadot Labs

Web3 is another evolution of the current Internet, bringing about many changes and impacts. As an important player in Web3, Polkadot's technological updates and important processes are often closely related to the development of the Web3 industry. Therefore, this issue of the "Polkadot Major Events" section is launched to provide an interpretation of the latest developments and trends of Polkadot, helping everyone grasp the development trends of Polkadot.

Background

October 2023 is bound to be an important time node in the next one or two years. The Federal Reserve has shifted from hawkish to dovish and hinted at a pause in rate hikes, triggering a "dry onion" market for BTC, and laying the groundwork for the ongoing small bull market.

According to Coingecko data, the global market value of Crypto has increased by over 100% from over 830 billion US dollars at the beginning of 2023 to the current 1.7 trillion US dollars. There is a high probability that the market will take another step up with the approval of the spot BTC ETF, which will also be an important event at the beginning of 2024.

Compared to the ups and downs of the Crypto market in 2022, 2023 was mainly characterized by relative stability. However, there were still many noteworthy events in the past year, from the bankruptcy of Silicon Valley Bank to the conviction of SBF, and CZ's temporary departure from Binance, as well as various regulatory issues throughout the year. The market seems to bid farewell with a different voice, but the future is still bright.

Polkadot returned to the public eye due to a good rise just over half a month ago. However, this was only a market reaction. In fact, the Polkadot ecosystem has had many commendable aspects in the past year, but the uneventful market has not brought it much attention until recently.

As a research institution that has been focusing on Polkadot and its ecosystem for several years, we (Polkadot Ecological Research Institute) have also released the Polkadot Annual Development Report for three consecutive years. Although the past 2023 cannot be described as eventful, new concepts are still emerging, and new stories are still unfolding. Therefore, it is an interesting and hopeful thing to observe the development of the Polkadot ecosystem through these narratives and share trends. Considering that the Parity data team has already released detailed reports on various events, we will share the review and outlook of Polkadot in 2023 and the beginning of 2024 in two major sections. Enjoy the following.

Review of Important Events in 2023

The past year can be described as a year of reflection, turning points, and innovation. As observers of the Polkadot ecosystem, we not only need to pay attention to the development of Polkadot itself, but also observe the development of the entire Crypto industry, as well as macro policies that affect the Crypto industry. Therefore, we have summarized several trends in the past year, including major events in the Polkadot ecosystem, their impact on the entire industry, and events related to chains, to summarize 2023.

1. Ethereum's Layer2 Upgrade is Hot

Ethereum, as a giant in the blockchain industry, plays an undeniable role.

In the past year, Ethereum's Layer2 upgrade became a market focus. The Arbitrum project successfully launched its native governance token ARB in March and held the most generous airdrop in history. In addition to competing with another major Ethereum Layer2, Optimism, Arbitrum attracted a lot of attention through strict airdrop rules and anti-whale strategies.

At the same time, on April 12, Ethereum officially completed the Shanghai upgrade, causing a sensation in the market. In the previous consensus mechanism upgrade, Ethereum transitioned from Proof of Work (PoW) to Proof of Stake (PoS), where validators need to stake 32 ETH to participate in block validation. This also means that the staked ETH and rewards will be locked for two years until the implementation of the Shanghai upgrade.

The Shanghai upgrade allowed users to withdraw staked ETH, unlocking over 16 million ETH. Contrary to expectations, the market did not experience a sell-off, but instead saw a price surge, and market attention soared. The significance of the Shanghai upgrade lies not only in unlocking staked ETH but more importantly in promoting the decentralization process of the Ethereum network, heralding the start of the DeFi 2.0 era, and marking a new milestone for "finance as a service."

With the advancement of the Cancun upgrade plan, expected to be implemented between March and April 2024, Ethereum will further improve transaction response speed and reduce transaction fees, creating favorable conditions for the development of new data storage and retrieval capabilities in the new phase. This series of upgrades is undoubtedly good news for the Ethereum Layer2 network and may once again drive market innovation.

2. Polkadot 1.0 Officially Delivered, Polkadot 2.0 Proposed

Looking back at the Polkadot ecosystem, in July last year, the Polkadot official announced the delivery of Polkadot 1.0 and achieved all the functions planned in the white paper since 2016. This version broke the silo effect between different blockchains by introducing innovative technologies such as parallel chains and relay chains, making Polkadot an open and interconnected platform.

Through cross-chain message passing, token staking, on-chain governance, and forkless upgrades, Polkadot 1.0 provided a strong infrastructure for the development of a multi-chain ecosystem and the construction of Web3. To enhance Polkadot's network governance and security sharing, dispute slashing and Polkadot OpenGov governance were also launched in the second half of the year as upgrades to Polkadot 1.0.

Of course, in the rapidly developing and changing industry, Polkadot also realized the need for more innovation and adaptability. Therefore, at the Polkadot Decoded 2023 event in June, Dr. Gavin proposed Polkadot's 2.0 version - "Polkadot is a multi-core computer."

This proposal marks Polkadot's pursuit of higher performance and a more flexible ecosystem. Through the concept of Coretime, Polkadot 2.0 will bring a new way of resource allocation, addressing some issues in version 1.0, such as the high threshold for slot auctions and the lack of consumption scenarios for DOT.

The block space of Polkadot, namely the block space of the relay chain, will become a valuable resource, and Coretime provides the possibility for its reasonable allocation. This flexibility provides more possibilities for the future ecosystem of Polkadot, allowing developers and users to more freely utilize Polkadot's core.

3. Rise of Chain Development Tools, Multi-chain Ecosystem Becomes Mainstream

With the continuous progress of the underlying architecture of blockchain, 2023 also saw a frenzy of chain development tool releases.

As early as October 2022, Optimism introduced the OP Stack concept, becoming the first to propose L2 Stacks products for Layer2 networks. In March last year, Arbitrum launched Arbitrum Orbit; in June, zkSync released ZK Stack for building ZK Rollup chains.

Subsequently, Starknet announced the launch of the Starknet Stack, a component tool dedicated to custom application chains (Appchains), at the Paris EthCC conference in July. Polygon also launched the Polygon CDK, a cross-chain development kit for developers to build zkEVM L2 networks, in August. This series adopted standardized, modular technical architecture stacks, providing developers with the ability to build blockchain networks more quickly.

Currently, the mainstream L2 Stack solutions in the market are mainly divided into the Optimistic Rollup series (OP Stack) and the ZK Rollup series (ZK Stack). The OP Stack plans to build a superchain (Superchain) empire, with a standardized underlying architecture and shared security, while the ZK Stack series uses zero-knowledge proof algorithms. The main difference between the different Stack solutions lies in their openness and expansion strategies.

Unlike the OP Stack's focus on building a unified and standardized superchain, the multi-chain architecture of Polkadot introduces a more flexible concept. For example, each chain in the Polkadot ecosystem introduces new consensus algorithms, and each chain can have its own set of validators. Cross-chain information relies on relay chains or the IBC protocol for transmission. Although this approach adds some complexity, it also makes the entire Polkadot ecosystem more diverse.

The explosive rise of chain development tools means that Layer2 networks are no longer limited to the development of a single chain. The market is also shifting from competition in the number, variety, and prosperity of applications in the initial on-chain ecosystem to a more open multi-chain platform.

The future will focus on building a multi-chain ecosystem, which involves interconnection and parallel development of multiple chains. This undoubtedly presents an opportunity for Polkadot to further expand a more open and flexible multi-chain ecosystem.

4. Introduction of Modularization Concept

The modular blockchain concept gained widespread attention in the industry in 2023, especially after Celestia's large-scale Genesis airdrop in late September. Celestia is the first public chain to emphasize the modular blockchain concept, and its airdrop covered 7579 developers and over 570,000 on-chain addresses, sparking renewed market interest in modular blockchain.

Previously, in October 2022, Celestia completed a $55 million financing at a valuation of $1 billion and encouraged innovative development in the field through the establishment of the Celestia Modular Fellows program. According to the latest data from the crypto data platform RootData, there are currently over 30 modular blockchain concept projects, including EigenLayer, Saga, and Fuel, with nearly 10 projects already receiving investments from well-known institutions.

The concept of modular blockchain originated from a reflection on traditional monolithic blockchain architectures, especially in response to the blockchain trilemma. The concept was first mentioned in a white paper co-authored by Mustafa Albasan and Vitalik in 2018, with the aim of addressing scalability, flexibility, maintenance, and update issues.

From an application perspective, modular blockchain improves system scalability, maintenance, and financial efficiency, better adapting to the constantly changing market demands.

For Polkadot, as a multi-chain ecosystem, the adoption and development of the modularization concept are particularly important. Polkadot's design philosophy inherently includes modular features, achieved through different parallel chains for multi-chain collaboration. In this context, the rise of modular blockchain aligns with the development of the Polkadot ecosystem.

5. Emergence of Inscriptions and Fairlaunch Trend

In 2023, the digital asset field witnessed the emergence of the noteworthy concept of inscriptions, becoming the focus of the industry and sparking intense debates about whether it is a technological hype or a valuable innovation. The rise of inscriptions is mainly attributed to the protocols in the BTC ecosystem, with ORDI, represented by the Ordinal protocol, once leading the inscriptions race.

Specifically, the popularity of inscriptions can be traced back to early 2023. ORDI completed minting on March 9, and although it did not initially attract widespread market attention, with the rise of the BRC20 ecosystem, ORDI's performance gradually gained market attention.

It was not until November 7, 2023, when Binance announced the listing of the ORDI trading pair, that the counterattack of BTC inscriptions truly began. ORDI once surged to over $90, from a minting cost of less than 1 cent to achieving a thousand-fold increase in less than 300 days. Meanwhile, SATS, as the second-in-command of the BTC inscription protocol, reached a market value of $1.137 billion after being listed on Binance on December 12, even surpassing ORDI's market value at one point.

The performance of ORDI and SATS ignited the concept of inscriptions, prompting other chains to launch their own inscription protocols, such as eths for Ethereum, sols for Solana, AVAV for Avalanche, and the Polkadot community also introduced the Polkadot inscription DOTA.

The success of inscriptions is not just a new form of asset, as smart contract chains inherently have the ability to issue assets. Behind the rise of inscriptions, the more important aspect is the concept of fair launch. Taking ORDI as an example, its issuance model avoids pre-mining and private placement, distributing tokens equally to community members, which has sparked widespread community participation. This fair launch model has also to some extent driven the popularity of the inscription concept.

Although the controversy about the value of inscriptions continues, innovators will only move forward, and inscriptions will bring more possibilities.

6. Awakening of the BTC Ecosystem

At the end of 2023, the BTC ecosystem once again experienced a nearly two-month-long frenzy, propelling some ecosystem projects built around BTC onto the stage and rising in the heat.

This can be traced back to the Bounce platform. Bounce is a decentralized DeFi auction protocol that was already listed on Binance before the rise of the Ordinals ecosystem, and has successfully launched several projects that have attracted significant market attention.

After the explosion of the BRC20-based inscription concept, Bounce quickly adjusted its strategy and actively embraced the BTC ecosystem. One of the projects launched, BitStable, a decentralized asset protocol for the BTC network, uses a mechanism similar to MakerDAO, allowing anyone to build stablecoins using BTC-related assets. Additionally, the cross-chain bridge MultiBit, based on BTC and Ethereum, was also launched on Bounce. With the popularity of inscriptions, these BTC ecosystem applications have also risen, establishing the reputation of Bounce.

It is worth noting that MultiBit was actually launched on the TurtSat platform. TurtSat is a community-led open platform for the Ordinals, supporting anyone to build, donate to, and benefit from the development of the Ordinals ecosystem through TurtSat.

Since its launch, the TurtSat platform has successfully launched multiple projects, including the BRC20 asset protocol CHAX, the Ordinals aggregation platform NHUB, the Ordinals lending platform DOVA, and the BTC ecosystem gaming platform RAIT. These projects are early BRC20 infrastructure construction platforms and have performed well after launch.

The innovation of inscriptions has attracted a large amount of funds and users to BTC, stimulating the rapid development of BTC ecosystem applications and filling the ecological gap of BTC. The BTC ecosystem is gradually awakening, embarking on its path to dominance like a just-awakened lion.

7. The Hot Trend of DePIN Concept

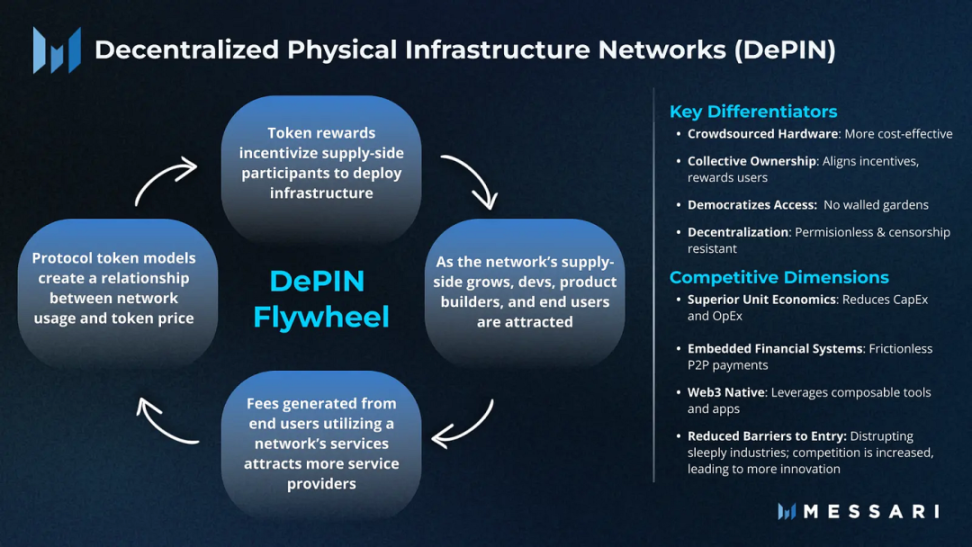

Another hot trend in the crypto narrative in 2023 is the concept of DePIN, which stands for Decentralized Physical Infrastructure Network.

The term DePIN was first proposed by Messari at the beginning of the year and was formally defined through the research report "The DePIN Sector Map," outlining the basic landscape of this concept. The core goal of DePIN is to deploy physical infrastructure and hardware networks in the real world through cryptographic economic protocols, using blockchain incentive mechanisms to drive the collaborative construction of this network by various participants.

In 2023, with the development of AI technology, the DePIN concept has further gained momentum, currently covering several categories including computing markets, wireless WiFi, wholesale data, service markets, vertical advertising, and energy.

The popularity of DePIN intensified around October of last year, with representative DePIN concept tokens such as the decentralized hotspot Helium Mobile and the automotive data network DIMO experiencing a surge in attention. At the same time, infrastructure solutions such as Render, leveraging GPU computing power, also began to emerge.

The hot trend of the DePIN concept has not only attracted widespread attention in the industry but has also been observed in many actively developing DePIN projects within the Polkadot ecosystem. For example, as AI gained traction in 2023, decentralized AI gradually entered the public eye, and the Polkadot ecosystem's Bittensor project has been dedicated to building a decentralized machine learning network, shining in 2023.

Similarly, peaq network focuses on decentralized energy supply chains. Despite the energy supply chain being considered a challenging aspect of DePIN, peaq aims to address regulatory expenses in the energy industry and promote the development of decentralized energy through blockchain technology and token incentive models.

According to Messari's 2023 DePIN market report, the DePIN market is expected to reach a scale of $35 trillion by 2028. Additionally, in 2024, we will witness the integration of DePIN with other crypto tracks, including deep experiments with new cryptographic foundational components such as AI, Memecoin, zero-knowledge proof (ZK) technology, and on-chain games. This further demonstrates the prospects of DePIN as an innovative direction covering multiple fields.

8. Polkadot Ecosystem Projects Exploring Multi-Chain Development

In 2023, Polkadot ecosystem projects have been actively exploring multi-chain development.

Phala Network brought off-chain computing to the Polygon ecosystem with the Lens Protocol, providing next-generation computing services for Web3 social builders. By leveraging Phala Network's efficient computing and cross-chain capabilities, Lens Protocol has improved the speed of social data processing, expanded data sources and coverage, and created faster and more diverse social experiences for users.

Astar also announced a collaboration with Polygon to jointly launch the Ethereum Layer2 network Astar zkEVM, aiming to become a gateway connecting the Ethereum and Polkadot ecosystems.

Manta Network, a ZK privacy parallel chain based on Substrate, launched the first EVM-compatible ZK (zero-knowledge proof) application platform, Manta Pacific, using the Polygon CDK. Through the data availability of Celestia and the zkEVM technology of Polygon, the platform enables efficient, secure, and scalable deployment and operation of ZK applications.

Parallel Finance collaborated with the Ethereum Layer2 solution Arbitrum to run Parallel's lending services on Arbitrum Rollup through the asset bridge, allowing assets on Ethereum Layer2 to benefit from Parallel's efficiency and low cost.

These collaborations are practical examples of cross-chain communication and interoperability, enhancing the compatibility and openness of the Polkadot ecosystem, and attracting more partners and users to Polkadot. The value and innovation in these collaborations can increase the returns of the Polkadot ecosystem and incentivize more investors and developers to support the Polkadot ecosystem.

9. Continued Strengthening of Regulation

As the crypto industry continues to develop and innovate, regulatory authorities in various countries and regions have strengthened their oversight of the industry over the past year to guard against potential risks and adverse effects. Some centralized exchanges (CEX) have faced stricter regulatory requirements, such as the U.S. Securities and Exchange Commission (SEC) accusing the second-largest U.S. crypto exchange, Kraken, of offering unregistered securities.

Regulatory authorities have also taken other measures, such as requiring user identity information, compliance with anti-money laundering rules, and payment of taxes. These regulatory measures have posed a certain threat to the circulation of some crypto assets, leading to a sharp decline in their prices and market values.

However, not all crypto assets have been affected in the same way, and Polkadot's native token DOT has demonstrated strong resilience in the regulatory storm.

The organization behind Polkadot, the Web3 Foundation, publicly stated that through their three years of communication and cooperation with the SEC, DOT was ultimately recognized as software rather than a security or currency. This means that DOT is not subject to regulatory restrictions by CEX and does not need to pay additional taxes, thereby maintaining its liquidity and value.

From the outset, Polkadot has actively taken measures to make the network more decentralized and resilient. The fact also proves that Polkadot can adapt to different regulatory environments, providing strong support for the development of the crypto industry.

10. Further Decentralization of Polkadot

Polkadot's initial vision was to achieve Web3, which requires Polkadot to be a resilient project, with the key being whether Polkadot is decentralized enough. To achieve this vision, Polkadot continues to advance its decentralized governance and market operations to ensure the security, stability, and innovation of the network. OpenGov and the Decentralized Future Plan are two important initiatives, representing the decentralized thinking and practices of Polkadot in governance and market operations, respectively.

OpenGov is an open decentralized governance platform launched by Polkadot, aiming to simplify and optimize its governance model. It abolishes centralized governance bodies such as the council and technical committee, delegating all decision-making power to token holders through governance referendums.

The Decentralized Future Plan is a funding program launched by the Web3 Foundation, aiming to support and develop innovative projects within the Polkadot ecosystem. The program allocates $20 million and 5 million DOT, covering nine key directions in the technical, ecosystem development, and community sectors. The goal of the program is to cultivate a thriving, self-sufficient Polkadot network, where both for-profit enterprises and non-profit organizations can receive funding support through the program to realize their ideas and contribute to the decentralized future.

With its open, inclusive, and innovative approach, Polkadot is leading the development direction of cross-chain platforms, contributing to the construction of a more free, fair, and sustainable decentralized future. In our report released in October 《万字战略报告丨波卡该如何摆脱增长困境,未来出路究竟在哪?》, we also made many recommendations for Polkadot's governance. Interested friends are welcome to review it.

11. Increased Influence of Polkadot in Traditional Sectors

In the past year, Polkadot's influence in traditional enterprises has further increased. The following are some of the news mentioned in the Polkadot official annual report about enterprises adopting Polkadot technology:

- Zodia Custody announced the provision of institutional custody and staking services on Polkadot.

- Import/export provider Banxa is helping users access Astar parachains through various payment methods and is committed to comprehensive ecosystem integration with Polkadot.

- Energy Web disclosed plans to join Polkadot to help large companies such as Shell, Vodafone, and Volkswagen in their decarbonization efforts.

- Parachain Frequency on Polkadot brought autonomous blockchain-based identity verification to 20 million users on its social media platform MeWe.

- KILT partnered with accounting giant Deloitte to issue reusable digital credentials for KYC identity verification.

- KILT and Deloitte are collaborating with the new ecosystem team Polimec to issue reusable KYC credentials, making global fundraising for digital assets possible.

- The Sovereign Nature Initiative's collaboration with Moonsama will bring data on Kenyan lions into the virtual domain, benefiting conservation efforts in the real world.

- Substrate-based peaq announced the introduction of Tesla into the Polkadot ecosystem through a partnership with the car-sharing startup ELOOP.

Of course, Polkadot's application in traditional sectors is not limited to the above areas, and there are many other possibilities waiting to be explored.

Predictions and Outlook for 2024

2023 seemed more like a year of reflection, turning point, and innovation. It was like the beginning of spring after winter. We believe that the entire industry may usher in a new era in 2024, based on our own judgment of the potential changes in Polkadot itself and the entire industry. The following are our viewpoints, and we welcome your different perspectives and contributions for discussion.

1. Four Key Polkadot Technologies Set to Launch

In his year-end summary for 2023, Polkadot founder Gavin Wood mentioned that Polkadot will welcome four key infrastructure upgrades in 2024: Agile Coretime, On-Demand Parachains, Ethereum Snowbridge, and Kusama Bridge. Here's a brief introduction to these technologies:

Agile Coretime represents the time required for validation and consensus in Polkadot 2.0, which is the scarcest resource in the Polkadot network. In Polkadot 1.0, core time was allocated to parachains through slot auctions. In Polkadot 2.0, core time will be a liquid, tradable, and accumulable asset that can be bought or sold as a fungible asset.

On-Demand Parachains is a more dynamic method of acquiring block space. Instead of acquiring block space through auctions like existing parachains, they are ordered by a collector when needed and send a special extrinsic to Polkadot's relay chain. This allows parachains to flexibly adjust block space usage based on their needs and market changes without incurring high costs for long-term leases.

Ethereum Snowbridge is a trustless bridge that enables interoperability between Polkadot and Ethereum. It is designed to be trustless, universal, and deterministically executed. As a general bridge, Snowbridge supports arbitrary message passing and cross-chain smart contract calls, allowing for not only basic cross-chain asset transfers but also the creation of cross-chain applications.

Kusama Bridge connects Polkadot and its sister network Kusama, aiming to truly link the two ecosystems into a "Dotsama ecosystem." With this bridge, Polkadot and Kusama can share resources, and Kusama can participate in Polkadot network governance as an entity.

These infrastructure upgrades will make the Polkadot network more flexible, efficient, open, and interconnected, collectively driving the development of the Polkadot ecosystem and laying a solid foundation for the future of Web3.

2. Further Developments in Polkadot 2.0

In addition to the four upcoming upgrades mentioned above, there is a fifth technology poised for release, namely Elastic Scaling. Elastic Scaling is a technology aimed at improving the efficiency and scalability of the Polkadot network, including Asynchronous Backing and the Sassafras algorithm.

Asynchronous Backing introduces a pipeline approach that allows validators to process multiple parachain blocks simultaneously. This will double the speed of parachain block production (from 12 seconds per block to 6 seconds per block), resulting in a maximum 800% performance improvement for parachains. Asynchronous Backing will have a significant impact on the overall performance and scalability of the Polkadot network.

Sassafras is a new consensus protocol designed to address forking-related issues commonly encountered in other probabilistic block-producing protocols. Its goal is to establish a unique association between slots and validators in each epoch, ensuring that each slot has only one validator. The protocol ensures the anonymity of validators associated with slots and establishes a binding mechanism between validators and slots.

The implementation of Elastic Scaling technology will bring higher throughput, lower costs, and a better user experience to the Polkadot network, enabling it to adapt to growing demands and complexity. In addition, according to Gavin Wood, Polkadot will also expand DAO primitives in the new year, including new Fellowships, multi-asset treasuries, expanded XCM, and some exciting new primitives currently in development.

Many of these upgrades are set to be rolled out in 2024, making it an exciting year for Polkadot.

3. ETF Revitalizes the Industry

ETF, or Exchange Traded Fund, is a special investment tool that can be traded on an exchange like stocks. Leading financial institutions such as Fidelity and BlackRock, which manage trillions of dollars in assets, have submitted BTC ETF applications to regulatory authorities. A BTC ETF is a fund traded on an exchange that can be used to purchase shares of BTC on compliant exchanges, with its value linked to the price of BTC. Investors can indirectly invest in BTC by purchasing BTC ETFs instead of directly purchasing BTC.

After continuous negotiations between financial institutions and regulatory authorities, the United States, the world's largest capital market, finally approved BTC ETFs on January 11, 2024, marking another significant historic moment for BTC.

The approval of the BTC ETF is likely to boost overall market confidence and attract more institutional investors to enter the BTC market, as ETFs provide a relatively traditional, low-risk, and compliant investment method. The influx of funds is also likely to drive up the price of BTC. Historically, similar events have occurred with the introduction of gold ETFs.

In 2004, the first ETF tracking the price of gold was officially launched (SPDR Gold Shares ETF, code: GLD). The introduction of GLD made it easier for individual and institutional investors to invest in gold without worrying about the storage and insurance of physical gold. Subsequently, the price of gold rose from around $400 per ounce in 2004. Of course, the price increase cannot be entirely attributed to the introduction of GLD, but the existence of GLD undoubtedly increased market attention to gold and enhanced its investability.

Similarly, as digital gold, BTC shares some similarities with gold in certain aspects, and the launch of the BTC ETF is likely to follow a similar path to the gold ETF. As a benchmark for crypto, BTC is also likely to lead the entire industry to enjoy the benefits of the influx of massive funds.

4. BTC Ecosystem Set for Explosive Growth

BTC has introduced the concept of inscriptions, allowing BTC, which does not have smart contracts, to have a new asset type. However, inscriptions can only create assets and cannot support more complex applications directly on BTC.

Although BTC already has some sidechain scaling technologies and recursive inscriptions that can give inscriptions more complex capabilities, both are difficult to support further development of the BTC ecosystem in terms of performance, fees, and usability. Therefore, BTC definitely needs expansion technologies that support both smart contracts and scalability to further open up the scope of BTC.

In fact, many teams have announced the launch of BTC Layer2 in 2024, including the BTC Layer2 project BEVM, which supports EVM and is part of the Pionex ecosystem.

Not only that, expanding more applications around BTC will also be an important development narrative for many projects. Some applications that were originally developed on Ethereum and other chains have gradually begun to embrace BTC in 2023, becoming part of the BTC ecosystem.

It can be foreseen that 2024 will be a year of explosive growth for the BTC ecosystem. Not only will there be many BTC Layer2 solutions, but there will also be many cross-chain applications that bridge BTC to existing Layer1 or Layer2 solutions. The focus of applications on these chains will also shift, actively embracing BTC.

Ultimately, the BTC ecosystem will form a pattern where "various inscription protocols on the BTC main chain compete to generate assets, while other Layer1 or Layer2 solutions build applications around the assets on BTC."

5. Inscriptions Spawn New Gameplay

In 2023, inscriptions brought a new asset category, but inscriptions are not just about issuing assets. After all, inscriptions are also popular on other smart contract chains. The most important role of inscriptions is Fair Launch, which means a fair sale. This issuance method is open, transparent, and does not allow projects and VCs to obtain a large number of chips in advance. The absence of potential dumping and fairness make inscriptions very popular among users.

The issuance method of inscriptions is simple and easy to operate, and it easily provides many loyal fans for projects, quickly becoming a direct way for some projects to kickstart.

At the same time, with studios entering the inscription market, inscriptions were once not so fair, but this indirectly encouraged more fair exploration of inscription gameplay.

For example, the Zero platform on Solana leverages some digital aspects of the blockchain to add randomness to inscriptions, greatly reducing the influence of studios. In addition, the DOTA inscriptions in the Pionex ecosystem also innovatively introduced the "block average mechanism," where the number of inscriptions in a block is limited, and all users in a block share them equally, avoiding studio-style bulk purchases. These mechanisms undoubtedly inspire a more fair distribution model.

Some new projects have also borrowed innovative inscription methods like Zero to explore more interesting Fair Launches.

In addition, inscriptions can also be combined with airdropped tokens or NFT whitelist issuance methods, becoming a prelude to the real issuance of assets for projects, making inscriptions a mainstream project marketing method. Alternatively, it can give new meaning to inscription assets, giving rise to entirely new business models. It is believed that the gameplay and models derived from inscriptions will flourish in 2024.

6. RWA Could Become a Hot Trend in 2024

RWA (Real World Asset) refers to the tokenization of real-world assets on the blockchain. RWA is favored by on-chain funds because it is backed by real-world legal assets, which usually have their own attributes, such as risk-free returns for assets like U.S. Treasury bonds. On-chain applications also actively explore incorporating the returns of RWA into their projects to gain more profits, as on-chain sources of endorsed returns are lacking.

On the other hand, putting RWA assets on the chain means that the sale of these financial assets can directly target Web3 users worldwide, making it easier to sell these assets and rapidly expand their scale. Therefore, for issuers who want to put real-world assets on the chain and for on-chain users or applications that want to obtain RWA assets, both have their needs, making it a win-win trend.

In the RWA field, it is not a matter of going from 0 to 1, but many RWA applications have been developed for several years. In addition to stablecoins, the high returns of U.S. Treasury bonds in recent years have also led to steady growth in U.S. Treasury bond-related RWA projects, with the market share expanding from $100 million in early 2023 to over eight times, reaching $860 million.

Centrifuge in the Pionex ecosystem also ranks first in Active Loans Value in private credit RWA, steadily growing from $80 million in early 2023 to a volume of $250 million.

The total value locked (TVL) of the entire RWA market has also expanded sevenfold from $700 million in early 2023, reaching $5 billion.

RWA is a type of product that places great emphasis on policy direction. Its difficulty lies not in creating the product, but in compliance and attracting assets willing to become RWA assets. However, in early 2024, with the official launch of the BTC ETF in the United States, this will further demonstrate the level of policy embrace for Crypto and provide confidence for more assets. In this context, the already rapidly growing RWA trend will soon become a market worth tens of billions of dollars in 2024, and may even challenge the trillion-dollar market to become a hot trend.

7. DePIN Set for Application Implementation Wave

Although DePIN was only mentioned as a new trend by Messari in early 2023, it is more of a summary and generalization of many projects into a broad category.

In fact, the Filecoin project, which emerged in 2017, belongs to this category. However, as a highly representative project in the decentralized storage direction within the DePIN category, Filecoin has been in development for many years but has not yet been widely applied, remaining more in the mining phase.

After all, Filecoin is a project from several years ago. With blockchain technology gradually maturing and more teams innovating and practicing in the crypto field, hardware infrastructure projects that can truly have widespread applications are gradually taking the stage of history.

For example, a sub-project of the long-standing DePIN project Helium, which focuses on 5G and communication networks, suddenly gained popularity at the end of 2023. This was not only due to its rapidly growing price, but also because the 5G and communication networks of Mobile can truly provide users with convenient communication and also allow them to earn substantial rewards by participating. Therefore, Mobile was able to quickly gain tens of thousands of users, a number that is rapidly increasing.

Since DePIN projects typically require unique consensus mechanisms to judge and incentivize users participating in building hardware networks, the Substrate framework behind Polkadot allows project teams to use ready-made functional modules to quickly build projects and also supports project teams in adopting their own unique consensus mechanisms to meet diverse requirements. Therefore, there are numerous DePIN projects in the Polkadot ecosystem, making it one of the ecosystems with the most DePIN projects.

In the decentralized storage direction, new projects like CESS have also emerged in the Polkadot ecosystem. Although CESS is still in the testnet stage, its strong usability and performance comparable to commercial-grade storage have already gained favor from many Polkadot hackathon teams. For example, the winter hackathon champion project Videown in early January 2023 is a decentralized video platform based on CESS, which not only demonstrates the practicality of CESS but also showcases the enormous potential of DePIN.

8. Further Eruption of Chains and Applications

Although many Layer2 projects released their own one-click Layer2 deployment tools in 2023, such as OP Stack and ZK Stack, for projects that use these tools to deploy chains, how to compete with well-established old-school Layer2 projects has always been a major issue.

The emergence of Blast broke the deadlock, as Blast supports passive interest for ETH and stablecoins and has designed a set of fission gameplay, allowing Blast to quickly kickstart and attract a large number of users and funds. While other Layer2 projects were steadily attracting funds and users through ecosystem development, Blast attracted funds and users first through profits and then developed its ecosystem.

Blast's TVL quickly reached $1.3 billion in a short period of time and sucked funds from other Layer2 projects. This new gameplay also inspired later projects, such as Metis and Manta, which quickly attracted a large amount of funds and users through expected returns and airdrops.

This approach is reminiscent of the launch of many DeFi projects during the DeFi Summer of 2020, so it is very likely that 2024 will see a Chain Summer similar to the DeFi Summer of 2020 (these Layer2 operations can also be applied to Layer1 or Layer3 of Polkadot and Cosmos, so we won't use Layer2 Summer here).

On the other hand, when deploying chains becomes easier and there are repeatable methodologies for kickstarting, teams wanting to deploy chains will consider new factors, such as sovereignty. Building an application on a smart contract-supporting Layer2 means that the project can enjoy the advantages brought by the users, funds, and network effects of other applications on that Layer2, but it also lacks a lot of sovereignty.

In contrast, if a team builds its own application chain (whether it is Layer1, Layer2, or Layer3), there are many areas where it can take charge, such as designing gas fee distribution, running independently without being easily influenced by other projects, and building its own application ecosystem.

In addition, after years of exploration, there is already a certain trend in terms of which functional modules are needed for building application chains and DApps, so tools for simplifying the construction of application chains and applications have emerged (similar to developing chains using the Substrate framework).

Tanssi in the Polkadot ecosystem focuses on the infrastructure for application chains, providing a range of tools and resources aimed at simplifying and enhancing the deployment process of application chains, helping developers deploy application-specific blockchains faster and easier. Astar also launched the Astar Tech Stack, a collection of tools and infrastructure aimed at simplifying the creation of custom DApps and blockchain-based products on the Astar Network.

Therefore, 2024 is likely to witness a lively scene where chains and applications take off, once again experiencing the industry's glory moments of 2020.

9. More "Web2.5" Cases

As we have described in many articles over the past year, regardless of which blockchain network it is, it urgently needs to bring in more traditional enterprises or users to expand its usage. Polkadot is no exception, as evidenced by a series of collaborations last year, such as KILT's partnership with accounting giant Deloitte to issue reusable digital credentials for KYC identity verification, Energy Web's entry into Polkadot to help large companies like Shell and Volkswagen move towards decarbonization, and peaq bringing Tesla into the Polkadot ecosystem.

We habitually refer to these changes as a transition from Web2 to Web3, also known as the adoption of "Web2.5". Since there have already been many applications in the past year, there are bound to be more anticipated cases discovered in the new year. After all, even Visa has launched its own Web3 loyalty program, so Polkadot is bound to see more collaborations, which will also become one of the engines driving Polkadot towards the mainstream.

If setting and promoting the technology has been Dr. Gavin Wood's important task over the past few years, then commercial implementation will be an important item on Polkadot's agenda for 2024.

10. GameFi Worth Anticipating

After experiencing more than a year of a bear market, GameFi has shown signs of a slight revival, as the financing amount in this field over the past year has not been less than $500 million, and the number of funded projects is close to a hundred, ranking at the forefront of the trend. However, what lies ahead for GameFi is not just a matter of playability, but also how to better integrate financial attributes. Otherwise, blindly following Ponzi schemes cannot save the market.

In 2023, leaders in the gaming blockchain space like Mythical Games announced their departure from Ethereum to launch a new "Mythos ecosystem" on Polkadot, and Evrloot revealed that its new game Stardust Colonies will be built on the Polkadot project Ajuna Network. These developments have laid the groundwork for GameFi on Polkadot, which was previously rare.

In the new year, the Polkadot ecosystem needs its own "Axie Infinity" or "StepN" to prove that it can produce high-quality, high-player GameFi products, rather than just staying on paper as design plans. As for how to demonstrate the unique functions and charm of the Polkadot ecosystem, it will take more time to verify, but these changes are happening and are worth our attention and vigilance.

Of course, for GameFi itself, despite the technological accumulation and development over the past few years, many still believe that GameFi may still have a long way to go before it can compete head-on with traditional games. Although 2024 is full of hope, some people predict that the next few years will be the true moment for the widespread popularity of GameFi.

Postscript

From a macro perspective, the United States is highly likely to continue to stop raising interest rates or even lower them in 2024, which will have a significant inflection point effect on global liquidity. The end of the interest rate hike policy will make market funds more abundant, providing a more convenient financing environment for enterprises and individuals, and will also bring new funds to the Web3 industry.

In terms of the industry, the crypto market will further mature in 2024, and mainstream crypto assets such as BTC and Ethereum will continue to attract global investors' attention. With the approval of BTC ETF, BTC is officially moving from the wilderness to the hall, just like when gold ETFs were approved, laying the foundation for Web3 to move towards the mainstream.

At the same time, as governments and regulatory agencies gradually explore the regulatory framework for central bank digital currencies (CBDC), it will bring new impetus to the compliance of the entire industry.

CBDC will inevitably affect existing payment systems and financial systems. Due to the potentially more efficient, transparent, and reduced intermediary involvement in the direct issuance and payment process of CBDC, it will also change the traditional tools and means of monetary policy, bringing real change to the currency itself.

In terms of industry applications, with the revival of DeFi, NFT, and GameFi, as well as the further implementation of new concepts like DePIN and RWA, it will inject more attention into Web3 and attract more talent to join. These more or less innovations provide momentum for the new year.

It can be foreseen that the Polkadot ecosystem will also demonstrate new vitality under these big backgrounds and narratives. After all, the accumulation of the past 7 years (counting from 2016) has laid a solid foundation for new development. Without this silent cultivation, it would be somewhat difficult to keep up with the pace of the times. Let's see if the Polkadot ecosystem can truly build high-rise buildings on a complete foundation in the next two years. This would be a great fortune.

Finally, borrowing a blessing from Dr. Gavin Wood, the founder of Polkadot, in his year-end summary to conclude our report for this year: "May there be more freedom, peace, and happiness in the world!"

See you next year!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。