As is well known, the price of cryptocurrencies is extremely unstable. In order to establish a reasonable price measurement standard in the cryptocurrency market and lay the foundation for the liquidity of various cryptocurrencies, stablecoins have emerged.

Authored by: SharkTeam

1. Overview of Stablecoins

As is well known, the price of cryptocurrencies is extremely unstable. In order to establish a reasonable price measurement standard in the cryptocurrency market and lay the foundation for the liquidity of various cryptocurrencies, stablecoins have emerged. Their design goal is to maintain stable value by anchoring the value of stable assets such as the US dollar. Therefore, the value of stablecoins is usually pegged to a fixed exchange rate of 1:1 with the US dollar, euro, renminbi, or other assets (such as gold).

In addition to their characteristics in value anchoring, stablecoins also play an important role as a means of payment, allowing users to make payments and transfers conveniently. Due to the relatively stable value of stablecoins, users find it easier to engage in commercial transactions and payments. As the basic currency for OTC, DeFi, and CeFi, stablecoins provide users with more financial services and product choices.

According to the mechanism and issuance method behind stablecoins, they can be divided into the following four categories:

(1) Centralized Stablecoins Based on Fiat Reserves

These stablecoins have a fixed exchange rate of 1:1 with fiat currencies (such as the US dollar, euro, etc.). The issuer usually holds an equivalent amount of fiat reserves in a bank account to ensure the value of the stablecoin. For example, Tether (USDT) and USDC (USD Coin) are representative stablecoins issued by centralized institutions, with USDT having the highest liquidity and a market value exceeding 92 billion US dollars.

(2) Decentralized Stablecoins Based on Cryptocurrency Collateral

These stablecoins are decentralized and use innovative solutions, built on blockchain protocols, making them more secure and transparent. Also known as collateralized stablecoins, their asset support usually comes from other cryptocurrencies, such as Ethereum or Bitcoin, to maintain their value stability. MakerDAO's DAI is a typical example, widely welcomed by DeFi protocols, generated through over-collateralization mechanisms.

(3) Decentralized Algorithmic Stablecoins

This is one of the types of decentralized stablecoins, with its value automatically adjusted by algorithms without the need for collateral, using market demand and supply to maintain a fixed price. Ampleforth is an algorithmic stablecoin that uses an elastic supply mechanism to automatically adjust the supply according to market demand.

(4) Hybrid Mechanism Stablecoins

These stablecoins combine the characteristics of the above different mechanisms to provide a more stable value. For example, Frax combines algorithm and fiat reserves, using a hybrid stablecoin mechanism, with part of the fiat reserves supporting it and another part managing the supply through algorithms to maintain price stability.

In summary:

Centralized stablecoins solve the problem of anchoring the value of virtual assets, linking digital assets to physical assets (such as the US dollar or gold) to stabilize their value, while also addressing the issue of access to virtual assets in a regulatory environment, providing users with a more reliable way to store and trade digital assets. However, they typically rely on the issuance and management of centralized institutions, posing financial audit risks and regulatory risks for the issuer.

The decentralized nature of decentralized stablecoins provides a more free and transparent way for the development of the cryptocurrency market, using transparent and verifiable smart contract code to establish market trust, but also facing challenges such as hacking attacks and governance risks.

2. On-Chain Data Analysis

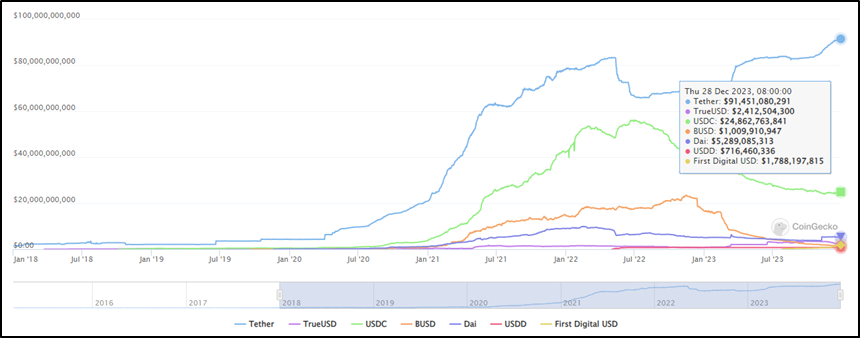

Since the launch of the first stablecoin USDT by Tether in 2014, various types of stablecoins have emerged in the market, such as USDC, DAI, BUSD, etc. The total market value of stablecoins has gradually increased since 2018, rapidly rising from mid-2020 and peaking on April 7, 2022, reaching a total market value of 182.65 billion US dollars. However, the market trend subsequently declined, and as of the current date (December 28, 2023), the total market value has fallen to 128.77 billion US dollars.

Figure: Stablecoin Market Cap (2018.2.1 – 2023.12.28)

Figure: Top Stablecoins Market Cap (2018.1.1 – 2023.12.28)

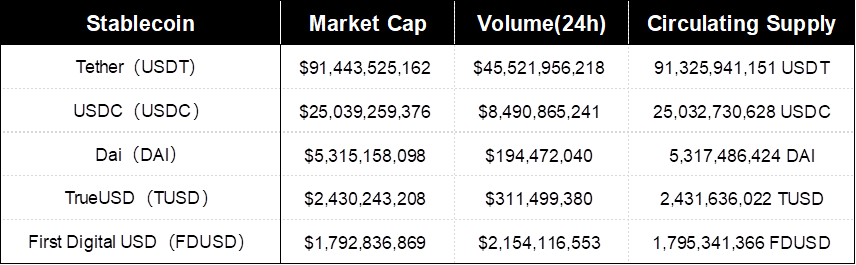

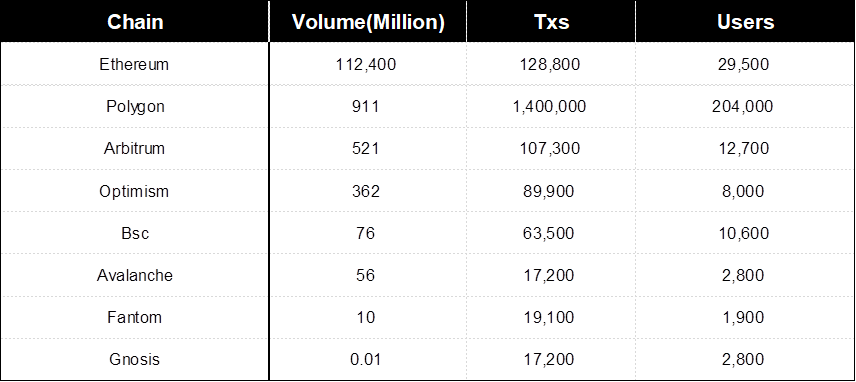

In terms of market share, USDT has always maintained a leading position. Since the beginning of 2020, the top five stablecoins by market value have been USDT, USDC, BUSD, DAI, and TrueUSD. However, in June 2023, due to sanctions against Binance, the market value of BUSD sharply declined, gradually losing its position in the top five. At the same time, after the launch of First Digital USD on June 1, 2023, its market value surpassed BUSD and became the fifth largest stablecoin as of December 14. The following are statistics on the market value, trading volume, circulating supply, and user base of the top five stablecoins:

Figure: TOP 5 Stablecoin's Market Cap, Volume and Circulating Supply. Data as of 2023/12/28

Figure: USDT 30-day trading volume, number of transactions, and user base, data as of 2023/12/28

Figure: USDC 30-day trading volume, number of transactions, and user base, data as of 2023/12/28

Figure: DAI 30-day trading volume, number of transactions, and user base, data as of 2023/12/28

3. Security and Risks of Algorithmic Stablecoins

Algorithmic stablecoins use a mechanism similar to shadow banking. Unlike traditional stablecoins, algorithmic stablecoins do not require centralized institutions to maintain their stability, but rather adjust the market's supply and demand relationship through algorithms to ensure that prices remain within a certain range. However, this form of currency also faces a series of challenges, including insufficient market liquidity and black swan events. The value of algorithmic stablecoins is not entirely supported by external reserves, but is regulated to maintain price stability through algorithm-based market mechanisms.

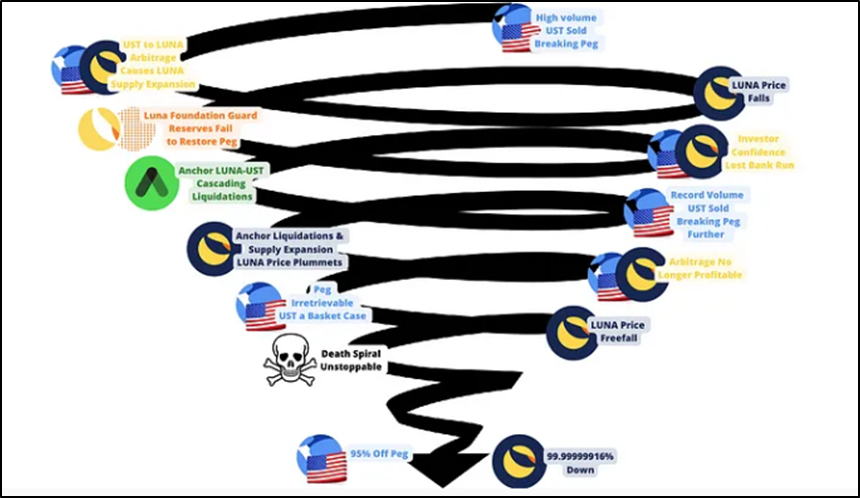

In recent years, algorithmic stablecoins have often collapsed due to the "death spiral" problem, mainly manifested in the following aspects:

(1) Imbalance of Supply and Demand

When the market demand for algorithmic stablecoins decreases, their price may fall below the target value, leading the issuer to need to destroy or repurchase part of the circulating supply to restore balance. This may further reduce market confidence and demand, leading to a vicious run, as seen in the collapse of Luna/UST.

(2) Governance Risks

Due to the operation of algorithmic stablecoins relying on smart contracts and community consensus, there may be governance risks, such as code defects, hacking attacks, price manipulation, and more.

(3) Legal Regulation

As algorithmic stablecoins do not have physical assets as collateral or anchoring, they face more legal regulatory challenges and uncertainties. It is expected that more countries or regions will restrict or prohibit the use of algorithmic stablecoins in the future.

(4) Case Study: Collapse of Luna/UST

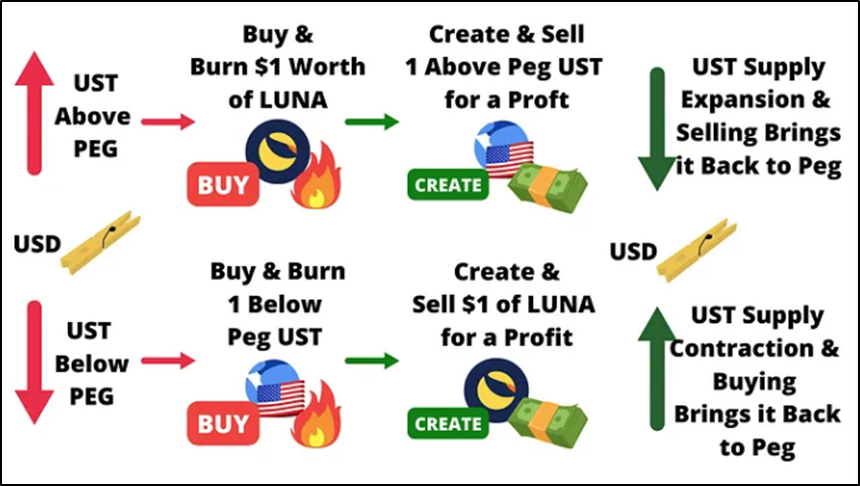

Business Model: Algorithmic stablecoin (UST/Luna) and high interest rate (Anchor):

The core design concept of the Terra ecosystem revolves around expanding the use cases and payment demand for the stablecoin UST. The operation of UST adopts a dual-token design, with Luna for governance, staking, and validation, and UST as the native stablecoin pegged to the US dollar. Simply put, whenever a UST is minted, an equivalent value of Luna must be burned, and Luna helps maintain the peg to the US dollar through arbitrage mechanisms: if the price of $UST is > 1$, there is an opportunity to burn $Luna, mint $UST, and take the difference as profit; if UST is at 1$, $Luna can be burned for $UST to restore the peg, buy 1 UST at a price lower than 1 dollar, and receive $Luna worth 1 dollar, then sell $Luna for profit.

Anchor Protocol (referred to as Anchor) is a DeFi platform launched by Terra in March 2021, essentially a lending platform similar to Compound. However, Anchor's uniqueness lies in its extremely high APY (Annual Percentage Yield), consistently maintained at around 20%. Under the stimulus of high APY, there was a surge in demand for UST from users, which is the core business of UST. In the Terra ecosystem, Anchor, as the "state-owned bank," promises a 20% super high current interest rate to attract public deposits (in the form of UST).

Income and Expenditure Model: Insufficient income to cover expenses, hidden dangers:

Anchor's main income comes from loan interest + PoS rewards from loan collateral (currently bLUNA and bETH) + liquidation penalties; Anchor's main expense is approximately 20% annualized deposit interest. Anchor also provides a high subsidy in ANC tokens to borrowers, and to maintain the price of ANC tokens, Anchor faces additional costs to maintain the price of ANC tokens, i.e., solving the selling pressure problem of ANC tokens.

This is the income and expenditure model of UST and Luna. Based on the current volume of UST and Luna, an additional operating cost of approximately one billion US dollars per year is required. It is clear that Anchor alone is unable to bear this expense. Therefore, in February 2022, when Anchor's reserve pool was about to be depleted, LFG announced a grant of 450 million UST to Anchor to replenish its reserve pool. This confirms one thing: Anchor is different from other lending protocols; it is essentially a part of the Terra planned economy, and its current business operations are not for profit, but a scenario product subsidized by Terra to expand the scale of UST.

Generation of the death spiral:

From the above analysis, it can be seen that Terra's complete logic is: through Anchor's self-made scenarios, shaping the demand for stablecoins; the demand drives the minting scale of UST, attracting users to enter; as users continue to enter, they create ecological data performance (TVL, number of addresses, number of projects, etc.) and gradually push up the price of Luna; the project party or foundation cashes out funds through Luna and provides subsidies to maintain high APY, thus creating a cycle.

If the above cycle remains stable, UST is the engine of Luna, and Luna is the stabilizer of UST. With more Web3 projects and users entering, the interaction between the two leads to a positive spiral when the trend is positive.

However, when the market value of Luna relative to the stablecoin decreases and the trading depth decreases, there will be insufficient collateral, increasing the risk of the stablecoin becoming unanchored, and the cost of maintaining consensus becomes higher, leading to a death spiral. For example, when the overall market declines and Luna is not spared, or when someone can attack the price of Luna, a death spiral will occur.

How high is the threshold for the appearance of the death spiral, and how great is the risk?

The project party is certainly aware of the importance of maintaining the cycle and the source of subsidies, and is taking measures to increase production reserves. Anchor is adding new collateral assets: bLuna, bETH, wasAVAX, bATOM, which will also help increase Anchor's profits. Introducing a dynamic anchor rate, according to the proposal, the anchored yield will decrease at a rate of 1.5% per month, with the minimum APY set at 15%, to be reached within 3 months. However, if Anchor's APY is lower than desired, the demand for UST and Luna will decrease, UST demand will shrink, more Luna will be minted, and the price of Luna will fall.

Therefore, the appearance of the death spiral may come from the overall market downturn, a decrease in Anchor's APY, or targeted attacks on the price of Luna. Currently, it seems that the appearance of the Terra death spiral is almost inevitable.

4. Analysis of Black and Gray Industries

"Black and gray industries" usually refer to illegal or even socially harmful industry chains. These industry chains often violate legal regulations and involve activities such as fraud, illegal transactions, smuggling, etc. In recent years, more and more "black and gray industries" have been using cryptocurrencies, especially stablecoin USDT, for illegal fundraising or money laundering, and the emergence of black U has seriously disrupted the safe development of the stablecoin ecosystem. It mainly includes the following aspects:

(1) Online Gambling

Online gambling is a branch of the black and gray industries with serious social harm. It involves the operation of online gambling platforms, network technology, payment systems, advertising, and more. The black and gray industries create seemingly legitimate gambling websites or applications to attract players to register and participate in gambling activities, promoting their gambling platforms through various means, including malicious advertisements, spam, etc., to expand their user base. Cryptocurrency is a commonly used payment method because it provides a relatively anonymous way of payment, making it more difficult to trace online gambling activities. Unlawful individuals in the black and gray industries create or purchase virtual identities before engaging in criminal activities, which in the case of cryptocurrency are blockchain addresses, and funds transactions through gambling platforms may be used for money laundering to conceal illegal gains.

(2) "Score Boosting" Platforms

"Score boosting" usually refers to the act of increasing the performance test scores of software and hardware through certain means. The black and gray USDT score boosting scam disguises itself as a money laundering fraud, with platforms claiming to be order-taking platforms for laundering USDT funds, but in reality, this is an investment scam. Once participants invest a large amount of USDT, the platform will refuse to return the funds for various reasons.

(3) Ransomware

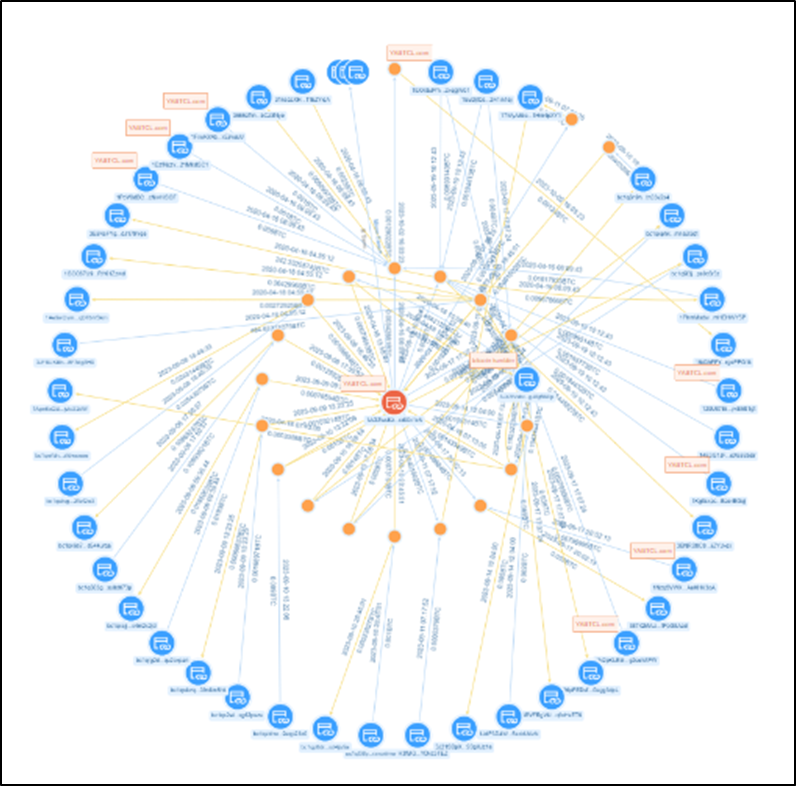

Ransomware attacks are a serious issue in current cyberspace security. They are usually spread through phishing emails or malicious links, combined with social engineering attacks to entice users to click and download to infect their computers. After the victim's data is encrypted, the ransomware typically displays a ransom message demanding a certain amount of ransom to obtain the decryption key. Payment of the ransom is usually required in cryptocurrency (such as Bitcoin) to increase the anonymity of the payment. As financial institutions and other critical sectors manage and store a large amount of crucial data and services, they have become the primary targets of ransomware attacks. In November 2023, Industrial and Commercial Bank of China Financial Services (ICBCFS), a wholly-owned subsidiary of Industrial and Commercial Bank of China (ICBC) in the United States, was attacked by the LockBit ransomware, resulting in significant adverse effects. The following image shows the on-chain transaction hash graph of a certain ransom collection address for LockBit.

Image: On-chain transaction hash graph of a certain ransom collection address for LockBit

(4) Terrorism

Terrorists use cryptocurrency for fundraising and money laundering to avoid monitoring and legal investigation by traditional financial institutions. Its anonymity and decentralized nature make it a tool that some terrorist organizations may exploit. Fundraising, fund transfers, and network hacking attacks are ways in which terrorist organizations may use cryptocurrency. For example, Ukraine has used cryptocurrency for fundraising, and Russia has used cryptocurrency to evade SWIFT sanctions. In October 2023, Tether (USDT) froze 32 addresses related to terrorism and war in Israel and Ukraine, collectively holding 873,118.34 USDT.

(5) Money Laundering

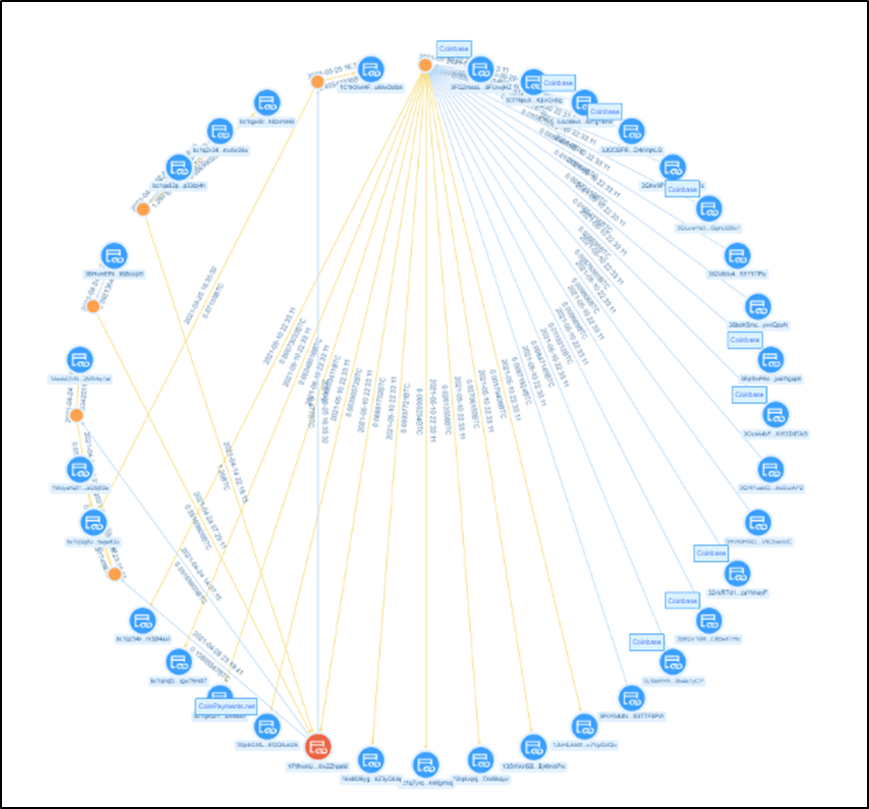

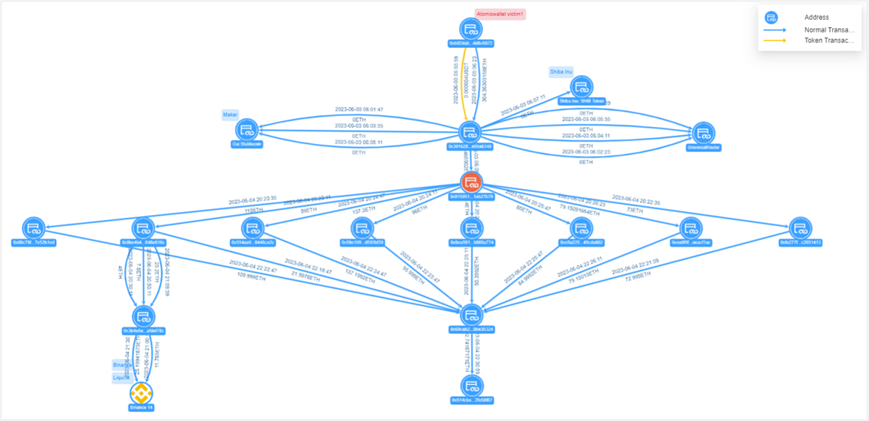

Due to the anonymity and difficulty of tracing cryptocurrency, it is often exploited by criminals for money laundering. According to data statistics and on-chain risk labels, over half of the assets in the black and gray market are associated with black and gray industries, and the vast majority are used for money laundering. For example, the North Korean hacker group Lazarus Group has transferred and laundered over $1 billion in assets in recent years. Their money laundering patterns typically include:

- Splitting assets among multiple accounts to increase tracking difficulty.

- Creating a large number of fake transactions to increase tracking difficulty. For example, in the Atomic Wallet incident, 23 out of 27 intermediate addresses were fake coin transfer addresses. Similar techniques were also found in the recent analysis of the Stake.com incident, but previous incidents involving the Ronin Network and Harmony did not use this interference technique, indicating an upgrade in Lazarus's money laundering technology.

- Increasing the use of on-chain mixing methods (such as Tonado Cash) for coin mixing. In earlier incidents, Lazarus often used centralized exchanges to obtain startup funds or engage in subsequent OTC transactions, but recently, they have been using centralized exchanges less and less, and may even be avoiding their use as much as possible, likely related to recent sanction events.

Image: Atomic Wallet fund transfer view

As the use of cryptocurrency in black and gray industries and other illegal activities continues to increase, regulation of cryptocurrency, especially stablecoins, becomes particularly important.

5. Stablecoin Regulation

Centralized stablecoins are issued and managed by centralized institutions, so the issuing institution needs to have a certain level of strength and credibility. To ensure transparency and credibility, the issuing institution should be subject to registration, filing, supervision, and auditing by regulatory authorities. In addition, stablecoin issuing institutions should ensure the stability of the exchange rate with fiat currency and promptly disclose relevant information. Regulatory authorities should require regular audits of stablecoin issuing institutions to ensure the safety and adequacy of their reserve funds. At the same time, establishing a risk monitoring and early warning mechanism to promptly identify and address potential risks is crucial.

Decentralized stablecoins adjust the total market currency supply based on supply and demand to determine the price, and they have a higher level of transparency, but they also pose relatively greater regulatory challenges. Checking for algorithm vulnerabilities, risk mitigation in extreme situations, and how to participate in community governance will become the main challenges of regulation.

In 2019, the issuance plan of Libra drew global attention to stablecoins, and financial risk issues related to stablecoins gradually surfaced. In October of the same year, the "Global Stablecoin Assessment Report" was released, formally proposing the concept of global stablecoins for the first time and pointing out their potential impact on financial stability, monetary sovereignty, consumer protection, and other aspects.

Subsequently, the G20 commissioned the Financial Stability Board (FSB) to review the Libra project, and in April 2020 and February 2021, the FSB separately released two sets of regulatory recommendations on global stablecoins. Under the FSB's regulatory recommendations, some countries and regions have also put forward their own stablecoin regulatory policies. Some countries have strengthened their regulation of stablecoins, such as the United States' "Stablecoin Payments Act Draft," regulatory policies in Hong Kong and Singapore, and the European Union's "Markets in Crypto-Assets Regulation" (MiCA).

In April 2023, the U.S. regulatory authorities released the "Stablecoin Payments Act Draft," which stipulates the conditions for the issuance and requirements of payment stablecoins, emphasizing the 1:1 pegging with fiat currency or other highly liquid assets. Issuers must apply for a license from the Federal Reserve Board within 90 days, undergo audits, and submit reports. The draft also grants the Federal Reserve Board emergency intervention and penalty powers. This act not only reflects the U.S. government's attention to the stablecoin market but also demonstrates its support and encouragement for crypto innovation.

In January 2023, the Hong Kong government discussed and released a summary of cryptocurrency, focusing on bringing cryptocurrency activities under regulation, specifying the scope and requirements of regulation, and outlining the principles of differentiated regulation, as well as emphasizing communication and coordination with international organizations and other jurisdictions.

In August 2023, Singapore released the conclusions of a consultation paper on the regulatory framework for stablecoins. On one hand, it revised regulations on historical regulatory scope, reserve management, capital requirements, and information disclosure, establishing the final framework and emphasizing differentiated regulation. On the other hand, it revised the "Payment Services Act" and related regulations, strengthening coordination and communication with international regulatory authorities.

In May 2023, the Council of the European Union, composed of government ministers from 27 EU member states, approved the "Markets in Crypto-Assets Regulation" (MiCA), a draft proposed by the European Commission in 2020, which will be implemented in 2024. MiCA mainly covers three areas: issuance rules for crypto-assets, which impose multiple requirements on issuers of various crypto-assets, a more complex set of issuance, authorization, governance, and prudential requirements; crypto-asset service providers (CASP), which need to obtain authorization from the competent authority and are subject to financial companies under the "Markets in Financial Instruments Directive II" (MiFID II); and rules to prevent the abuse of the crypto-asset market.

The United States currently maintains a leading position in cryptocurrency regulation, and its "Stablecoin Payments Act Draft" is expected to become the world's first formal legislation specifically regulating stablecoins. Policies in other regions such as Hong Kong and Singapore still need time to mature into formal regulations. The regulation of stablecoins varies among countries, and the legislative process is at different stages. Relevant institutions or operators should constantly assess risks, adjust business models according to applicable laws and regulations, comply with relevant regulations on stablecoins, and mitigate potential compliance risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。