Looking at the timeline, the most crucial point is still the final decision date of the Ark & 21shares application on January 10th. The market's sentiment towards this point is the strongest.

Author: Yilan, LD Capital

The Bull's Engine Starts

On October 13th, the U.S. Securities and Exchange Commission (SEC) announced that it would not appeal a court ruling regarding Grayscale's refusal to convert GBTC to a spot ETF. This ruling, which occurred in August of this year, deemed the SEC's rejection of Grayscale Investments' application to convert GBTC to a spot Bitcoin exchange-traded fund (ETF) as incorrect.

This key event ignited the current market trend (as seen from the CME BTC OI chart, there was a significant surge in open interest on October 15th). Alongside the Fed's positive pause, the bullish trend in the BTC market continued. With the arrival of applications from Hashdex, Franklin, and Global X, the "window period" was extended again on November 17th, providing the market with a reason to adjust. Looking at the timeline, the most crucial point is still the final decision date of the current round of applications from Ark & 21shares on January 10th, and the market's sentiment towards this point is the strongest. As of now, the results of whether it will be approved can be obtained as early as next Wednesday (January 3rd).

Can a Spot ETF be approved in the current state?

In terms of market expectations, Bloomberg ETF analyst James Seyffart believes that the likelihood of a spot Bitcoin ETF being approved before January 10th next year is as high as 90%. As someone closest to the SEC, his views have been widely circulated in the market.

Griffin Ardern, head of the BloFin Options Desk & Research Department, released a study on potential Authorized Participants (AP) buying into the seed fund of a possible spot BTC ETF that may be approved in January.

Griffin's research concludes that an institution has continuously purchased $1.649 billion worth of BTC and a small amount of ETH through the same account from October 16th to the present, using compliant exchanges such as Coinbase and Kraken. Institutions capable of making $1.6 billion in cash purchases are few and far between in the entire crypto market. Combined with the fact that the funds were transferred to Tron rather than Ethereum and the trajectory of the coin transfers, it is highly probable that this account belongs to a traditional institution headquartered in North America.

In theory, there is no limit to the scale of the seed fund, as long as it can prove sufficient liquidity on the day of trading. Traditional seed fund purchases usually take place 2-4 weeks before the ETF is issued to reduce the risk of Authorized Participants (APs), such as market makers or ETF issuers, holding positions too early. However, due to the impact of the December holidays and settlements, purchases may have started earlier. Based on the above evidence, it is reasonable to speculate that the spot BTC ETF will be approved in January, but this cannot be used as a basis for certainty.

In terms of the ETF approval process, the longest period is 240 days, and the SEC must make a final decision. As the earliest applicant, Ark & 21shares must show the deadline for the approval result of their current application to the SEC is January 10, 2024. If ARK is approved, it is highly likely that several subsequent applicants will also be approved.

If rejected, ARK will need to resubmit materials, theoretically restarting another 240-day application process. However, in reality, if any institution is approved in March-April 2024 or later, ARK may also be approved ahead of schedule.

In terms of the SEC's attitude, the SEC's previous rejection of Grayscale's proposal to convert GBTC to a Spot ETF was mainly due to two reasons:

- Concerns about the trading of cryptocurrencies on unregulated platforms, leading to difficulties in monitoring, and pointing out that market manipulation is a long-standing issue in the spot market. Although the SEC has approved cryptocurrency futures ETFs, these ETFs are all traded on platforms regulated by U.S. financial regulators.

- Many investors in BTC spot ETFs use pension and retirement funds for investment, and they cannot afford high-volatility and high-risk ETF products, which may lead to investor losses.

However, the SEC did not appeal against Grayscale again, and in the process of applying for ETFs by major asset management companies, the SEC's more active communication reflected a higher probability of approval. The SEC's website recently disclosed two memoranda, one of which showed that on November 20th, the SEC held discussions with Grayscale regarding the proposed rule changes for the listing and trading of Grayscale Bitcoin Trust ETF. On the same day, the SEC also discussed the proposed rule changes for the listing and trading of iShares Bitcoin Trust ETF with BlackRock, the world's largest asset management company. The memorandum was followed by a two-page PPT produced by BlackRock, showing two ways of ETF redemption: the In-Kind Redemption Model or the In-Cash Redemption Model. The In-Kind Redemption Model means that the final redemption is in the form of BTC shares held by the ETF, while the In-Cash Redemption Model uses equivalent cash to replace BTC shares. BlackRock seems to be more inclined towards the former (it seems that the conditions for In-Cash have already been agreed upon). As of the 20th of this month, the SEC has held 25 meetings with the ETF applicants. This also indicates that the two new conditions have been discussed in multiple meetings, including 1) the need for ETFs to use cash for creation and removal and to remove all In-Kind redemptions; 2) the SEC hopes that the applicants can confirm the information of APs (Authorized Participants, i.e., underwriters) in the next S-1 filing update. If these two conditions are met before the expected approval date of January 10th, it seems that all processes are ready. These are positive signals that the SEC's attitude may have changed.

In terms of the multi-party game, the approval of a Spot BTC ETF is a game of interests between the majority Democratic SEC, CFTC, asset management giants like Blackrock, and influential industry forces like Coinbase. It is widely believed that Coinbase being chosen as the custodian by most asset management companies is beneficial for its revenue growth, but the actual custodial fees (generally ranging from 0.05% to 0.25%) and the additional international perpetual trading income and spot trading volume income are not significant. However, Coinbase is still one of the largest beneficiaries in the industry after the approval of a spot BTC ETF, and has become a major government lobbying force in the U.S. crypto industry after the collapse of FTX.

BlackRock has already launched a stock fund related to cryptocurrencies, namely the iShares Blockchain and Tech ETF (IBLC). However, despite the fund being launched for over a year, its assets are only less than $10 million. BlackRock also has sufficient motivation to push for the approval of a spot BTC ETF.

And BlackRock, Fidelity, and Invesco, among other traditional asset management giants, play a unique role in government regulation. As the world's largest asset management company, BlackRock currently manages approximately $9 trillion in assets. BlackRock has always maintained close ties with the U.S. government and the Federal Reserve. U.S. investors are eagerly anticipating the legal ability to hold cryptocurrencies such as Bitcoin to hedge against fiat currency inflation. Institutions like BlackRock have fully recognized this and are using their political influence to pressure the SEC.

In the 2024 presidential election political game, cryptocurrencies and artificial intelligence have become hot-button issues in the 2024 election cycle.

The Democratic Party, Biden, the White House, and the current regulatory agencies appointed by the president (SEC, FDIC, Fed) seem to be largely opposed to cryptocurrencies. However, many young Democratic members of Congress support cryptocurrencies, and so do many of their constituents. Therefore, a turning point is also possible.

Republican presidential candidates are more likely to support crypto innovation. Republican leader Ron DeSantis has stated that he will ban CBDC and support innovation related to Bitcoin and cryptocurrency technology. As governor, DeSantis has made Florida one of the most crypto-friendly areas in the U.S.

While Trump has made negative comments about Bitcoin in the past, he also launched an NFT project last year. And he primarily supports states like Florida and Texas, which largely support the crypto industry.

The biggest uncertainty comes from Gary Gensler, the Democratic SEC leader. Gensler believes that, apart from Bitcoin, most token trading on Coinbase is illegal. Under Gensler's leadership, the SEC has taken a tough stance on crypto. Coinbase is facing SEC litigation over its core business practices. Binance is facing a similar lawsuit and is defending itself in court. In the worst case scenario, regulatory crackdowns could reduce Coinbase's revenue by more than a third, according to Mark Palmer, an analyst at Berenberg Capital Markets. "There is almost no hope of changing the stance of most SEC commissioners in the short term."

Coinbase and other companies are not waiting for court rulings, but are hoping that Congress will separate crypto from securities regulations. Executives from Coinbase and other companies have been pushing for legislation to limit the SEC's regulatory power over tokens and to establish rules for "stablecoins" (such as USDC, a digital dollar token held by Coinbase).

Crypto companies are also trying to defend themselves by lobbying against bills that require them to comply with anti-money laundering requirements. Executives argue that this is expensive or impossible to comply with in a decentralized world based on blockchain assets and transactions. However, with each ransomware attack or terrorist attack funded in part by token-based fundraising, their task becomes even more challenging. Organizations associated with Hamas have requested crypto donations both before and after attacks on Israel.

Some bills are making progress towards their goals. For example, the House Financial Services Committee has passed a bill supported by Coinbase on crypto market structure and stablecoins, paving the way for a full House vote. However, there is no indication that Senate Democrats will introduce this bill, or whether President Joe Biden will sign a crypto bill.

As this year's spending bill may be a top priority for Congress, and with Congress entering election mode in 2024, controversial crypto bills may be difficult to make progress for some time.

"FTX's collapse was a setback, but some in Congress recognize that crypto is inevitable," said Christine Smith, CEO of the Blockchain Association. The industry may have to settle for Bitcoin exchange-traded funds for now, while its lobbying efforts continue to push for legislation that will bring it to the finish line next year.

According to a recent study by Grayscale, 52% of Americans (including 59% of Democrats and 51% of Republicans) agree that cryptocurrencies are the future of finance; 44% of respondents said they want to invest in crypto assets in the future.

For the SEC, the most important reason for opposition and contradiction with cryptocurrencies still lies in the inherent manipulability of BTC, which cannot be fundamentally resolved. However, we will soon get the result, whether the SEC will succumb to the pressure from various game forces and approve the BTC spot ETF.

Sensitivity analysis of Spot BTC ETF & BTC price impact

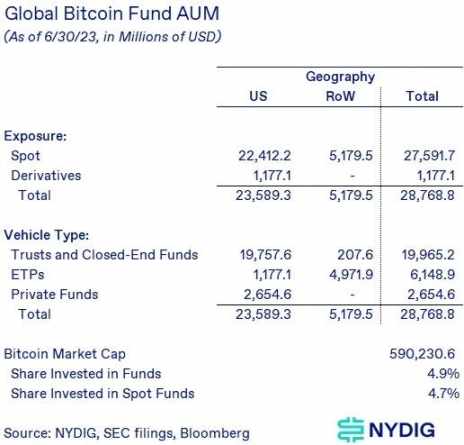

Although the U.S. has not yet launched a direct ETF related to spot Bitcoin, investors have already participated in the Bitcoin market through existing product structures. The total assets under management (AUM) of these products have exceeded $30 billion, with approximately 95% invested in products related to spot Bitcoin.

Before the appearance of a spot BTC ETF in the U.S., investment methods and product structures for BTC included trusts (such as Grayscale Bitcoin Trust GBTC), BTC futures ETFs, spot ETFs already launched outside the U.S. (such as in Europe and Canada), and other private funds with BTC allocations. The AUM of GBTC alone has reached $23.4 billion, the largest BTC futures ETF BITO AUM is $1.37 billion, and the AUM of the largest spot BTC ETF BTCC in Canada is $320 million. The allocation of BTC in other private funds is not transparent, and the actual total amount may be much larger than $30 billion.

Spot ETF vs. existing alternatives

Spot ETF vs. existing alternatives

Compared to investment product structures, the tracking error of trusts/closed-end funds (CEFs) is lower (the returns of BITO, BTF, and XBTF lag behind the spot Bitcoin price by 7%-10% annually), the liquidity is better than private funds, and the potential management fee costs are lower (compared to GBTC), for example, Ark has set the fee rate at 0.9% in its application.

Potential fund inflows:

Existing demand

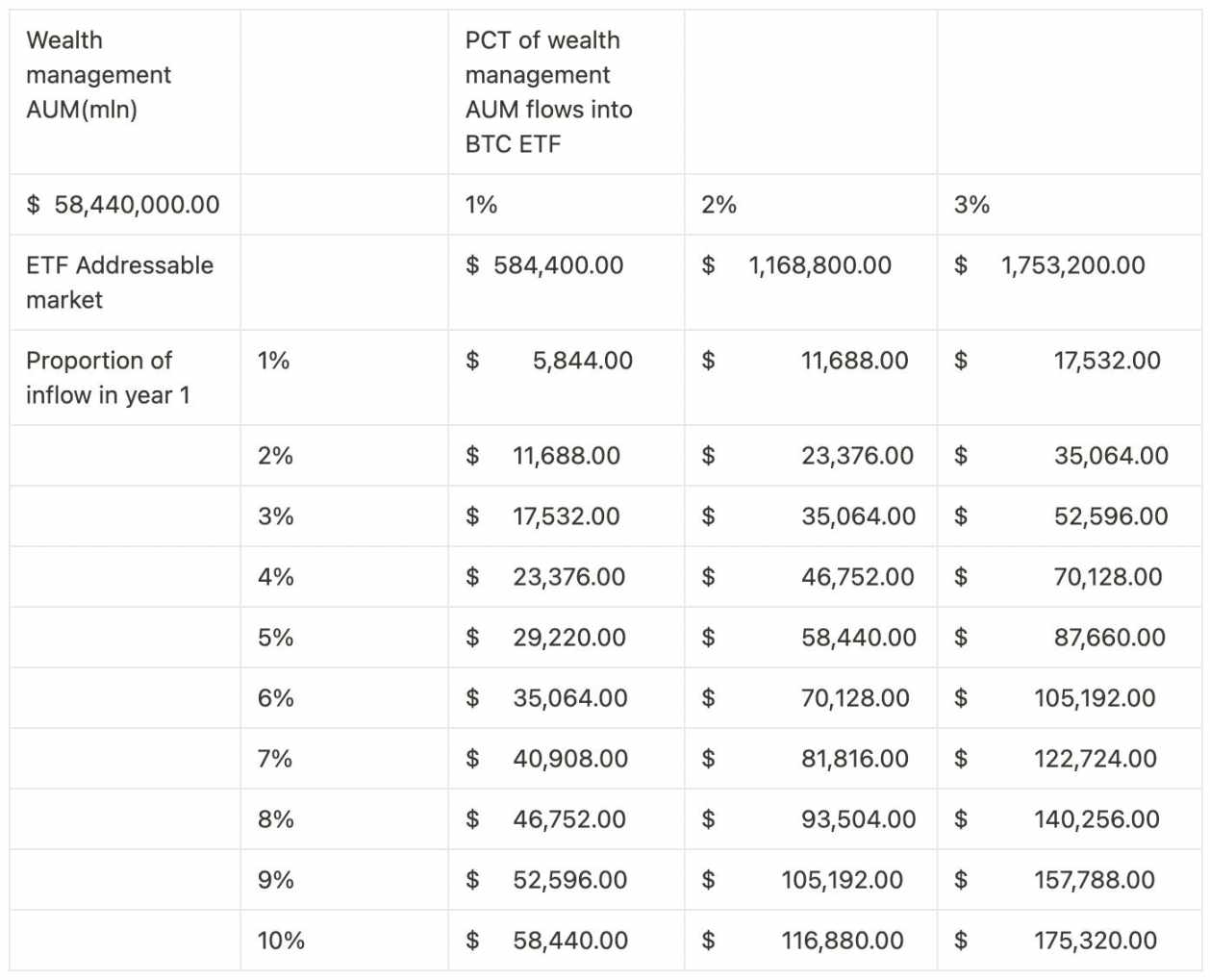

It can be foreseen that a large amount of GBTC's AUM will flow out before the fee structure is improved, but this will be compensated by the new ETF demand. Assuming that 1% of the $58.44 trillion in wealth management AUM flows into BTC, with 5% flowing in the first year, it would bring in $29 billion in existing wealth management fund inflows. Assuming that 10% of the funds enter on the first day, it can bring in $2.9 billion in buying pressure (10% * $29 billion), combined with the pressure level of BTC's rise, the market value of BTC on October 13th was $557 billion (BTC price = $26,500), and considering the inflow of funds brought about by the spot ETF without considering other factors, the target price for BTC from October 13th is $53,000 (the main consideration is the pressure level of the rise, and the impact of the inflow factor on price changes is difficult to predict due to the dynamic changes in market trading volume). However, due to the complexity of market sentiment, it is very likely that there will be a situation of a rise followed by a drop.

By analogy, the AUM of the gold ETF is 209 billion, and the total market value of BTC is 1/10 of gold. Therefore, assuming that the AUM of the BTC spot ETF can reach 10% of the Gold ETF's 209 million AUM, which is 20.9 billion, then assuming that in the first year, 1/10*20.9 billion funds will flow in (after the Gold ETF is approved, approximately 1/10 of the total AUM will be retained in the first year, and the AUM will gradually accumulate, reaching 1.2 times the first year's AUM in the second year, experiencing the largest inflow in the 6-7th year, and then the AUM will start to decrease. The remaining buying pressure will be realized in a few years), which means the first year will bring in a net inflow of 2.1 billion dollars.

Therefore, by comparing with SPDR Gold (an ETF issued by State Street Global Advisors, the largest and most popular one), we can see that SPDR's AUM is 57 billion. Assuming that the AUM of the BTC spot ETF can reach 10%-100% of SPDR's 57 billion AUM, which is 5.7 billion-57 billion (assuming that in the first year, 1/10*5.4 billion = 540 million - 5.4 billion funds will flow in, after the Gold ETF is approved, approximately 1/10 of the total AUM will be retained in the first year, and the AUM will gradually accumulate, reaching 1.2 times the first year's AUM in the second year, experiencing the largest inflow in the 6-7th year, and then the AUM will start to decrease. The remaining buying pressure will be realized in a few years). Using the SPDR Gold to deduce that the first year's 5.4-54 billion dollars of fund inflow for BTC is a very conservative estimate.

By using a very conservative method of estimating the inflow of 1% of the $58.44 trillion in wealth management AUM into BTC, it is estimated that the first year's inflow of funds after the BTC spot ETF is approved will be around 5.4 billion - 29 billion dollars.

If we consider the additional adoption from the retail side, the percentage of BTC holdings in the U.S. was 5%, 7%, 8%, 15%, 16% in 2019-2023, ranking 21st among all countries. The approval of the spot BTC ETF is likely to further increase this percentage. Assuming this percentage increases to 20%, adding 13.2 million retail customers, calculated at an average household income of $120,000, assuming an average holding of $1,000 BTC per person, it will generate an additional demand of 13 billion dollars.

Conclusion

As more and more investors begin to appreciate the benefits of Bitcoin as a store of value or digital gold, combined with the increasing certainty of ETF launches, the upcoming halving, and the combined impact of the Fed's interest rate hike suspension, it is highly probable that the price of BTC will be pushed to $53,000 in the first half of next year.

The approval of the Ethereum spot ETF, combined with the 240-day application process for the BTC spot ETF, and the securities qualification dispute for Ethereum compared to BTC, will probably be much later than the approval of the BTC spot ETF. Therefore, perhaps Ethereum will only welcome its ETF market when Gensler is replaced by a more crypto-friendly leader.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。