This is very similar to the early days of Ethereum. Capital and miners helped it grow, but eventually it declined and became a mere tool.

Author: Zuo Ye

After the two main forces of the Move language, Aptos and Sui, rose to prominence, the ecological scarcity and construction desolation made it difficult for people to understand why the Meta series public chain, born with a silver spoon, has fallen to the point where it can only maintain its luxurious lifestyle by "selling coins."

Solend on Solana is famous for "entering" the "game chain," but in reality, Sui public chain does not have games. The reason is simple: they are all in the same family, so they naturally support each other. After all, the real danger is not each other, but the giant known as Ethereum.

SUI's call: It's better to do DeFi than games

The strategic offensive of the current Alt Layer 1 against Ethereum's ecology is aimed at the EVM, a large group of public chains that have built a three-dimensional defensive posture in order to maintain their throne.

At this time, the breakthrough came from Solend on Solana, unexpectedly launching the Suilend lending product on Sui. Two points are puzzling: why didn't the projects on Solana choose to be compatible with EVM and instead join the Sui (Move) ecosystem? Secondly, is Sui starting to do DeFi instead of games?

To answer this question, let's first look at the following two pieces of news:

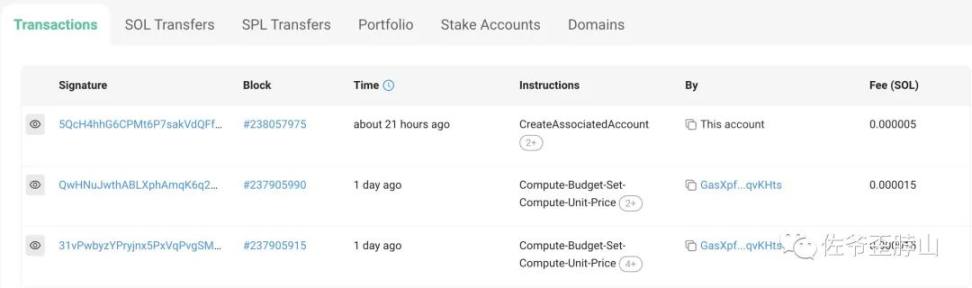

- Solana's locked volume exceeds $1.5 billion

- SUI's locked volume exceeds $200 million

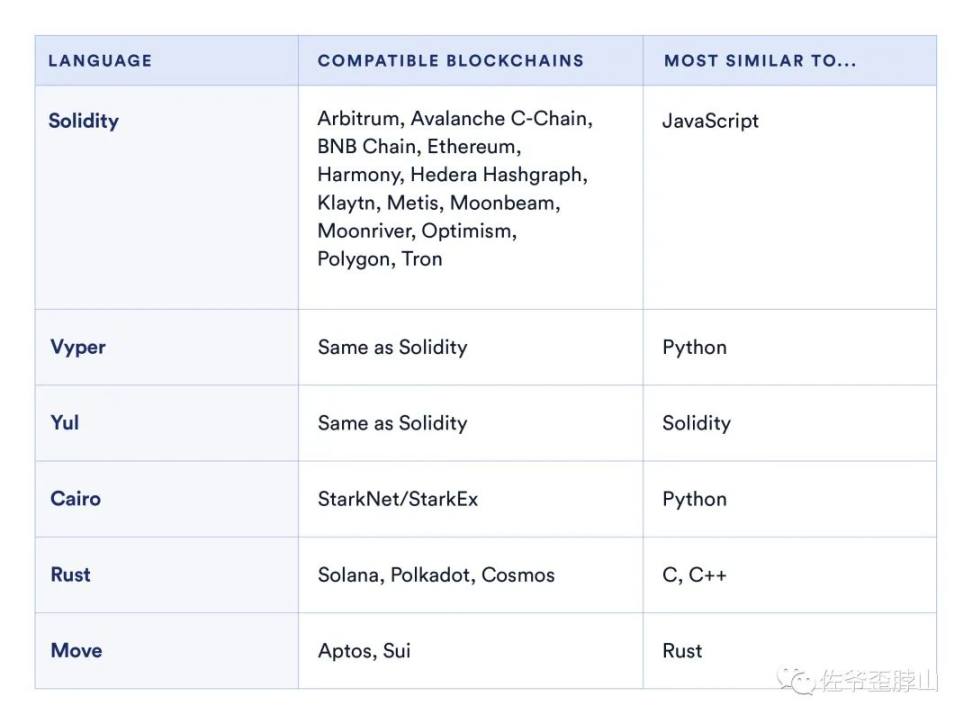

Commonly used programming languages in blockchain

Image source: Chainlink Blog

In addition, let's add some knowledge. (Not very rigorous to say) Move is a variant of Rust. Solana says that the relationship is similar to the two states of Qin and Zhao. They are all of the Zhao family, and there is no reproductive isolation, so they can intermarry. Therefore:

- The cost for Rust developers in the Solana ecosystem to migrate to Move-based public chains like Sui is much lower than going to EVM.

- Move public chain is actually a versatile paradigm, also following the path of high-performance L1. Facing Solana's charge, Sui also needs to help out.

- Sui continues to release unlocked tokens. On the 31st of this month, 4 million $SUI will be unlocked. Raising the price in advance can reduce some losses.

This is roughly the current strategic offensive situation in the competition among public chains (L2). The projects on Solana are actually all from the same origin, engaging in a high-performance L1 battle against Ethereum's L2, and have not yet reached the doorstep of Ethereum.

In the name of Move, in the practice of Rust

Yesterday, Deep Tide published an article, noting that parallel EVM will become the mainstream technology trend next year, and also cited the former co-founder of Polygon to support this. I want to point out that parallelism is not a new concept. It has been used in the field of computer science for a long time, and it is not a new concept for blockchain either. At least Sui is a major advocate of parallel computing.

Simply put, parallelism is like diverting traffic when there is a traffic jam. Whether it's widening the road or building a viaduct, the latest technology, such as switching from fuel cars to electric smart cars and fully optimizing route planning, is also a new approach.

Let's stop at the technical topic. It's just a sigh. Sui is parallel, ahead of its time, and becoming a prophet. Being technically ahead is indeed not as direct as pumping up the price.

Thinking of Sui reminds me of the early pioneer of domestic + Move + PoW mechanism, Starcoin public chain, which was developed using Move outside of Meta (Facebook). However, it did not catch the wave of rapid development and has now become a tear of the times. @jolestar was once a member of Starcoin. I hope that the Chinese people can make new achievements in the field of Move.

Move is actually a variant of Rust. Nowadays, Solana and Sui have begun to unite their ecosystems, but Aptos, Polkadot, and Cosmos have not yet followed suit. If these public chains can unite to deal with the EVM ecosystem, they can expand Solana's application space and also supplement the mainstream projects in the industry for later entrants, without crowding on Ethereum.

In the increasingly popular Alt L1 field, the first to go public was the first-generation Ethereum killer, Polkadot, followed by Cosmos. However, the former suffered from the peculiar parallel chain auction, and the latter was lifted to the sky by Luna-UST and then brought back down to earth. But in terms of technological evolution, they formed the early development paradigm of Rust, until Solana stabilized its position.

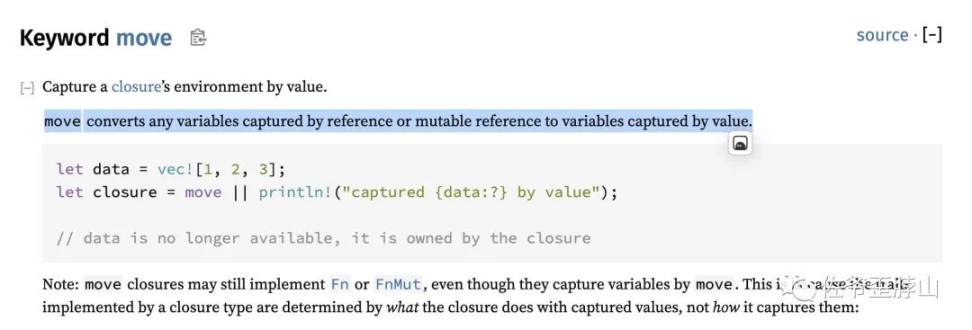

Looking back at the early glory of the Move language-based public chains, most people could not understand why one language could become the representative of many public chains. In fact, Move itself is a keyword in Rust. It is better to say that CTO Sam Blackshear of Sui invented the Move language than to say that he transformed Rust.

It is worth mentioning that Huawei is also a sponsor of the Rust Foundation. The wonderful knowledge points are instantly connected. The layout and exploration of the Chinese people in the Rust field are like getting up early and arriving late.

Where did Polkadot go?

The grand alliance of Rust (Move) language cannot be without Polkadot, but in this wave, Polkadot did not perform well. Perhaps Gavin Wood became wealthy too early and lost the motivation to move forward with a heavy load.

This question can be rephrased: Why has only EVM formed an ecosystem, while the Rust system has not?

In the past, people would reflect on this, attributing it to systemic issues, such as Rust being difficult to learn, a small number of developers, insufficient number of users and TVL, low project retention and user conversion rates, and many other reasons.

But after Solana rose, everything changed drastically.

It turns out that there was no leading big brother. EVM has an absolute core and ballast stone. Ethereum's excellence and superiority created the industry's second hard currency, ETH, and then stabilized the developers in the EVM ecosystem, giving them the patience to cross the cycle. After several bull and bear cycles, the rest of the ecosystem was either merged or surpassed. This is the true nature of everything. If you want others to say you are good, first you have to be good yourself.

Many projects on Solana are native. Take Raydium, for example. If you have used it, you will definitely be amazed by its experience. A 1,000 U transaction is almost completed instantly, and the fee is almost zero. In the face of absolute cheapness and efficiency, all accusations against the chain are gone. After all, they are all PoS. Why not choose a fast and cheap one?

So where did Polkadot go? Perhaps it got lost in the big house.

Conclusion

It seems to be talking about Sui, but it is actually expressing the opportunities in Rust. We have captured it before. This is very similar to the early days of Ethereum. Capital and miners helped it grow, but eventually it declined and became a mere tool.

I hope that developers and capital can seize this opportunity and build the future!

References:

https://cryptoslate.com/project-reports/sui/

https://medium.com/@kklas/smart-contract-development-move-vs-rust-4d8f84754a8f

https://doc.rust-lang.org/std/keyword.move.html

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。