Dova is a staking and lending protocol in the Bitcoin ecosystem, with the primary goal of unifying liquidity between the Bitcoin network and EVM network.

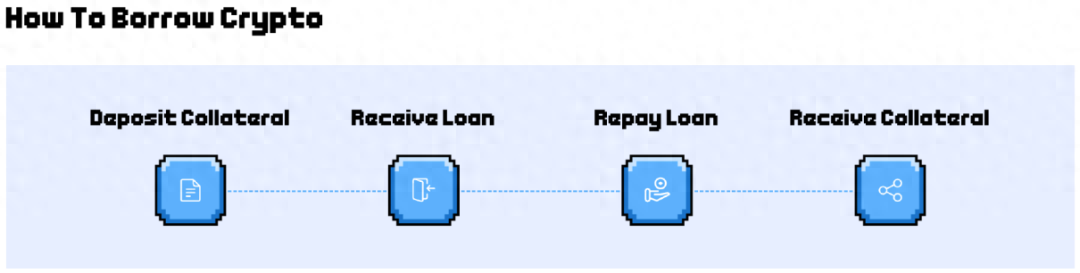

The Dova platform features staking and lending functions, allowing users to stake BRC20 assets on the Dova platform to earn interest, as well as to use the staked assets for lending and participate in DeFi activities.

According to Dova's roadmap, the staking and lending functions will be launched in the first quarter of 2021. In addition to staking and lending, Dova will also introduce staking and swap functions. Both DEX and lending are essential for DeFi.

- Analyzing Dova Protocol

Dova Protocol is an emerging DeFi protocol in the BTC ecosystem, aiming to bridge the gap between the Bitcoin ecosystem and EVM-compatible chains. With the increasing interest in decentralized finance (DeFi) from 2020 to 2021, Dova Protocol aims to bring some of these functionalities and liquidity to the Bitcoin network.

At its core, Dova provides a trustless bi-directional anchoring between Bitcoin (BTC) assets and tokenized BTC assets on the EVM chain, allowing broader application of Bitcoin ecosystem assets in the DeFi ecosystem. The protocol utilizes a dual anchoring mechanism, locking BTC assets on the Bitcoin blockchain while minting tokens representing the locked BTC assets on the EVM chain, which can be exchanged back to the locked BTC ecosystem assets at any time.

The Multi-Bit BTC-evm bridge lays the foundation for expanding the use cases of Bitcoin through DeFi, enabling functionalities such as lending, collateralization, cross-chain interoperability, and more, traditionally applicable only to ERC-20 tokens. For example, Dova Protocol plans to introduce lending and collateralization functions for the BTC ecosystem in the near future. The combination of Bitcoin's proof-of-work security minimization and DeFi functionalities on the EVM chain provides an attractive path towards decentralization and transparency. The emergence of Dova Protocol brings new vitality to the Bitcoin ecosystem. It not only provides DeFi functionalities and liquidity to the Bitcoin network but also enables widespread application of Bitcoin ecosystem assets in the DeFi ecosystem through the dual anchoring mechanism, establishing a close connection between BTC assets locked on the Bitcoin blockchain and tokens minted on the EVM chain.

The uniqueness of Dova Protocol lies in its utilization of Bitcoin's proof-of-work security and DeFi functionalities on the EVM chain, providing more possibilities for the Bitcoin ecosystem. Through the Multi-Bit BTC-evm bridge, DeFi functionalities are expanded, allowing functionalities such as lending, collateralization, cross-chain interoperability, traditionally applicable only to ERC-20 tokens, to be applied to the Bitcoin ecosystem.

In the future, Dova Protocol plans to introduce more innovative functionalities, such as lending and collateralization for the BTC ecosystem. These functionalities will further drive decentralization and transparency for Bitcoin, making it a more open and fair financial system.

Technical Architecture

Under the Multi-Bit engine, Dova Protocol smoothly transfers state between Bitcoin and EVM chains (such as Ethereum, BNB chain, or Polygon) through its relay node network. The adoption of this model is inevitable, as the Bitcoin blockchain is not compatible with chains supporting the Ethereum Virtual Machine (EVM), which lacks smart contract functionality. The Multi-Bit relay system tracks assets locked on Bitcoin (such as BRC20) and the corresponding assets minted on the EVM chain to facilitate bi-directional exchange.

The relay node cluster mutually checks transactions in a decentralized manner through economic incentives and security deposits, ensuring complete execution of transactions on both blockchains. Dova Protocol cleverly incorporates other significant DeFi primitives originating from the EVM chain into its technical stack: Chainlink price feeds for accurate asset (such as BRC20) price conversions during relay transfers; Chainlink VRF for providing secure and verifiable on-chain randomness; and The Graph for convenient access and parsing of relevant blockchain data for Dapp interfaces.

By leveraging Bitcoin's unparalleled security and achieving compatibility with DeFi components through the relay network, Dova has created a bridge, unlocking unprecedented functionalities. The protocol essentially acts as a cryptographic router, enabling asset routing between vastly different blockchains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。