Source: Coral Finance

In January 2023, after the launch of the Bitcoin Ordinals protocol, a wave of enthusiasm for script assets such as BRC20 and Ordinals ARC20 was stirred up on chains such as Bitcoin. Especially after the leading script assets such as ORDI and Sats were listed on Binance and gained over a thousand-fold increase, the FOMO sentiment in the script market continued to reach new highs, ushering in a new era of "chaotic dance" in the script market. Many users enthusiastically participated and enjoyed the wealth code brought by a new round of on-chain dividends. Similarly, after a long period of silence and a depressed bear market, the cryptocurrency market also ushered in a new round of emotional release.

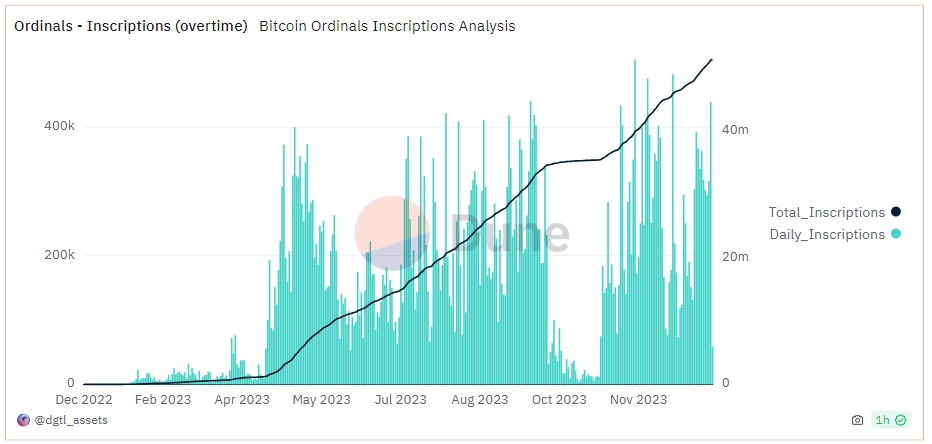

From a data perspective, according to Dune data, as of December 22, the cumulative fee income generated by the Ordinals protocol script casting alone reached 4,812.3 BTC, equivalent to 209,890,275 USD. The total amount of script casting has exceeded 50 million. After April 2023, Ordinals script assets almost always maintained a high casting volume (this does not include statistics for other on-chain scripts), which fully demonstrates the enthusiasm of on-chain players for script assets.

Image Source: https://dune.com/dgtl_assets/bitcoin-ordinals-analysis

The script sector is not limited to the Bitcoin ecosystem. It also includes script projects on other chains such as Arbitrum, Solana, Avalanche, BNB Chain, Polygon, and even some long-dormant on-chain ecosystems such as Fantom and Dfinity. The script market is also showing a flourishing trend in multi-chain ecosystems.

Many people refer to the script frenzy as the "carnival of long-tail investments" because script assets themselves adopt a launch method called "Fair Launch," which allows investors to directly cast in a fair manner after the assets are launched, without pre-participation by VCs or insider trading. Therefore, both VCs and whale users have to go to specific interfaces to cast in a first-come, first-served manner, or to buy in the secondary market. In the new wave of enthusiasm, long-tail investors have more say, which also gives the rise of the script sector a more "revolutionary" flavor.

"Hidden Concerns" in the Development of the Script Market

However, behind the booming script market, there are still some hidden concerns about sustainable development. The token issuance scheme based on the Ordinals protocol gives script assets a certain uniqueness, so script assets usually indirectly build transactions in a manner similar to NFTs, especially script assets like BRC20 that operate directly on the Bitcoin Layer1, making it more difficult to establish liquidity.

Similarly, in the early development of the script market, the infrastructure of the script market can be described as "rough." The surge in script transactions has caused gas fees on the Bitcoin chain to soar. Not long ago, the lowest confirmed gas on the Bitcoin chain even reached 400 s/vb, and gas fees even exceeded 100 USDT. In addition to the Bitcoin chain, gas fees on chains such as Avalanche, Polygon, and even Arbitrum have also reached extreme levels, and Arbitrum chain even crashed due to excessive on-chain traffic.

In addition to the underlying layer, there are very few applications that can support script assets. Only a few wallet projects, including Unisat, can support users in casting script assets and trading script assets with relatively low efficiency. There are almost no other Lego scenarios for script assets. So when users successfully cast or purchase script assets, the first thing that comes to mind is to place an order for sale, rather than continuing to hold.

Therefore, overall, the liquidity of script assets is even lower than that of the NFT market. In this situation, when script assets have extremely low initial pricing, it will further promote the formation of exaggerated paper gains for such assets and continuously create a FOMO sentiment, giving the illusion that everyone can earn from the script market. This premium established on extremely low liquidity usually leads to a high level of speculation. Under this FOMO sentiment, it also leads to the continuous loss of users and funds in other races and narratives.

From the past development experience of financial markets, increasing liquidity and circulation rate is usually an important measure for deleveraging. The good news is that the script sector tends to lean more towards technical narratives, which is fundamentally different from the essence of meme and NFT sectors. Many developers are already willing to participate and hope to help the script sector gain liquidity and promote the narrative of the script race in a new way through innovative technical solutions and mechanisms.

Script Liquidity Facilities

Establishing infrastructure to provide liquidity for script assets is one of the directions to capture liquidity in the script race. There have been some cross-chain bridge protocols that support BRC-20 assets, such as MultiBit and TeleportDAO.

MultiBit is a BRC20 to ERC20 cross-chain protocol based on BRC20 bidirectional cross-chain bridge design, which can achieve cross-chain transfer of assets between BRC20 and ERC20 tokens. Similar to MultiBit, TeleportDAO has also established a cross-chain Ordinals market, supporting cross-chain transfer and trading of assets between BTC and Polygon.

Allins is a DEX that builds liquidity for script assets in the form of AMM. It encapsulates script scripts from different chains in its unique virtual machine and continuously updates assets through indexers, and then establishes smart contract-based liquidity pools for these script assets. Users can further purchase and trade script assets through AMM and earn income through script assets in the Farming market.

In addition to the above solutions, the derivative race Coral Finance is also exploring in this direction. The protocol further extends its premium trading mechanism from digital assets to the script market to help the script market establish unique extended scenarios and lay out the second half of the script race in advance.

Extending the Premium Trading Mechanism to the Script Market with Coral Finance

Coral Finance is a blockchain derivative protocol with a unique premium trading mechanism that provides reliable, non-inflationary liquidity solutions for projects. It also improves the capital utilization efficiency of users and provides asset appreciation and hedging means.

In the premium trading mechanism, Coral Finance introduces a new derivative asset called cToken, which holders can obtain by pledging the original token 1:1 to the premium pool.

After completing the pledge, the value of the obtained cToken will be much higher than that of the original token, but cToken is locked and cannot be circulated. Users need to continuously unlock the locked cToken by making beneficial liquidity actions, including providing liquidity and completing transactions, to continuously unlock the cToken and earn income from the premium.

For example, taking BTC assets as an example, we can pledge 1 BTC token to the corresponding cBTC premium pool and obtain 1 locked cBTC token. After that, we need to provide liquidity for cBTC (additional purchase of cBTC) to change the cBTC token from a locked state to an unlocked state (tradable) and earn income from it.

Generally, the value of cToken will be a multiple of the value of the original token, and this premium mainly comes from the fluctuation of the intrinsic value of the asset over time, trading strategies, and market behavior. Therefore, when cToken is unlocked and traded, traders engage in a game with multiple parties and can benefit fully from it. Arbitrageurs can withdraw liquidity at any time and also redeem cToken 1:1 for the original token.

Coral Finance supports users in providing liquidity to one side of the pool in the form of a single token, rather than adding liquidity to both sides simultaneously based on the constant in AMM pools, which significantly improves the efficiency of capital utilization.

Based on the premium incentive mechanism, when users want to profit from the premium pool, if they do not hold the original token, they need to buy the original token to participate in the premium pool, which will drive the liquidity of the secondary market for the original asset. If users hold the original token, their participation in the premium pool will further reduce the circulation of the original token in the secondary market, which is more conducive to managing the market value of the asset. When participating in premium trading, users need to continuously contribute to the liquidity of the premium pool in order to obtain premium income (or even avoid losses), which will also provide a continuous source of liquidity for cToken.

Currently, Coral Finance is expanding this liquidity system to the script asset market. On the one hand, Coral Finance has launched a new cross-chain swap function and, through cooperation with other cross-chain facilities in the market, can further introduce a wider range of script assets into Coral Finance.

We can see that, apart from some leading script assets, the vast majority of script assets have a small market value and relatively dispersed chips. Therefore, under the promotion of the premium mechanism, script assets can not only obtain liquidity more widely from the market but also create usage scenarios for these script assets, further offsetting the bubble effect brought about by FOMO sentiment. From another perspective, script assets have a very broad user base, and more users can potentially capture leveraged returns from the script market through Coral Finance, which is also a new gain for Coral Finance itself.

Overall, Coral Finance's premium trading mechanism has great flexibility and scalability. Currently, it can support various types of assets such as cryptocurrencies, script assets, and RWA stocks. Coral Finance is expected to play a valuable role in various financial fields in the crypto world.

In addition to building specific liquidity facilities, the establishment of a complete Layer2 ecosystem around the Bitcoin system will further promote the role of script assets in various chain applications and provide a foundation for the long-term narrative space of this sector. In this direction, Coral Finance is also launching products built on the Bitcoin Layer2 version to comprehensively serve the Bitcoin ecosystem.

The Booming Script Market Accelerates the Return of the Bitcoin Ecosystem to Its Peak

The Bitcoin ecosystem is non-Turing complete. Although BTC's market value still accounts for over 50% of the total cryptocurrency market value and has the strongest consensus, its lack of compatibility with smart contracts has weakened its influence in the crypto market after DeFi Summer.

The script form dominated by Ordinals is crucial for the development of the Bitcoin ecosystem. By carving some information on the smallest unit of BTC, the satoshi, to enable the Bitcoin system to generate non-fungible token assets, it solves the problem of issuing assets on the Bitcoin chain. In fact, some Bitcoin communities are using this approach to issue some blue-chip NFT assets on the Bitcoin chain, and the application of BRC-20 has also led to an explosion of asset types in the Bitcoin ecosystem, with many people enthusiastically participating.

In order to reasonably implement the carving and casting of script assets, it has once again driven the upgrade and innovation of the technology in the Bitcoin ecosystem. In addition to Ordinal, there have been further asset issuance schemes such as Atomicals, Runes, PIPE, Taproots Assets, and so on. In addition, many well-known Bitcoin scaling solutions have been mentioned and valued again, such as Stacks, Lightning Network, RSK, RGB, BitVM, and so on. Under the promotion of the script wave, these Layer2 and sidechain solutions are expected to achieve new upgrades in technology and can build new underlying layers with different characteristics around Bitcoin Layer1, similar to the support provided by Bitcoin Layer1 in settlement and security, as in the Ethereum system.

In fact, some Bitcoin Layer2 solutions that are compatible with EVM, such as BitVM and Stacks, have been able to achieve various functions similar to Ethereum Layer2. Drawing on the mature solutions and development history of the Ethereum ecosystem, the DeFi application ecosystem around Bitcoin is expected to land quickly and attract a large number of developers to participate (there is already momentum in this direction). Some mature projects may also quickly migrate to the Bitcoin ecosystem.

This means that in the development of the Bitcoin ecosystem, sidechains and Layer2 are expected to become one of the important development directions in the next bull market, and this is also the best opportunity for the Bitcoin ecosystem to return to its peak. Therefore, both the script race and the Bitcoin ecosystem have tremendous development potential and prospects.

In addition, some views indicate that the crypto market is evolving towards a bull market phase, with events that can have an impact including the Bitcoin halving cycle, ETF applications, and Fed interest rate cuts, which also indicate that the bull market around the Bitcoin ecosystem may be coming soon.

We can see that old DeFi protocols such as Compound and AAVE, which were beneficiaries in the early stages of the Ethereum DeFi ecosystem, still have huge opportunities in the new wave of development in the Bitcoin ecosystem. In this potential bull market wave, Coral Finance is not only an early player in the script field but is also making lateral explorations in the direction of Bitcoin Layer2, which puts it in a favorable position before the arrival of the next bull market, seizing an advantageous position in the ecosystem. In the constantly evolving trend of the crypto industry, Coral Finance is expected to have tremendous development potential under its innovative value system and become a standout DeFi protocol in the crypto industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。