Bitcoin 4-hour Chart

Review of the Previous Article👇

The current market situation is indeed as mentioned in the previous article, leaning towards the bullish scenario 1; after reaching 41800, there was a strong rebound at a small level, and the current price is consolidating around 43600; whether the market continues to move upwards or encounters resistance and undergoes another round of downside liquidity, attention should be paid to subtle price movements.

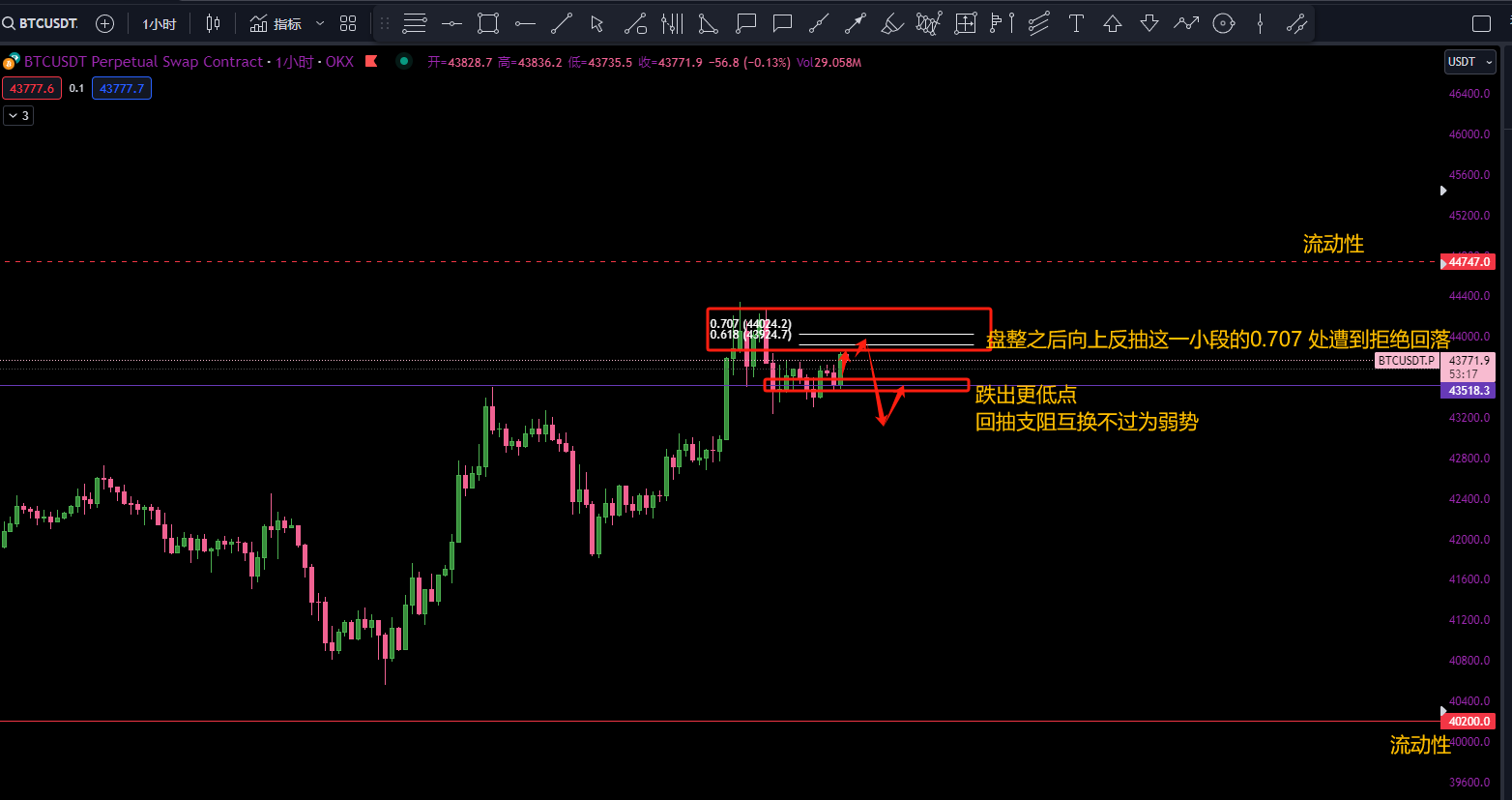

Bitcoin 1-hour Chart

Bitcoin is currently above the double top, which is also a support and resistance swap position; one should not be overly bearish until it falls back.

Key Focus 1

The location of the previous high liquidity is the key focus; the upper liquidity has accumulated all short positions from December 12 to today, December 21. Therefore, pay close attention to any false breakout price behavior.

Key Focus 2

The location of the long position liquidity at 40200; this is the intended long position; do not forget about it. If the market reaches this point, falls below, and then returns, it can be considered for an upward trend. If it falls below and does not return, it is certainly not advisable to catch a falling knife; this area has accumulated long position liquidity from December 11 to December 21.

Today's Focus: After consolidation, test whether the price is rejected at 43900~4400. If the market reaches 43900~4400 and shows a bearish engulfing pattern, and then falls below the support and resistance swap position of 43518, it indicates apparent weakness. As shown in the chart, pay attention to the pullback; if the pullback is weak, profits can be sought in the downward direction.

If it reaches near 43900 and there is no price action, pay attention to the location of the previous high liquidity. Those with long positions below should protect themselves at the previous high and consider hedging to avoid a roller coaster ride.

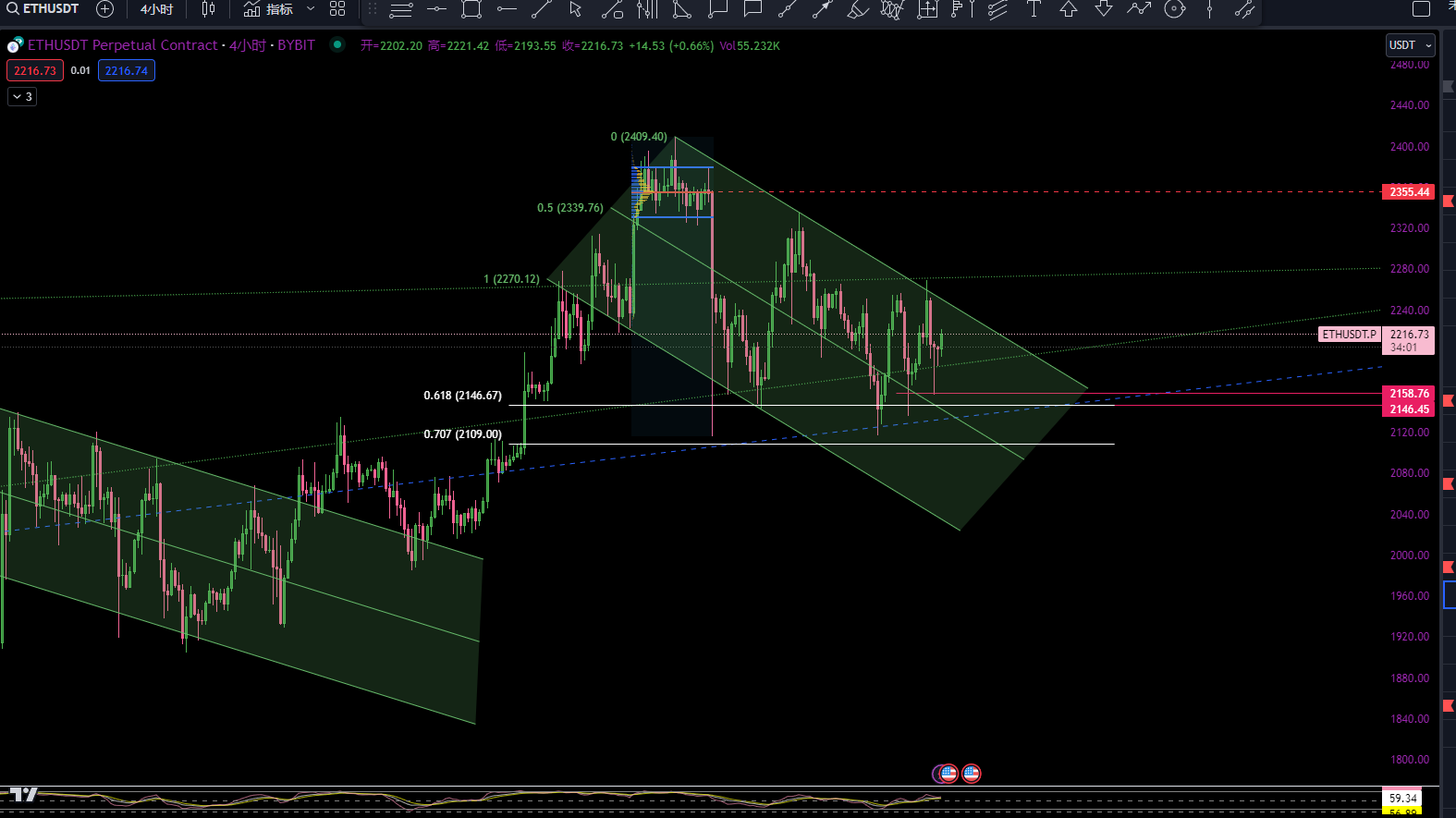

ETH 4-hour Chart

Since the last surge, Ethereum has been in a sluggish adjustment, and from a form perspective, it looks like a flag shape; this type of form is usually one of the continuation forms. It is worth noting that the daily 0.618 level integrates the weekly resistance trend line; so every time the market falls to around 2140~2150, there is a small rebound. Overall, Ethereum is not weak in terms of form; it can only be seen as an adjustment.

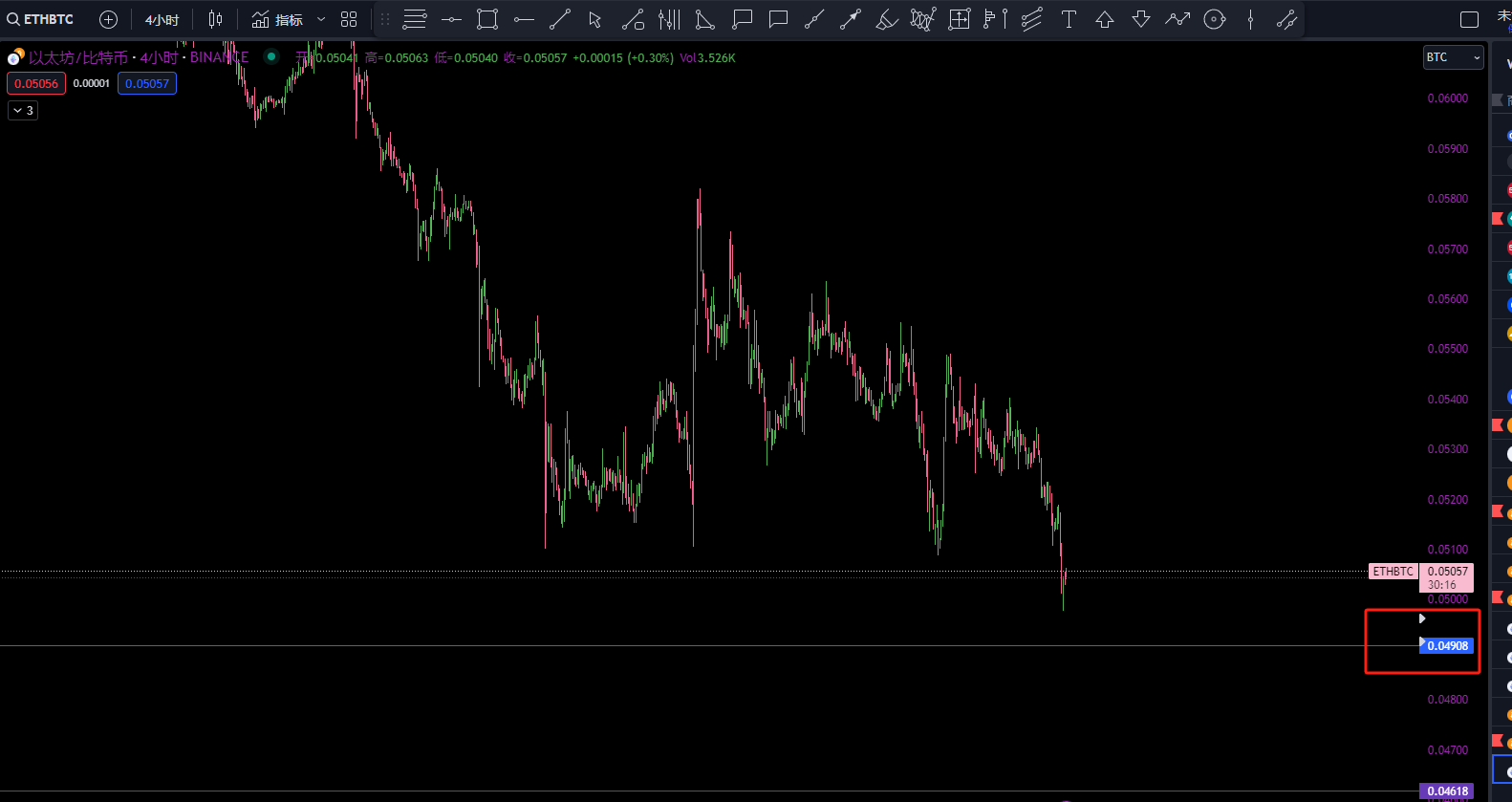

It is worth paying attention to the ETH/BTC exchange rate.

The 0.4908 level of the exchange rate has been mentioned multiple times; this is the defense since 2022. If it falls below and then returns, Ethereum will have a round of fountain-like surge. If the price falls through this level without any return, Ethereum will continue to be sluggish. The whales who went long on the ETH/BTC exchange rate during this round of decline were basically liquidated quite miserably; for example, this friend is in a dangerous situation.

At 2:30 AM, the ETH/BTC exchange rate fell below 0.05 (dropping to a minimum of 0.4977), triggering the liquidation of 4210 ETH, which was sold for 203.28 WBTC to repay the debt, worth 9.26 million US dollars.

After being forced to liquidate, he borrowed 997 ETH through a flash loan, actively repaid 92 WBTC, and still has 1,463 WBTC to repay; it is estimated that he is not sleeping well. If the position mentioned above cannot hold, then a collective pullback led by Ethereum in the altcoin market will present another opportunity; more bullets can be fired into the market. More specific layouts will be arranged in the free communication group. Interested partners can follow me.

Creating a High-Quality Circle

Spot market potential coins are the main focus

I will share some content: as shown in the following conditions:

Overall position ≥ 10,000u, those who want to join can follow directly;

(Operating with only a few hundred or a few thousand units has too little room. If you don't have it, you can also send a private message. Those who pass the screening can also join) Purpose: to become bigger and stronger, and create brilliance in the next bull market!

The article ends here. I will provide more detailed analysis in the communication group. If you want to join my circle, please follow directly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。