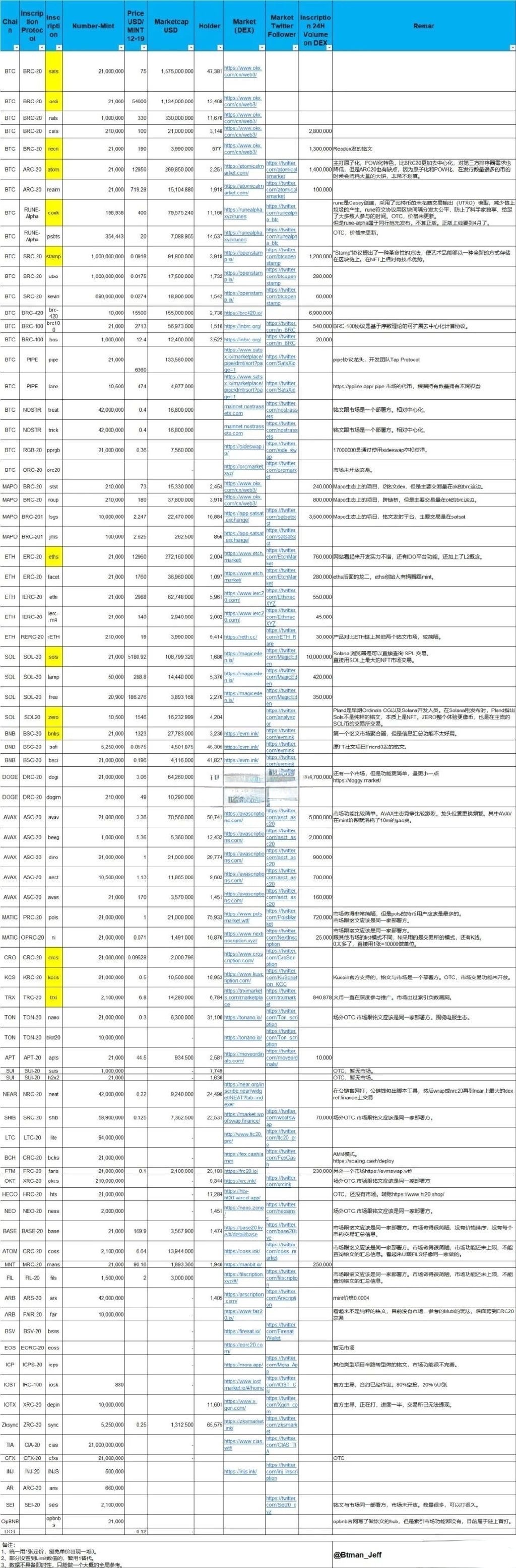

Binance has successively listed three inscription coins, bringing wealth effects to the market and prompting retail investors to flock to the inscription track, stimulating various chains to enter a phase of frenzied asset creation. It's very similar to DeFi Summer. Despite having so much information, I don't think the peak is due to that. During DeFi Summer, there was also excessive FOMO, with a lot of chains replicating the DeFi ETH suite, but when the trend receded, there were no real users and transactions left.

Nevertheless, the valuations of these mid-to-tail DeFi projects at the time were still between 50-100 million. In the current frenzy of inscription, mid-to-tail inscriptions have been hyped to 20-50 million, which I think makes a lot of sense. The inscription is divided into three stages: childhood: February to May 2023. Prime: November to mid-December, the phase of inscription hype caused by Binance. Middle age: mid-December to the end of January, the phase of secondary inscription competition.

The food chain consists of Mint players - OTC players - inscription market players - exchange players. The food chain referred to by DeFi is: airdrop/IDO - on-chain players trading players.

At the current stage, the supply of inscriptions is rapidly increasing, and we have observed the emergence of some paid inscriptions, which disrupt the fairness of inscriptions and take advantage of the ignorance of retail investors. There are also some non-inscription projects, Readon/Friend 3, issuing coins in the form of inscriptions. This is good for the projects themselves. But all of this has immediately led the market into a divisive stage. Currently, retail investors are not enough to split the OTC group.

So it's best to pay attention to: a. tap: Ordi, Sats b. Expected tap inscriptions on other BTC protocols: atom, cook, stamp c. Expected tap inscriptions on mainstream public chains: eth, sols, bnbs, avax? d. Expected exchange of public chain inscriptions: cross, kccs, trxi, the first two types of small public chain inscriptions need to prepare corresponding tools, scripts, RPC to stay on the desktop.

There will be some projects that combine the gameplay of BTCfi, such as $AUCTION and $MAPO full set, and there should be new projects of this kind, which everyone can pay attention to.

This data feels a bit strange, the turnover rate is too low. Avax can be said to be the melee of the 8 kingdoms, the dragon iteration is too fast = no dragon? UTXO model, the current market heat is mainly concentrated in the Bitcoin ecosystem. In the inscription market, DOGE/BCH/BSV/LTC, if the inscription market value/public chain market value is much lower than the account model ETH/BNB/SOL/AVAX, I haven't found the reason, please give me some understanding.

In the currency circle, you need to have a keen insight into the trend and keep up with a good team and a good leader. Follow the official account: Cryptofish, and you will already be halfway to success in the currency circle!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。