Original Author: @cryptocholy

Hello, esteemed reader @cryptocholy, it's been a while. I've also heard about the LayerZero project, and now let me analyze this project for you.

The goal of this article is to re-examine the phenomenon of the LayerZero project, which has become one of the most discussed projects in the past few months.

Such precedents are important: it seems that a lot has been said about this project, but there are not many deep analyses at the core. Through a deeper understanding, we gain some important discoveries, which will provide a basis for analyzing other projects and complement the picture of web3.

I will discuss a strategy for accumulating capital and present arguments for why LayerZero is likely to adopt this strategy (and whether this strategy is available to us).

What is special about this project, what role do VCs give it, and why do they bet that L0's solution is an important part of the future of web3?

This article is for those who:

Rethink the long-term value of $ZRO tokens, or the impact after the airdrop.

Prepare for the active phase of the market. (Reference period 1-2 years)

Obtain new analytical ideas applicable to other projects.

Consider/adopt the investment arguments insisted upon by leading VCs.

We are now in a period full of possibilities: the bear market may have ended, and strong projects that have experienced and survived the crisis may define the future bull market. The upcoming halving of $BTC will be an important milestone towards an active market phase.

Currently, we have the opportunity to gather the "results" of the bear market, similar to $SOL, $FLOW, $AVAX, and $NEAR (they all went through the last bear market and flourished in the recent bull market). Some have actively participated in "multi-contribution" projects, and there is another approach suitable for long-term investors, which I will introduce below. Let's get started!

Disclaimer: This article may seem too "positive" about LayerZero, and that is the purpose of the article - to explore the reasons why it is highly valued in the market and among the audience through specific project examples, to provide new insights. After experiencing various twists and turns in Web3, this project has undergone rigorous scrutiny and has received strong support from industry leaders.

In this article, I deliberately rely on information from public sources (as I cannot share unpublished information).

This is not investment advice - please do your own research (DYOR).

The technical part is co-authored by the creators of the myslepotok channel.

To save your time, I have made efforts to divide the article into two parts:

General analysis information, ideas, and insights about the project.

In-depth exploration of the essence of the project, its technical aspects, competitive comparisons, and its ecosystem.

Don't worry if the article looks long, most of the content is prepared for those who want to delve deeper.

The content was produced in strategic partnership with @Lilgreencandle.

Overview

Brief introduction: The uniqueness of LayerZero (VC trends)

What is unique about LayerZero and how does it fit into VC trends?

Technology and the problems it solves

What problems does LayerZero's technology solve?

Technical explanation

An easy-to-understand introduction to LayerZero's technology.

Competitors and network effects, is LayerZero ahead?

Who are LayerZero's competitors, and is it ahead in network effects?

Why choose LayerZero?

Why is LayerZero needed with cross-chain bridges?

Sub-product - Stargate

What is Stargate, and is it a sub-product of LayerZero?

Team and funding situation

Who is the LayerZero team, and how do they attract investment?

Token $ZRO

Details about the $ZRO token.

Is airdrop a forced strategy or a clever marketing tactic?

Is the airdrop mandatory or a clever marketing strategy?

Is a valuation of $30 billion too high?

Is a valuation of $30 billion too high?

Conclusion, LayerZero's impact on web3, why now?

Overall assessment of LayerZero, what impact does it bring to the future of web3, and why now?

Cryptocholy is looking for like-minded people?

What type of partners is Cryptocholy looking for?

In-depth

LayerZero's technical architecture and 13 steps for message delivery.

Detailed architecture, features, advantages, and disadvantages of LayerZero's technology. 13 steps for message delivery.

Technical and marketing comparison of LayerZero's competitors

Comparison of LayerZero's competitors from a technical and marketing perspective.

Ecosystem overview

Overview of LayerZero's ecosystem.

Brief Overview: The Uniqueness of LayerZero

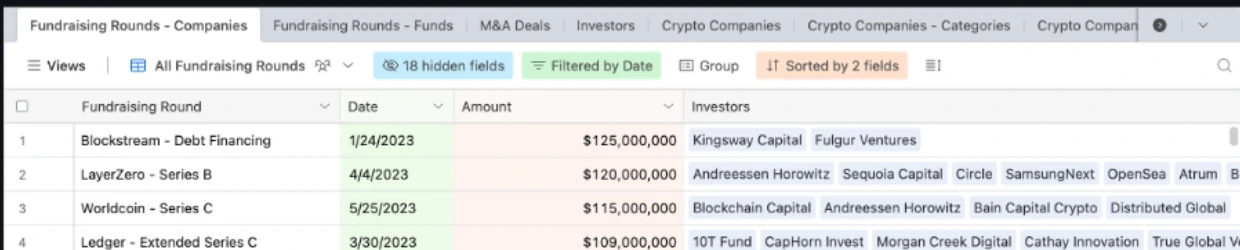

Currently, in the large web3 venture capital field, there is a successful investment proposition: to invest a large amount of capital in later-stage projects (Series A, B, C), connecting various resources in this way to influence the appreciation of their $10/30/100 million investment, rather than diversifying funds into 100 projects, each with a $500,000 investment.

For example, A16Z allocated only one-third of its latest $4.5 billion fund to seed-stage (early) investments.

There is a fairly common rule that the final round of financing is often completed within a few months/quarters before going public, which is a very short waiting time in the standard of venture capital. The first project that made me notice this rule was APTOS.

The project raised over $350 million from the smartest funds in web3.

Notably:

In March 2022, a $200 million financing was completed, with a valuation of $800 million.

In July 2022, a $150 million financing was completed, with a valuation of approximately $2 billion.

In September 2022, strategic investments were obtained from Binance Labs and Dragonfly, with a valuation reaching $4 billion.

In October 2022, APTOS went public, with a global circulating market value of approximately $8 billion (peaking at $19 billion), and began executing contracts.

The project quickly grew 5 times in valuation before going public, and the last round of investment was almost done just before going public, meaning investors achieved a multiple of their multimillion-dollar investment in a very short time.

*It is worth noting that investors may have partially sold their allocations in the spot market, or hedged their risk by using short positions against FDVs that match the valuation level.

At this stage, investors take on relatively small risks because the project has gone a long way, validated hundreds of assumptions, built a strong team, and attracted continuous funding for several years. The work results and achievements can be tracked (unlike seed round investments, where you invest in the founder's idea).

Additionally, there is usually strong venture capital (VC) support, which helps them identify trends and profit from the rise of the $APT market.

Then, I decided to filter out similar projects to find common patterns. My selection criteria include:

Attracted over $100 million in investment

Went public this year/last year

Comparatively at the investor level:

SUI - Attracted over $336 million in investment.

The last round of financing in September 2022 reached $300 million, with a valuation of approximately $20 billion.

When it went public in May 2023, the peak market value reached approximately $14 billion, and the current trading market value exceeds $6 billion.

OPTIMISM - Attracted over $179 million in investment.

In a financing round in March 2022, the valuation was $1.5 billion.

Went public in July 2022, with an average trading market value of around $700 million, peaking at over $1.2 billion.

WORLDCOIN - Attracted over $125 million in investment.

In a financing round in March 2022, the valuation was $30 billion (the same as LayerZero's valuation).

In May 2023, an additional $115 million in financing was raised (led by a16z).

Listed on Binance in July 2023, with a current circulating market value exceeding $21 billion.

ARBITRUM - Attracted over $124 million in investment.

In the last Series B financing round in 2021, the valuation was $1 billion, however, from the fourth quarter of 2022 to the first quarter of 2023, it can be purchased in the off-market at an FDV of $2 billion to $5 billion.

The current market value is $12 billion (peaking at $17.5 billion).

In all of these projects, there is an opportunity for reinvestment based on the valuation of the last round of financing (or close to the valuation).

With such a large amount of capital and a network of relationships, projects are able to achieve the best listings, marketing, market creation, and partnerships.

Except for ARBITRUM, these projects all have a common investor, A16Z.

$OP, participated in 2/3 rounds of financing, with experience leading the investment twice.

$SUI, 2/2, led the investment once.

$WLD, 2/2, led the investment twice.

$APT, 2/2, led the investment once.

Here, we continue to focus on the protagonist of this article, LayerZero:

Attracted over $290 million in investment.

In April 2023, the last round of financing was $120 million, with a valuation of $30 billion.

In the past two rounds of financing, A16Z led the investment.

The token is expected to be launched in the third/fourth quarter of 2023.

*One is the official lead investor, and the other is an unofficial lead investor.

**For detailed information about $ZRO, please refer to the $ZRO section.

It is no longer necessary to list all of LayerZero's investors here, as they have attracted top-tier investors: A16Z, Sequoia, Binance Labs, CoinFund, Franklin Templeton, Tiger Global, Multicoin, Spartan, DeFiance, and this is just a part of them.

It is worth mentioning that the last round of financing was for "pure strategic coordination," as stated by the CEO of LayerZero, they actually did not need this funding.

"We want to make breakthroughs in the gaming industry and the Asia-Pacific market, and this funding is largely used for the company's development there."

It is possible that this is more of an opportunity for funds to reinvest.

Based on many indicators, we can see how LayerZero fits into the late-stage investment strategy, just as I discussed the successful launches of $OP, $SUI, $ARB, $APT, $WLD before.

In many ways, we can see how LayerZero fits into the late-stage investment strategy I revealed in the successful launches of $OP, $SUI, $ARB, $APT, $WLD, and it is not a coincidence that it was chosen by funds:

For a long time, this strategy has been called "Fat protocol," that is, investing in L1 blockchains (now also including L2), from which investors have gained huge returns (e.g., flow, solana, arbitrum, optimism, etc.). However, the concept of "Fat protocol" is gradually disappearing, and the profitability and superiority of blockchains are being replaced by applications. The former GP of Spartan stated that applications will surpass blockchains in profitability.

Another example that adds confidence is that LayerZero Labs, with investors such as FTX and Alameda, quickly bought back their shares in November 2022.

"This will put us in a very strong position for the next few years. Even in our aggressive predictions, we have at least 7 years of development time, with abundant capital and one of the best teams in the entire crypto space." - CEO of LayerZero

Revealing the essence of LayerZero's technology, we realize that it is a delayed-action bomb. The protocol aims to connect all blockchains and their applications. In other words, this protocol not only stands outside the competition between blockchains and applications, but also catalyzes this struggle, opening the door to a new future for Web3.

A reasonable question is, why did the project raise a record-breaking approximately $300 million from the world's best supporters?

It is worth noting that venture capitalists currently have a critical influence in the web3 space, and sometimes even have the power to shape the future. They already know what we might see in 2024 and beyond (because they supported these projects in the early stages), which directly affects their decision to invest a large amount of funds at such valuations.

"There is no longer any doubt that the future of cryptocurrencies and web3 is multi-chain, and LayerZero has created a critically important infrastructure to make this possible." - A16Z GP Ali Yahya

Multicoin - one of the main lead investors in LayerZero's early rounds in 2021. They introduced Solana to the world (dominant investor in the seed round), also supported Arweave, Dune Analytics, and CyberConnect and Sei, which successively landed on Binance Launchpad in the seed round.

LayerZero paves the way for the first batch of full-chain applications, providing opportunities for lending, AMM, management, etc., and truly enables them to be independent of the network." - Kyle Samani, partner at Multicoin Capital. "Dapp developers no longer need to write chain-specific code; instead, they can use LayerZero to create a unified interface for communication across all chains. Anyone who wants to share or integrate state across multiple chains should use LayerZero. Just like most applications do now.

A16Z is, in my opinion, the most noteworthy venture capitalist in the current web3 space, so I will introduce them as soon as possible:

Founded in 2009, it has become a global leader:

Supported Facebook, Pinterest, GitHub, Instagram, Skype, Coinbase, and more.

Chris Dixon, GP and CEO of A16Z Crypto, topped the Forbes 2022 Millennial List and was selected as one of the world's best venture capitalists by Coinbase trading.

Supported crypto projects include: Ripple (angel round), Solana, Flow (key role in Coinbase's creation in 2018), Near, Uniswap (lead investor in the first round in 2020), Aptos, Avalanche, dYdX, Compound, MakerDAO, Arweave, and the list goes on.

In an article about bear market research in 2022, we mentioned that Andreessen Horowitz raised a $4.5 billion crypto fund to take advantage of favorable trades in the bear market. This makes it the "richest" fund in web3.

It is A16Z that has set an unofficial goal - to achieve 1 billion crypto users by 2031.

There is an increase in Web2 investors:

Samsung Next - This is Samsung's venture capital division, actively investing in blockchain startups, and is an early investor in projects like Axie Infinity, Sui, Aleo, and Sandbox.

BOND - A Web2 institution that has supported Airbnb, DocuSign, Facebook, LinkedIn, Spotify, and Square.

Franklin Templeton - An institutional fund with assets under management of over $1.5 trillion, with a wide investment portfolio, recently invested in cryptocurrencies, with the portfolio also including Sui and Aptos.

I believe this represents a new level of user introduction: this project is even being discussed outside the Web3 community. This seems to be a good entry point for new users to enter the market.

Christies (the largest auction house) has only a few investments, one of which is in L0, and has also made two rounds of investments (other investments are related to NFTs and art-related products).

I think this is a strategic investment, as the company is actively exploring web3 and has been selling NFT artworks through its auction house for a long time (reputable in the 1/1 art field).

This indicates that LayerZero is poised to become a leader in the next wave of adoption, including in the NFT space, as they are addressing the issue of transferring NFTs between networks.

Web3 is entering a critical product level, and may even have a strategic impact on Web2/traditional business products, which is attracting institutional investors. Projects like LayerZero that solve important problems help attract users and businesses to enter Web3.

Technology

LayerZero - is a full-chain interoperability protocol.

"Our mission is to connect every smart contract in every network." - CEO of LayerZero.

Full-chain protocols like LayerZero allow users and developers to interact across different blockchains as if they were one unified network.

In short, if two different systems have interoperability, it means they can "communicate" with each other and understand each other, even if they are developed by different teams and use different technologies or standards.

The core idea of full-chain technology is simple: in Web3, due to the existence of numerous networks and decentralized users/applications/funds, there is a risk in token transfers, and centralized exchanges also bring problems. Full-chain technology aims to allow users and applications to fully enjoy the benefits of Web3 without needing to understand its complexity. Essentially, it transforms the cryptocurrency ecosystem into a unified network.

The goal of LayerZero technology is to address the issue of the dispersion of products and user assets across different networks. The protocol will allow "information exchange" between blockchains, enabling:

Secure transfer of tokens/NFTs between different networks

Access to liquidity on networks like Solana, Aptos, etc., for Ethereum applications

"Communication" between incompatible (and compatible) blockchains, creating new levels of applications and user experiences

Yes, you can support specific blockchains and access solutions from other blockchains without additional operations, making your interaction experience seamless.

In the context of web3, it is committed to creating networks for specific tasks, and it may be difficult to imagine the future without such technology: for example, Zora has created a Layer2 solution for NFTs, and it would be difficult to imagine how NFTs could be "transferred" to other networks without LayerZero.

Furthermore, web3 is striving to adapt to the arrival of new users. Currently, for newcomers to feel comfortable in DeFi, they need to have at least a basic understanding of the mechanisms of multiple major blockchains, dozens of projects, and more complexly, how these blockchains interact with each other.

This is not a simple task, as with registering on an exchange, you can trade almost any token without having to worry about networks and other complexities. But can we rely on trust in centralized structures?

"Not your keys - not your tokens."

Imagine an exchange that integrates liquidity from all blockchains, providing users access to protocols for the best lending, yield farming, trading, and leveraged trading of any token in any network, all within a decentralized application.

Sounds impossible? But this is exactly what LayerZero technology aims to achieve.

"By enabling cross-chain operability, LayerZero enables developers to create decentralized applications that were previously almost impossible to achieve." - Ali Yahya, partner at A16Z.

At the same time, all the "inter-network communication" processes will seamlessly take place, and end users may not even notice it.

"For the average user, their protocol will run in the background, as easy as standard railroad tracks." - CEO of LayerZero.

Summarizing the essence of the LayerZero solution in simple terms

What problem does it solve?

The simple explanation of the LayerZero solution is that it makes interactions between different blockchains imperceptible to ordinary users, just like the international flight system. Different countries have their own airlines and airports, and they all operate according to their own rules and standards. However, due to international standards and protocols, passengers can fly from one country to another, transferring between flights of different airlines. This is possible because all these systems are interoperable - they can "communicate" with each other to ensure smooth and efficient travel for passengers.

Similarly, LayerZero enables communication and exchange of transactions between different blockchains, even if they are developed by different teams and use different technologies. This can make the use of cryptocurrencies and blockchain technology simpler and more convenient, just like international flights make travel simpler and more convenient for passengers.

Sequoia Capital also describes this technology with a simple analogy:

In the current cryptographic context, it can be compared to DoorDash or Uber, which only operate between iOS or Android users. Imagine if you could only book a ride from a driver with the same phone as you, even if a driver with a different phone is just a minute away. Or, as another analogy, imagine if Gmail users could only send emails to other Gmail users, and Yahoo users could only send emails to other Yahoo users, and so on. The fragmentation of the first layer of blockchains creates barriers for users and protocols. Networks are most efficient for users with unified user, data, and liquidity.

Competitors and "Network Effects"

It is naive to think that only one team is solving such a huge problem. I will provide a list of projects that are working to solve similar problems:

When discussing competitors of the L0 project, it is important to note that the valuation and recent rounds of financing consider the competitive landscape. However, L0 focuses not only on technology but also on efficient management and marketing. These three components together create a unique advantage for L0 compared to other projects.

Comparing LayerZero (L0) to competitors such as Avalanche (AVAX), Cosmos (ATOM), Polkadot (DOT), and Near (NEAR) (mentioned in some investment comments) is not appropriate because L0 adopts a more modern technological approach. More detailed competitive analysis can be found in the additional information (competitors of Chainlink and Axelar also have detailed analysis).

Chainlink's Cross-Chain Interoperability Protocol (CCIP):

Launched in July 2023.

LayerZero's technology actively integrates ChainLink's services, including "risk-led accounting."

CCIP has good connections and reputation, but a smaller user base, as they aim to serve central banks and companies rather than individual users. L0 is also working to attract a user base.

Chainlink and L0 offer similar functionalities, such as message exchange and "endpoints" in each network. However, there are key differences in decentralization and security.

For example, Chainlink has a high level of decentralization due to having multiple validating nodes. However, unlike L0, Chainlink lacks oracles and relayers, which may lower the level of security. In L0, oracles and relayers interact to verify transactions, preventing the possibility of tampering with transactions when Chainlink or nodes are attacked.

Initially, L0's whitepaper indicated their plans to connect with Chainlink's oracles. However, as Chainlink is their competitor, L0 developed their own oracles and relayers, which mutually verify each other, providing an additional layer of security.

Axelar is currently ahead of L0 in decentralization (which will be improved with the implementation of ZkLightClient), but it entered the market during the collapse of 3ac, terra, and celsius, which severely affected the price of its tokens, damaging its reputation. Therefore, the technology has not seen widespread demand.

Zero-Layer Network Effects as a Competitive Advantage

The School-Cryptostartup from A16Z (2020) explains the importance of network effects in the development of crypto startups.

For ease of understanding, it is worth watching the video (at least from 35:15).

In simple terms, the characteristic of the LayerZero project is its ability to quickly and massively gain the trust of customers and users. This makes it difficult for competitors to catch up without significant advantages.

To emphasize this point, I would like to remind everyone that this lecture was hosted by Ali Yahya - a general partner at A16Z. It is he who has been involved in investment transactions for LayerZero, Matter Labs (ZkSync), Solana, and Alchemy. Undoubtedly, L0 has taken this competitive strategy into account.

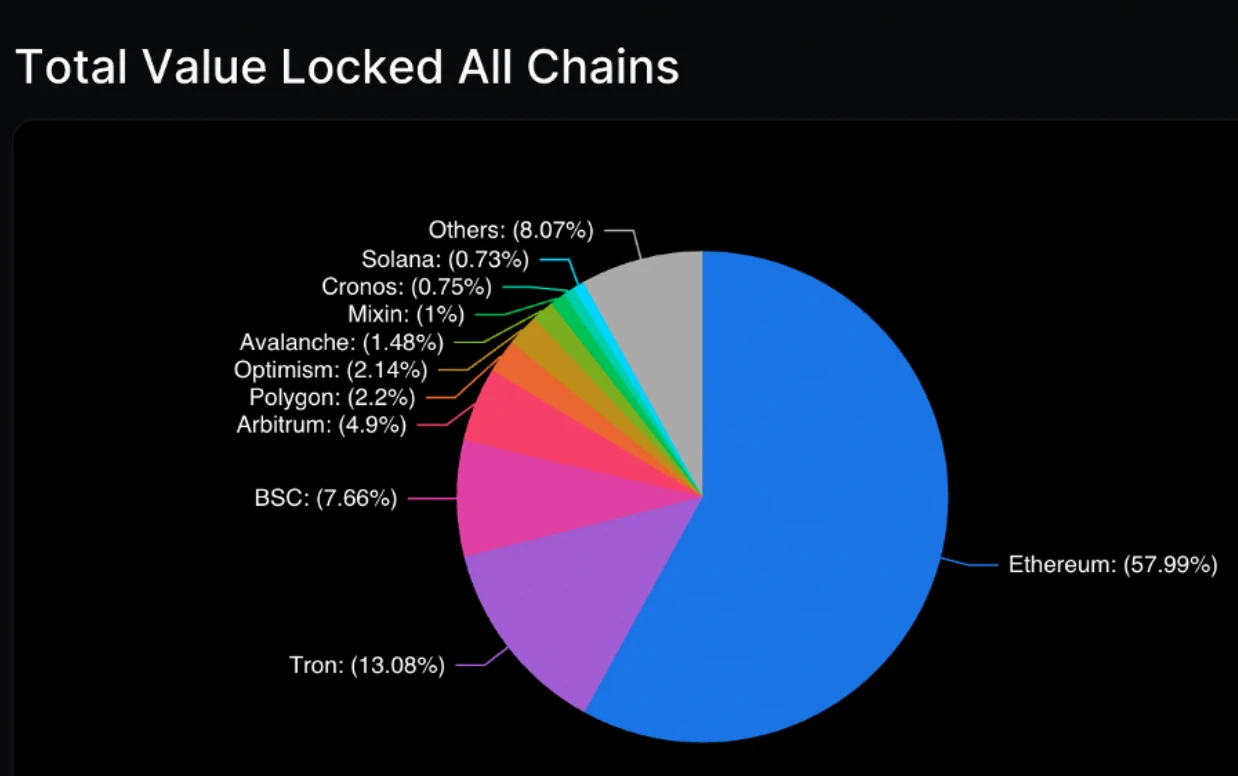

Take Ethereum as an example, it is one of the leaders in the field. By entering the market first and gaining influence and trust, Ethereum is almost impossible to displace from its position. For modern L1 competitors, we clearly see that they can only integrate with Ethereum, trying to attract its user base.

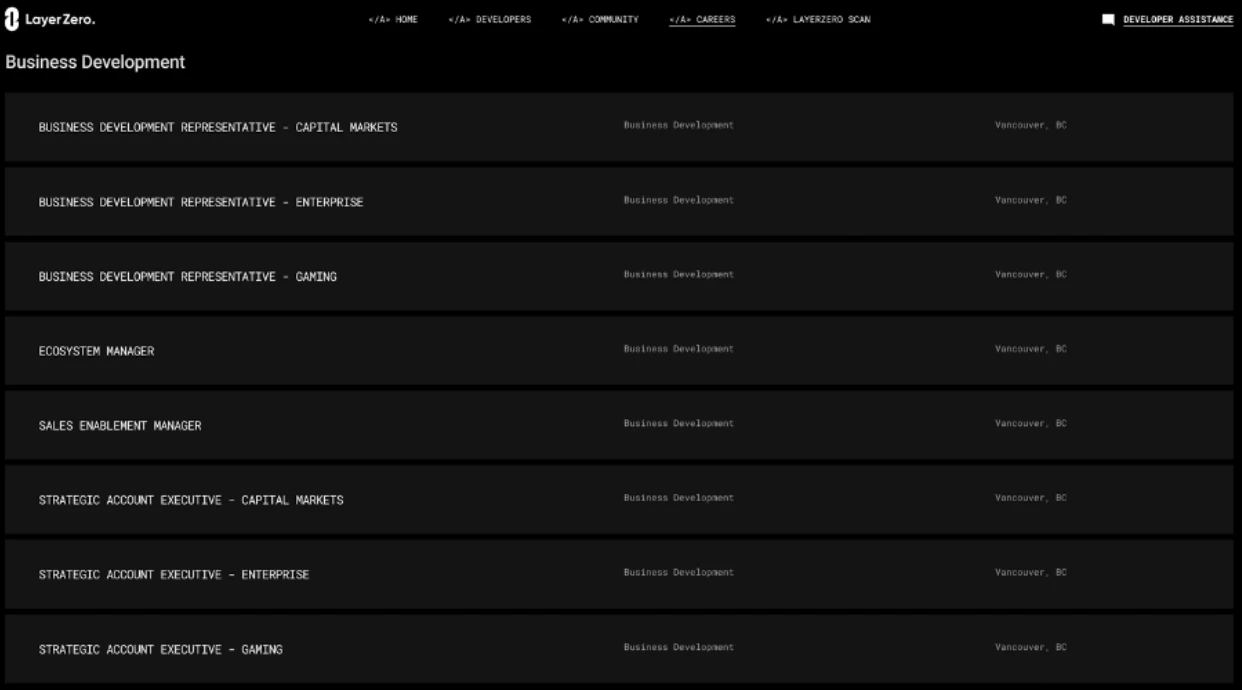

A similar situation also occurs in LayerZero, where competitors' solutions either have not been successful or have just launched. In addition to significant marketing in users and projects, LayerZero actively hires employees for sales and promotion. It is worth noting that, according to the CEO's statement, they are particularly focused on the gaming sector.

It is also worth noting that LayerZero clearly has a more abundant reserve of resources, both in terms of financing and the potential of relationship networks (including web2, etc.). There are also economic motivations in the project's development and support from funds.

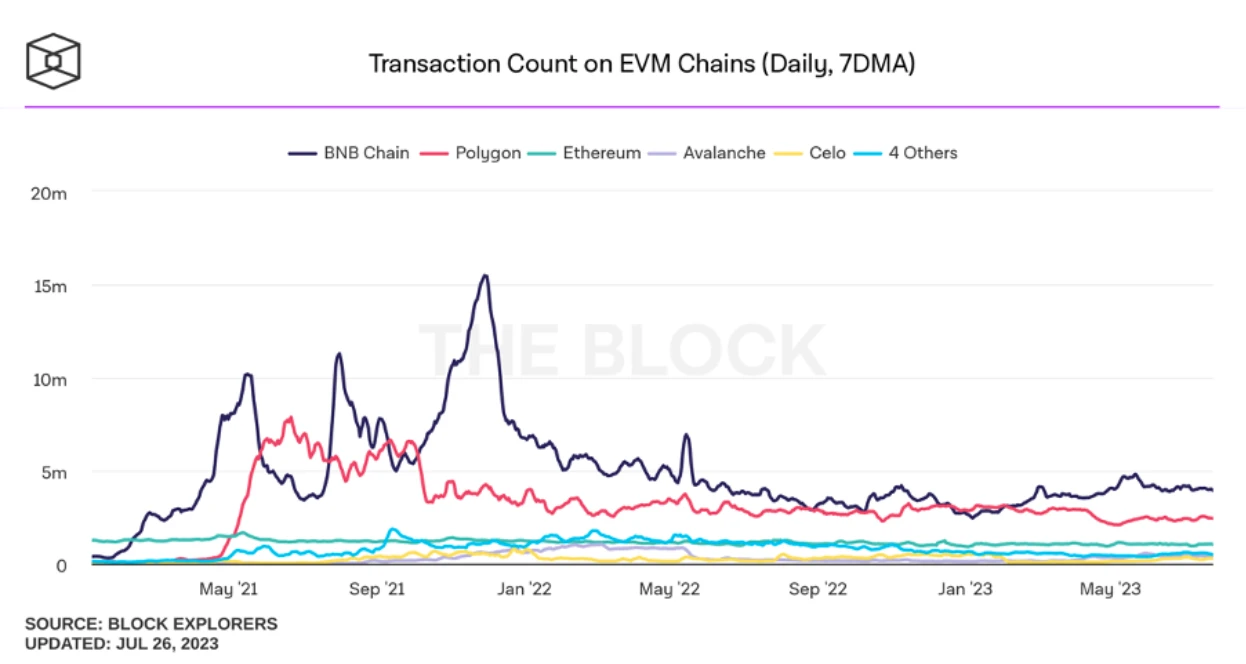

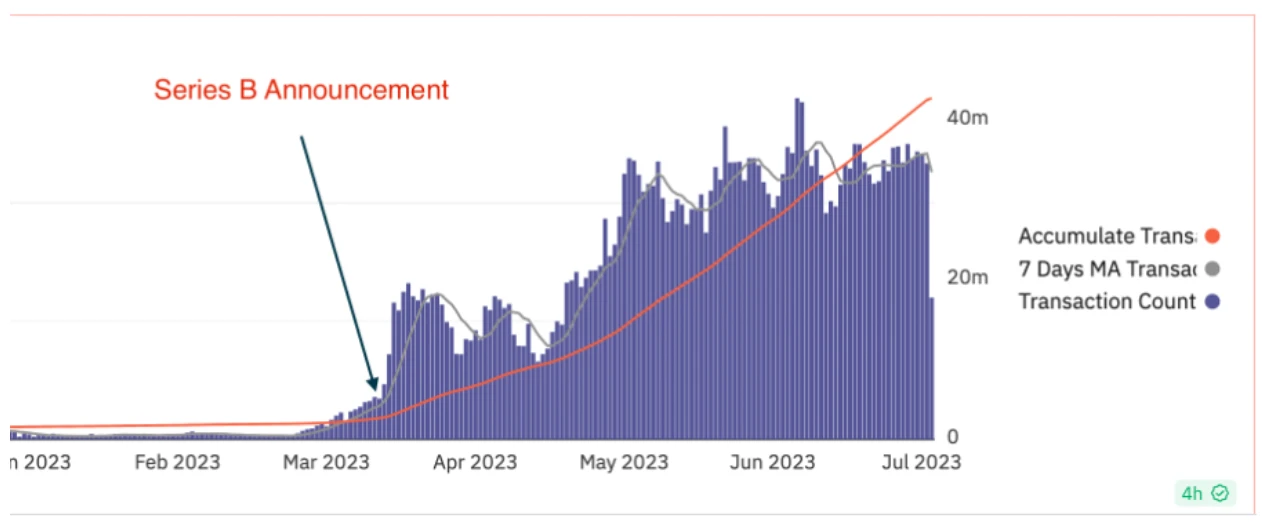

In addition, it is important to consider that the project has processed over 50 million transactions, with the most active days reaching over 1 million transactions.

Despite active discussions about airdrops, which may involve the entire transaction volume, it is important to understand that the project did not experience significant technical failures during this period! This entire stress test provided the team with valuable datasets. It is difficult to imagine competitors going through a similar situation, which is an important advantage.

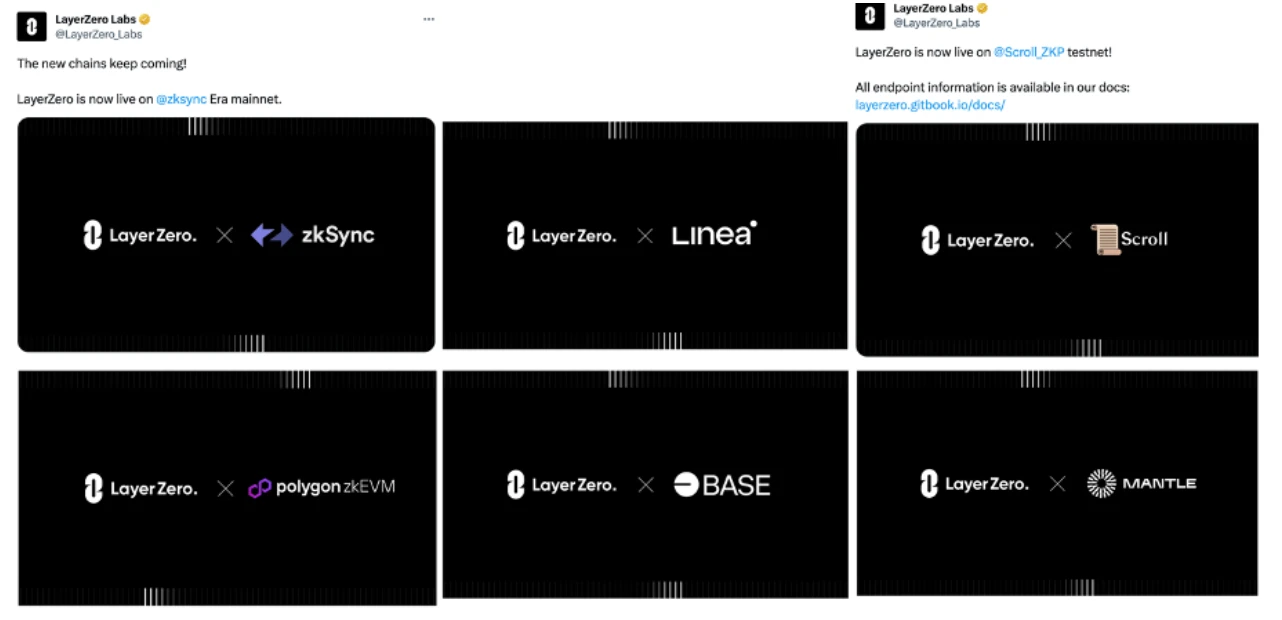

This valuable experience has been gained in the pursuit of "connecting blockchains and supporting truly large-scale applications." L0 has already supported over 30 networks.

Over 100 (existing or under development) applications that should be noted.

It should also be noted that the Stargate product, specifically designed to showcase LayerZero technology (created by the same team), has a total market value that exceeds Axelar (±60 billion USD compared to ±40 billion USD).

Finally, to consolidate its advantage, LayerZero is hiring successful product marketing leaders, such as Polygon. The latter can proudly showcase its DApps ecosystem.

Since there are cross-chain bridges, why do we need LayerZero?

Today, most cross-chain transactions occur on so-called cross-chain bridges, which solve interoperability issues by locking assets on one chain and issuing equivalent tokens on another chain, acting as intermediaries in the process.

According to DeFi Llama (2022) data, there are currently about $33 billion in cryptocurrency locked in bridging protocols.

However, these cross-chain bridges introduce additional centralization and security vulnerabilities to the system, as they act as intermediaries.

Approximately $2.6 billion in crypto assets have been stolen from bridges.

I described the problem and even vulnerabilities in an analysis article six months ago.

It is likely that LayerZero may become the "solution to the bridging problem," as investors believe that LayerZero will not be a victim of theft similar to the above. "We have always been confident in the future of cross-chain interoperability, but until we met LayerZero, the technology to achieve this goal was not sufficient," said Michelle Bell, a partner at Sequoia.

To move, for example, $1000 worth of cryptocurrency from blockchain A to blockchain B, an individual must send a message through an intermediary chain, which confirms the transaction, and then the intermediary chain notifies B that the funds have been transferred from A. However, these intermediary chains become attractive targets for hacker attacks.

In simple terms, LayerZero eliminates the need for using an "intermediary chain" through its solution, allowing tokens to move smoothly from point A to point B.

Sub-product: Stargate

The Stargate, representing the main product technology of LayerZero, created by the LayerZero team, cannot be ignored.

Stargate is a liquidity transfer protocol, simply put, a cross-chain bridge based on LayerZero technology.

Remarkable Achievements - Since its launch, the value of assets transferred through this protocol has exceeded $18 billion.

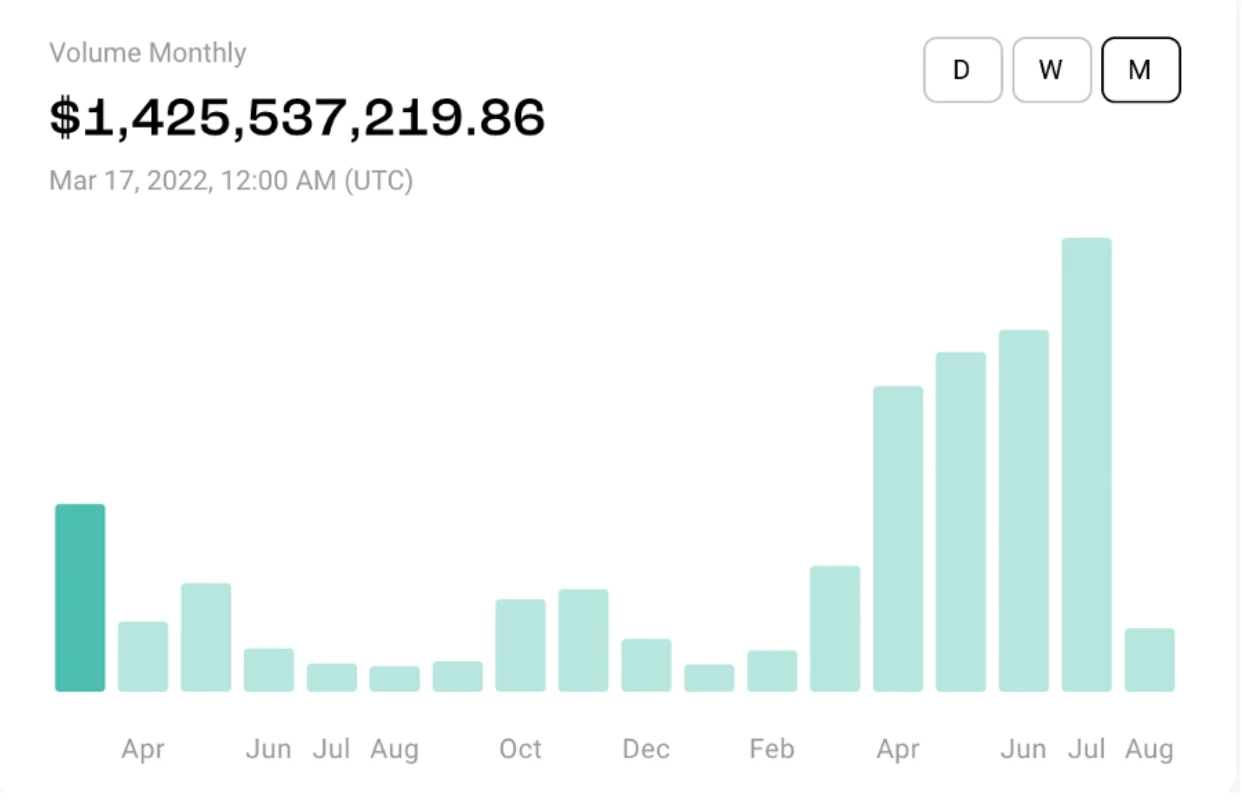

It has been mentioned that this is not sustainable due to the presence of airdrop hunters, as the transaction volume exceeded $1.4 billion in the first month of launch.

For the past few months, the protocol has maintained its position at the top of the cross-chain bridge transaction volume rankings, leading by almost double.

It cannot be ignored that this transaction volume may include the share of airdrop hunters. However, it is equally important to note that significant transaction volume was observed before the announcement of the Series B financing. Market effects cannot be ignored, as it clearly attracted active users, and the open market has evaluated one of LayerZero Labs' products, representing the value of the technology alone at $600 million.

Introduction to the Team and Financing

LayerZero's command running Stargate in the lens of Sequoia Cap

Interestingly, the core members of the team met at the InterOperability Lab at the University of New Hampshire.

Brian Pellegrino, CEO of LayerZero:

In 2015, he was one of the world's top poker players.

In 2016, he sold an artificial intelligence for baseball analytics to some of the largest baseball companies.

In 2018, he collaborated with engineers from A16Z to create a token launch platform, which he later sold and returned to the field of artificial intelligence.

In 2020, he, along with Caleb Bannister (Chief Engineer and Co-Founder of LayerZero) and Ryan Zarick (CTO of LayerZero), created the world's best poker artificial intelligence.

With the launch of Binance Smart Chain in 2020, he became interested in this technology and decided to create a game with the current co-founder. There, he faced the problem of unreliable bridges.

In May 2021, LayerZero officially released the official document "LayerZero: Trustless Cross-Chain Interoperability Protocol."

The document detailed how their free open-source protocol would become the first to enable direct transactions on all blockchains while remaining decentralized, transparent, and persistent.

At that time, the protocol was quietly developed without much attention, but around that time, 0xMaki, co-founder of SushiSwap, joined LayerZero. 0xMaki could have easily joined any team in web3, but he chose this little-known startup.

What did such a well-known figure in the web3 field like 0xMaxi decide to offer? It's relationships, of course. 0xMaxi is responsible for business development, which involves building partnerships and opening "necessary" doors. Although this aspect of the work was going smoothly within the core team of L0, even without him:

In October 2021, inspired by hiring 0xMaki, Pellegrino wrote on Twitter, "We are building the most powerful team in the field of cryptography on a legitimate basis, and no one knows yet."

Representatives from Sequoia realized that, to some extent, LayerZero solved a significant problem defining the future of the internet. On the other hand, it's like inventing the water pipe.

Today's internet is built on similar breakthroughs. Before the creation of the Transmission Control Protocol/Internet Protocol (TCP/IP) transport protocol, internal networks between universities and government institutions in different countries could not exchange data.

This led to a joint A+ round of financing in 2022, raising $135 million. "LayerZero's technology is the glue of cryptography," Maguire said. "It connects all other cryptocurrencies. The collective value far exceeds the sum of its parts. Brian hopes the entire cryptocurrency will succeed, hoping that every area of cryptocurrency becomes more valuable."

Token $ZRO

Although LayerZero's official token has not been formally confirmed, related quotes can already be found on Binance. Details of the latest round of trading have been leaked to the public media, with news articles mentioning LayerZero's "token warrants." A recent transaction on Infopool has attracted market attention, involving the market maker Wintermute.

Through public surveys, we learned that some exchanges have shown significant interest in LayerZero.

$ZRO has at least three use cases:

- Payment for validators (autonomy and decentralization);

- Voting support in network governance (decentralization);

- Payment of fees instead of using native tokens.

Payment of validator fees, i.e. Project Essence: This will allow for the launch of one's own Oracle & Relayer to handle transactions, leading to a more autonomous and decentralized network. Currently, the only Oracle is Chainlink, and the Relayer is a collaboration between LayerZero, Polygon, and Sequoia Capital.

Governance: This involves classic DAO voting.

Using $ZRO to pay fees: This possibility has been confirmed, as mentioned on Github, along with other updates and references in other repositories. More details on this can be found here. (Additional material provided by the author of the "Мыслил. Удивился. Пишу." channel, who is highly talented and is an intellectual collaborator on this article. I strongly recommend following his analysis of the project, as the channel belongs to the category of treasure with only about 2,000 fans.)

Stargate: It is said that investors in LayerZero Labs also hold $STG (Stargate) tokens, in addition to $ZRO.

We still have not seen the official token economy.

It is likely that we will see a solution similar to teams like Aptos, Optimism, and Arbitrum: the token economy will be announced a week or two before the token release and possible user rewards.

Is airdropping a forced strategy or a clever marketing tactic?

Particularly noteworthy is the way of attracting users to the ecosystem. The listing on Arbitrum + the largest airdrop in history on March 23. On April 2, news of a new round of financing of over $12 billion was revealed. Based on experience, such financing rounds are usually not completed in one or two months, especially considering the complexity of the last quarter of 2022.

All of these events are likely interconnected. In addition, articles about possible airdrops have already begun to appear in the news media, inevitably citing similarities with $ARB.

Does this look like a "vampire attack" designed to spark user interest? After all, what could be more attractive to users than a potential airdrop? Meanwhile, the LayerZero team almost doesn't need to put in too much effort, just guide the whole process.

At this stage, almost everyone believes that some form of airdrop will occur, indicating that there is already a large user base familiar with the LayerZero project:

Is a valuation of $30 million high?

We have had a difficult 2022.

In this industry, the valuations of startups sharply declined by 50% in the first half of 2022, continuing into the second half. Since then, the valuations of crypto startups have continued to decline by about 15% compared to the first half of 2023, dropping to nearly 70%. These data were provided by the Vice President of Business Development at Ava Labs.

Overall, investors are concerned about the declining valuations, so they are offering "smaller checks."

In the first six months of 2023, startups in the Web3 space attracted about $5 billion, six times less than the $30 billion in the same period in 2022.

The first quarter of 2023 was also recorded as the quarter with the lowest capital invested in this vertical since the fourth quarter of 2020.

In the first quarter of 2023, LayerZero completed a Series B financing at a valuation of $30 billion, raising $1.2 billion.

This was the largest financing round in the Web3 space in 2023.

During a period of record low fundraising and depressed valuations, LayerZero attracted a record-breaking round of financing. I'll leave the part I'm thinking about to you, let's continue:

LayerZero's listing plan is scheduled for Q3/Q4.

The Bitcoin halving event will occur in April 2024.

After a lock-up period of 12 months, unlocking will occur approximately six months after the halving.

The halving occurred at the end of 2012 -> Bitcoin reached its all-time high (ATH) at the end of 2013/early 2014.

The halving in 2016 -> Bitcoin reached its ATH in 2017.

The halving in 2020 -> Bitcoin reached its ATH in 2021.

In other words, the distribution of $ZRO tokens is likely to occur during one of the best periods in the market.

It is worth noting that there is a series of global projects waiting for the right time to launch, and it is very likely that we will witness the most active bull market in the history of cryptocurrencies. For more details, please see: [link].

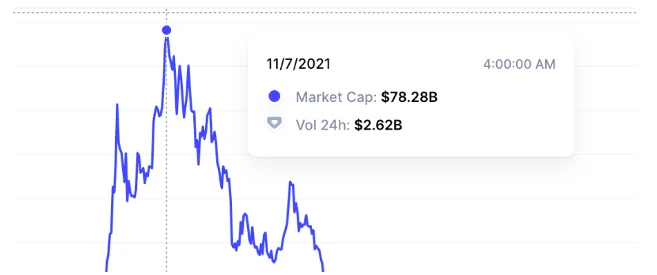

If the current valuation seems high ($30 billion), I remind you to review the market value levels of projects during previous bull markets (such as $SOL):

$XRP

$AVAX

Based on the trend, we are likely to witness new records:

How does this relate to LayerZero? A year ago, people saw this project as the cornerstone of the future of web3, and the recent large-scale financing further solidified this view.

The future will see large-scale applications aimed at simplifying the experience for new Web3 users, as well as AAA+ games aimed at attracting new users and uniting existing network enthusiasts. These applications are likely to be built using LayerZero (it's hard to imagine truly large-scale applications without such technology).

In other words, there is a great chance that this project will become the "circulatory system" of the next stage of blockchain technology development.

Conclusion

Currently, LayerZero is demonstrating remarkable results. We clearly see the narrative of "airdrop hunting," which provides interesting insights. Airdrop hunters are also chasing "Fat-protocol" projects, and according to their analysis, generous airdrops are a good investment, and metrics, teams (almost like venture capital analysis), are also important. Interestingly, all of these are preceded by technology/experience/teams.

Currently, the market is preparing for projects that are being launched/actively developed: ZkSync, ZkEVM, Base, Linea, Scroll, and modular blockchains are not sitting idly by: Mantle has already integrated, and we are still waiting for Celestia, among others.

The important point is: the above projects are all very important technical solutions that will clearly impact the future of web3. They are now being evaluated by the market, receiving huge demand (users/investors) and attention. There is interest in investing in some of these projects.

What's most interesting? The solution of LayerZero (Stargate/products based on L0) is already/will become the link for these projects: it covers all new networks, blockchains, and LayerX solutions, essentially embodying the concept of omnichain.

In other words, with the launch of LayerZero, everything is just beginning. Regardless of the metrics of airdrop hunters, they will continue to transfer assets through LayerZero-based cross-chain bridges, and the technology will be adopted and promoted. When all these projects fully enter the public market, L0 can undoubtedly become a part of the circulatory system of web3.

The metrics of airdrop hunters are a clever means of analysis with limited resources, aiming to select the highest quality projects so that the tokens obtained have value and demand. In a sense, this is also an investment.

We see the future direction of web3, and blockchain technology is being applied and demonstrated in new ways. One day, I will provide a more detailed introduction to the above series of projects, but from all the data, some things become difficult to argue:

Seeking Like-Minded Individuals

Assuming you are interested in the above thoughts and analytical insights: I would be happy to collaborate with like-minded individuals. Recently, I became a partner of a web3-VC (details will be provided in private communication), and our goal is to build a robust investment portfolio from the foundational projects we see in the market peak: LayerZero, ZkSync, StarkNet, Lens Protocol, Celestia, ***, and more.

We believe this is an excellent way to diversify the investment portfolio, including a strategic index of leading "fat protocol" crypto projects selected during the bear market, and ensuring that the token unlocks of these projects will occur during the expected peak of the bull market through rigorous due diligence by venture capital firms.

We have invested in LayerZero and signed a direct SAFT (Simple Agreement for Future Tokens) with the project team, and at the time of this publication, our allocation is still small, at $150,000 to $200,000.

We are in the final stages of negotiations with some of the projects mentioned above. Currently, our investment portfolio includes projects such as Sui, Aptos, Sei, ZkSync, and Celestia.

We are interested in mutually beneficial cooperation in trading, social networking, and analysis, and we are open to those who:

- Recognize the value of this proposal and share the above vision and have investment experience;

- Have an investment amount of $25,000 or more.

We also welcome discussions with representatives from the venture capital field (syndicates, community venture capital, individual investors) who are interested in trading, analysis, and introductions.

You can contact me via private message, leaving a brief introduction about yourself: Telegram link or through the feedback form.

Please do not consider this as an advertisement, as only 0.1% of people will respond, and only those who are truly interested and see value in it will respond.

Furthermore, based on this, I will start building a closed community based on interests, so if you provide value in other areas, I would be happy to engage. Here is a link to a form.

Thank you for taking the time to read, and I am happy to share my work! Please subscribe, this is just the beginning! We will stay in touch, always yours: @cryptocholy.

This article was written in strategic partnership with @Bullmart.

If you need more information, please continue reading:

For this set of chapters, I sincerely thank the channel: Thought. Surprised. Writing. The author of the channel spent several months delving into all aspects of LayerZero, allowing us to "deeply" understand this project.

LayerZero Technology:

LayerZero - "Message Protocol." In order to understand how messages are transmitted more intuitively, we have broken down how it is done. This process involves 13 steps, which you can view at this link: [click here] (thanks to the journal zero channel).

The main idea of L0 is to introduce a cross-chain message delivery mechanism between blockchains. To make it work, smart contracts are needed in networks A and B, which interact with the UltraLightNode (ULN) and Endpoint. They, in turn, communicate with the Oracle and Relayer, which exist off-chain.

The process of message transmission is divided into three stages:

The user sends a request to the smart contract in network A, which interacts with the ULN. The ULN sends a request to the Oracle and transmits transaction data. The Oracle verifies the user's request and the authenticity of the token transfer.

The Relayer verifies if the data from the smart contract in network A matches the data from the Oracle. If the data matches, it enters the sending stage. Otherwise, the transaction is rejected.

The final stage is the confirmation of message delivery to the smart contract in network B through the ULN. The Oracle receives confirmation of the completed transaction and completes the loop.

The important components of the system are: user applications, UltraLightNode and Endpoint, Oracle and Relayer. To better understand the technical details, we will discuss each component separately.

User Applications: These are on-chain applications developed based on L0 within the network. For example, it can be a Stargate contract used to receive or send funds in Polygon or other supported networks.

UltraLightNode & Endpoint: These are smart contracts created by L0. User applications interact with them to provide instructions for the desired operations. First, the Endpoint receives the operation in the sending network, then passes the information to the ULN. This provides a secure way to access the Oracle and Relayer and minimizes transaction costs.

Oracle & Relayer: They are off-chain, running independently to ensure security and cost reduction. The Oracle receives the transaction ID from the ULN, processes the data, and passes it to the Relayer for verification. After the transaction is completed, the Relayer reports the successful transaction. The Relayer verifies the authenticity of the data from the Oracle, and if the data is authentic, it sends the message instruction to the user application in network B through the ULN.

The advantages of LayerZero (L0) technology compared to other cross-chain services include:

- Reliable verification of transactions due to the mutual verification mechanism of Oracle and Relayer.

- Reduced transaction fees in the sending network due to the data transmission system, where only headers are transmitted, and the required data is extracted off-chain.

- Use of OFT and ONFT standards to transfer tokens for different purposes.

- Independence between Oracle and Relayer to ensure security in case one of them is threatened.

- Use of third-party Oracle and Relayer for more secure and autonomous message data delivery.

From a technical perspective, L0 considers the drawbacks of competitors listed in the whitepaper, including: Polkadot, Thorchain, Anyswap, Cosmos, Chainlink, but apart from considering marketing and reputation factors and competition with Wormhole, the real competitor may be Axelar.

The drawbacks of LayerZero technology include:

Due to the use of third-party services belonging to Polygon and Sequoia, such as Chainlink and Industry TSS Oracle, there is a lack of decentralization.

There is a lack of node quantity (about 5) compared to Axelar, which has approximately 70 nodes.

Single relayer ownership: L0 has a single relayer owned by the project itself, which also leads to a lower level of decentralization.

To address the issue of limited node quantity, a transition is underway to the Zklight client, and this transition is being tested by a friendly project called Polyhedra.

Competitiveness from Marketing and Technical Perspectives

The effectiveness of the project is determined by the collaborative efforts of marketing, technical foundation, and management. In some projects, one of these components may be missing or dominate the others.

Some projects succeed because they rely on one or more aspects, as people do not always need a perfect product, but rather something they are willing to like.

Dogecoin and Shiba Inu both rank in the top 20 of all cryptocurrencies. Dogecoin's success can be attributed to luck, while Shiba Inu can be attributed to a combination of luck, management, and marketing.

Polygon has been "restructured" and is trading with the best companies in the world, actively participating in the trend of L2, demonstrating the effectiveness of its marketing department.

Bitcoin brought us cryptocurrency technology, anonymity, and decentralization principles, while Ethereum embodies ecosystem and DeFi/NFT/DAO fields.

As competitors to L0, there are Chainlink's CCIP, Axelar, Wormhole, and some analysts mention Avalanche, Polkadot, Cosmos, and Near.

Although Axelar is superior to L0 in terms of decentralization, it has not been well received due to the negative impact of the token price from the collapses of 3ac, Terra, and Celsius.

Wormhole is a product from 2017 and has experienced the collapse of FTX, the bear market, and a theft of hundreds of millions of dollars in 2022, but it still maintains its position in the market.

What brings Axelar and Wormhole together? Uniswap chose them, abandoning LayerZero, Celer, DeBridge, and Multichain. Many people may not have heard of Wormhole, but they remember Axelar. Their common characteristics are technology and efficient management.

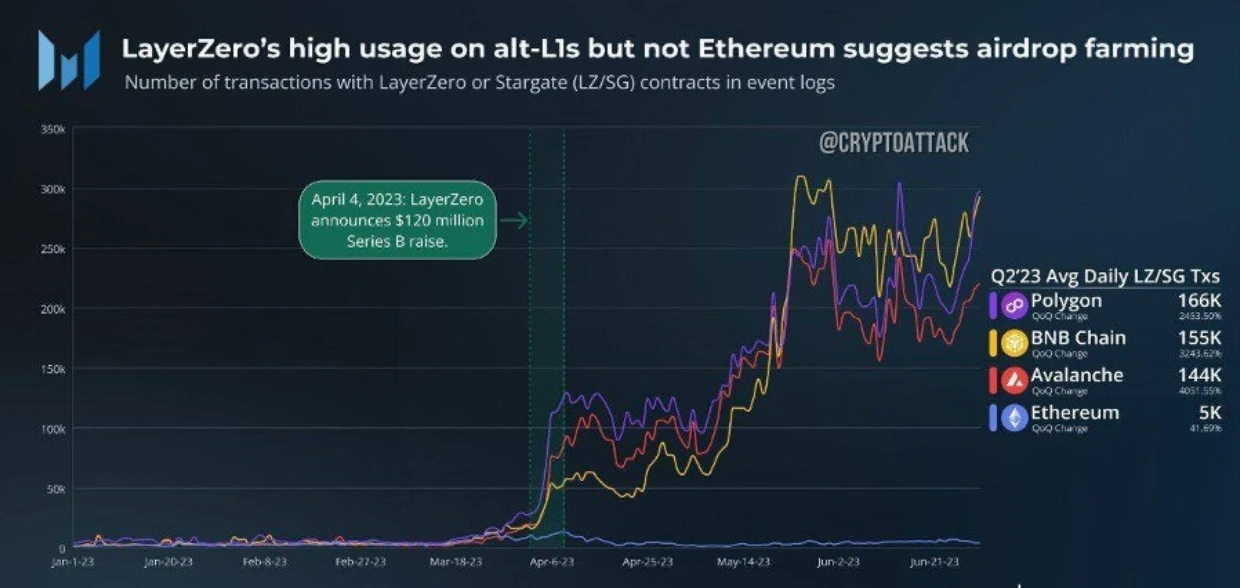

LayerZero, in the cryptocurrency field in 2023, is widely recognized, and although it was not chosen by Uniswap, its metrics surpassed all other projects after the announcement of rounds and the launch of Arbitrum. They do not hide the fact that this is part of their marketing plan.

For many, marketing is just banner advertising, but it permeates human consciousness and behavior, opening opportunities for projects. Without management, a project will collapse, and without marketing, it will not attract attention.

We can see differences in methods and strategies. For example, AVAX is another L1 blockchain launched before the appearance of L2 solutions. They now divide the network into C, X, and P, a decision that seems outdated.

On the other hand, it can be said that DOT is outdated in concept, despite the initial enthusiasm around the project. The idea of creating multiple L1 blockchains based on DOT has not been realized. As an alternative, Optimism successfully developed an effective SDK, launching projects like Base and OpBnB on it.

Cosmos and NEAR have encountered management issues. After receiving funding, we have not seen significant progress from them. Although Cosmos has held some hackathons, both projects have not shown significant development.

On the other hand, Polygon demonstrates an example of effective management and marketing. They do not focus on technology but strive to "keep up" with the trend of L2. Their approach in the business aspect is respectable.

Overall, when choosing investors, it may be based on the team's passion and their professional experience, potential trends (the success of Optimism, the push of Arbitrum, the existence of multiple EVM blockchains), and their technical capabilities, although not revolutionary, in understanding the ability to "keep up with the trend." Technically, real competitors may include Axelar, CCIP, IBC, and Nomad, although their success in technology is quite limited.

Let's take a look at the technical composition of the L0 project, excluding the marketing aspect. In this context, we are particularly interested in comparing with competitors (Axelar, CCIP, IBC, and Nomad).

Axelar and CCIP provide some interesting technical examples. However, their approaches and implementations are different.

For example, IBC is not just a cross-chain messaging service; it is a blockchain that can handle the transfer of tokens to other networks connected to the Cosmos Hub. However, the number of networks connected to IBC seems to be in need of improvement. Currently, the top networks connected to IBC include Cronos and Kava, and Cosmos has promised to add support for Ethereum by the end of this year. This, together with the characteristics of Tendermint technology, makes the cost of using IBC higher than L0, even when introducing support for Ethereum or other top 20 networks.

CCIP is a true competitor to L0 globally. Like L0, CCIP is a cross-chain messaging protocol with offline services, making its use cheaper than other competitors. They both have points on each network (L0 is endpoints, CCIP is Ramp), and L0 also has oracles and relayers, while CCIP only has DON, for which they have installed ARM as an alternative to relayers for secondary verification. However, CCIP seems to be more technologically advanced than L0, as it is an oracle itself and can launch multiple DONs, while L0 directly relies on its main competitor - Chainlink.

It is worth mentioning Circle, which has departed from L0 and started using OFT technology (based on the "mint and burn" principle), not on L0 but on CCTP. Circle realized its strength and market value, choosing its own path and connecting to over 20 services at launch.

Regarding the LayerZero network: LayerZero is primarily a message delivery service, focused on building and deploying infrastructure on as many networks as possible, including EVM and non-EVM. Nevertheless, the LayerZero team is developing flagship products based on its technology, including Stargate, Aptos Bridge, Testnet Bridge, and BTC Bridge. At the time of writing this article, LayerZero technology is available on over 30 mainnets and almost 40 testnets. 95% of these are EVM networks, and adding them is not difficult due to mature methods and experience. However, each non-EVM network has its peculiarities, requiring individual handling, which slows down its integration process. So far, Aptos has joined as the first similar network in the non-EVM networks. Considering Aptos's recent entry into the market and the good relationship between the LayerZero leadership and the Aptos team, it is likely that the decision to integrate it was made in advance.

The prospects for adding new networks can be evaluated in two ways: market promotion (based on announcements from the team and leadership) and technical readiness (based on technical preparation for network integration).

Potential applications of LayerZero technology and the team's priorities: L0 technology opens up new possibilities for cross-chain products, including DEX/Bridge, governance, lending, and yield. A DEX/Bridge based on L0 allows token transfer between networks without the need for wrapping, reducing fees and risks. Cross-chain governance allows projects to cover a wider audience by distributing their tokens across all networks. Cross-chain lending allows assets to be used as collateral in one network without the need for token exchange in another network. A cross-chain yield aggregator can leverage L0 to create the most profitable mining conditions across different networks.

According to their job postings on their website, the L0 team is interested in the development of the gaming, capital markets, and enterprise sectors. This indicates that L0 technology may be used to transfer assets or instruction messages to large enterprises, the gaming industry, and financial organizations.

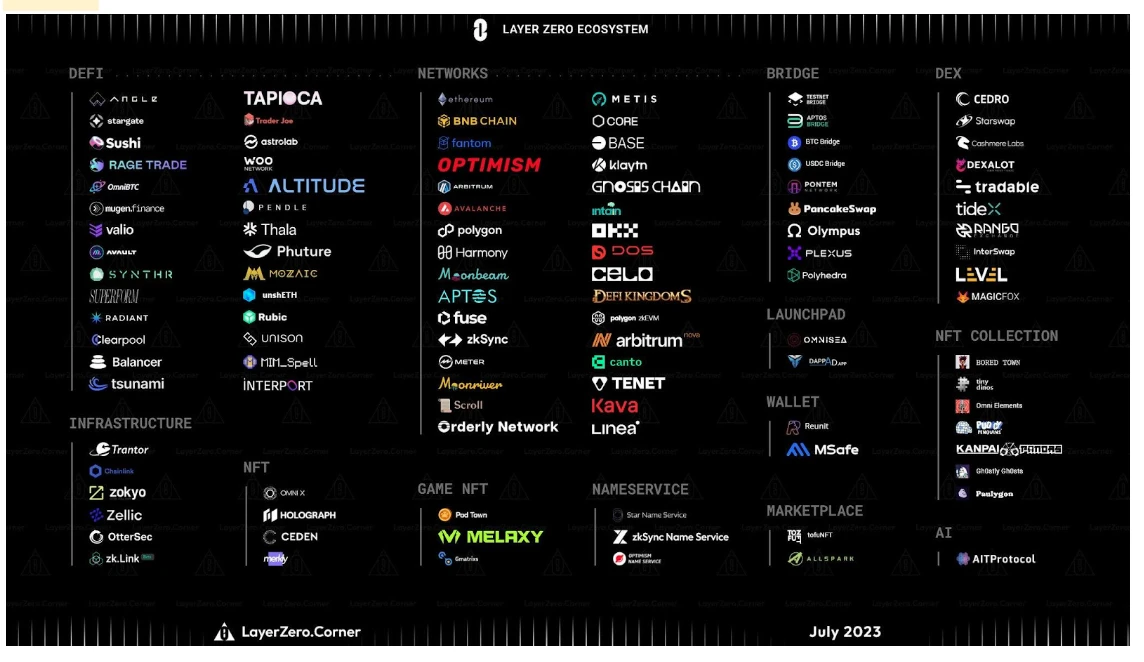

LayerZero Ecosystem

The main task of the L0 team is to provide technology and SDK suites to facilitate infrastructure development, with a focus on cross-chain interoperability. The L0 ecosystem includes about 70 popular applications, with a daily trading activity of 1000 times and a total user application connection count of 5000.

Let's consider each category in the L0 ecosystem separately and determine the level of the project based on criteria such as cryptocurrency user demand, implementation quality, and popularity within the L0 ecosystem.

1. Bridge: This category includes projects that run entirely on L0 technology, hybrid projects using network-side liquidity pools, and optional projects using only some features of L0. An ideal example of a bridge based on L0 is btcbridge, which conveys messages about the transfer of btcb tokens and uses FT for burning on another network. Hybrid projects include stargate, aptosbridge, testnetbridge, and liqudswap, as well as multiple bridge projects existing in target networks, such as harmony and coredao bridge. Optional projects, such as pancakeswap, sushiswap, and fi woo, use stargate's liquidity pools and L0 technology to process user exchange requests. There are a large number of bridge projects in the L0 ecosystem, and although they may not be as popular as the projects in the examples, they collectively account for a significant portion of all transactions within L0, indicating a high demand in the global industry for cost-effective and available cross-chain bridge projects, and they are well-received by users within the L0 ecosystem. In terms of quality, given the existence of numerous similar solutions and the actions of developers, they have successfully created usable sample bases and convenient documentation for deploying their own bridge projects or integrating them into their products, which has brought the assessment of implementation quality to a high level.

2. Networks: In L0, networks such as arbitrum, polygon, and optimism are the most popular, along with many gaming networks. However, non-EVM networks such as Bitcoin, Ripple, and Dogecoin are not as popular.

3. DEFI (Decentralized Finance): This category includes platforms that use L0 technology to exchange or purchase tokens on the platform and then send them to other networks using L0 technology. Examples include angle money, interport, cashmerelabs, abracadabra, credo finance, and radiant.

4. DEX (Decentralized Exchange): Although popular in the cryptocurrency industry, it is not the most rational under the specific conditions of L0 technology. Representative projects include ragetrade and dexalot.

5. NFT Platforms: In the L0 ecosystem, there are trading platforms for exchanging or selling NFTs, as well as aggregation websites that allow the creation and transfer of NFTs using ONFT technology. Examples include omnisea and omni-x, while aggregation websites include holograph, zkbridge, and merkly. Particularly noteworthy is the Polyhedra project, which developed zkbridge. The project combines OFT technology with ZK technology and simultaneously developed its own infrastructure solution.

6. NFT Collectibles: This category is developing slowly due to the low demand for cross-chain NFT collectibles. A prominent example is Pudgy Penguins, one of the favorite collectibles of the L0 team. They are one of the earliest all-chain collectibles and have received positive publicity from their holders on social media due to their popularity.

7. Gaming: The team is actively developing the gaming sector, enabling the transfer of gaming tokens between different networks to expand the user base by connecting a large number of "gaming" networks and projects. They are committed to developing games in the Asia-Pacific region. A popular gaming example is DeFiKingdoms.

8. Launchpad: Launchpads are not popular under current market conditions. Examples include omnisea and dappdapp.

9. Wallets: The projects reunit and msafe have added support for transactions using L0 technology in their wallets.

10. Infrastructure: This is a very interesting section as it combines atypical projects with interesting concepts. This category includes Name Services, which have a high internal popularity due to the lack of popular Name Services (such as ENS), but are difficult to implement without these Name Services. Representative projects include SNS, Zk NS. Polyhedra is one of the most prominent representatives in this category, as it has developed the functionality to run Oracles on ZK technology in addition to cross-chain NFT transfers, which will make L0 more decentralized and secure, as its current Oracle is their direct competitor Chainlink. Similarly, representatives of this category include Zklink, Ottersec, and Zellic. This category can be seen as a very important area for the expansion of the project ecosystem, as it provides high-quality infrastructure projects with low internal popularity but for further integration.

When summarizing the ecosystem, it is noteworthy that the categories developing most rapidly include: Bridge, Networks, DeFi, NFT Platforms, Gaming, and Infrastructure, indicating that L0 tends to expand to other networks through token and NFT transfer technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。