Trading philosophy: Look at the trend in the big cycle, and find the position in the small cycle.

Market review: In the previous article, it was explicitly stated that in the bullish market, Bitcoin reached the important resistance level near 44700, and Ethereum reached the important resistance level near 2400. It is advisable to consider laying out short positions. There should be a significant retracement here. Currently, the lowest point of the market is near 40300 for Bitcoin and near 2110 for Ethereum. After the market hit the lowest point, it quickly rose to the current position near 42200 for Bitcoin and near 2240 for Ethereum. This is the long-term layout position for the bullish prediction as mentioned in the previous post.

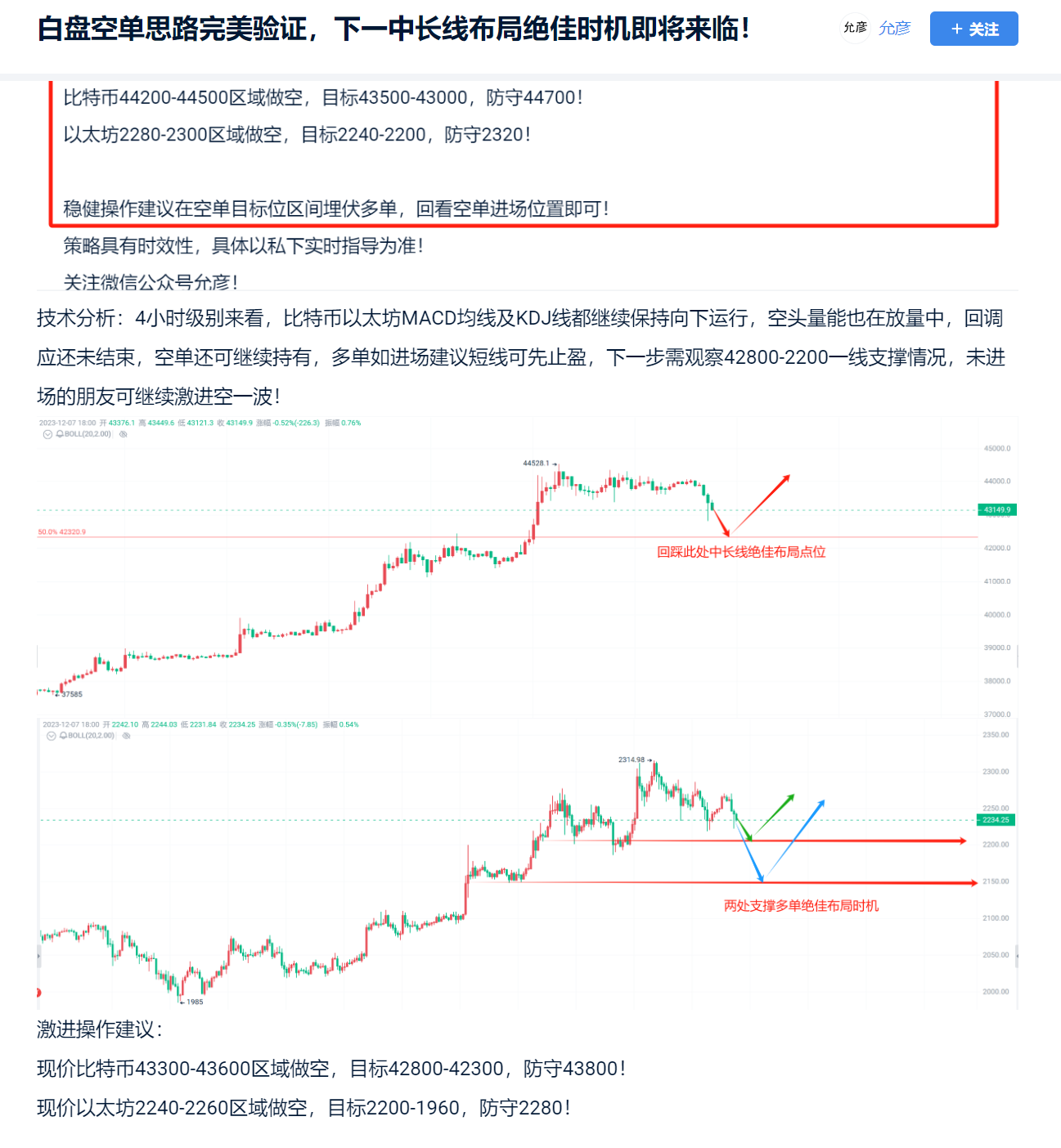

Technical analysis: The weekly chart shows a large bullish candle, the Bollinger Bands continue to widen, the MACD moving average continues to move upward, and the bullish volume continues to increase. At the daily chart level, Bitcoin is currently hovering around the Fibonacci 50% level near 42300, and Ethereum has just touched the support at 2150 before rising to around 2230. The KDJ line is moving downward, the MACD moving average is running flat, and the bullish volume is in a shrinking state. At the 4-hour chart level, the MACD moving average continues to move downward, and the bearish volume continues to increase, while the KDJ line is running flat and upward.

In summary, the market has experienced a significant retracement, and it is expected to continue the bullish trend after washing out. As predicted earlier, it is necessary to consolidate above the strong support before breaking through the key resistance level.

Trading suggestions:

Long position in the range of 41700-42000 for Bitcoin, with a target of 42800-43200 and a defensive position at 41400.

Long position in the range of 2190-2210 for Ethereum, with a target of 2280-2300 and a defensive position at 2170.

The strategy is time-sensitive, and specific guidance in real time should prevail.

Follow WeChat public account "允彦"!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。