From a global perspective, the United Arab Emirates (UAE) has already entered the top ten countries with the most residents investing in cryptocurrencies.

Authored by: MIIX Capital

According to research by HedgewithCrypto, Dubai (UAE) is one of the countries/regions with the highest adoption of cryptocurrencies in the past three years, second only to Turkey (the research defines adoption based on various factors, including the number of cryptocurrency ATMs, population acceptance rate, online interest in cryptocurrencies, and legislative support for cryptocurrencies). With the relaxation of Dubai's invitation policy, the thriving cryptocurrency market in the Middle East and North Africa is attracting more and more businesses and individuals to develop in Dubai. If the UAE is the light of the cryptocurrency industry in the Middle East and North Africa, then Dubai is the most dazzling place in this light.

Tips:

Dubai is the economic center of the UAE and the absolute center of the UAE's cryptocurrency market. This article will focus on Dubai and the entire UAE, combining relevant data and information to analyze and elaborate on the cryptocurrency market in this region.

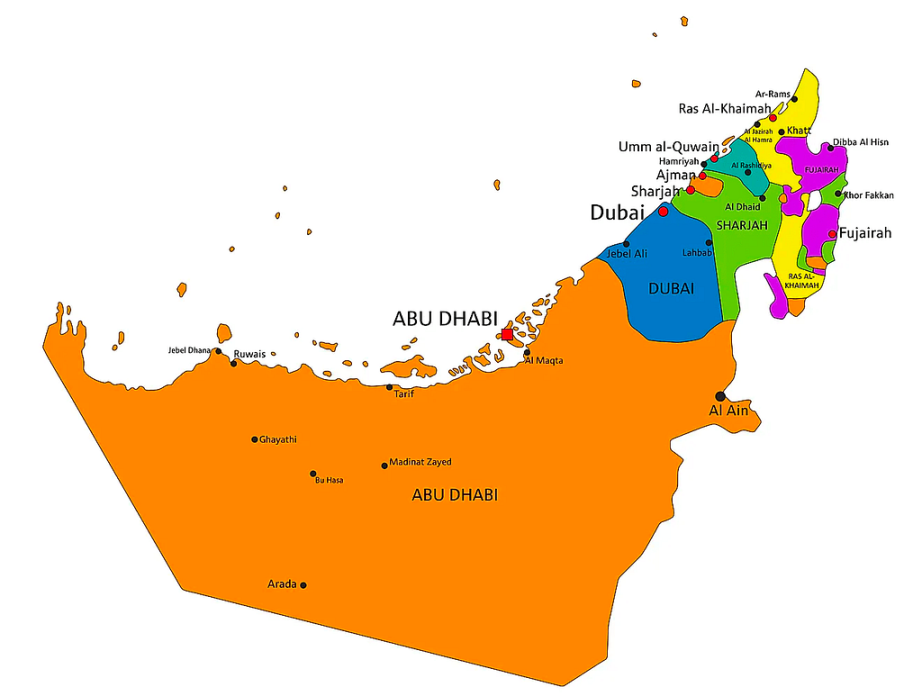

Relationship between Dubai and the UAE: Dubai City is the capital of the Emirate of Dubai, located in the central part of the Emirate of Dubai. Dubai City is the political, economic, and cultural center of the Emirate of Dubai and the most populous city in the Emirate of Dubai.

The Emirate of Dubai is one of the seven emirates of the United Arab Emirates, located in the southeastern part of the Arabian Peninsula. The Emirate of Dubai has the largest population and the most developed economy among the emirates of the United Arab Emirates.

Dubai is the pillar of the UAE's economy and international image. Dubai's economy mainly relies on the tourism industry, aviation industry, real estate, and financial services. It is one of the most popular tourist destinations in the world and the economic and financial center of the Middle East region. Dubai's economic development has a significant impact on the UAE's economic development.

1. Regional Macroeconomic Indicators and Current Situation

1.1 Land and Population Scale

The United Arab Emirates (UAE), located in the eastern part of the Arabian Peninsula, borders Saudi Arabia to the west and south, Oman to the east and northeast, and the Persian Gulf to the north, facing Iran across the sea. It has a total area of 83,600 square kilometers and a coastline of 734 kilometers, consisting of 7 emirates. As of June 2023, the total population of the UAE is 10.17 million, with foreigners accounting for 88% of the population. Arabic is the official language, and English is widely used.

Dubai is located on the southern coast of the Arabian Gulf in the United Arab Emirates. It borders Abu Dhabi to the south of the Emirate of Dubai, Sharjah to the northeast, and the Sultanate of Oman to the southeast, with an area of approximately 4,114 square kilometers, accounting for 5.8% of the total area of the UAE. As of June 2020, Dubai's population is 3,392,408, accounting for approximately 41.9% of the total population of the UAE, making it the most populous city. The population increases by 177,020 people annually, with a growth rate of 5.64%. The population density is approximately 408.18 people per square kilometer, more than eight times the national population density.

1.2 Economy and Related Indicators

The UAE is the second largest economy in the Gulf Cooperation Council (GCC), second only to Saudi Arabia. It is one of the wealthiest countries in the world and one of the countries with the highest per capita GDP (PPP) in the world. While developing the petrochemical industry, the government has made diversifying the economy, expanding trade, and increasing non-oil revenue in the gross domestic product (GDP) a top priority. In recent years, the UAE has vigorously developed a knowledge economy with information technology at its core, while also focusing on renewable energy research and development.

In 2022, the UAE's GDP was $446.6 billion, with a GDP growth rate of 8.9% and a per capita GDP of $47,700, about 80% higher than the OECD average. Over the past 6 years, the per capita GDP of the UAE has grown by 24.7%. In 2022, the per capita GDP increased by 21.1% year-on-year. In the first quarter of 2023, Dubai's actual GDP reached 111.3 billion dirhams (approximately $30.3 billion), with a year-on-year growth of 2.8%, significantly higher than the EU's 1.1% and the United States' 1.8%. According to Kearney's 2023 Global City Comprehensive Ranking, Dubai ranks 23rd in the global city comprehensive ranking and first in the Middle East and North Africa region.

Data released by the Dubai Statistics Center shows that the financial and insurance industry accounts for 15% of the GDP, with the financial industry growing by 3.2% and contributing 12.7% to the GDP. Data from the Central Bank of the UAE shows that compared to the same period last year, credit balances increased by 3.5% and deposit balances increased by 14.9%. The UAE Purchasing Managers' Index (PMI) confirmed that the non-oil private sector has been expanding for 28 consecutive months, with employment growth reaching its fastest pace since July 2016.

1.3 Regional Economic Development Forecast

Domestic institutions and several international organizations in the UAE predict that the UAE's economy will return to steady growth in 2023, and the economic outlook remains optimistic. Standard Chartered Bank's report "The Future of Trade: New Opportunities in High-Growth Corridors," released in June, predicts that its exports will reach approximately 2 trillion dirhams by 2030, with an average annual growth rate of 5.5%, and Dubai will occupy an extremely important position in future development and growth.

From a global perspective, with the continuous rise of the digital economy, Dubai urgently needs to find the next economic growth point. The Web3 field, led by blockchain technology, is closely related to its advantageous financial sector and closely integrated with the digital economy.

Although Dubai (UAE) faces objective problems such as cultural differences, geopolitical constraints, and a complex environment, it provides an excellent trial-and-error environment and elements for cutting-edge technology and financial innovation industries, including the cryptocurrency industry, due to its superior regulatory policies and business environment. In particular, Dubai's cryptocurrency market, under the encirclement of countries such as Japan, South Korea, and India, has already shown a leading trend. PricewaterhouseCoopers estimates that by 2024, the potential blockchain market in the Middle East and North Africa region centered around Dubai (UAE) will exceed $3.2 billion.

2. Industrial Structure and Geocultural Factors

2.1 Composition of Industrial Structure

The UAE ranks fifth in terms of oil reserves among Middle Eastern countries. While developing the petrochemical industry, the government has made diversifying the economy, expanding trade, and increasing non-oil revenue in the GDP a top priority. Efforts have been made to develop industries such as cement, aluminum refining, plastic products, building materials, clothing, and food processing, and to focus on the development of agriculture, animal husbandry, and fisheries. In recent years, there has been a strong focus on developing a knowledge economy with information technology at its core, while also emphasizing research and development of renewable energy. In June 2009, the capital, Abu Dhabi, became the headquarters of the International Renewable Energy Agency.

Dubai's oil reserves account for only 5% of the UAE's total, and its oil economy is almost unsustainable. In 1979, Dubai began a nationwide effort to develop infrastructure and promote diversified industrial economic policies. Port trade, tourism, and financial services have become the pillar industries of Dubai. Through Dubai as a base, it has entered the vast market of nearly 4 billion people in the Middle East, Africa, South Asia, and Europe.

Dubai ranks 37th among the top 50 financial cities globally and first in the Middle East region. With the transformation of the digital economy, the cryptocurrency industry has entered Dubai's vision and is strategically positioned as an important part of the future industrial structure. Its strong policy support has accelerated the clustering of the cryptocurrency industry and even achieved mandatory applications in certain areas, highlighting the strong government effect.

2.2 Influence of Culture and Geocultural Factors

The UAE integrates politics and religion and is a racially diverse country. UAE nationals account for only about 15% of the population of the emirates, with the rest of the population consisting of expatriates from the UK, India, Pakistan, Bangladesh, and the Philippines, with the number of British expatriates exceeding 100,000.

As the most famous immigrant city, Dubai has a relatively diverse religious and linguistic environment, and its complex social environment and cultural fragmentation have become bottlenecks for the development of the internet world, requiring considerable attention to local cultural transformation and vigilance in the large-scale promotion of software applications.

Located in the GMT+4 time zone, Dubai has a strategic location with relatively friendly time differences with Europe, the United States, and Southeast Asia, making it convenient for business travel to connect the markets of the Middle East, Asia, Europe, and Africa. However, geographically, Dubai's rugged terrain and year-round high temperatures, coupled with scarce rainfall, make it unsuitable for living. Additionally, the UAE, where Dubai is located, is not a neutral country, and its complex relationships with neighboring Persian Gulf countries, as well as the political maneuvering between the Middle East and countries like the United States, directly affect the local economy.

3. Cryptocurrency Market History and Current Situation

3.1 Industry Layout and Development Process

Marwan Alzarouni, CEO of the UAE Blockchain Center, stated in a media interview that the UAE, especially Dubai, has always been forward-looking and rapidly developing in any future technology, and cryptocurrencies and blockchain are no exception. As the pillar of the UAE's economy, Dubai has been planning and guiding policies around the cryptocurrency industry from an early stage. As of now, Dubai has become an indispensable core member of the cryptocurrency industry globally:

In 2013, the "Smart Dubai initiative" was launched;

In 2016, the Global Blockchain Council was established;

In 2018, it was announced that 50% of government transactions would use blockchain technology by 2021;

In 2019, the "Dubai Blockchain Strategy 2020" was released to build Smart Dubai;

In March 2022, the Virtual Asset Law was enacted, and the Virtual Asset and Regulatory Authority (VARA) was established;

In August 2022, the metaverse strategy was announced, along with a five-year strategy for the metaverse;

In August 2023, it was announced that AI and Web3 licenses would be issued by the DIFC;

In October 2023, the first "Dubai AI and Web3 Festival" was announced to be held in the ancient city of Jumeirah in September 2024.

3.2 Global Ranking of Cryptocurrency Readiness Index Top 2

In a report based on the Cryptocurrency Readiness Index designed by the cryptocurrency tax software company Recap, Dubai ranks second, and the region's 0% tax rate is an attractive place for cryptocurrency investors to reside. Additionally, according to information released by Holborn Assets, there are 772 cryptocurrency companies in Dubai providing jobs for practitioners, making it the first choice for most cryptocurrency practitioners.

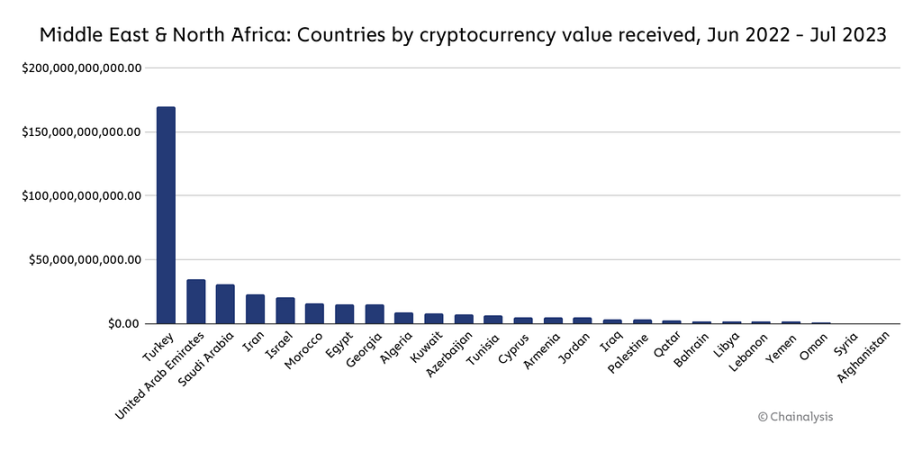

In Chainalysis's Cryptocurrency Adoption Index ranking, the UAE ranks second, only behind Turkey. Data shows that the cryptocurrency industry has contributed approximately 100 billion dirhams ($27.25 billion) to Dubai, accounting for 4.3% of the UAE's GDP. Currently, more than 90 investment funds and 12 enterprise incubators, including Binance, ALPEX, Metahero, and Huobi, are gathered in Dubai. It has been disclosed that there are over 1,400 blockchain or cryptocurrency startups with a total valuation of 90 billion dirhams ($24.5 billion).

3.3 Globalization Increases Cryptocurrency Acceptance

In the entire Middle East, people have a very positive outlook on and high acceptance of cryptocurrencies. Various industries such as hotels, restaurants, and government agencies have started accepting cryptocurrency payments. In Dubai (UAE), support for shopping with USDT is available, for example, for purchasing houses, vehicles, and watches.

The well-known UAE hotel company LucidPay uses blockchain systems for payments and has introduced a stablecoin based on the Tezos blockchain network;

A black diamond was purchased by entrepreneur Richard Hert in an auction using cryptocurrency for $4.3 million;

In 2014, a business bay pizza shop in Dubai initiated cryptocurrency transactions and accepted Bitcoin payments;

Some hospitals and clinics accept Bitcoin as payment from patients, and some hospitals also accept cryptocurrency donations;

The UAE government-licensed organization Kiklabb has started accepting cryptocurrency payments;

The real estate industry also encourages the use of cryptocurrency, with UAE developers announcing the acceptance of Dogecoin as a payment method.

As one of the countries with Bitcoin ATMs, Dubai's first Bitcoin ATM was installed at the five-star Rixos Premium Hotel in 2019. At the self-service terminal, visitors can insert cash and immediately purchase Bitcoin.

Furthermore, according to the latest research from the human resources platform Deel, Dubai employees rank first in cryptocurrency withdrawals in the region. Ethereum is the preferred cryptocurrency, with a withdrawal rate of over 51%, followed by USDC and Bitcoin. Tarek Salam, Deel's expansion director, stated, "The adoption of cryptocurrencies in Dubai has surged, and residents in other regions are actively participating in the cryptocurrency ecosystem."

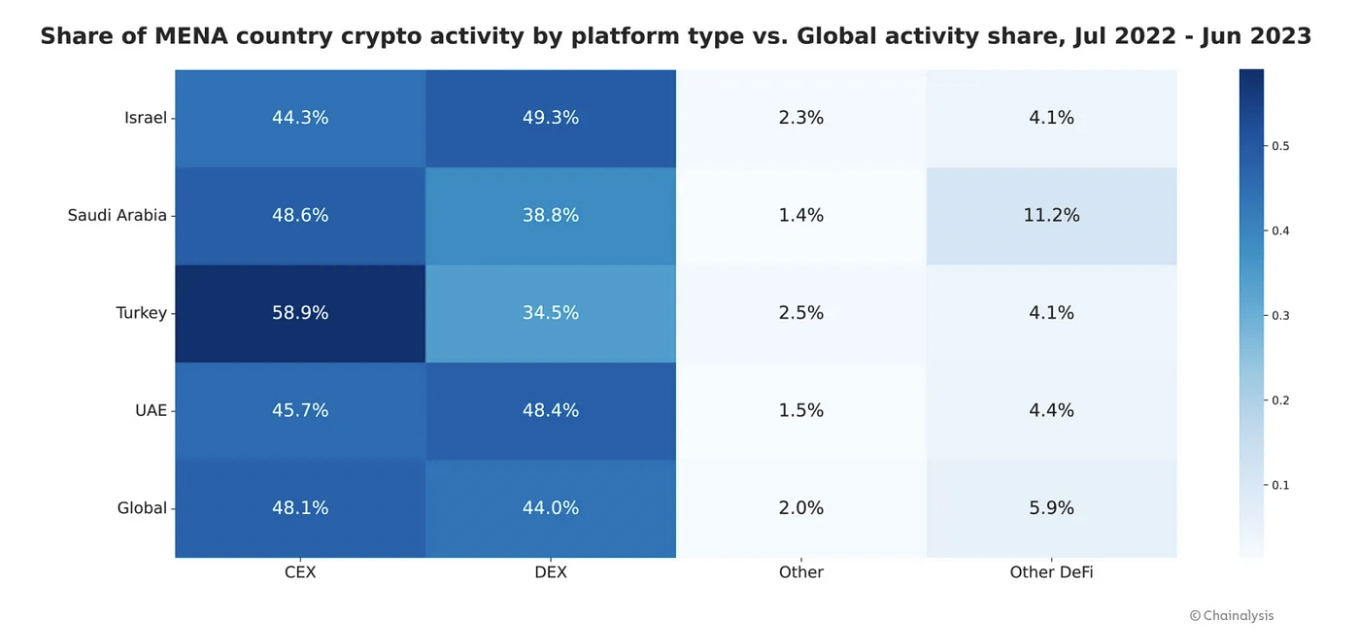

3.4 Preference for CEX and DEX in the Region

There are significant differences between different countries. Referring to the heatmap below, the chart compares the activities of some top cryptocurrency economies in the Middle East and North Africa region by platform type.

The heatmap distribution of users in Dubai (UAE) on CEX and DEX is 45.7% and 48.4%, respectively, with a very small difference. Business24-7, the best broker review website in the region, ranked the most popular CEX and DEX in the region after screening, evaluating, and comparing the existing 174 CEX and 89 DEX in the UAE:

eToro: Most preferred by beginners;

OKX: Offers a variety of derivatives and high liquidity;

Binance: The largest globally, with the most tokens;

HTX: High-yield savings, favored by users;

ByBit: Best user experience.

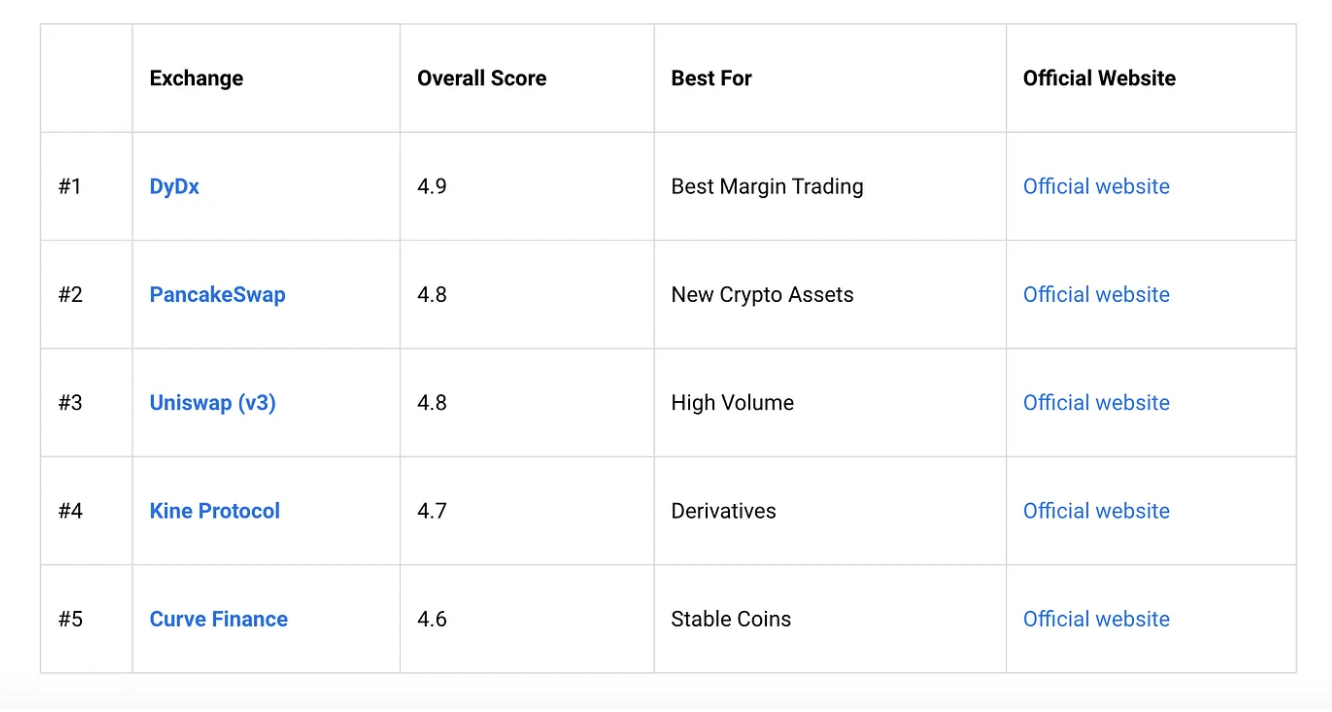

- DyDx: Best decentralized exchange for margin trading

- PancakeSwap: Best decentralized exchange for new crypto assets

- Uniswap (v3): Exchange with the highest trading volume

- Kine Protocol: Best derivatives exchange

- Curve Finance: Best stablecoin DEX

3.5 Belief that Cryptocurrencies Will Change the Financial and Gaming Industries In a survey conducted by KuCoin on the UAE region, the most notable finding was that 66% of respondents believe that the cryptocurrency industry has the potential to impact the financial sector, while 53% believe that cryptocurrencies will play a crucial role in the gaming industry. This highlights the transformative potential of cryptocurrencies in reshaping traditional financial services and enhancing gaming innovation and experiences.

Additionally, 37% of respondents believe that the real estate industry is another sector that is poised for significant change, as blockchain's transparency in real estate transactions can effectively reduce friction in the purchasing process, potentially revolutionizing the industry to make transactions more efficient and secure.

These findings indicate a growing awareness of the potential impact of blockchain on various industries and underscore the expanding influence of cryptocurrencies in today's world. As industries embrace blockchain and cryptocurrencies, we may witness changes in various aspects of life, from our real estate transactions to how we experience entertainment and participate in governance processes.

3.6 Popular Tracks and Applications in the Dubai (UAE) Region Currently, Dubai's Web3 ecosystem is highly diverse, encompassing a wide range of areas such as protocols, web3 infrastructure, DeFi, cryptocurrency exchanges, NFT platforms, metaverse, and Web3 games. Various top cryptocurrency projects are migrating to Dubai in unprecedented numbers.

The Crown Prince of Dubai and Chairman of the Executive Council, Hamdan, announced the launch of a metaverse strategy and the establishment of the "Future Technology and Digital Economy Supreme Committee" to design policies, analyze trends, and oversee the implementation of strategies related to the digital economy and future technologies, including the metaverse, artificial intelligence (AI), blockchain, and Web3, actively building the capital of Web3.

According to regional reports, DEX and related tokens have not gained high popularity in the Dubai region due to their technical non-compliance with local Islamic law, and related projects are rarely implemented in Dubai. However, the NFT industry is expected to experience a growth rate of approximately 45.5% annually, with a projected compound annual growth rate of 32.1% from 2022 to 2028. Similarly, GameFi and SocialFi projects are popular among local users.

In terms of payments, according to a report by ResearchAndMarkets, the prepaid card and digital wallet market in the region had a compound annual growth rate of 9.2% from 2018 to 2022 in terms of value. During the forecast period from 2023 to 2027, the market is expected to have a compound annual growth rate of 12.3%, increasing from $5.66 billion in 2022 to $10.3 billion in 2027. Cryptocurrency platforms are partnering with payment providers, a trend that is evident worldwide.

- User Characteristics and Investment Preferences 4.1 Young Investors More Bullish on Cryptocurrencies According to a study by the financial services company Holborn Assets, interest in cryptocurrency investments is growing in the UAE, with young Emirati investors more bullish on crypto assets compared to Western investors.

Among the 1,000+ respondents surveyed, 30% were aged 18 to 30, 45% were aged 30 to 40, and investors over 40 accounted for only 25%. Younger investors are more bullish on the cryptocurrency market, while older investors find satisfaction in including cryptocurrency investments in their portfolios.

In terms of nationality, Emiratis are the most enthusiastic group for investing in cryptocurrencies, accounting for 33%, followed by Arab expatriates (23%), Asian residents (24%), and Westerners (19%).

4.2 People More Bullish on Long-Term Cryptocurrency Investments The survey revealed various reasons for participating in cryptocurrencies: 59% of users are involved in cryptocurrencies for long-term investment purposes, highlighting the increasing willingness of people to use cryptocurrencies as a store of value. Additionally, 35% of respondents are attracted to cryptocurrencies as a means of diversifying their investment portfolios, and 11% are primarily motivated by hedging against inflation.

Compared to traditional finance, 29% of respondents believe that cryptocurrencies are a more convenient way to hold assets, as cryptocurrencies are being recognized for more than just financial investments:

- 34% are enthusiastic about short-term trading

- 22% use cryptocurrencies for daily payments and transactions

- 12% engage in cross-border remittances

- 9% purchase NFTs and other digital assets

4.3 BTC and ETH Are the Preferred Investments for Most People Bitcoin, often referred to as "digital gold," is the favorite cryptocurrency investment choice for UAE users, with 72% of users expressing a preference. This strong support reflects Bitcoin's global reputation as a reliable store of value and its enduring position as the preferred digital asset.

Ethereum has become the second most popular cryptocurrency investment choice, with 52% of UAE users expressing a preference for it. Ethereum's versatility and utility, including its smart contract functionality, resonate with UAE investors. In comparison, stablecoins lag slightly at 45%, indicating that UAE users may value blockchain applications over stability.

Additionally, infrastructure projects and Layer 1 blockchains hold a significant position in investment preferences in the UAE, with 24% and 21% of respondents expressing interest, respectively. Furthermore, 22% of respondents express interest in AI-related cryptocurrency projects, highlighting the region's inclination to integrate AI into blockchain technology to explore its potential in advanced data analysis and automation.

4.4 Cryptocurrency Remittances and Transactions Have Entered Daily Life

The survey shows that, in addition to investment, there is a strong interest in remittances, daily transactions, and purchases, indicating that cryptocurrencies are increasingly integrating into Dubai's financial landscape. Data from Ripple and FPC also show that most payment companies believe that global merchants will use more cryptocurrencies in the short term. 64% of representatives from Middle Eastern payment companies believe that over 50% of merchants will start accepting cryptocurrency payments in the next three years.

The survey also reveals that the willingness of UAE users to accept digital assets in their personal lives is increasing. For cross-border remittances, nearly 40% of survey participants consider cryptocurrencies to be a more efficient and cost-effective international remittance method. 40% of people find the practicality of cryptocurrencies attractive for payment transactions. 36% of people are willing to use crypto cards for daily shopping, highlighting the growing desire for the practical application of cryptocurrencies in daily financial activities.

Additionally, 20% of users are interested in cryptocurrency gifts, and 17% of users are willing to receive and pay salaries in cryptocurrency. This growing adoption indicates a shift of cryptocurrencies in the UAE from speculative assets to practical tools. These diverse cryptocurrency interests not only reflect evolving financial perspectives but also signify a more widespread acceptance of the role of blockchain in various aspects of life in the UAE.

- Innovation Trends and Market Advantages 5.1 People Expect More Innovation in the Cryptocurrency Field, Combining AI and Identity Verification The survey shows that people in the UAE are highly interested in various cryptocurrency innovations, with the integration of AI and the cryptocurrency industry topping the list, with as high as 62% of respondents expressing optimism. Additionally, 32% of participants are more concerned about more secure and decentralized identity verification solutions based on the cryptocurrency industry, while 29% of respondents are more interested in supply chain tracking using blockchain technology, highlighting the desire to improve supply chain management transparency and traceability.

Decentralized Finance (DeFi) remains intriguing, attracting the interest of 26% of respondents. DeFi innovations provide opportunities for more inclusive and convenient financial services, including lending and liquidity mining.

The data from the survey shows that interest in the cryptocurrency world and ecosystem is growing, expanding from gaming to social interaction, business, and education. Whether through the integration of AI and the cryptocurrency field, more secure identity based on blockchain, or supply chain tracking transparency, these innovations are reshaping the cryptocurrency landscape and paving the way for more advanced and inclusive financial and digital experiences.

5.2 Strong Financial Infrastructure and Global Network Advantages are Significant The UAE, as an emerging center for cryptocurrency industry development, is making waves. 53% of respondents believe that Dubai (UAE)’s most unique advantage is its ability to attract funds and capital, providing the resources needed for innovation and scalable enterprises for cryptocurrency startups and entrepreneurs, laying the foundation for success. Additionally, 46% of respondents emphasize that Dubai (UAE)'s strong financial infrastructure provides a solid foundation for cryptocurrency companies, creating an ideal environment for seamless transactions and trust-building.

The presence of talented labor, favorable regulatory environment, and tax policies (recognized by 34% and 32% respectively) further enhance the attractiveness of the UAE as a cryptocurrency hotspot. The global network and activities (42%) further highlight the appeal of the UAE for cryptocurrencies. These international networks and industry activities create valuable opportunities for knowledge exchange, collaboration, and global relationship building.

Furthermore, the presence of innovative startups and communities is driving a dynamic cryptocurrency ecosystem, promoting collaboration and knowledge sharing, providing rich insights, innovation, and partnerships, advancing the UAE's position as a thriving nation in the cryptocurrency ecosystem on the world stage. These advantages make the future of the cryptocurrency industry in the UAE look very promising.

- Investment Environment and Investment Institutions 6.1 Favorable Investment Environment Attracts More Resources The report shows that in 2021, the Middle East and North Africa (MENA) region saw a record $23 billion in venture capital, with Dubai leading the way as the preferred destination for venture capital. In 2022, traditional internet-era venture capital giants such as Sequoia Capital, Tiger Global, and Bridgewater Associates began to appear intensively in cryptocurrency investment and financing events, with fund sizes reaching hundreds of millions of dollars, further boosting investment enthusiasm in Dubai. In 2023, the heat of the cryptocurrency market has somewhat declined, but with the resource tilt of top institutions such as Binance and Bybit, various investment institutions continue to emerge in the Dubai region, attracting a large number of cryptocurrency industry entrepreneurs.

6.2 Popular Tracks Are More Likely to Attract Institutional Favor In-depth research on investment institutions in Dubai (UAE) reveals that infrastructure, DeFi, GameFi, and payments are several popular tracks that are more likely to attract the attention and favor of institutional investors.

Because of policy inclinations and government guidance, most local investment institutions in the UAE are involved in cryptocurrency market investments or project incubation. In our research on 18 investment institutions in Dubai (UAE), including traditional capital, emerging crypto funds, local venture capital in Dubai (UAE), and private investment companies of the Dubai royal family, 68.2% are more willing to invest in infrastructure projects and blockchain application projects. In addition to this, there is DeFi and GameFi, with the proportion of GameFi gradually increasing in 2023.

- Regional Cryptocurrency Market Regulatory Policies On January 23, 2023, UAE Minister Thani bin Ahmed Al-Zeyoudi stated at the World Economic Forum in Davos, Switzerland that cryptocurrency assets will play an important role in UAE's global trade and will be included in the national trade policy in 2023. He further emphasized that "as the UAE creates a regulatory framework for virtual assets, the focus will be on making the Gulf countries friendly and safe for virtual assets."

7.1 Leading the Global Regulatory Framework Compared to many countries that take a hostile or indifferent attitude towards cryptocurrencies, Dubai (UAE) has chosen to take a positive approach:

- In 2016, Dubai first launched its blockchain strategy.

- In 2018, Abu Dhabi established the world's first cryptocurrency regulatory framework.

- In 2020, the UAE Securities and Commodities Authority (SCA) issued the Crypto Assets Activities Regulation (CAAR).

- In 2021, at the federal level, the SCA was explicitly designated as the regulatory authority for virtual asset activities and investment services within the UAE, responsible for licensing and supervision.

- In 2022, Dubai established its own Virtual Assets Regulatory Authority (VARA).

In fact, India, the Philippines, and Pakistan are all among the top ten in the adoption index in the UAE, which is also a good sign for the UAE. These countries account for a large part of the UAE's expatriate population, and the increasing popularity of cryptocurrencies in these countries may be related to the increasing adoption of cryptocurrencies in the UAE.

7.2 Multiple Jurisdictions and Diverse Regulatory Frameworks The UAE has multiple regulatory agencies for crypto assets, each targeting its own jurisdiction and specific business. To determine which regulatory framework applies, it is necessary to understand the main jurisdictions in the UAE:

- Mainland or Onshore Jurisdiction: Refers to any of the 7 emirates of the UAE where companies can be registered through their respective economic departments, such as the Dubai Economy Department (DED) and the Abu Dhabi Department of Economic Development (ADDED).

- Economic Free Zones: There are over 40 economic free zones (with Dubai having over 30), with the Dubai Multi Commodities Centre (DMCC) being the largest economic free zone.

- Financial Free Zones: These are the Abu Dhabi Global Market (ADGM) and the Dubai International Financial Centre (DIFC).

- Onshore Offshore Jurisdictions: Jebel Ali Free Zone and RAK International Corporate Centre, which provide offshore jurisdiction suitable for legal structures for family trusts and family foundations.

For mainland companies, regulation is overseen by the UAE Securities and Commodities Authority (SCA) and the UAE Central Bank. The two financial free zones also have their own regulatory bodies, the Dubai Financial Services Authority (DFSA) and the Financial Services Regulatory Authority (FSRA). Additionally, the over 40 economic free zones in the UAE can issue licenses for specific business activities. Each of the 7 emirates in the UAE can also enact their own laws to regulate virtual assets.

The diverse Web3 regulatory frameworks, on one hand, actively explore suitable regulatory strategies to promote innovation, and on the other hand, provide multiple choices for market participants to adapt to specific virtual asset businesses.

7.3 Brief Analysis of the Application of Major Regulatory Frameworks VARA's jurisdiction includes regulating the entire Dubai emirate's cryptocurrency service providers (including exchanges, venture capital funds, NFT platforms, etc.) in coordination with the federal-level SCA and the UAE Central Bank. Therefore, all related activities will fall under regulation, including but not limited to exchanges, brokers, custodians, and service providers.

DFSA strictly limits the types of cryptocurrencies that can be accepted, with only accepted crypto tokens being regulated, while other types of virtual assets, such as utility tokens and NFTs, are explicitly excluded from financial regulation. DIFC's regulation is more suitable for hedge funds investing in virtual assets, family offices, traditional financial service companies (including investment advisory, brokerage, trading, and custody), and Bitcoin-related financial activities.

ADGM has revised the Financial Services and Markets Regulations (FSMR) to include the "virtual asset industry" under regulation, which includes various provisions related to Digital Assets, ICOs, Digital Securities, and Market Rules. ADGM's regulation is more suitable for Web3 venture capital companies, virtual asset custodians, and holding companies investing in Web3 projects.

Economic free zones have signed memoranda of understanding with the SCA, including the Dubai Multi Commodities Centre (DMCC), the Dubai World Trade Centre (DWTC), and the International Free Zone Authority (IFZA). Regulation in economic free zones is more suitable for Web3, Metaverse, or NFT projects, as well as single-family offices managing investment in virtual assets for high-net-worth individuals.

7.4 Clear Regulatory Rules Supported by Cryptocurrency Users People's various attitudes towards cryptocurrency regulation reflect the subtle nature of the cryptocurrency industry. About 41% of respondents strongly support clear and comprehensive regulation, emphasizing the need for structured regulation, believing that this will promote industry growth and protect investors.

23% of participants advocate for self-regulation, believing that the cryptocurrency industry should establish its own standards, emphasizing the belief that the cryptocurrency community can effectively address challenges without external regulation. Only 13% of people are in the middle ground, supporting practical and reasonable regulation, emphasizing fairness and clarity, and balancing regulatory oversight with the flexible and adaptive needs of the cryptocurrency industry.

On the other hand, 7% of people strongly oppose regulations, fearing that they may stifle innovation and hinder financial freedom, while 7% of people are skeptical and reserved about regulation, expressing concerns about potential negative impacts, highlighting the importance of carefully considering and evaluating the consequences of regulatory actions. Clearly, the discussion around cryptocurrency regulations in the UAE is very complex and requires delicate balancing measures to meet the diverse needs and expectations of stakeholders.

- Conclusion In recent years, Dubai's GDP has been growing rapidly, with the financial industry's share continuously increasing. During this process, Dubai has also become one of the countries/regions with the highest adoption of cryptocurrencies in the past three years, second only to Turkey. Despite its drawbacks such as a small number of developers, few well-known capital sources, hot climate, and weak economic robustness, its zero tax rate, high security, and friendly regulatory policies have attracted more and more cryptocurrency institutions and projects to migrate or establish branches here.

In the UAE, the majority of the population is made up of expatriates from the UK, India, Pakistan, Bangladesh, and the Philippines, where practitioners from various continents and countries interact, giving the cryptocurrency industry a globalized development from the outset. More and more young people here are enthusiastic about and fond of cryptocurrency investments, full of enthusiasm for industry innovation, and have a very high level of friendliness towards various types of cryptocurrency applications and cryptocurrency enterprises. A group of outstanding blockchain technology developers and cryptocurrency economic ecosystem builders are gathering in Dubai, working together for the future.

The Middle East has become the base for many ecosystem projects, with strong compatibility in finance, digital economy, cryptocurrencies, and AI, deeply integrated here. The Dubai government's policies and regulations have been providing the cornerstone for the industry, creating an ideal environment for cryptocurrency industry entrepreneurship. With more and more institutions and personnel entering, Dubai's cryptocurrency market is bound to become the next growth point for the Middle Eastern economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。