Web3's cleverly designed token incentive mechanism can allow newcomers to surpass market leaders.

Written by: DeFi Cheetah

Translated by: Deep Tide TechFlow

This article aims to explain how the first principles of Web3 work in different business models of Web3 and Web2. This will be very helpful if you are a builder or from a Web3 VC.

How are successful Web3 models different from Web2 models?

i. Minimized trust settings reduce the switching costs and loyalty of Web3 users, making it difficult for Web3 projects to scale.

ii. Industry open source, product homogeneity, weak network effects.

iii. Lack of economies of scale: the cost borne by current Dapp users does not decrease much with the addition of each additional user.

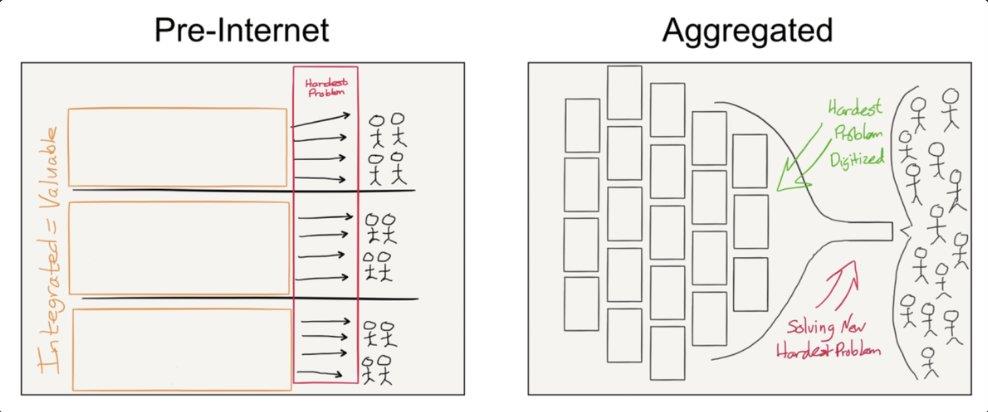

Many Web3 projects attempt to replicate successful Web2 business models by aggregating suppliers, distributors, and users onto a single platform. This is to pay homage to the aggregation theory, where most successful Web2 enterprises have simplified consumer markets, such as FB and Amazon.

Why are Web2 aggregators so successful?

a. User stickiness is a powerful weapon against competition.

b. Strong network effects, reducing user acquisition costs.

c) Economies of scale: the more users, the less each person pays.

This is not the case in Web3.

For a, as the aggregator develops, the stickiness of Web2 users is stronger due to the customizability of services and higher brand awareness. Aggregators have more data to optimize the user experience in their operations. Users also find it risky to establish trust and confidence in unknown new platforms.

In other words, in Web2, users must trust the aggregator to provide good quality control of services, excellent service discovery, and curation. Therefore, platform stickiness is strong, and the "winner takes all" phenomenon is evident.

For example, in online shopping without a guarantee of goods delivery, most people choose Amazon because it has quality control and a rating system to ensure that sellers are legitimate. Coupled with Amazon's brand, the default risk is much lower compared to sellers on unknown platforms. Therefore, more consumers choose to shop on Amazon rather than easily switch to other new platforms.

But in Web3, protocols operate with minimized trust settings through smart contracts, where operations are transparent, predetermined by certain rules in the code, and automated by smart contracts. Therefore, the switching costs in Web3 are much lower, and brand awareness is much weaker.

For example, Uniswap does not take a cut from LP fees. Some believe this is due to regulatory issues, but this is not convincing. A more reasonable explanation is that the Uniswap team knows that changes in fees could have a huge negative impact on its trading volume.

Therefore, rather than profiting directly from order flow, Uniswap is more inclined to use its first-mover advantage to expand horizontally by launching the intent-based architecture Uniswap X, challenging current liquidity aggregators like 1inch and CoWSwap.

Apart from the fact that most trading volume does not come from natural persons, the cost for users to trust new Web3 platforms is not high because operations are open to the public through code, so everyone can know if a new protocol is truly effective; in contrast, Web2 aggregators hide their workings in the background. Some Web2 service providers require custody of users' assets, requiring users to rebuild more trust in them, while in Web3, users interact with aggregators in a non-custodial manner. All of these reduce the switching costs for users.

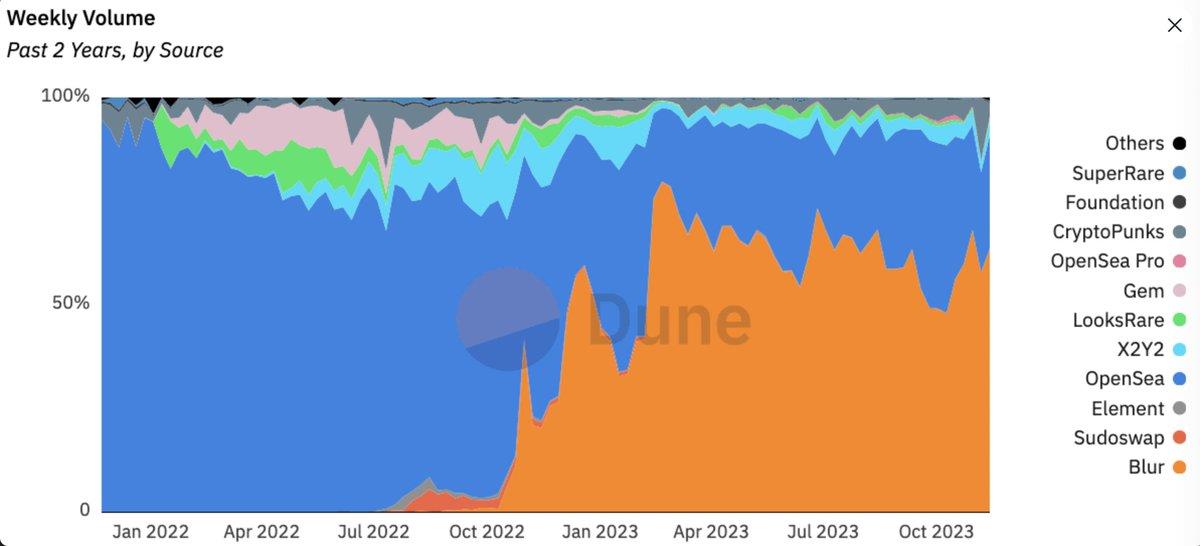

At the same time, cleverly designed token incentive mechanisms in Web3 can allow newcomers to surpass market leaders. This is also how most successful protocols guide initial total value locked (TVL) and users in Web3 and address the cold start problem in Web3. Before the airdrop by Blur, Opensea was the market leader in the NFT market. But it is well known that Blur's token incentives overturned Opensea's dominance, forcing Opensea to make significant adjustments to its reduced market share. The ability for newcomers to surpass market leaders is unprecedented in Web2.

In Web3, due to lower user loyalty, the relationship between aggregators and users is more dynamic, making it more difficult for protocols to scale. Competitors can execute "vampire attacks" or lower fees to stay competitive.

For b, as the user base in Web2 aggregators grows, more service providers are attracted to them, which in turn attracts more users because they become more valuable to users. Therefore, user acquisition costs will decrease over time. But the dynamics in Web3 are completely different.

In other words, Web2 aggregators can create more value for users by integrating more service providers into their platform. This product heterogeneity allows aggregators to differentiate themselves from other competitors in the market.

For example, as more small property owners join Airbnb, more travelers become its members because it can offer them more apartment/accommodation choices for vacation. When network effects start to provide more value to users, Airbnb does not need to spend much to acquire users.

In contrast, even if more service providers are integrated into Web3 aggregators, the flywheel of network effects will not easily start in Web3 because of the homogeneity of products: most dApps on the supply side are open source and universally accessible to aggregators, offering similar value to users.

In fact, unless they continue to innovate and provide more advanced features, market leaders cannot provide very different product suites for users, which newcomers can easily replicate. The ongoing development and maintenance costs are a form of acquisition cost for Web3 aggregators.

For cross-chain bridges, they need to continuously add support for new blockchains as new blockchain ecosystems emerge. Not to mention token incentives as another form of retaining users. These recurring costs greatly reduce the network effects that Web3 aggregators can enjoy.

Users in Web2 can benefit from economies of scale, as the more users, the less each user on average has to bear the cost. This is because fixed costs are an important part of some aggregator expenditures. Netflix is an illustrative example of economies of scale.

On Netflix, even with the same amount of on-demand video content, the more users, the less each user should bear the cost because the cost is already fixed. Therefore, more users reduce the cost. Again, this is not the case in Web3.

Although there are ongoing R&D and maintenance expenses in Web3, users still have to bear huge variable costs independent of economies of scale—decentralization costs, paying validators fees for consensus on blockchain state.

EIP-4844 can help reduce fees on L1, but congestion fees unrelated to economies of scale due to limited block space weaken the dominance and moat of aggregators. No matter how cheap 1inch is, users still have to pay more when the network is congested.

There is one exception: L2. The more users, the less each user should bear the cost.

L2 costs typically include a fixed cost and a variable cost: (i) the cost of publishing blocks on Ethereum and (ii) the cost of running sequencers.

Let's take Optimism as an example:

Assuming the gas price on Ethereum is 25 gwei and 1 ETH is $2k:

- One-time cost of deploying OP Stack on the mainnet = approximately 1 ETH

- Fixed cost of OP Stack, even without running any transactions, (ii): approximately 0.5 ETH per day

- Variable cost (DA), (i): 0.000075 ETH per transaction

After EIP-4844, assuming (i) is reduced by 10 times, i.e., approximately $0.015 per Tx + (ii) fixed cost, using 0.00001 ETH (approximately $0.02) as Tx surcharge to cover fixed costs, 50k transactions per day are needed to cover (i) + (ii) costs (before EIP-4844, the price per Tx was approximately $0.17, and after EIP-4844, it is $0.03)

Assuming there is a positive correlation between users and the number of transactions, the more users, the more transactions, and the lower the Tx surcharge to cover L2 costs. However, for most Web3 aggregators, economies of scale cannot be easily achieved as the number of users increases.

Therefore, by applying first principles to simplify the nature of the Web3 industry to the simplest dimensions and reasoning from there, what Web2 aggregators enjoy cannot be directly applied to Web3: user stickiness, network effects, or economies of scale. Token incentives, minimized trust, and permissionlessness are some of the fundamental principles reshaping Web3 business models.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。