MYX, a decentralized perpetual exchange leading the forefront of financial innovation, is now at the forefront of Defi, ready to face the challenge.

MYX recently completed a $50 million valuation with a $5 million seed round of financing, led by HongShan (Sequoia China), with other investors including Consensys, Hack VC, OKX Ventures, Redpoint China, HashKey Capital, Foresight Ventures, GSR Markets, Alti5, Leland Ventures, Cypher Capital, Bing Ventures, Lecca Ventures, and others. These funds will be used to accelerate MYX's technological innovation and market expansion, and to promote the rapid launch and scaling of its mainnet products.

TL; DR

MYX is an innovative decentralized perpetual exchange that achieves zero-slippage trading through the unique Matching Pool Mechanism (MPM), efficiently matching long and short positions, resulting in a capital efficiency of up to 125x, and increasing unlimited possibilities.

MYX reconstructs the entire trading process, ensuring system stability through intelligent funding rates, and increasing scalability through upcoming LP yield swaps and other functions.

With a team that has managed exchanges with monthly trading volumes in the billions and assets exceeding $1 billion, MYX is committed to creating a simple yet rich product experience for users. Additionally, the team has diverse funding backgrounds to ensure stable resource cooperation and operations after the project goes live.

MYX's Core Design: Matching Pool Mechanism Engine

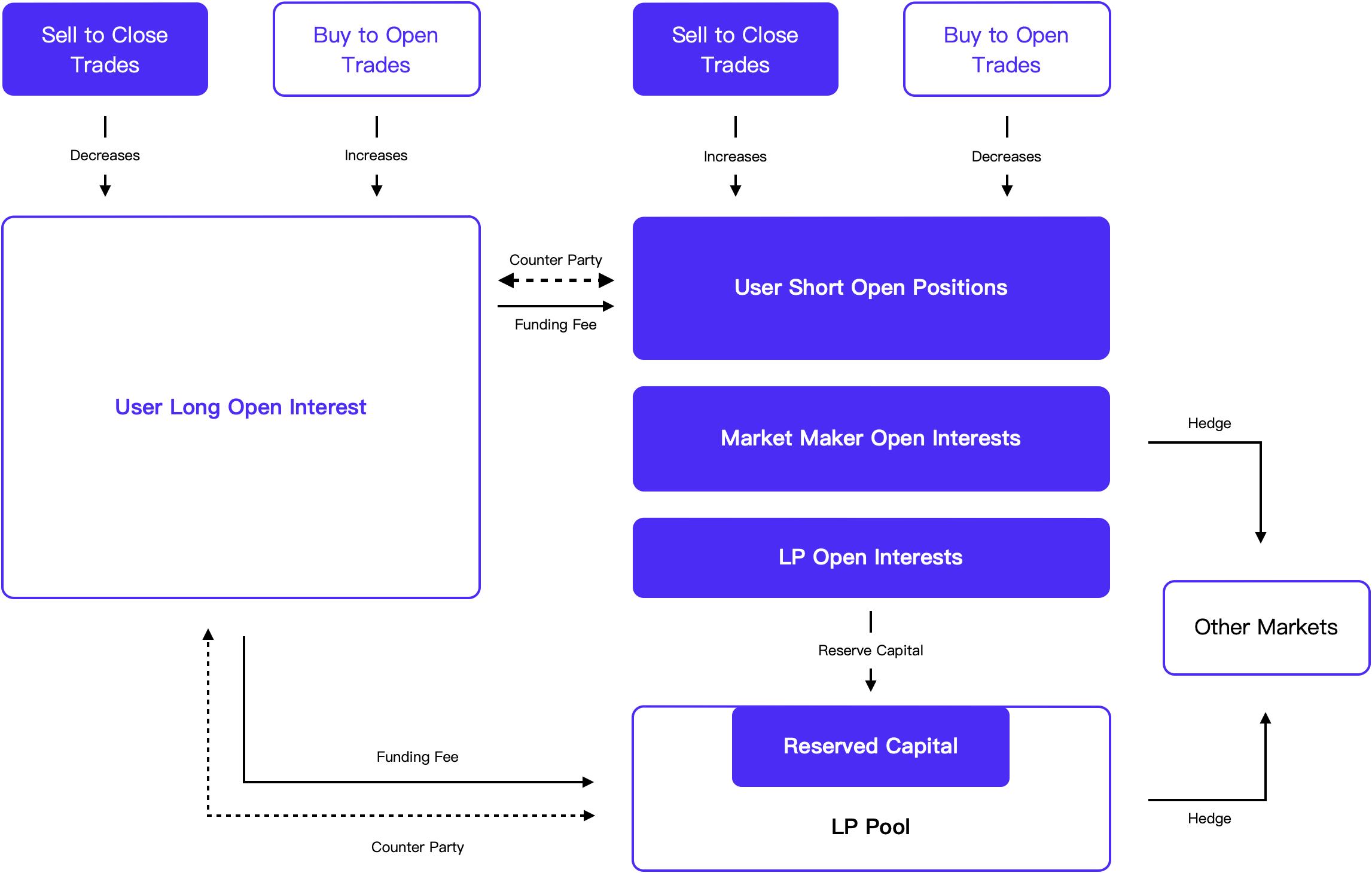

MYX has created the Matching Pool Mechanism engine, which disrupts traditional methods. Under this engine, LPs will only bear the net open position of the platform. Therefore, LPs are no longer involved in long and short trades, but instead focus on efficiently managing and hedging risks, without relying on traders' losses to make a profit. When long and short trades are balanced, capital efficiency is maximized; in the case of imbalance, LPs and market makers receive fair compensation through continuous and stable funding rates.

How It Works

In the traditional spot pool model, LPs directly bear the counterparty risk of long and short positions, with each trade occupying a certain amount of liquidity, resulting in low capital efficiency. In MYX, the MPM mechanism matches long and short traders, quickly releasing the temporarily occupied liquidity when the long and short trading counterparties are formed, allowing LPs' capital efficiency to be infinitely amplified under ideal conditions.

This innovative mechanism aims to provide sustainable income based on real user needs for traders, market makers, and LPs, abandoning the old model of excessive reliance on token incentives or traders' losses. The Matching Pool Mechanism helps users achieve new breakthroughs in risk management and income maximization, driving the trading ecosystem to progress in a more fair and sustainable manner.

Trading Costs

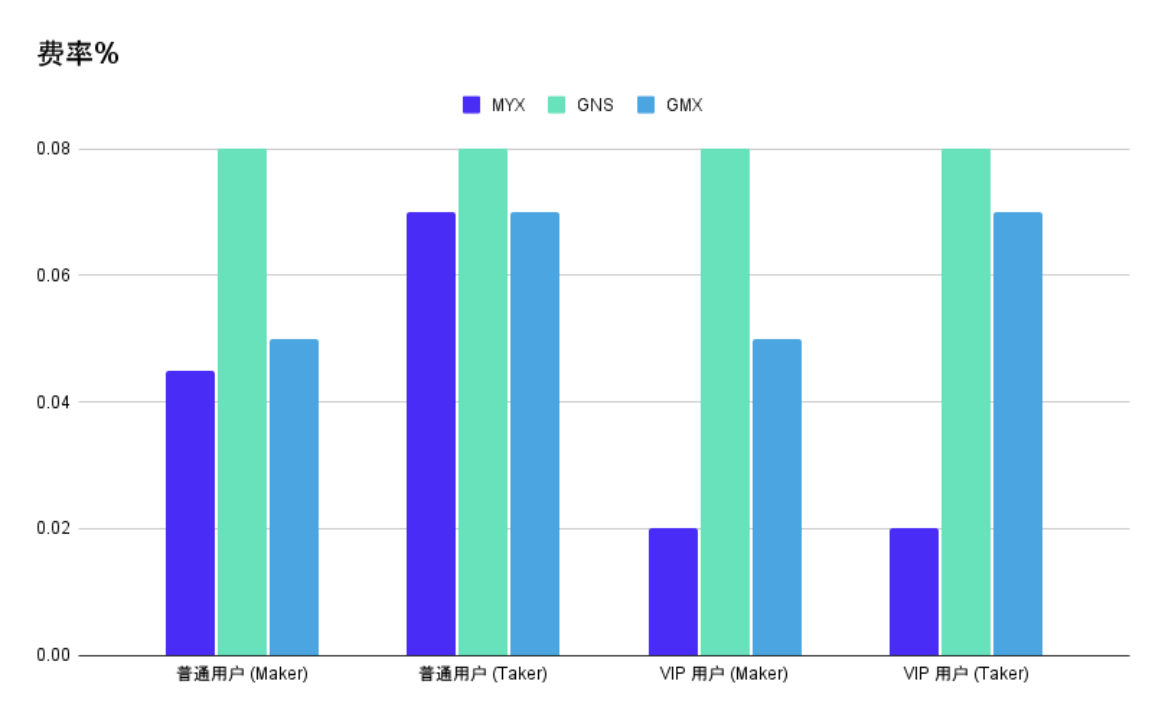

MYX's outstanding Matching Pool Mechanism trading engine provides users with the most competitive trading fees in the market. Taker fees are only 0.07%, while Maker fees are as low as 0.045%. VIP users have the opportunity to enjoy excellent trading fees as low as 0.02%.

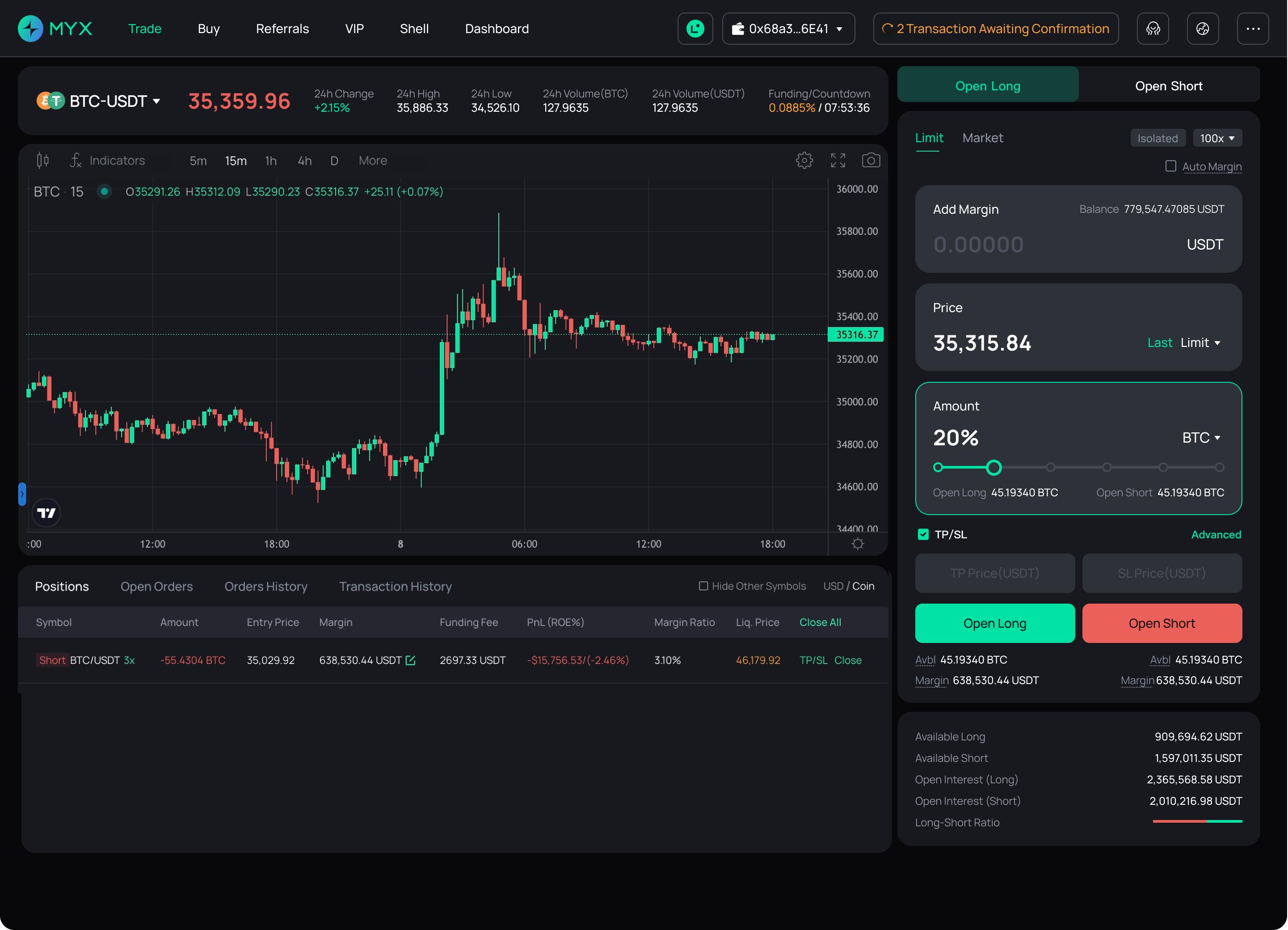

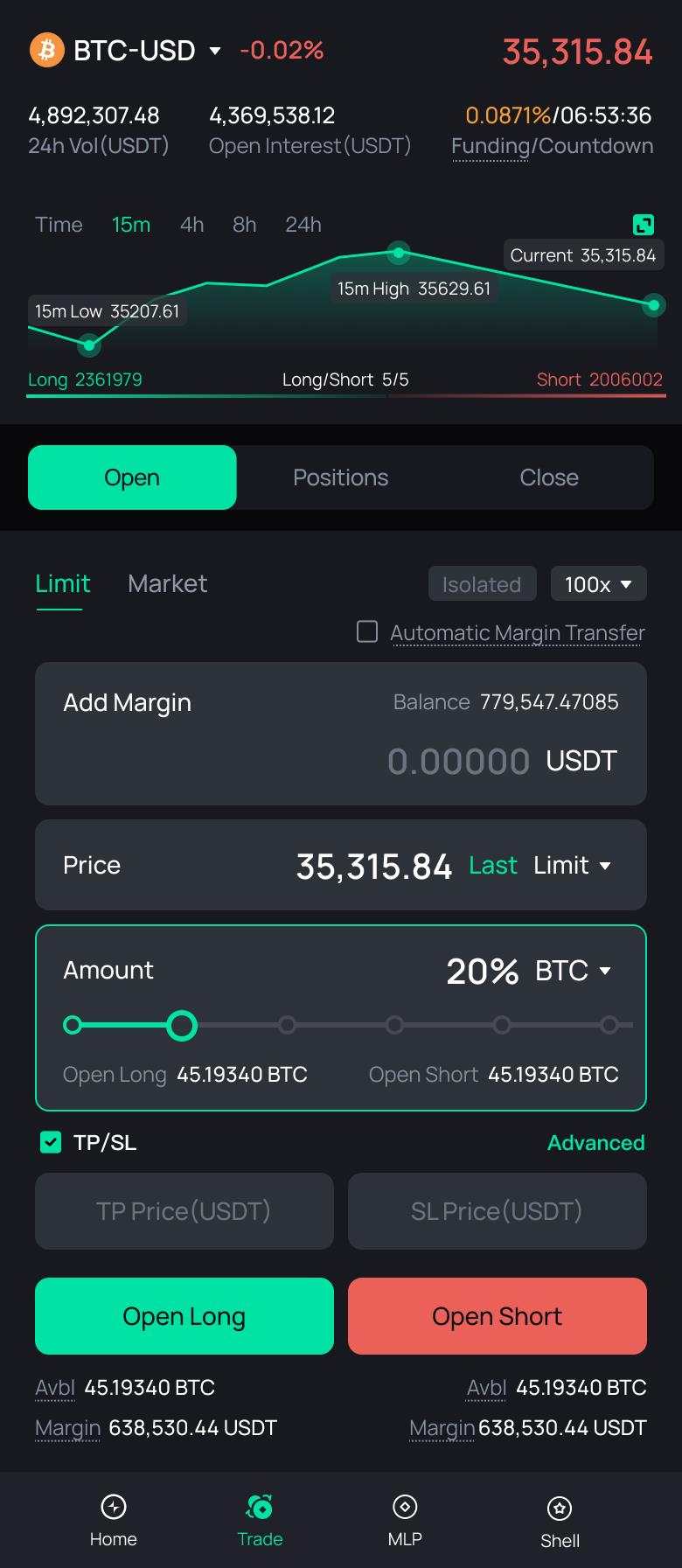

Additionally, MYX adopts a dual oracle mode to ensure that the execution prices of trades are always most favorable to users, allowing users to experience zero-slippage trading and avoid additional costs due to slippage.

MYX is committed to optimizing users' trading experience, providing the best rates and the most favorable trading execution prices, and the lowest holding costs, creating a more competitive trading environment for users.

MLP Scalability

MYX has redefined the role of liquidity providers by introducing MLP yield swap funds, increasing their risk management capabilities and providing multi-level scalability.

Internally, the LP fund serves as a link between market makers and users, providing new fundraising channels for market makers and allowing users to participate for stable returns, optimizing fund liquidity and usage efficiency, and enhancing the overall attractiveness of the platform.

Externally, MLP is essentially a non-leveraged tool with no bankruptcy risk. It can be combined with third-party protocols such as lending and staking in the DeFi ecosystem to introduce leverage or create synthetic assets, providing users with more diversified investment strategies and income enhancement possibilities.

From a broader perspective of the DeFi ecosystem, the development of cross-chain technology enables MLP to support transactions on different public chains, strengthening the interoperability of the entire ecosystem and opening up new markets and investment channels for MLP, greatly expanding its application scope and potential income opportunities. With the continuous development and improvement of cross-chain solutions, the high capital liquidity and adaptability of LP funds will become a major competitive advantage for MYX.

Keeper System

MYX has also introduced a key decentralized component: the Keeper system. This system gives token holders and LP stakers greater participation, allowing them to become guardians of the platform. The Keeper plays a crucial role in ensuring the autonomy and security of smart contract operations, while also enhancing the decentralization and sustainability of the entire platform.

By participating in the Keeper system, community members can not only receive token rewards but also share trading fees, increasing their sources of income and directly promoting the activity of the platform's economy. With the expansion of MYX's cross-chain liquidity function, the role of the Keeper becomes even more critical, as they help drive capital to flow freely across different chains, expanding the role of LPs and enhancing the connectivity of the entire DeFi ecosystem. Therefore, the Keeper system is not only part of MYX's decentralized architecture but also the core of its LP fund scalability strategy.

User Experience

As an ambitious platform, MYX always prioritizes user experience. Through the innovative Matching Pool Mechanism (MPM) to achieve zero-slippage trading, ensuring that every trade is executed at the best price, greatly reducing trading friction. In terms of trading fees, we offer the lowest on-chain trading fees, with regular users paying only 0.045% for Maker trades and 0.07% for Taker trades, while our VIP users can enjoy fees as low as 0.02%, providing users with the most competitive trading fees in the market.

Holding costs are also a focus for us. We have no borrowing costs, and with an intelligent funding rate system, the platform's long and short open positions determine the funding rate. By introducing market makers on a large scale, we can balance long and short open positions, resulting in lower long-term holding costs for users.

In addition, MYX provides a user experience similar to that of centralized exchanges, simplifying the operation process and providing comprehensive trading guides and tutorials, as well as 24/7 online customer service, to ensure that even first-time users can easily start trading. These mechanisms all operate on-chain, have been audited by PeckShield, and are undergoing an audit by SlowMist. These audits further ensure the platform's security and reliability, providing users with an efficient and low-cost trading environment.

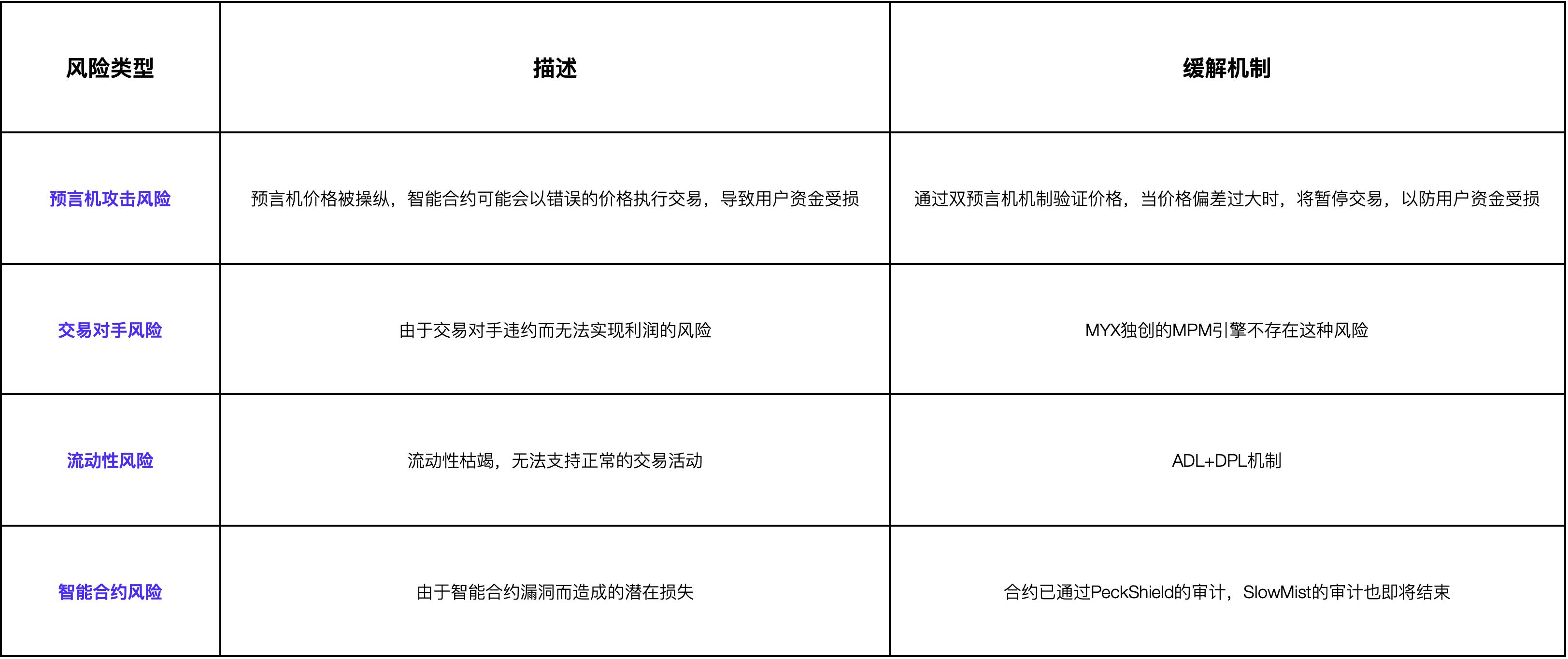

Risk Control

In MYX, LPs do not rely on profiting from traders' losses. Instead, they choose to achieve seamless liquidity integration between CEX and DEX through an intelligent funding rate adjustment system and the use of a large-scale market-making model, increasing the overall market liquidity and minimizing the common issue of gratuitous losses in traditional DEX platforms.

This unique approach allows LPs to more easily and effectively manage risk exposure and hedge against it. Even in the event of extreme market volatility or liquidity depletion, MYX effectively prevents malicious attackers from profiting from liquidity depletion through the use of the DPL+ADL mechanism. The application of this mechanism greatly enhances market stability and liquidity, eliminates potential risks and attacks, and protects the interests of traders and liquidity providers. MYX has laid a solid foundation for the stability and reliability of the trading ecosystem through comprehensive risk control measures.

User Advantages

For Trading Users

- Fair trading market: Open-source smart contracts, zero MEV, and not reliant on user losses for profit.

- Low trading costs: Enjoy the lowest on-chain fees during trading, reducing your trading costs; no need to pay borrowing interest while holding, reducing long-term holding costs.

- Best depth: Ensure trades are executed at the best price, with no slippage for large market orders, zero slippage, and full trading advantages.

- User experience: User-friendly interface, leading beginners to start trading easily. Trading guides, 24/7 professional customer service, always ready to help. Diverse strategies, easy to follow, and trade with ease, extremely convenient.

For LP Users

- Sustainable high returns: Based on the powerful MPM mechanism, MYX achieves higher neutrality of LP holdings and matching efficiency, providing users with stable and high returns.

- Smarter risk control system: Equipped with an intelligent risk control system to comprehensively prevent network downtime, oracle attacks, liquidity squeezes, one-sided markets, and asset collapses, committed to providing a safer, more efficient, and competitive trading environment, safeguarding user asset security.

Capital Investment and Recognition

In the current environment, with its innovative MPM mechanism and the team's strong technical and operational background, MYX has successfully completed a $50 million valuation with a $5 million seed round of financing. This round of financing has received favor and support from top-tier capital, including Sequoia Capital and many other investment institutions, involving multiple market ecosystems, including CEX, market makers, and local communities, providing a solid foundation for the continued development of the project.

Founder's Thanks and Outlook

MYX founder Mark stated, "We are very honored that even in such a depressed market environment, this round of financing has still received favor from many top-tier capital. This is not only due to the efforts of our team but also reflects the capital's recognition of our entrepreneurial concept, execution path, and innovation capabilities. Faced with the potential market size of nearly $900 billion in the decentralized derivatives track every quarter, we have always believed that the most important thing is how to achieve overall trading volume growth through product innovation, mechanism innovation, and business innovation, rather than competition between protocols.

In fact, at this moment, we are at a critical juncture. With the progress of BTC spot ETF and the upcoming BTC halving next year, we may enter a new cycle at any time. Only products that can meet the demands of the times and users can take the lead among many competitors. For MYX, our ambition is never just the trading volume or fee numbers. We always look forward to the day when MYX can become the clearing center for decentralized derivative trading on-chain, fully unleashing the infinite potential of our matching pool trading engine. Of course, this also requires the strong support of capital and ecological partners. We hope that together we can push decentralized derivative protocols to new heights."

Conclusion

MYX, a decentralized perpetual exchange leading the forefront of financial innovation, is now at the forefront of Defi, ready to face the challenge.

MYX has adopted a series of innovative mechanisms, including optimizing liquidity, reducing trading costs, enhancing user-friendliness, and improving risk control strategies. These mechanisms not only solve the problems existing in traditional trading platforms but also create significant advantages for users and liquidity providers. With the support of many top-tier capital, it further confirms the market's high recognition of MYX's innovative model and future development potential.

As decentralized perpetual exchanges continue to grow, MYX will continue to optimize platform performance and user experience to meet the rapid growth of market and user demands, striving to build MYX into a leading global decentralized perpetual contract trading platform.

MYX not only represents innovation but also efficiency and sustainability. It injects new vitality into the decentralized finance field and will continue to drive the entire industry forward. We look forward to the future success of MYX, providing an excellent trading experience for a wider range of users. Follow MYX and start your journey into decentralized trading.

Contact Us

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。