On November 26th at 23:00, the stablecoin USTC in the Terra ecosystem suddenly surged, reaching 0.05 USDT from 0.02 USDT within one hour, a 250% increase. As of the time of writing, it was still maintaining around 0.065 USDT, reaching a new high in a year. Influenced by the anticipation of the airdrop of the new stablecoin project Mint Cash in the Terra ecosystem, the heat of USTC returned overnight. The market speculates that this is related to the airdrop empowerment of Mint Cash developed by former Terra members and the proposal to restore the anchoring of USTC to the US dollar.

What is Mint Cash

Mint Cash is a stablecoin system based on BTC collateral, intending to provide a stable and efficient payment and savings solution by combining the advantages of the Terra ecosystem with the anti-censorship and anti-inflation properties of Bitcoin. The project maintains purchasing power stability and provides income to cash holders through an innovative synthetic exchange mechanism, while also promoting the development of DeFi.

According to the official white paper, the main features and design goals of Mint Cash include:

- Not relying on centralized institutions, fully supported by Bitcoin collateral to achieve stablecoin exchange and payment;

- Using a synthetic asset exchange mechanism to achieve high capital efficiency without the need for excessive collateral as in traditional over-collateralization systems;

- Achieving monetary policy flexibility through adjustments in interest rates, taxation, collateral mechanisms, etc., to resist price shocks;

- Providing stable and high-yield savings accounts through the Anchor protocol;

- Supporting multiple currencies, including stablecoins of other major fiat currencies besides the US dollar;

- Drawing on the economic model of traditional monetary policy and adjusting it to the characteristics of blockchain to achieve the smooth operation of Mint Cash tokens and various stablecoins;

- Avoiding large capital outflows through moderate capital control measures to maintain system stability;

- Providing a synthetic foreign exchange lending market to increase system liquidity and achieve interconversion between multiple currencies.

Participation Method:

Mint Cash allows users to participate in two ways using USTC: first, by holding UST or LUNA before the Terra collapse on May 10, 2022; second, by locking and destroying a specified amount of USTC through the Mint Cash airdrop.

Team Members

The core developers of Mint Cash come from the former Anchor team and Aleph Research, with core developers under Aleph Research responsible for developing the stablecoin protocol. At the same time, Aleph Research is also involved in the development of the new version of the Anchor Protocol, Anchor Sail, which will play a key role in stablecoin growth and anchoring in the Mint Cash ecosystem. In addition, the team is also planning to collaborate with the smart contract platform CosmWasm and the EVM L1 blockchain Berachain to build Polaris EVM support based on the Cosmos SDK.

Reasons for the Surge in USTC

The reason for the surge in USTC is that the core developer of Mint Cash, Shin Hyojin, previously tweeted to explain the airdrop rules: "We will airdrop an equivalent amount of tokens at a valuation of 1 USTC = 1 USD (specific circumstances may vary), which is a discount of up to 99%." In the eyes of most users, USTC was not valued at more than 0.015 USD before this surge, and even after the surge, it has only reached up to 0.067 USD, which is an amplifier of more than 20 times in valuation.

Although Shin Hyojin clarified in a tweet on the 27th, stating "this is an initial valuation quote, meaning the tokens received will not always be exchanged at a 1USTC = 1 USD ratio," the market sentiment had already been ignited. Currently, the total circulation of USTC exceeds 9 billion, and it can be speculated that the nominal initial valuation of this project will be very high, possibly reaching several billion USD.

Design Model of Mint Cash

Instead of using algorithmic stablecoins, Mint Cash generates stablecoins through BTC collateral, which is similar to MakerDAO's over-collateralization model. So, what are the differences between Mint Cash's design and MakerDAO's DAI, and are there any unique aspects?

According to the white paper published by Mint Cash, let's take a look at the virtual liquidity model between MintCash and Bitcoin:

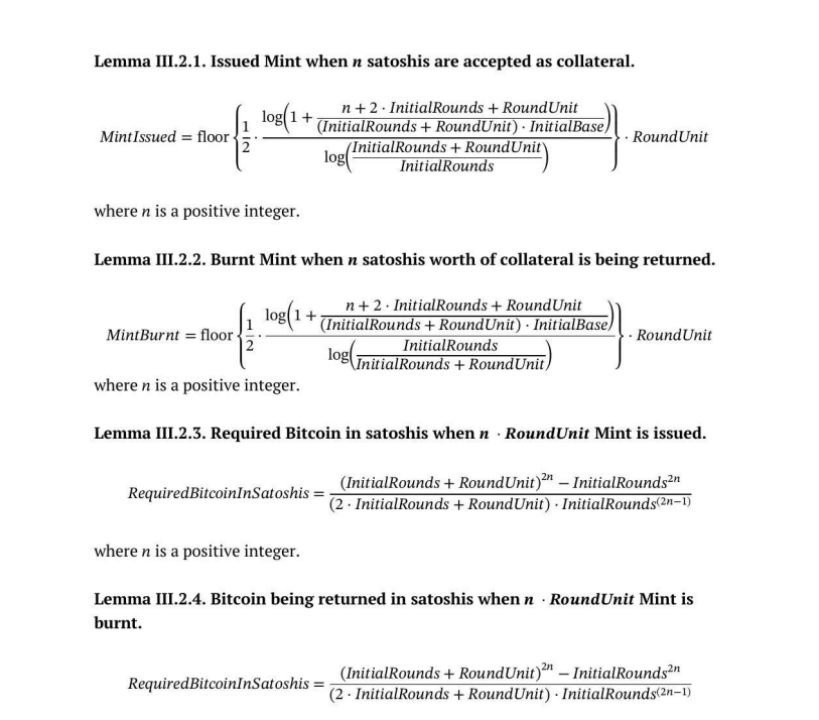

The virtual liquidity model between MintCash and Bitcoin is defined in the document by the following four lemmas:

Lemma III.2.1: Defines the quantity of MintCash issued when n satoshis are collateralized.

Lemma III.2.2: Defines the quantity of MintCash destroyed when the collateral corresponding to n satoshis is redeemed.

Lemma III.2.3: Defines the amount of Bitcoin collateral required to issue n RoundUnits of MintCash.

Lemma III.2.4: Defines the amount of Bitcoin collateral returned when n RoundUnits of MintCash are redeemed.

These formulas establish the correspondence between the input and output of MintCash and Bitcoin. When different amounts of Bitcoin collateral flow into the system, the corresponding issuance or destruction of MintCash can be determined based on these formulas.

To control capital flow, the white paper also mentions the introduction of the BaseCollateralLiquidity parameter, combined with the constant product formula in Uniswap, forming a virtual liquidity model with a liquidity upper limit. This limits the total amount of capital that can flow into or out of the system within a unit of time. The virtual liquidity model controls the capital exchange process between MintCash and Bitcoin, laying the foundation for the characteristics of flexible monetary policy and capital control in Mint Cash.

In summary, Mint Cash and MakerDAO demonstrate two different methods and philosophies in stablecoin generation. MakerDAO's DAI focuses on providing stability through over-collateralization and partially relies on centralized stablecoins, while Mint Cash emphasizes the use of Bitcoin's decentralized properties through synthetic exchange mechanisms.

Conclusion

Overall, the goal of Mint Cash is not to pull USTC back to 1 USD. Its essence is to launch a new project, which can be participated in using USTC for IDO. In a sense, the airdrop of Mint Cash is a positive attempt for USTC to move towards destruction and deflation by expanding its use cases. By stimulating users to actively lock USTC for the airdrop and subsequently destroying the corresponding USTC.

Based on the currently disclosed information, the use cases of USTC, Mint Cash, and the new Anchor are not closely related, and users should exercise caution when participating. It is also important to note that Mint Cash only has a white paper at the moment and has not officially launched a product.

Follow Us

veDAO is a one-stop platform for AI-driven web3 trend tracking and intelligent trading, combining market trend analysis with trading depth presented by big data, dedicated to creating a web3 AI exchange more suitable for buying, selling, and investing for both Web2 and Web3 users.

veDAO has an industry-leading AI language model composed of on-chain analysis and sentiment indicators, providing proactive data support to users. It combines intelligent, fast, secure, and real-time monitoring AI trading functions. As of now, the platform has been heavily used by over 40,000 users, is associated with 22,000+ Web3 vertical industry Twitter KOLs, and has a veDAO expert committee composed of 180+ professional institutions. The platform project library exceeds 10,000, and there are 240+ scouts continuously adding Web3 projects with veDAO.

veDAO is continuously upgrading at a bi-weekly update pace, determined to build a bridge from Web2 to Web3, becoming the preferred platform for future Web2 and Web3 users to search for projects, find hotspots, observe trends, and engage in primary investment and secondary trading.

Website: http://www.vedao.com/

Twitter: https://twitter.com/vedao_official

Facebook: bit.ly/3jmSJwN

Telegram: t.me/veDAO_zh

Discord: https://discord.gg/NEmEyrWfjV

Investment carries risks, and the projects are for reference only. Please bear the risks on your own.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。