Mint Cash airdrop "essentially allows participation in IDO with USTC", and the valuation of USTC at $1 seems to be just a "deceptive technique" played by the team.

By Frank, Foresight News

Last night at 23:00, the original Terra ecosystem stablecoin UST (USTC) suddenly skyrocketed, reaching 0.05 USDT from 0.02 USDT within an hour, a 250% increase, and still maintaining around 0.0414 USDT at the time of writing, reaching a new high in a year.

As a "failed project" in the minds of many, LUNC/USTC successfully attracted public attention with this round of speculation. The market interpretation is also diverse. What are the reasons behind the sharp rise of USTC? What new variables are worth paying attention to?

The Past and Present of USTC

First, we need to distinguish between LUNC/USTC and LUNA.

After the Terra ecosystem collapsed in May 2022, the original Terra network was renamed Terra Classic, and the token was renamed LUNA Classic (LUNC), and the algorithmic stablecoin UST was renamed Terra Classic UST (USTC).

Subsequently, the team, excluding the algorithmic stablecoin factor, rebuilt the new public chain Terra 2.0, and the token was named LUNA (of course, this LUNA is not the same as the previous LUNA, so it is distinguished from the pre-collapse LUNA as "LUNA2" in Binance contracts).

In short, LUNC/USTC is the token that inherits the lineage of LUNA/UST before the collapse in May 2022. If we were to make a comparison, LUNC/UST is to the new LUNA, just as ETC is to ETH.

At the same time, before the collapse in May 2022, the circulation of UST (now USTC) reached a peak of about 18 billion, surpassing BUSD at one point and ranking third among stablecoins (only after USDT and USDC).

However, during the collapse in May, a large amount of UST was minted into LUNA through the UST-LUNA arbitrage mechanism, leading to a continuous decline in circulation. As of the time of writing, the latest circulating supply of USTC is about 9 billion.

Mint Cash's Rebuilding Plan

Objectively, the Terra Classic community has been actively trying to rescue itself over the past year, proposing a comprehensive plan to re-anchor USTC to $1, but all have been shelved due to the lack of practical operability and no one pushing for it.

It wasn't until Mint Cash was established on October 7 that it may have become the key trigger for the sharp rise of USTC and the market sentiment warming up. Let's first take a look at what Mint Cash is and what it aims to do.

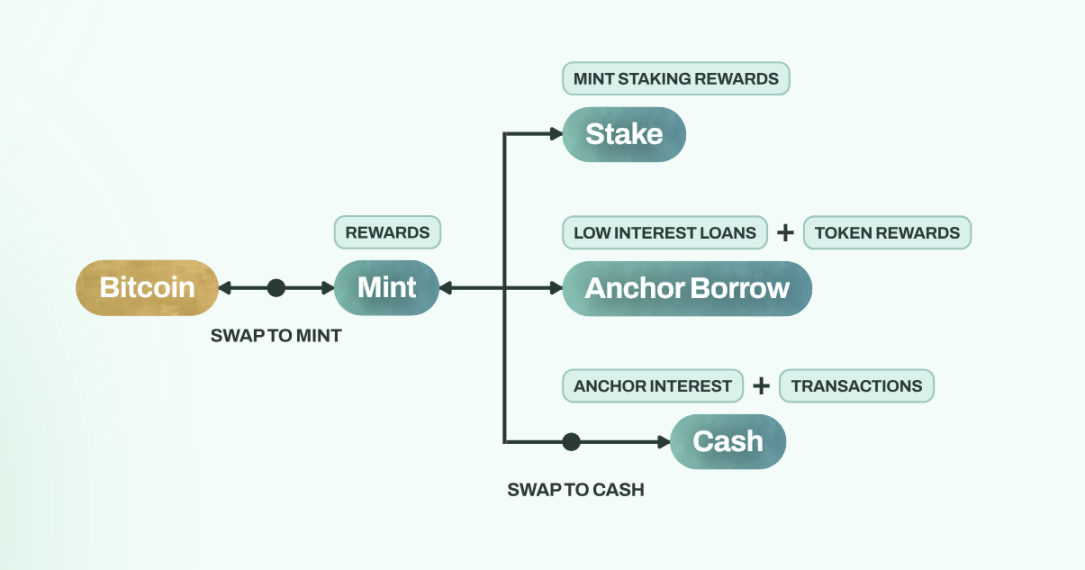

According to the official website, Mint Cash is a "permissionless and price-stable payment and savings currency system," with core developers from the former Anchor team and Aleph Research, planning to build the Polaris EVM chain based on Cosmos SDK together with CosmWasm and Berachain.

Mint Cash currently has two core products publicly disclosed: the new stablecoin CASH and the new Anchor "Anchor Sail".

New Stablecoin CASH

First, Mint Cash plans to launch "a digital currency pegged to various real-world currencies, fully backed by BTC."

Anyone can mint CASH by holding and staking Bitcoin (nBTC, wrapped Bitcoin for Cosmos IBC).

It has a single nBTC collateral pool that can actively trade with CASH, just like a "central bank" can actively arbitrage in the foreign exchange market (Swap module). However, Mint Cash also emphasizes that "CASH is not pegged to collateral, so there is always a risk of collateral depreciation and decoupling events."

In short, the concept of CASH is actually to issue a "gold standard" currency on the chain, and the "gold" reserve in this gold standard is "digital gold" Bitcoin.

New Anchor "Anchor Sail"

Based on this, Mint Cash plans to rebuild the original fixed savings yield protocol Anchor and launch Anchor Sail.

After minting CASH in the previous step, users can place it on Anchor Sail to earn savings yield, or pledge it to validators to receive a portion of transaction fees and tax revenue.

The Logic Behind the Sharp Rise of USTC

So why did USTC experience a sharp rise?

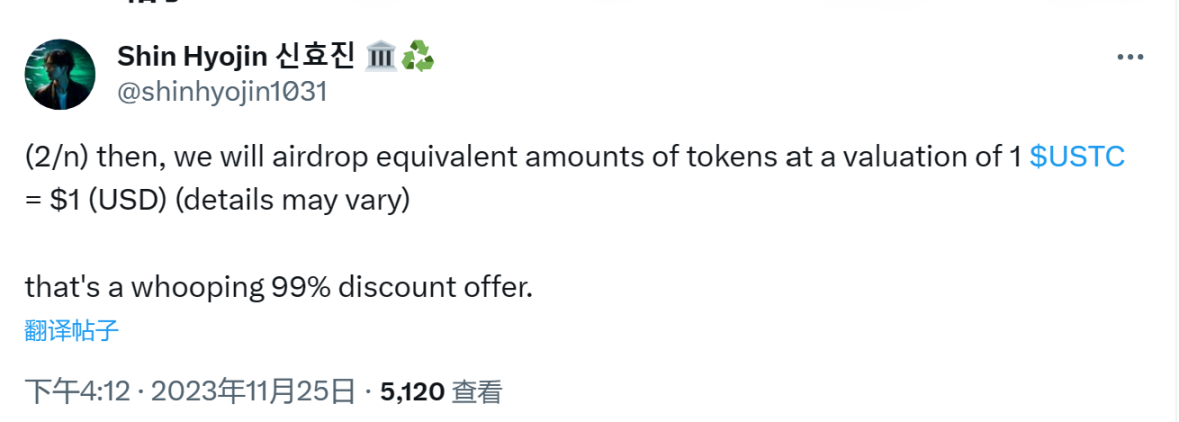

The reason lies in the airdrop rules revealed by Mint Cash's core developer Shin Hyojin (users who held UST before the Terra collapse are also eligible for the airdrop): "We will airdrop an equivalent amount of tokens at a valuation of 1 USTC = 1 USD (specific conditions may vary), which is a discount of up to 99%."

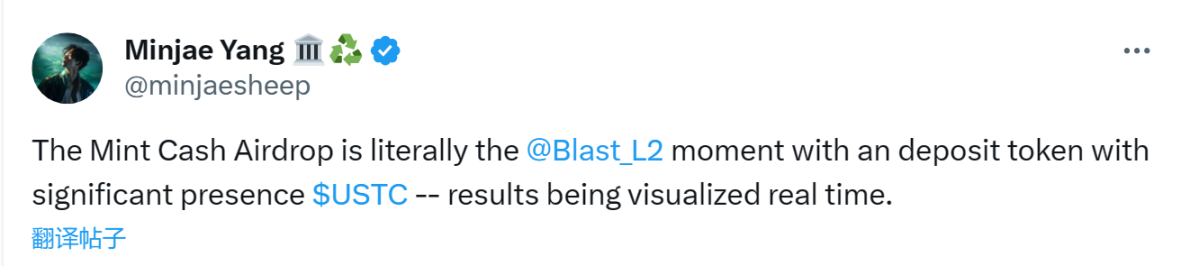

And according to a tweet by core developer Minjae Yang, the Mint Cash airdrop "is actually in the form of a Blast, USTC has significant influence, and the results are visualized in real time."

This means that in the future, the airdrop should be calculated in the form of locking USTC, and USTC will be valued at $1 for the calculation—holding 100 USTC is equivalent to holding $100 in locked calculation shares.

In the eyes of most users, USTC was only around $0.015 before this round of speculation, and even after the sharp rise, it only reached a high of $0.05, which is more than a 20-fold valuation amplifier.

Although Shin Hyojin clarified in a tweet this morning, stating "this is an initial valuation quote, meaning the tokens received will not always be exchanged at a rate of 1 USTC = 1 USD," the market sentiment has already been ignited.

Risk Warning

However, upon careful consideration, this valuation amplifier seems to be just a "deceptive technique" played by the team, because the airdrop quantity is calculated based on the locked USTC shares. Therefore, whether everyone's USTC is valued at $1 or $100, there is no difference:

Everyone's USTC is valued at $1, so it doesn't matter how much it is valued at or how much is locked. In the end, "if everyone's USTC is valued at $1, then a $1 valuation has no meaning."

In essence, this Mint Cash airdrop is "essentially opening a new project that can be participated in using USTC for IDO" (as mentioned by @0xLoki), and it has simply found a use case for USTC—stimulating users to actively lock USTC to participate in the airdrop and then destroying the corresponding USTC.

It is worth noting that in September of this year, the Terra Classic community voted to stop minting USTC in order to protect "the community and external investors by helping to restore the anchoring through the destruction of USTC."

Therefore, to some extent, Mint Cash is indeed making a beneficial attempt to push USTC towards deflation through expanding its use cases.

However, at least based on the information currently disclosed, the use cases of USTC, CASH, and the new Anchor are not closely related, so users should participate with caution.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。