Hester Peirce, a commissioner of the U.S. Securities and Exchange Commission (SEC) who is known as the "mother of encryption," expressed her support for the approval of a Bitcoin spot ETF in an interview on Wednesday, November 22. She pointed out that there are differing opinions within the regulatory agencies, but she emphasized the importance of reaching a consensus on significant regulatory reforms.

Hester Peirce, a commissioner of the U.S. Securities and Exchange Commission (SEC) who is known as the "mother of encryption," expressed her support for the approval of a Bitcoin spot ETF in an interview on Wednesday, November 22. She pointed out that there are differing opinions within the regulatory agencies, but she emphasized the importance of reaching a consensus on significant regulatory reforms.

Following Binance's settlement with the U.S. Department of Justice and its CEO Zhao Changpeng's admission of financial misconduct, the price of Bitcoin may surpass $40,000 this year, marking a turning point in the cryptocurrency landscape.

Regarding Zhao Changpeng's settlement, Hester admitted in an interview with Bloomberg that it is necessary to establish a regulatory framework that encourages innovation and allows cryptocurrency companies to operate in the United States. She also called for active cooperation in formulating necessary regulations and supported open dialogue and public participation to develop effective guidelines.

She reiterated her public stance on the application for a Bitcoin spot ETF, believing that the SEC has no legitimate reason to refuse approval. She expressed her belief that the relevant applications should be approved and indicated that while enforcement actions and litigation are part of regulatory tools, she is more inclined to take a more proactive approach to explore alternative tools to promote innovation and compliance in the cryptocurrency industry.

Hester continued to emphasize the importance of the SEC working with regulatory agencies such as the Commodity Futures Trading Commission (CFTC) to ensure a comprehensive and consistent regulatory environment. She believes that Congress has the potential influence in making meaningful reforms in the cryptocurrency industry.

She also emphasized the importance of reaching a consensus among SEC commissioners on significant regulatory changes and expressed her willingness to work with Congress and the CFTC to streamline the regulatory process, create an environment that encourages innovation, and ensure investor protection.

In summary, Hester took a fairly clear stance in the interview, supporting the approval of a Bitcoin spot ETF and promoting regulatory transparency to cultivate a balanced ecosystem, encourage growth, and address potential risks.

According to The Block, JPMorgan believes that Binance's settlement with the U.S. Department of Justice is "positive" for cryptocurrency exchanges and the industry. The bank's analysts stated that the settlement eliminates the "potential systemic risk assumed by Binance's collapse."

Bitcoin's Seasonality

Bitcoin's price rose by 28% in October this year, and with the expectation of the approval of a Bitcoin spot ETF in the United States, the upward trend may continue, further demonstrating people's confidence in Bitcoin as a legitimate asset class.

Seasonality is another factor, with Bitcoin's average return rate in December being 12%. Based solely on this indicator, there is an opportunity for the price of Bitcoin to rise to $42,000.

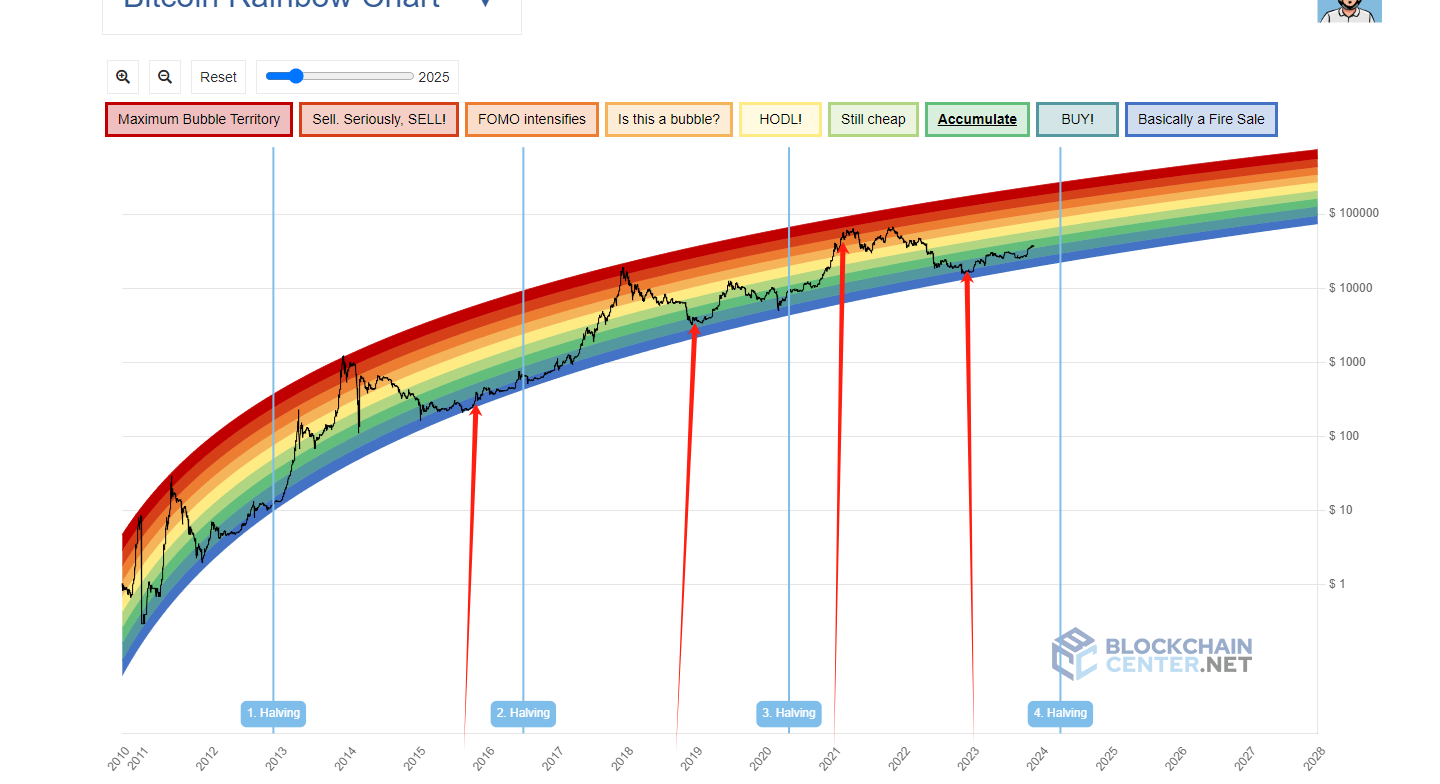

From the rainbow chart, we can see that whenever the price of Bitcoin approaches the orange and red zones, the market tends to be passionate or even in a passionate period; it is also the peak of each bull market; naturally, it is a dangerous period for retail investors because retail investors always buy when there is a lot of hype.

On the other hand, whenever the price of Bitcoin is based on the blue zone, it is a period of market panic; for example, the last time Bitcoin dropped to around $15,000, there was panic in the market, and many people were waiting for Bitcoin to drop to $8,000. Currently, from a macro perspective, for spot players, it is still good and profitable; it is only when it reaches the orange and red zones that we need to be cautious. At that time, I will naturally remind everyone in the group. As a spot player, it's really not too late at this point.

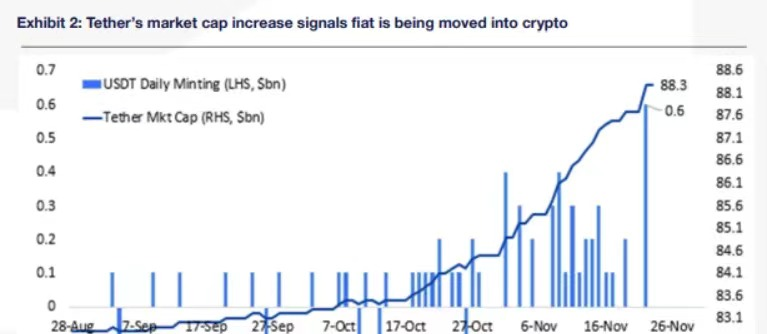

Stablecoin USDT Market Cap Increases by $5 Billion

Since September, the market cap of the stablecoin USDT issued by Tether has increased by $5 billion, indicating a growing trend of institutional investors converting fiat currency into stablecoins and possibly exchanging them for other cryptocurrencies.

Last night, it seems that an additional $6 billion USDT was minted, which may indicate that funds may flow into Bitcoin after Binance/CZ reached an agreement with the U.S. law enforcement and the possibility of a Bitcoin spot ETF being approved in January.

The macroeconomic environment continues to favor the cryptocurrency market. Matrixport predicts that the inflation rate will halve again, dropping to 1.6%. After the 10-year U.S. bond yield peaked at 4.95% in this cycle, the bond yield is expected to drop to 2.60% in 2024 or 2025. The adjustment of the bond yield is expected to lead to a rise in the stock market, and stock market performance is often related to cryptocurrencies. Considering the above factors, there is a high possibility of Bitcoin reaching a new high this year. From a structural perspective, as mentioned earlier, the weekly structure of Bitcoin lays the foundation for an upward trend.

The cryptocurrency market is about to undergo significant changes. Morgan Stanley predicts that after the halving event in early 2024, Bitcoin will rebound. Currently, before reaching this milestone, there are approximately 137,100 Bitcoins yet to be mined, which is expected to be achieved within the next 150 days. The recent agreement between the United States and Binance has been a catalyst for optimistic sentiment, laying the foundation for a new era of cryptocurrency. Following this development, Bitcoin found strong support between $31,000 and $32,000 after breaking the macro ascending triangle pattern.

The growing interest of institutions in Bitcoin is seen as the driving force behind its potential to surpass a market value of $3 trillion by mid-2025. Historical patterns indicate that the halving event, which reduces miner rewards, typically triggers a small bull market.

Creating a High-Quality Circle

Spot Trading as the Main Focus

I will share some content: as shown in the following conditions:

Overall position ≥ 10,000u, those who want to join, remember to follow

(Operating with a few hundred or a few thousand units is too small. If you don't have it, you can also send a private message. Those who pass the screening can also join) Purpose: to grow and strengthen, and create brilliance in the next bull market!

That's all for the article. I will do a more detailed analysis in the discussion group. If you want to join my circle, please follow directly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。