The Aragon DAO, once hailed as the "largest DAO platform in history," passed a vote yesterday to prepare to take legal action against the legal manager of the Aragon Project, the Aragon Association (hereinafter referred to as AA).

On November 21, according to the official website of the Aragon DAO, the Aragon DAO community has passed two votes in support of Patagon Management LLC, a crypto trading company in Delaware, USA (hereinafter referred to as Patagon), to sue the Aragon founding team. They also provided 300,000 USDC to support Patagon's legal action.

In fact, there have been clues about this vote for a long time, and the source of the controversy is the AA.

Aragon DAO: Lawsuit Aims to Hold AA Members Accountable and Protect Investor Funds

The AA can be said to be the legal steward of the Aragon project, responsible for managing the funds raised in the sale of Aragon network tokens. According to the official website, Aragon's founders, Luis Cuende and Jorge Izquierdo, respectively serve as members of the Aragon Association's board of directors.

It is reported that this vote was in response to AA's previous actions—AA had previously dissolved and terminated the operation of the governance token ANT through an ETH redemption method.

At the same time, the proposal states that others will also be able to help fund the lawsuit. If successful, Aragon DAO's community members will recover the funds and receive 10% interest annually. They will also share 5% of the total funds and return it to token holders. However, if unsuccessful, they will not receive compensation.

In addition, the lawsuit will be overseen by a supervisory committee, composed of representatives from investment company Arca, cryptocurrency trader DCF God, and other individuals using aliases Wismerhill, Tedward, CM, Triangle, and Yakitori.

Detailed documents on the voting page show that on November 2, AA unilaterally closed the governance token ANT without going through the voting process. At the same time, AA provided a redemption plan for about 95% of the BV, but retained $11 million as "obligations," as well as unclaimed funds after one year, leaving holders in a difficult situation.

"An estimated 25-32% of holders have not claimed funds, and they will retain over $50 million, returning only about 60,000 ETH (about 22%) of the 275,000 ETH initially raised by investors."

Furthermore, the detailed information in the document shows that the proposal aims to decide whether to initiate proceedings against responsible AA members to ensure that investors' funds are returned to them and not taken by the Aragon team.

It is worth noting that Patagon, who has been elected by the Aragon DAO as the plaintiff in this lawsuit against the AA, previously issued a 24-page investigative report on August 11, pointing out that in June, AA had considered "selling the project" at an unknown price to an undisclosed bidder.

This report also accused AA of wasting various encrypted assets worth $180 million and questioned whether the organization was complying with Swiss nonprofit laws.

AA: The proposer of the proposal is spreading "unfounded accusations" to seek personal gain

In response to the passage of this proposal, AA also made a positive response on November 22, stating that if necessary, they will defend themselves in court. They believe that the proposer of the proposal has been spreading "unfounded accusations" to maximize personal profit, and these accusations are false: "If necessary, we look forward to proving in court that they are unfounded."

AA pointed out on social media that the proposer of the proposal is "several accounts claiming to be RFV Raiders," and these accounts do not represent a larger group of ANT token holders. At the same time, as AA has used 87% of its funds to allow all ANT holders to exchange their ANT for ETH, over 11.1 million ANT have participated in the redemption.

In contrast, only about 1.6 million ANT were voted by these accounts and passed the proposal: "Interestingly, after the DAO vote, several accounts immediately participated in the redemption process."

Community: The true innovation of Aragon lies in finding all the ways governance can go wrong

Regarding this event and the long-standing issues of the Aragon DAO, the opinions within the cryptocurrency industry community are diverse, but all focus on the governance dilemma of DAO.

DCF GOD, a cryptocurrency industry investor and community KOL, pointed out: "This is crazy. The Aragon DAO has voted in favor of directly suing the Aragon team for an unfair redemption offer. This may be the first time a DAO has paid to legitimize its own team?"

Kain Warwick, the founder of Synthetix, also commented: "The real innovation of the Aragon project lies in finding all the ways governance can go wrong. They say DAO governance is chaotic and dysfunctional, maybe all the founders with super voting rights are not paranoid…"

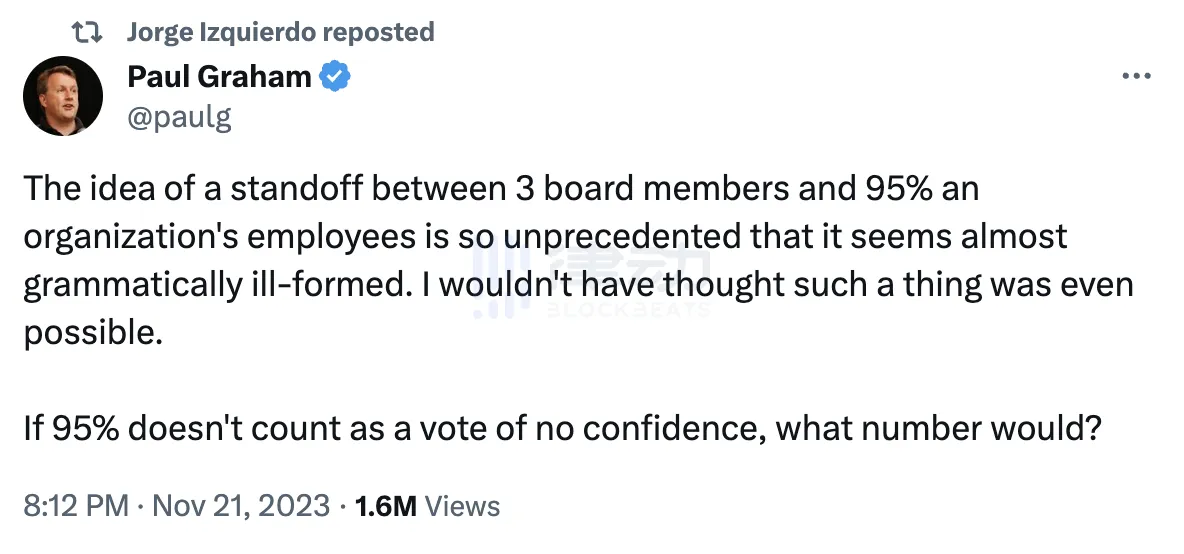

It is intriguing to note that, according to BlockBeats, Aragon's co-founder Jorge Izquierdo (@izqui9) updated his social media account on November 21, the same day the Aragon DAO passed a proposal to sue the AA. Jorge retweeted a comment from Y Combinator founder Paul Graham (@paulg) regarding recent developments in the OpenAI board. In the tweet, Paul expressed that the idea of a standoff between 3 board members and 95% of the employees is "unprecedented" and almost seems wrong: "I never thought such a thing was possible. If 95% doesn't count as a vote of no confidence, what number does?"

This may also reflect Jorge's thoughts on governance challenges to some extent.

The largest DAO platform in history has faced governance challenges this year

In fact, Aragon is a decentralized governance solution for the Web3 community and organizations, and it is the largest DAO platform in history. It has been in existence for 6 years and has managed over $9 billion in assets at one point. Aragon has made significant contributions to the industry's development of DAOs, such as developing aragonOS—an experimental governance DAO framework at software speed—and providing support for Ethereum-based DAOs like Lido and Curve.

However, this platform and its legal manager, AA, have faced ongoing issues this year. For example, on May 10th of this year, AA announced the revocation of voting rights for ANT token holders, which included decisions on the strategic direction of Aragon's future development and the use of over a billion dollars in funds.

Prior to the announcement of the revocation of voting rights for ANT token holders, cryptocurrency investment fund Arca had called for a buyback of ANT tokens in an open letter. AA believed that "investors like Arca launched a 51% attack" and referred to Arca and others as a "gang" that had disrupted many DAOs and their communities.

On May 17th, Arca's Chief Investment Officer Jeff Dorman publicly stated, "The narrative of a 51% attack is actually incorrect. We are ANT token holders, we want to use our tokens to participate in governance, and we did not attempt to dissolve Aragon."

Previously, community members listed AA's past "six sins" (Aragon community member (@Samsara79416227) pointed out that AA ignored voting, lacked transparency, did not drive issue resolution, made their team members feel frustrated, the executive directors lied, and showed malice). Now, the Aragon DAO has voted to take AA to court. This may also reflect the common governance challenges faced by DAOs to some extent. How will DAOs solve governance challenges in the future, and where will they go? BlockBeats will continue to follow this.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。