In Javier Milei's view, the establishment of the central bank in 1935 marked the beginning of all of Argentina's problems. He supports the economic thought of the Austrian School and calls himself a "short-term anarchist" and a "long-term anarchist capitalist".

By Jaleel

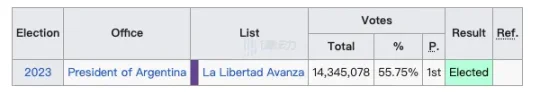

The presidential candidate Javier Milei, who once threatened to blow up the central bank of his own country, has been officially elected as the President of Argentina today. "The Argentine people have chosen another path," Javier Milei's opponent Massa, who was defeated, reluctantly announced his retirement from frontline politics.

In the second round of elections on November 19, Javier Milei received 55.7% of the votes, while Massa received 44.2% of the votes. After defeating this final opponent, Javier Milei will assume the presidency on December 10. "Today, the reconstruction of Argentina begins. This is a historic night for Argentina," Javier Milei told jubilant supporters at his campaign headquarters in Buenos Aires.

During the campaign, Javier Milei's campaign promises repeatedly included abolishing the central bank and the peso, and using the US dollar as the legal tender to overcome the inflation disaster facing Argentina, which has plunged 40% of the country's 45 million citizens into poverty and pushed the inflation rate to over 140%.

In his vision, after closing the central bank of the country, Bitcoin will also become the main remedy for Argentina's inflation. Before the presidential election, Javier Milei frequently appeared on various talk shows, often extolling the benefits of Bitcoin and cryptocurrencies. "Bitcoin can eliminate central banks," Javier Milei said.

Perhaps due to Javier Milei's election, Bitcoin has surged past $37,000, now trading at $37,356, up 2.3% in the past 24 hours.

Austrian School President of Argentina

"I know how to eliminate the cancer of inflation," Javier Milei declared in the final presidential debate last Sunday.

In Javier Milei's view, the establishment of the central bank in 1935 marked the beginning of all of Argentina's problems. Without a central bank, Argentina was the richest country in the world. From 1880 to 1935, the average annual inflation rate was only 0.9%. The establishment of the central bank in 1935 fooled everyone: the average inflation rate soared to 6% per year. After the nationalization of the central bank in 1946, the average annual inflation rate was 250% until 1991. This was a complete disaster.

Javier Milei, an economist and economic analyst, supports the economic thought of the Austrian School and is a staunch supporter of laissez-faire capitalism, calling himself a "short-term anarchist" and a "long-term anarchist capitalist".

In the field of blockchain, the Austrian School is not a foreign concept. The founder of the Austrian School believed that "money is not an invention of the state". Currently, the must-read book in the circle, Hayek's "The Denationalization of Money," also clearly expresses the view that the government and the monetary system must be completely separated. The views in this book were considered shocking in 1974, but the emergence of Bitcoin in 2009 made them seem less crazy, and even a great prophecy. Many people even believe that it was this book that helped inspire Satoshi Nakamoto, who himself is highly likely to be a liberal based on the Austrian School.

Xiong Yue is one of the early Bitcoin evangelists in the country and a senior Austrian School economics researcher. He pays close attention to Javier Milei's campaign: "In fact, he is like my senior brother. Search for Mileiy Huerta de Soto on YouTube and you will know. Javier Milei is greatly influenced by De Soto, and he also writes articles to commemorate De Soto, very Austrian."

Argentines Choose a New Path

"Due to the current situation, we are temporarily unable to display prices on the shelves. Please inquire at the checkout for prices. All cash promotions are suspended until further notice. Thank you for your understanding." This is a notice posted outside a small market in Argentina, reflecting the chaos in the Argentine economy in recent years.

Nathan, a journalist, returned to the Argentine capital in early April for the first time in 10 years and experienced this firsthand. Like everyone else, the first thing Nathan did after landing was to exchange currency, but the exchange rate in this place varies greatly, depending on the method and location of obtaining pesos.

The official exchange rate is 1 US dollar to 220 pesos; after visiting several Western Union money transfer offices to exchange currency, he was told that there was no cash available. With the "guidance" of local friends, Nathan found a "cuevas" or black market on a street, where the exchange rate was close to 400 pesos.

But Nathan faced a second major problem because the largest denomination of banknotes currently is 1000 pesos, worth less than $2.04. After exchanging currency, he had a large stack of bills in his wallet and pockets, carrying a backpack full of pesos for daily expenses, which made him feel extremely conspicuous and anxious.

It is hard to imagine that this is Argentina, which ranked among the top ten economies in the world in the early 20th century. In recent years, due to the impact of international economic and financial situations, as well as the pandemic, Argentina's domestic economic growth has not only slowed significantly, but the inflation rate has also reached 100%, and the value of the peso has depreciated, making it the weakest currency globally this year. The pessimistic forecast from Bank of America suggests that the official exchange rate of the peso will fall to 545 by the end of this year and to 1193 by the end of next year.

Therefore, in the complex situation of the domestic economy, many people believe that the change of government in Argentina's election is the best solution to change the Argentine economy. Javier Milei's unconventional stance has resonated with many people, especially young voters who are proficient in the internet and technology.

Zocaro, a spokesperson for Bitcoin Argentina, believes that the use of cryptocurrencies in Argentina has been growing since around 2020, with many people starting to buy Bitcoin and stablecoins. More and more people are using cryptocurrencies to send funds to family and friends abroad or to purchase goods from overseas, as more and more people in Argentina, who may only be able to afford bread with the money they take out in the morning to buy bacon, are using cryptocurrencies as a way to protect their value.

Unlike the mysterious "cuevas," Zocaro said, "Cryptocurrencies are completely legal in Argentina, and people are beginning to notice the inflation of the US dollar and see Bitcoin as a possible alternative. Most young Argentines prefer Bitcoin, Ethereum, and stablecoins. Some provinces, such as Mendoza, have taken measures to allow people to pay taxes with cryptocurrencies."

According to a survey conducted by Americas Market Intelligence in April 2022, nearly 51% of Argentine consumers have purchased it. This proportion is higher than the data from a similar survey conducted at the end of 2021, which was only about 12%. The survey also found that as many as 27% of Argentine consumers regularly purchase cryptocurrencies, with the main reasons for purchasing including investment, preventing inflation, and avoiding government control.

Although many older Argentines still prefer to hold US dollars in cash, more and more young people and residents are starting to prefer USD stablecoins. "They don't need to deal with cash and can complete transactions through their phones," said a platform that provides cryptocurrency trading for Argentine users, with two-thirds of Argentine users being under 35 years old.

Javier Milei's remarks about introducing the US dollar as the official currency of the country have received applause from supporters, and many economists are discussing Argentina's financial disaster.

In any case, in a country where the annual inflation rate exceeds 140% and two-fifths of the population live in poverty, Javier Milei's victory proves that the Argentine people are tired of traditional politics and economic disasters, and are willing to try new things, choosing a new path.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。