Market Review

Yesterday, Bitcoin saw an intraday increase of nearly 3000 points, forming a beautiful V-shaped rebound. Reviewing our intraday analysis, in the morning we provided a suggestion to look for Bitcoin around 35400 and Ethereum around 1965. By midday, Bitcoin and Ethereum respectively reached 35401 and 1967, initiating the intraday increase. During this time, we provided the first guidance around 36000, and later in the second round of actual trading, we suggested a second upward movement around 36000 (original suggestion at the end of the paragraph). With the second intraday increase in the early morning, we indicated a second guidance at 37400, successfully capturing nearly 2000 points for Bitcoin and over 80 points for Ethereum, achieving a perfect conclusion for the day.

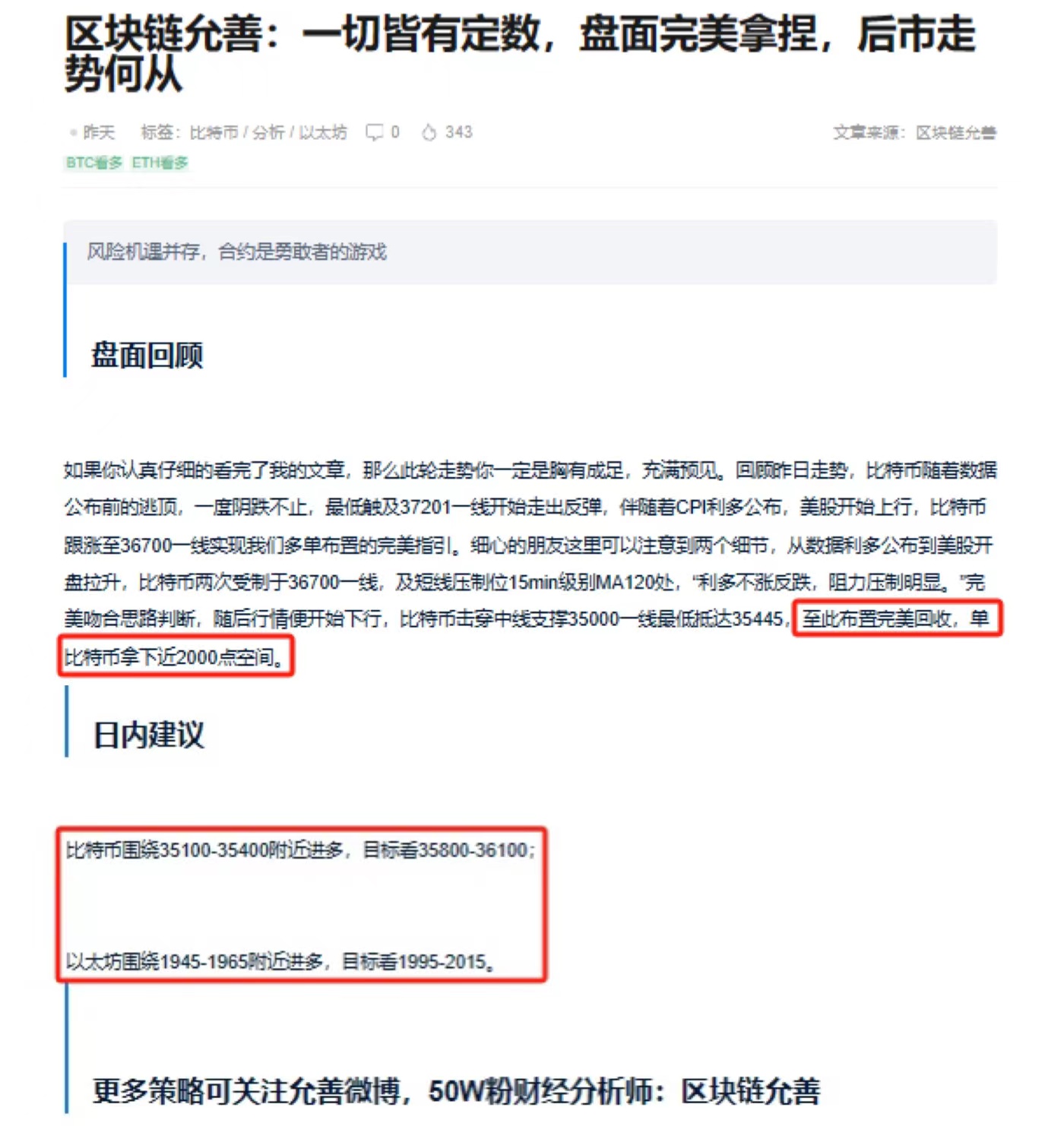

Bitcoin and Ethereum's second round of long position layout completed

Market Analysis

In the early morning, the SEC once again announced a delay in the decision on the Hashdex Bitcoin ETF and Grayscale Ethereum Futures ETF applications. This news was not surprising, but the short-term uptrend in Bitcoin following the announcement surprisingly expressed the determination of the bulls, pushing the price close to the key level of 38000 and preliminarily completing the second peak of this upward movement. Based on this news, it can be anticipated that the delay in the GlobalX application next week will be a foregone conclusion, leading to another vacuum period. At this moment, we should return to rationality, and the bullish celebration should temporarily come to an end.

On the technical side, we continue to simplify and focus on the recovery of indicators at higher levels, looking at the 3-day and weekly trends. The need for correction is imminent. Even though the long-term outlook is positive, in the short term, we are unlikely to receive support from the macro market. Therefore, we should stay grounded and focus on this round of correction.

Intraday Suggestions

For Bitcoin, consider entering a short position around 37500-37800, with a target of 36800-36500.

Due to the structural demand for a rebound, Ethereum should not be excessively bearish. Priority should be given to a target around 2030-2000.

For more strategies, follow Yunshe on Weibo, a financial analyst with 500,000 followers: Yunshe, Blockchain Financial Analyst

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。