This article discusses the rules, deductions, and impacts that investors need to understand in order to remain compliant and minimize tax obligations in the rapidly changing cryptocurrency tax environment.

Author:LIZA SAVENKO

Translation: TaxDAO

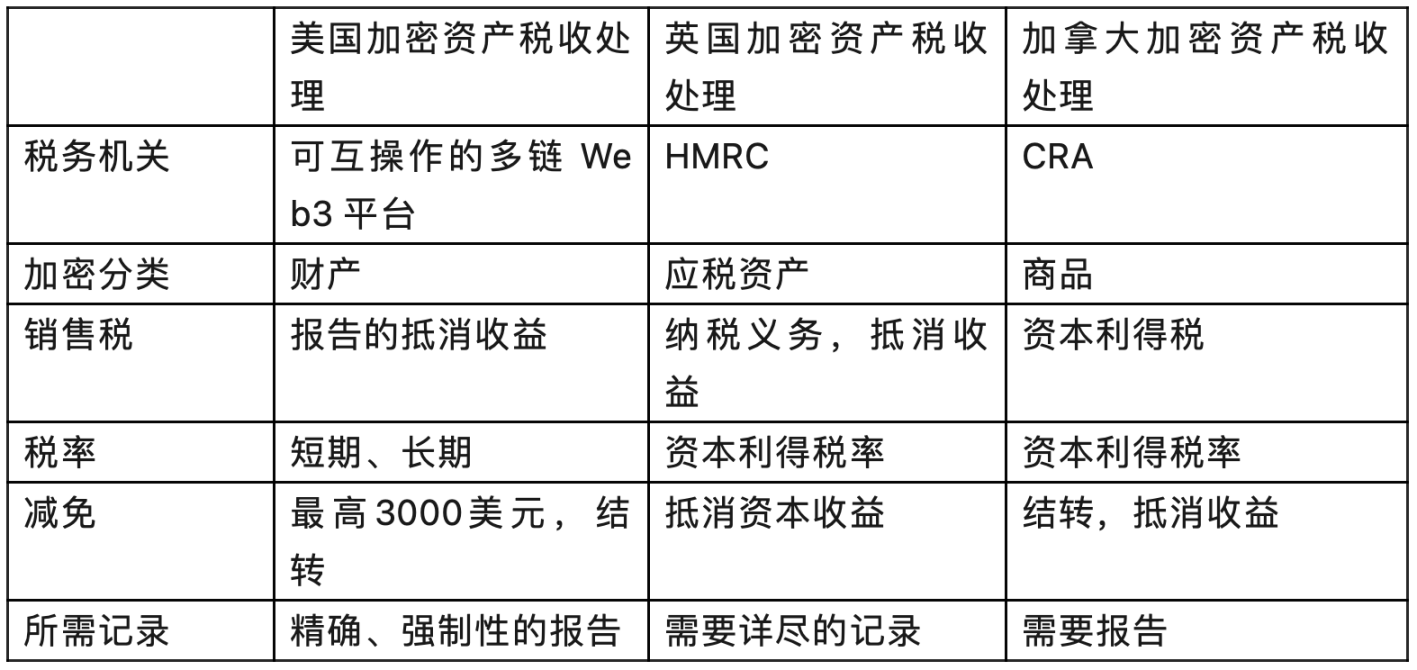

Cryptocurrency taxation is an increasingly important issue, and governments around the world are working to establish clear rules for taxing digital assets. In the United States, the United Kingdom, and Canada, cryptocurrency holders must navigate complex regulatory environments, making it crucial to understand how cryptocurrency losses are taxed and their potential impact on tax obligations. Whether a novice in cryptocurrency trading or an experienced investor, reporting income and paying applicable taxes in accordance with local regulations is crucial.

To comply with local cryptocurrency tax laws, cryptocurrency holders must ensure clear communication and compliant operations to avoid legal issues. This article discusses the rules, deductions, and impacts that investors need to understand in order to remain compliant and minimize tax obligations in the rapidly changing cryptocurrency tax environment.

1. Taxation of Cryptocurrency Losses in the United States

1.1 Taxation Methods for Cryptocurrency in the United States

In the United States, the IRS requires reporting all cryptocurrency sales, as it classifies cryptocurrency as property and subject to capital gains tax. Profits and losses from cryptocurrency transactions are categorized by term, allowing losses to offset gains and reduce overall tax liability.

Unless generating interest related to equities or under other specific circumstances, cryptocurrency in a portfolio generally does not require taxation. Additionally, if cryptocurrency invested by an individual has completely lost value and is no longer traded on an exchange, the loss cannot be reported.

Maintaining accurate trading records is crucial for accurately calculating capital gains and losses. Furthermore, reporting losses and gains is mandatory, and the IRS is actively enforcing penalties for inaccurate reporting.

1.2 Taxation and Offset of Cryptocurrency Losses in the United States

In the United States, cryptocurrency losses are typically classified as capital losses, occurring when the value of cryptocurrency decreases from purchase to sale, exchange, or use. Reporting cryptocurrency losses can result in tax reduction through two methods: income tax deductions and offsetting capital gains.

When losses exceed gains, the resulting net loss can be used for income tax deductions, with a maximum deduction of $3,000 from income. Any remaining excess loss can be carried forward to offset future capital gains and $3,000 of other income in subsequent years.

Cryptocurrency losses can save a significant amount of taxes, offsetting capital gains without a limit on the amount, potentially reducing a substantial tax burden. The IRS categorizes losses into short-term losses and long-term losses according to traditional investment frameworks. Short-term losses from holding assets for less than a year are taxed at ordinary tax rates (10%–37%), while long-term losses from holding assets for over a year are taxed at lower capital gains tax rates (0%–20%).

1.3 Wash Sale Rules and Handling of Cryptocurrency Losses in the United States

In the United States, due to the IRS's classification of property, investors can utilize cryptocurrency for tax-loss harvesting, selling at a loss to reduce taxes. As the IRS considers cryptocurrency as property rather than a capital asset, technically, cryptocurrency is not subject to wash sale rules, providing greater flexibility.

Cryptocurrency holders can utilize losses to offset gains without the constraints of wash sale rules, enabling them to sell at a loss for tax advantages and reinvest to maintain positions. Nevertheless, regulatory changes may expand rules to include cryptocurrency in the future, and this article recommends adopting a more conservative strategy to maximize capital gains reduction.

2. Taxation of Cryptocurrency Losses in the United Kingdom

2.1 Taxation Methods for Cryptocurrency in the United Kingdom

In the United Kingdom, reporting cryptocurrency losses on tax returns is an important step in reducing overall tax liability. To initiate this process, maintaining complete records of each cryptocurrency transaction is crucial.

The HM Revenue & Customs (HMRC) in the UK considers cryptocurrency as a taxable asset, meaning that trading or selling cryptocurrency may result in tax obligations. As the HMRC's current treatment of cryptocurrency is similar to most other financial assets, it requires compliance with record-keeping and capital gains tax requirements. The type of transaction determines the exact tax treatment.

In the UK, capital gains tax is a consideration for individuals trading cryptocurrency. The capital gains tax rates are directly related to the taxation and tax-free thresholds for cryptocurrency losses. The current capital gains tax rates range from 10% to 20%, depending on an individual's income and gains.

2.2 Taxation and Offset of Cryptocurrency Losses in the United Kingdom

When reporting cryptocurrency losses, it is necessary to complete the capital gains tax section of the self-assessment tax return. This section allows offsetting capital losses against any capital gains generated in the same tax year.

In the UK, investors cannot directly offset their income tax obligations with capital losses from cryptocurrency. However, when cryptocurrency transactions result in losses, they can be deducted from the total capital gains in the tax year.

If the total losses exceed gains, the remaining losses can be carried forward to offset future gains. This mechanism is a crucial tool for managing tax obligations, especially in the volatile cryptocurrency market, which can lead to significant losses and substantial gains.

It is important to note that there is no immediate requirement to report cryptocurrency losses. However, if claimed, there is a four-year window from the end of the tax year in which the loss occurred. This flexibility allows taxpayers ample time for financial assessment and loss claims consistent with personal tax planning.

Overall, by accurately recording and reporting cryptocurrency losses, individuals can fully utilize tax reliefs provided by the UK government while effectively managing cryptocurrency tax obligations. Neglecting this step could result in the loss of the ability to carry forward losses.

2.3 Optimizing Cryptocurrency Tax Reporting in the UK through Token Pooling

It is worth noting that the HMRC in the UK requires taxpayers to pool their tokens to calculate the cost basis in cryptocurrency trading profit and loss reports. Tokens must be categorized into pools, each with associated pool costs. After selling tokens from a pool, a portion of the pool cost (and allowable expenses) can be deducted to reduce gains.

Each time tokens are purchased or sold, the total cost should be recalculated. When tokens are purchased, the purchase amount is added to the relevant pool, and when tokens are sold, a certain proportion of the amount is deducted from the cost.

3. Taxation of Cryptocurrency Losses in Canada

3.1 Taxation Methods for Cryptocurrency in Canada

The Canada Revenue Agency (CRA) considers cryptocurrency as a property and taxes it as a commodity, falling under the categories of business income or capital gains. Disposing of cryptocurrency, such as selling it, exchanging it for another cryptocurrency, or using it for purchases, triggers capital gains tax.

In Canada, purchasing or holding cryptocurrency is not taxed because it is not considered legal tender. Therefore, using it for payments is considered barter transactions with corresponding tax consequences, potentially resulting in capital gains or losses based on the value change when exchanging cryptocurrency for goods or services.

While cryptocurrency provides a degree of anonymity, the Canadian government has the capability to track cryptocurrency transactions, as exchanges are required to report transactions exceeding $10,000. Even transactions below the threshold may require customer data disclosure as per CRA requirements.

3.2 Taxation and Offset of Cryptocurrency Losses in Canada

In Canada, investors need to report capital losses to the CRA to reduce their tax obligations, as the agency requires the submission of income tax and benefit returns for the sale of capital property, regardless of the resulting gains or losses.

Canadian cryptocurrency taxpayers can use cryptocurrency losses to offset various capital gains, carry forward net losses, or use them to offset gains from the previous three years. However, cryptocurrency losses cannot be used to offset regular income in the current year, and 50% of cryptocurrency losses can be used to offset capital gains in subsequent years or carried back to previous years, similar to the tax treatment of cryptocurrency capital gains.

Generally, when allowable capital losses occur within a tax year, they should first be used to offset any taxable capital gains in the same year. If there are still unused losses, they are included in the calculation of net capital losses for the year and can then be used to reduce taxable capital gains in the previous three years or any future year.

It is important to emphasize that to obtain tax benefits, investors must "realize" their losses by selling cryptocurrency, exchanging it for another cryptocurrency, or using it for purchases; unrealized losses cannot be reported on the tax return.

3.3 Superficial Loss Rules and Handling of Cryptocurrency Losses in Canada

Canada's superficial loss rules are similar to the wash sale rules in the United States, preventing investors from artificially creating losses by selling and immediately repurchasing the same asset within a specific timeframe, ensuring a fair tax system.

According to the CRA, if two conditions are met (the taxpayer or an affiliated person acquires identical cryptocurrency before or after the sale within 30 days; at the end of this period, the taxpayer or affiliated person holds or has the right to acquire identical cryptocurrency), the rule will apply to prevent wash sales, and these losses cannot offset capital gains but are added to the adjusted cost base of the repurchased property.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。