For most users, options products are difficult to understand and even if they are good, they won't play.

As an effective hedging tool, options can help users lock in maximum risk and pursue higher profits. In the traditional financial field, there are a wide range of institutional and professional users, but in the relatively early stage of the crypto industry, there is still room for scale development and liquidity improvement.

Currently, there are more non-financial professional users in the crypto industry, and the non-linear profit curve characteristics of options, as well as more professional pricing models, have led to higher trading thresholds, which cannot meet their needs.

Addressing the above pain points, on November 15th, OKX announced the launch of a new product called Yield Hunter, based on options construction. In terms of the overall style of the product, it reduces user understanding thresholds through a clear and graphical profit curve; in terms of trading experience, it simplifies the order placement process for option sellers and displays returns in an annualized form, reducing the threshold for user participation, allowing even novice users to easily earn high annualized returns.

In short, OKX Yield Hunter is as simple as a financial product, and in the future, users can easily participate in options. The launch of OKX Yield Hunter reduces the participation threshold for crypto options products and will bring in more new users.

An Analysis of OKX Yield Hunter

OKX Yield Hunter is a non-guaranteed trading product designed to help users achieve higher annualized returns. It is built on the basis of selling options contracts, and when users invest in Yield Hunter, they receive option premiums from selling option contracts. The user's returns depend on the relationship between the expiration price and the target price. Users can choose between two products based on their own market judgment: "earn when BTC doesn't rise" or "earn when BTC doesn't fall."

For example, for options products based on BTC and ETH, including "earn when BTC doesn't rise," "earn when BTC doesn't fall," "earn when ETH doesn't rise," and "earn when ETH doesn't fall," users can choose the investment product that suits them. After successfully placing an order, they can hold until expiration for settlement or close the position early.

Regarding the product's returns, OKX Yield Hunter presents them in the form of estimated annualized interest rates, making the returns clear at a glance. In terms of participation, it offers a "invest U earn U" format, eliminating the cumbersome exchange process. In terms of product selection, users can flexibly choose the target price range, expiration date, and yield, offering great flexibility. Additionally, it also provides leverage of 1-X to increase capital utilization, and more.

Through OKX Yield Hunter, users who lack the ability to construct multi-leg options asset portfolios to achieve their return goals, are unclear about the pricing and profit characteristics of options, or are unsure about how to choose options, can easily participate. OKX has significantly reduced the participation threshold for users in terms of understanding and participation, greatly improving convenience and operational experience.

Furthermore, it is worth noting that OKX Yield Hunter not only significantly reduces the participation threshold for options products in terms of product experience, but also can provide users with relatively high annualized returns. Although not guaranteed, the estimated annualized interest rate displayed by the product is higher than that of general financial products. How is this achieved?

To answer this question, we first need to have a simple understanding of options.

Understanding Options with One Image

Options are a type of choice, that is, the right to buy or sell a specific commodity at a specific price in the future.

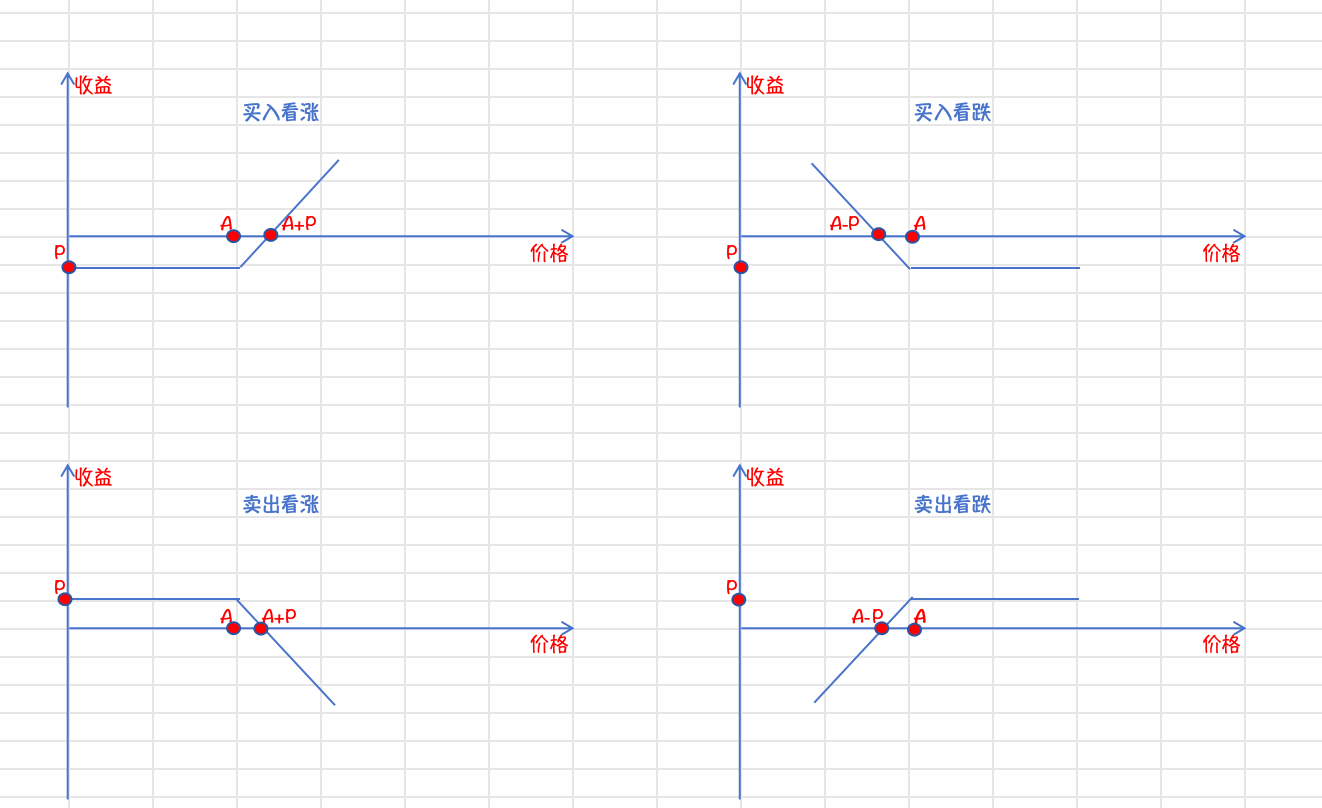

There are many options strategies, such as collar options, seagull options, bull spread & bear spread options, and so on. These seemingly complex and obscure options are mostly composed of very common single strategies, which can be either bullish or bearish, mainly including: buying call options, buying put options, selling call options, and selling put options.

Combining the following sketch, let's analyze the four single strategies and their risks and returns. The horizontal axis represents the price of the underlying asset, and the vertical axis represents the return. A is the exercise price, and P is the premium. Taking buying call options as an example, if Zhang San buys BTC call options with an exercise price of A for a premium P, it means that on the expiration date, Zhang San has the right to buy BTC at the price of A.

If the price of BTC on the expiration date is greater than A, theoretically, Zhang San will earn as much as BTC rises, with unlimited returns. However, considering the premium P as the cost, Zhang San can start earning only when the price of BTC on the expiration date is greater than A+P. Regardless of how much it rises, Zhang San will make money by buying BTC at the price of A, so the right can be exercised. If the price of BTC on the expiration date is less than A, theoretically, Zhang San will lose as much as BTC falls, with unlimited losses. But Zhang San can choose not to exercise the right to buy BTC at the price of A, and only lose the premium P, so the loss is limited. The same applies to other scenarios.

OKX Yield Hunter is built on the basis of selling options, as can be seen from the above figure, the selling options under the single strategy include selling call options and selling put options. Selling call options means that Zhang San will lose money if the price of BTC rises, but will earn the premium P if it does not rise; selling put options means that Zhang San will lose money if the price of BTC falls, but will earn the premium P if it does not fall.

Although selling options will most likely earn the premium P, the premium P (option price) of the option is jointly determined by factors such as the price of the underlying asset, exercise price, price volatility of the underlying asset, remaining time, and interest rate, which can affect the value and trading price of the option. Taking the price volatility of the underlying asset as an example, according to the characteristic of limited loss and unlimited return of options, the more violent the price fluctuation of the underlying asset, the higher the return if the direction is correct, and the more controllable the return if the direction is wrong, so the higher the volatility, the greater the value.

There are numerous options strategies in the current market, and through diversified combinations and calculations, they can be applied to various market conditions, even achieving profits under the premise of capital preservation. This is why OKX Yield Hunter is a non-capital-guaranteed trading product that helps users achieve higher annualized returns.

OKX Creates Simple Trading Tools

Options, like futures, serve functions such as risk management, price discovery, and asset allocation. However, compared to futures, options can be combined into diverse strategies, and the risk can be calculated in advance.

However, for many users in the cryptocurrency industry who are accustomed to spot or contract products, the threshold for getting started with options products is relatively high. Through OKX Yield Hunter, users are provided with an extremely convenient and effective hedging tool, which will promote the popularization of options products in the cryptocurrency industry.

Currently, OKX's financial products are in a leading position in the industry and have become the preferred tool for users to hedge risks and earn stable returns during the prolonged bear market of the past two years.

Looking at OKX's financial products, whether it's the current Yield Hunter, or previously launched products such as Dual Currency and Shark Fin, they are continuously simplifying trading tools through innovation, reducing the threshold for user usage, and providing ultimate trading services.

After all, "simplicity is the ultimate sophistication, because of simplicity, so efficient."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。