Important Notice: Update AICoin PC version (V2.8.4) or above: https://www.aicoin.com/zh-CN/download to experience the estimated liquidation chart.

1. What is the Estimated Liquidation Chart?

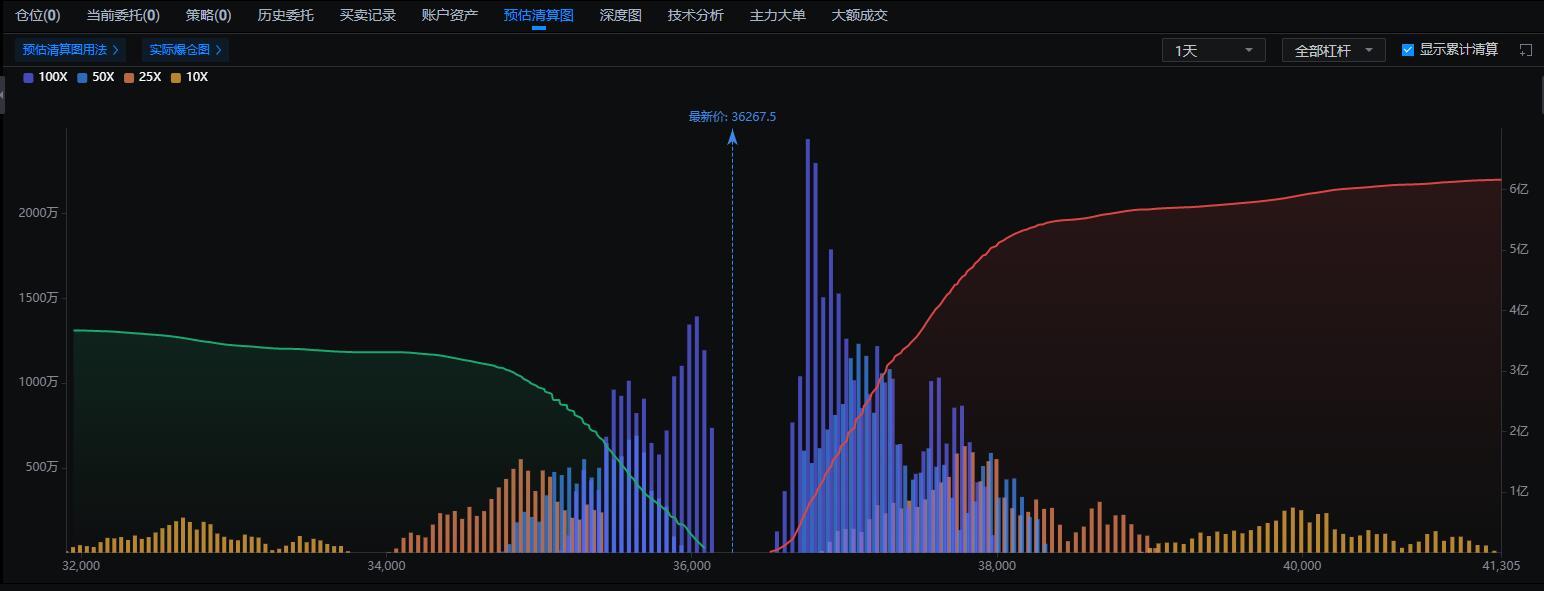

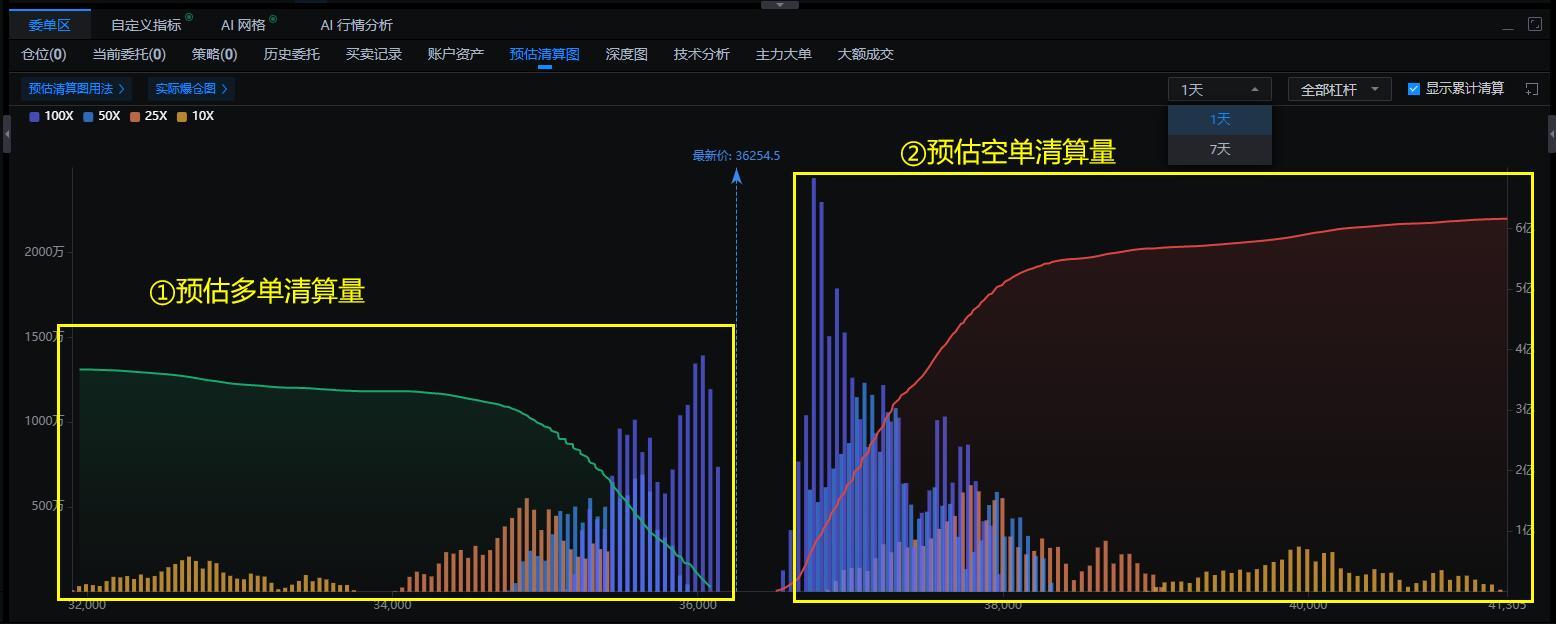

The Estimated Liquidation Chart is based on deep data analysis, predicting the potential liquidation volume (forced liquidation volume) of various cryptocurrency contracts over a specific time period. It displays possible liquidation (forced liquidation) activities at different price levels, helping traders identify market trends and potential risks.

2. Highlights of the Estimated Liquidation Chart

1. Intuitive Display: Clearly distinguishes potential liquidations of long and short positions, indicating which side has more participants and which side has fewer making profits.

2. Multiple Time Frames: Supports analysis of liquidation trends over different time periods from short to long.

3. Flexible Application: Can be used to predict price reversal points and assist in trading decisions.

3. How to Use the Estimated Liquidation Chart

1. Utilize liquidation inertia to earn profit space

If a large number of long positions are liquidated (long positions need to be sold to close), it will lead to a continued price 【drop】, allowing for profit from the downward inertia. The opposite is true for short position liquidations.

2. Identify the number of long and short positions, profit from the minority

If the predicted liquidation volume of long positions is significantly higher than that of short positions within the same price deviation range, it indicates that most of the market participants are going long. According to the "80/20" principle, choosing the minority camp may yield higher profits.

3. Capture price reversal opportunities after large liquidations

If a significant volume of liquidations occurs at a certain price level, the price may move towards it, and after reaching the liquidation point, the price may reverse, allowing for profit.

4. Avoid large estimated liquidation price levels, set take profit and stop loss to maximize profits

Positions with a large estimated liquidation volume may experience reversals. Setting take profit and stop loss can help avoid these price levels and prevent accidental losses.

4. Where to View the Estimated Liquidation Chart?

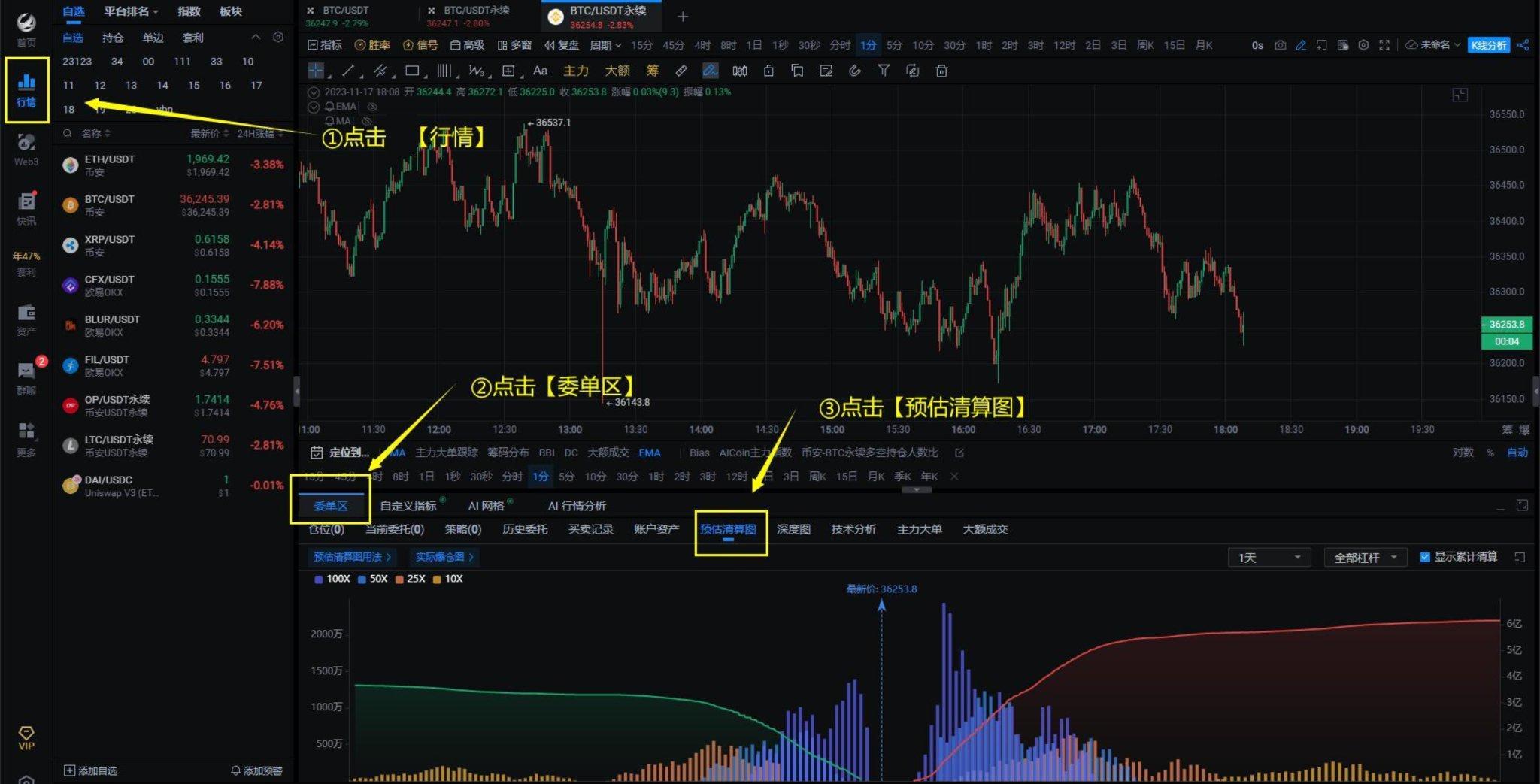

Directly click: 【Open Liquidation Chart】, or view it in the AICoin PC version under 【Market】-【K-line Bottom - Order Area】-【Estimated Liquidation Chart】.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。